Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma.eth)

On June 29, members of the Polkadot community, Alice und Bob and Jeeper, released the Polkadot Treasury operation report for the first half of 2024 on the official governance forum. Some of the numbers mentioned in the report are astonishing, which has led to community doubts about the current status of the Polkadot Treasury operation and concerns about its sustainability.

Astronomical Expenditure

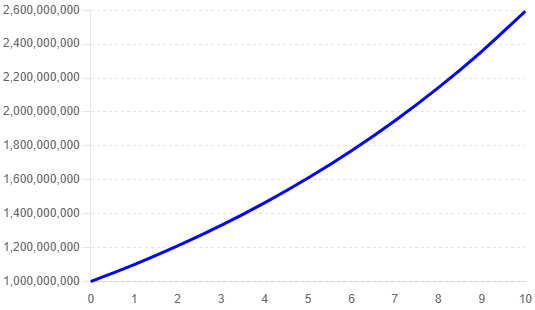

The key points of the report are: In the first half of 2024, the Polkadot Treasury spent a total of 87 million US dollars (11 million DOT). Considering that the current reserve balance of the treasury is 245 million (38.2 million DOT), at the current spending rate, these reserves will only be enough to support the Polkadot Treasury for another 2 years…

These unexpectedly high numbers have clearly shocked the entire industry. Kain Warwick, the founder of Synthetix, sharply commented on this: "The speed at which the Polkadot Treasury is burning money is faster than hackers stealing money."

Following the shock is the confusion. Many community members have expressed on social media that it is difficult to imagine how Polkadot managed to burn through 87 million US dollars in just half a year.

Where was the expenditure allocated?

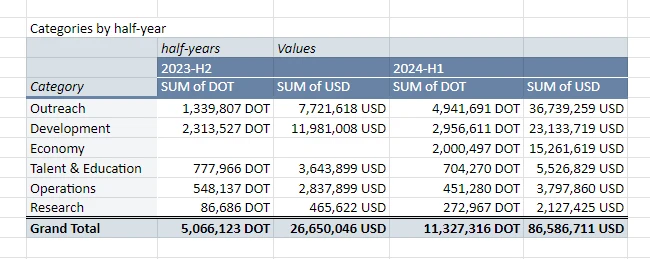

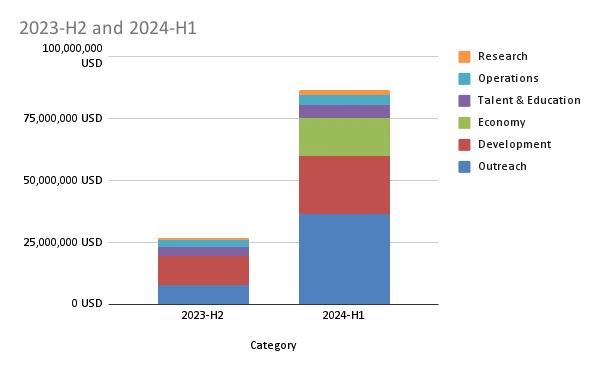

According to the detailed explanation in the "Payments" section of the report, compared to the second half of 2023, the DOT-denominated expenditure of the Polkadot Treasury in the first half of 2024 increased by 2.4 times. However, due to the rise in the price of DOT itself, the U-denominated expenditure of the treasury increased by 3.2 times.

In terms of expenditure categories, the Polkadot Treasury expenditure is mainly directed towards six major areas — research, operations, talent education, economy, development, and marketing. From the comparison in the following figure, although there have been slight changes in the expenditure structure, the absolute values of expenditure in these six major areas have all increased compared to the second half of 2023.

The largest expenditure is in "marketing" (outreach), with a total expenditure of 37 million US dollars. The "marketing" expenditure includes advertising and media expenses, online and offline community event costs, as well as sponsorships for large conferences and business development activities. Among them, "advertising" expenses account for the majority, with a total expenditure of 21 million US dollars, including a sponsorship of 6.8 million US dollars to a football club, 1.9 million US dollars sponsorship to race car driver Conor Daly, and a 1.3 million US dollars sponsorship to the esports organization HEROIC.

The second largest expenditure direction is "development," with a total expenditure of 23 million US dollars, including 5.1 million US dollars for the development of Polkadot protocol and SDK functions, 4.1 million US dollars for the development of data services and indexing functions, and 3.9 million US dollars for the development support of wallets such as SubWallet, Talisman, and Nova.

Following closely is the "economy" direction of expenditure, which is a major expenditure item for many other public chain ecosystems to attract traffic. Polkadot's expenditure in this area seems to be "much less," spending only 15 million US dollars on liquidity incentives.

In the "talent and education" direction, Polkadot invested a total of 5.5 million US dollars in the first half of the year. The majority of this was allocated to ecosystem training and hackathons, with 3.1 million US dollars used in the Polkadot Blockchain Academy series of events and multiple hackathons, averaging between 60,000 and 600,000 US dollars per event.

In the "operations" direction, Polkadot spent a total of 3.8 million US dollars in the first half of the year. The largest expenditure came from "governance," with a total expenditure of 2.5 million US dollars, including a 640,000 US dollars sponsorship to a foundation in the Cayman Islands by OpenGov for legal packaging.

"Research" is the smallest expenditure direction for Polkadot, with a total expenditure of 2.1 million US dollars in the first half of the year.

How much reserve is left? Can the income increase?

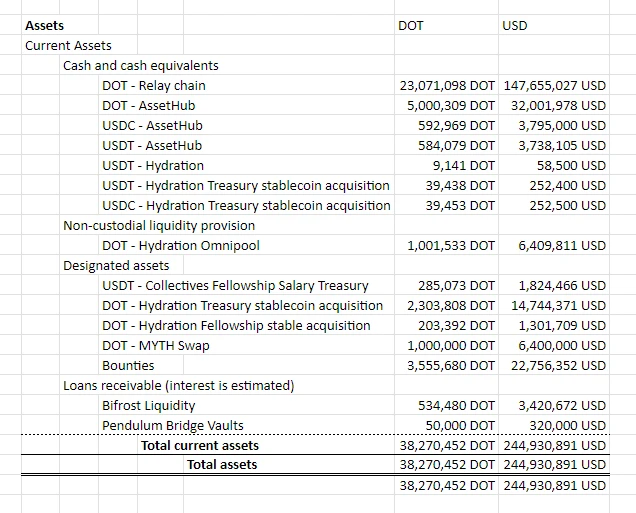

As mentioned earlier, the current remaining reserve value of the Polkadot Treasury is 245 million US dollars, equivalent to 38.2 million DOT. However, it is necessary to further clarify the composition of these remaining reserves.

In short, the composition of the remaining reserves in the Polkadot Treasury is as follows:

Cash and cash equivalents: 29 million DOT (approximately 188 million US dollars), mainly including DOT, USDT, and USDC held by Polkadot in relay chