Author: Alex Liu, Foresight News

BTC is the strongest consensus and largest asset in the cryptocurrency industry, reaching the pinnacle in the race for decentralized value storage. But nothing is perfect, does such an asset have flaws at present?

Yes! Most of the liquidity is locked on the chain and cannot generate income for the holders. Let's take a simple example:

Xiao Zhang and Xiao Li entered the coin circle at the same time. Under the recommendation of a big shot, Xiao Zhang heavily invested in Bitcoin and stopped operating after transferring it to a cold wallet; Xiao Li bought Ethereum and interacted with various DeFi protocols on the chain. The two often communicate, and Xiao Zhang gradually understands: Xiao Li pledged his ETH in the LST protocol, deposited it in EigenLayer to participate in "restaking," bought Pendle's PT to lock in an annualized yield of over 20%, and deposited it in Blast to accumulate points and eventually receive airdropped tokens. Although the returns on various financial behaviors vary, and the price of Ethereum fluctuates, the amount of ETH tokens in his hands is indeed increasing day by day.

But Xiao Zhang still has so much BTC in his hands. Because Bitcoin itself does not support smart contracts, he cannot find a native and convenient way to "utilize" his BTC.

Xiao Zhang is somewhat anxious. He feels, "In a situation where opportunities are everywhere, letting assets sit idle and not generate income is simply a crime." Just like idle real estate, although it does not affect its own value, it "loses" rental income. How can he make his BTC "generate income"?

BTC income, the potential of the race track, and the mismatch of infrastructure

Compared to ETH income, the BTC income track is indeed still a blue ocean.

The proof-of-work (PoW) mechanism of Bitcoin limits holders from earning income through direct staking. Although Bitcoin dominates in market value, a large amount of Bitcoin is not fully utilized. Especially when compared with Ethereum—although Ethereum's total market value is far less than Bitcoin's (Ethereum's market value is $400 billion, about one-third of BTC's)—its total value locked (TVL) in the decentralized finance (DeFi) field is tens of times that of BTC.

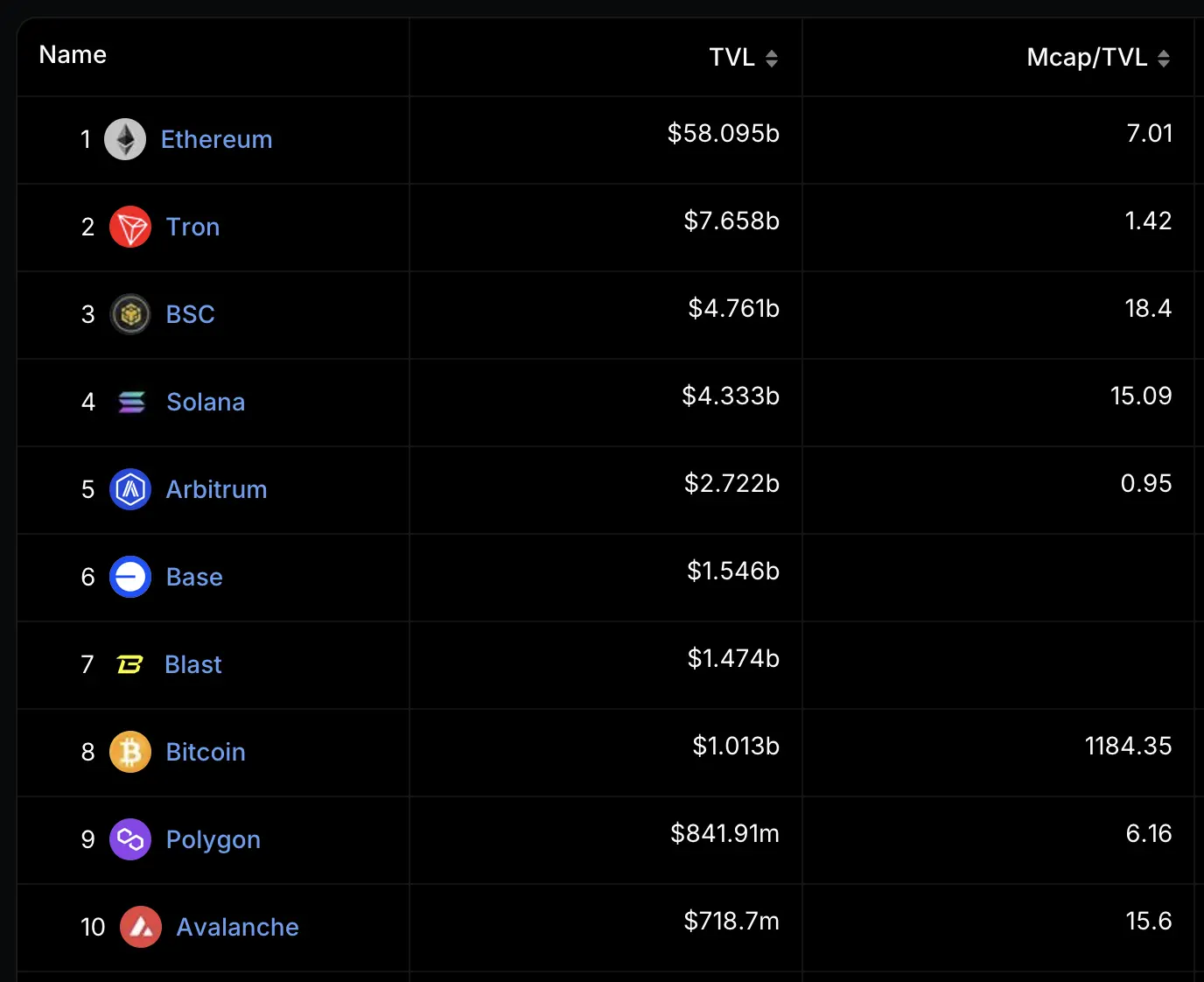

Total value locked on various chains, ratio of locked value to market value. Source: DeFiLlama

According to the data in the above figure, it only takes 5% of BTC to enter the income track for its TVL to exceed that of the Ethereum mainnet; and if the ratio of locked value to market value reaches the same level as Ethereum's, it will create a super-large market with a locked value of over $150 billion! It can be seen that the track has massive potential. However, the infrastructure construction of the BTC income track is not mature at present, which undoubtedly represents a mismatch between the potential of the track and the infrastructure. How to reverse the situation, attract users, and broaden the market?

The development of Bitcoin's Layer 2 (L2) solutions provides new opportunities for its income, but these solutions are currently not user-friendly for retail investors. The vision of Master Protocol is to solve this problem through its product innovation and become the user entry point for the track.

What can Master Protocol bring to Bitcoin?

Current state of Bitcoin income

As mentioned earlier, a large amount of Bitcoin liquidity is locked on the chain, and its income potential has not been fully realized. To solve this efficiency problem and release the massive liquidity of BTC, the industry has developed various Bitcoin Layer 2 (L2) solutions, using different technical solutions to promote BTC staking and income generation.

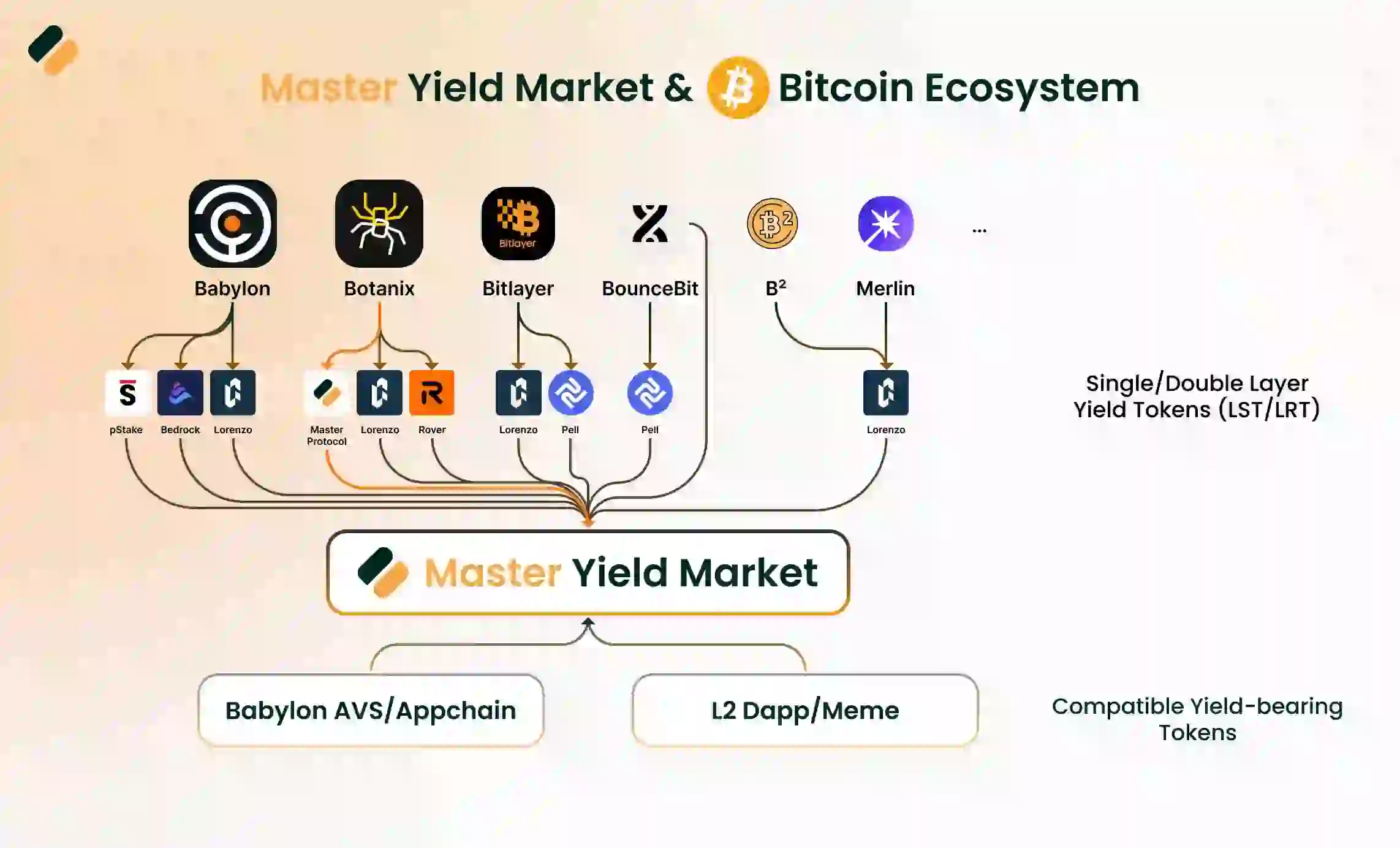

Well-known Layer 2 solutions such as Babylon, Botanix's Spiderchain, Bitlayer, BounceBit, B², and Merlin have created various methods to support Bitcoin staking. Apart from Babylon using remote staking, most Layer 2 solutions use bridging or mirroring technology to transfer native Bitcoin to a proof-of-stake (PoS) chain.

Through liquidity staking protocols such as Master Protocol, pStake, Bedrock, Pell, and Lorenzo, users can stake Bitcoin on various Layer 2 solutions and receive Liquid Stake Tokens (LST) as their staking certificates. This operation allows users to reinvest their LST in various scenarios, ensuring income without affecting liquidity. In addition, by adopting the restaking protocol, users can further stake LST to obtain Liquid Restake Tokens (LRT), further enhancing their investment capabilities and asset liquidity.

Staking and restaking will provide users with network and protocol rewards, so the aforementioned LST and LRT are income-generating assets. We classify them as single-layer/double-layer income tokens. Looking ahead, with the development of new Active Validating Service (AVS) on Babylon, the wider recognition of application chain value, and the growth of DApps and Memes on other Layer 2 solutions, new income tokens will be created in the Bitcoin ecosystem.

Product positioning of Master Protocol

There are already various Layer 2 solutions and liquidity staking protocols (LST protocol) in the Bitcoin ecosystem, such as Botanix Spiderchain, etc. These protocols aim to improve the scalability and liquidity of Bitcoin, but their complexity (such as the need for frequent network switching and multiple asset bridging) makes it difficult for ordinary users to participate. Master Protocol attempts to simplify this process and increase user participation through its product portfolio, especially the Master Yield Market and the liquidity staking protocol (LST protocol) on Botanix Spiderchain.

Two main products of Master Protocol:

- Master Yield Market: Provides income trading opportunities, aggregates Bitcoin ecosystem assets, packages them into MSY, and splits them into MPT (principal) and MYT (interest) for user trading.

- LST Protocol on Botanix Spiderchain: Increases the liquidity and yield of Bitcoin through the liquidity staking protocol.

Bitcoin ecosystem and product positioning of Master Protocol

In this way, Master Protocol can play a synergistic role among multiple protocols in the Bitcoin ecosystem, which is beneficial for the overall ecosystem development. By packaging and aggregating Bitcoin ecosystem income-generating assets issued by various protocols, Master Protocol can serve as a one-stop Bitcoin ecosystem income trading center. Users can access income opportunities from different protocols through this "entry point," eliminating the hassle of repeatedly comparing and switching among the myriad of protocols. As a user entry point, in addition to Master Protocol itself being adopted, multiple Bitcoin ecosystem protocols cooperating with it can also benefit from the flow of users.

All of this is based on the core product of Master Protocol, the Master Yield Market.

Master Yield Market

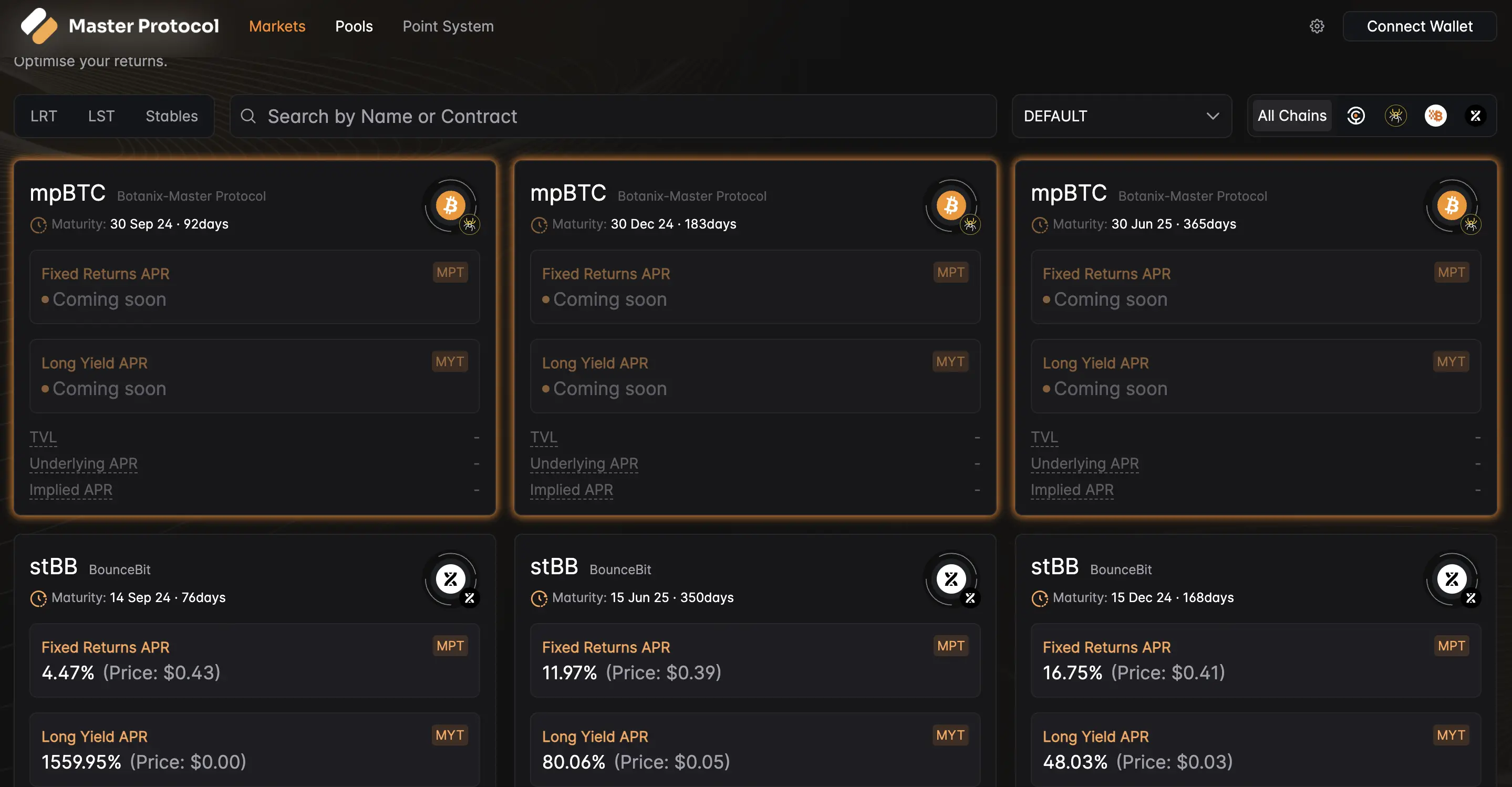

The basic function of Master Yield Market is to aggregate Bitcoin ecosystem assets, package them into MSY, and split them into MPT and MYT for user trading. Its principle is similar to the Pendle protocol.

- MPT (Master Principal Token): Represents the principal. Buying MPT can lock in the profits of underlying assets in advance, equivalent to fixed-income products.

- MYT (Master Yield Token): Represents the interest. MYT has a low unit price but can increase the capital utilization rate, equivalent to leveraged speculation on expected returns.

The Master Yield Market can be understood as the Pendle of BTC. This is high praise and also symbolizes unlimited potential—Pendle is the only DeFi protocol to break through this year, and the platform and token price have developed very well, driving the development of on-chain interest rate derivatives. In the TradeFi sector, interest rate derivatives occupy the majority of the market in the derivatives market. As of June 2023, the overall position in the derivatives market has reached $71.47 trillion, with the position of uncleared interest rate derivatives reaching $57.37 trillion, accounting for 80.2% of the market share. This is precisely the track that is most easily entered by institutions. With the approval of the BTC ETF by the SEC, perhaps the interest rate trading platform on BTC will first be adopted by institutions, bringing greater room for imagination than the success on Ethereum.

Master Yield Market interface

Currently, the Master Yield Market has partnered with multiple partners such as Botanix, BounceBit, Bitlayer, etc., and supports assets including BounceBit's native assets stBB and stBBTC. Assets planned to be launched soon include assets from the Pell protocol on BounceBit and Bitlayer, Bedrock (uniBTC) and pSTAKE (yBTC) assets on Babylon, multiple BTC Layer 2 assets from the Lorenzo protocol, and the Master Protocol assets (mpBTC) on Botanix Spiderchain.

The Master Yield Market will integrate these diversified assets and provide them to users in the form of MPT and MYT for trading. This strategic integration will provide better accessibility to the Bitcoin ecosystem, significantly enhance Bitcoin's liquidity and capital utilization, and drive the ecosystem towards prosperity.

In the future, the Master Yield Market will also support USDT and other BTC assets (ETH, BSC, etc., multi-chain), such as purchasing MPT and MYT for the underlying assets of various ecosystem projects directly with wBTC. This means that Master Protocol has helped these projects with asset routing to achieve the required cross-chain transactions, providing users with a seamless and smooth interactive experience.

As a result, retail investors in the Bitcoin ecosystem now have the opportunity to easily engage in yield trading, which is the core advantage of Master Protocol. However, even the best protocol depends on user adoption. To achieve this, Master Protocol chooses to incentivize users through the Master Yield Pass.

Master Yield Pass

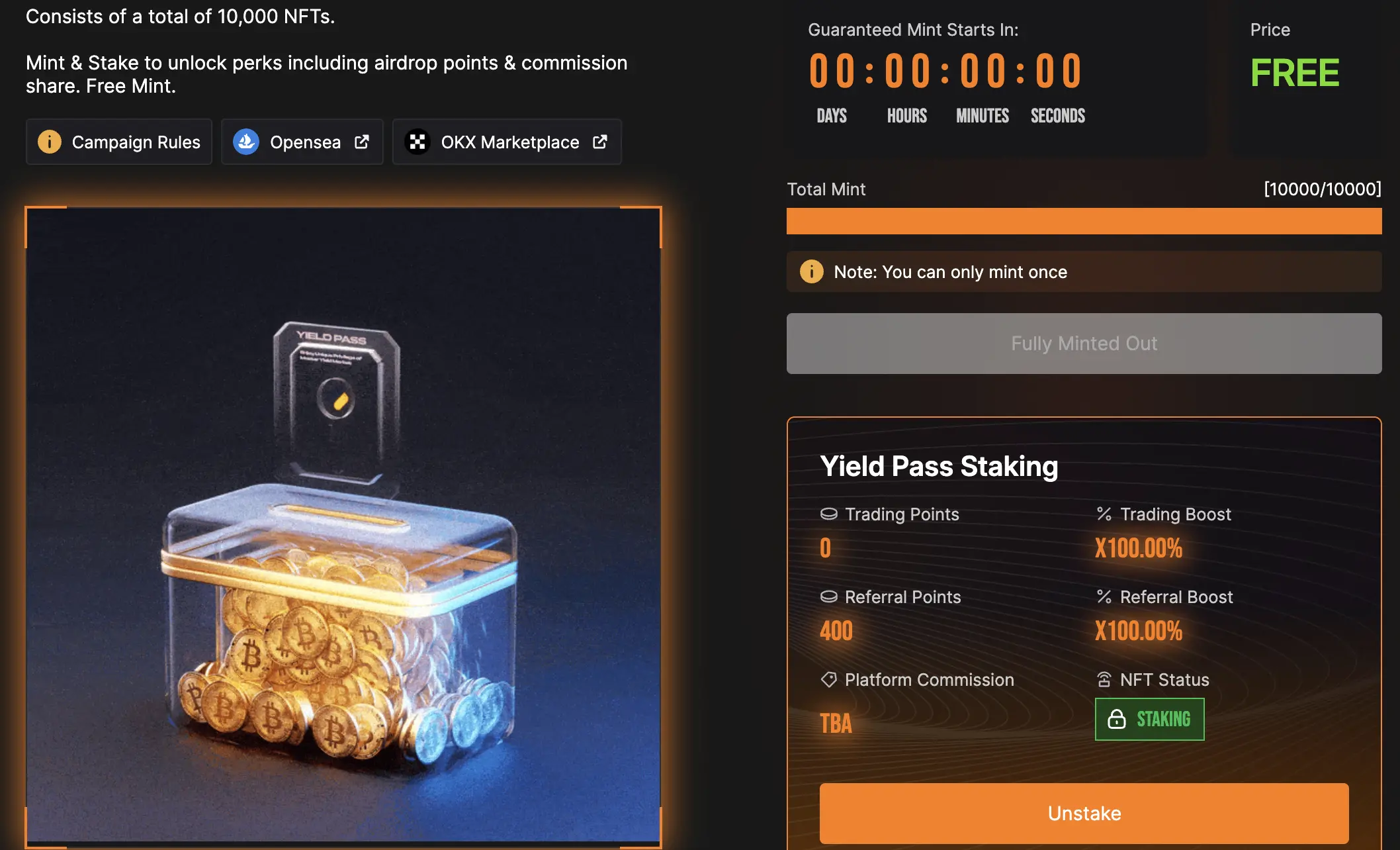

The Master Yield Pass is an incentive measure launched by Master Protocol, with a total of 10,000, and was freely minted on Base on June 24. Currently, all NFTs have been minted for free and can be purchased on secondary NFT markets such as Opensea. Its current price in the secondary market is only 0.001 ETH, approximately $3, with very low cost. If you are optimistic about the BTC income track, you can consider buying it to anticipate future airdrops/trading returns.

The benefits of staking the Master Yield Pass include:

- Earning points from the Trading Pool and Referral Pool, which can be exchanged for token airdrops in the future.

- Platform fee dividends. Assuming the total trading volume reaches $200 million and the platform fees reach the million-dollar level, each NFT can receive over $100 in dividends. (For comparison, the yield trading platform Pendle on Ethereum has accumulated trading volume in the billions of dollars.)

- Future benefits: such as whitelist qualifications for NFTs/events/IDOs, etc.

Minting and staking page for the Master Yield Pass

Trading mining (Trading Pool) and referral mining (Referral Pool) are the main gameplay, but it should be noted that they also use two independent point calculation systems, and their point bonuses are not shared.

Trading Mining - Trading Pool

Earn points based on trading volume, with a 3x bonus for staking the Yield Pass.

Point Calculation Rules

- Individual total points = Individual total trading volume x point bonus coefficient;

- Number of airdrops an individual can receive = Individual total points during the event / Total points across the network during the event x Total airdrop quantity

- 1 - Staked Pass Holder

- Holding and staking the Yield Pass can earn a 3x point bonus

- If a user's total trading volume is 1,000 USDT, the points they can earn are: 1,000 (total trading volume) x 3 (Yield Pass bonus) = 3,000 Points

- 2 - Unstaked Pass Holder and Non-Pass Holder

- Can only earn basic trading points

- If a user's total trading volume is 1,000 USDT, the points they can earn are: 1,000 (total trading volume) x 1 (no bonus) = 1,000 Points

Referral Mining - Referral Pool

Earn points based on the number of referrals, with a bonus for staking the Yield Pass.

Referral Pool score panel

- 1 - Point Calculation Rules

- Stake Pass Holder: Automatically mine 200 points per day, multiplied by the buff bonus to calculate the actual points earned. The formula is: Points = 200 (daily base points) * [100% (base coefficient) + 2% (each Holder Buff bonus) * number of Holders + 1% (each non-Holder Buff bonus) * number of non-Holders + 50% * invitation points bonus]

- For example, if A stakes an NFT, invites 50 staked Holders and 100 non-Holders who have completed a $100 trading volume verification, and joins Team B with a 50% point bonus, then A can earn a daily points of: 200 x (100% + 50 x 2% + 100 x 1% + 50% * 50%) = 650 points

- Unstaked Pass Holders and Non-Pass Holders: No automatic mining points, no Buff bonus

- 2 - As an Inviter

- Only staked Pass Holders can act as inviters

- If the invitee is a Pass Holder and has staked: Each invitee can provide a 2% Buff bonus, and both parties can receive a random points red packet

- If the invitee is an unstaked Pass Holder or a Non-Pass Holder: Each invitee can provide a 1% Buff bonus (the invitee must complete at least $100 in trading volume for valid user verification, and after verification, both parties can receive a random points red packet)

- 3 - As an Invitee

- If the invitee is a Pass Holder and has staked: The invitee can enjoy a 50% Buff bonus after joining the team (if the inviter's Buff bonus is currently 50%, the invitee can receive a 25% Buff bonus after joining the team)

- If the invitee is an unstaked Pass Holder or a Non-Pass Holder: No bonus can be obtained; if the user completes valid user verification (trading volume reaches $100), they can receive a participation prize (random red packet, 10-200 points)

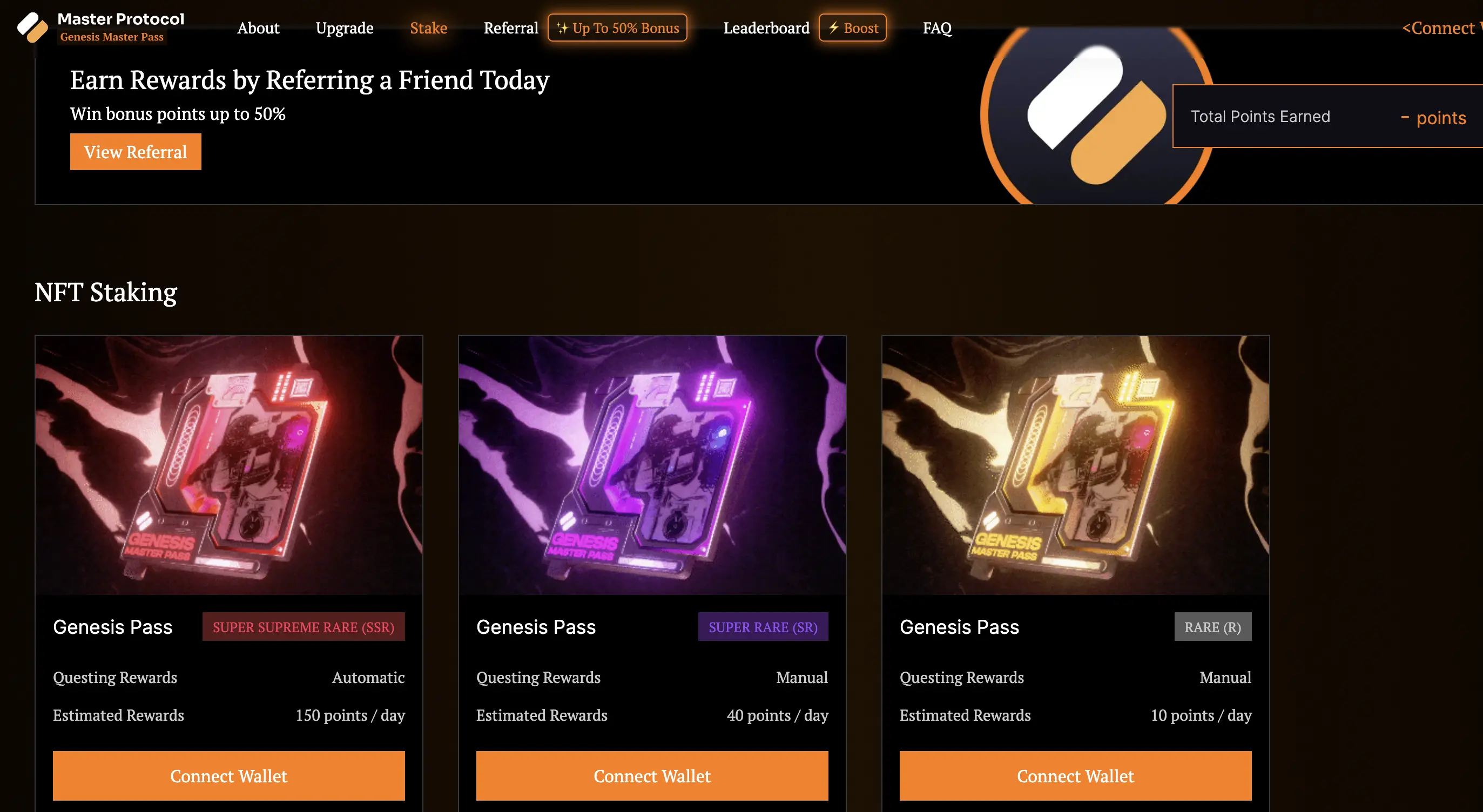

Genesis Master Pass

Genesis Master Pass staking page

In addition to the Master Yield Pass, the first NFT series launched by Master Protocol, the Genesis Master Pass event is also ongoing, and participating in staking tasks can also earn airdrop points. This series can currently be purchased on secondary markets such as Opensea, and interested readers can learn more and participate through the official documentation and tutorials.

Participating in the BTC Ecosystem through Master Protocol

In summary, the Master Yield Market of Master Protocol simplifies the process of Bitcoin yield, allowing retail investors to directly trade Bitcoin's LST and LRT assets using USDT, ETH, or WBTC, thereby unlocking significant earning opportunities in a simple and efficient manner. While innovating products, it incentivizes users through multiple equity NFT series, promotes trading activities and user acquisition, and accelerates its own adoption. The BTC yield track, with potential and infrastructure mismatch, has found its "user entry". Perhaps after truly finding the Project Market Fit, the potential unleashed by this sleeping giant will amaze us all.

Now, Xiaozhang can pledge his Bitcoin liquidity on Botanix Spiderchain through Master Protocol, purchase the underlying assets stBBTC of BounceBit on Babylon to lock in profits, buy uniBTC YT issued by Bedrock on Babylon, and strategically position himself for token airdrops from Bedrock and Babylon—using multiple methods to yield from his BTC, no longer envying Xiaoli.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。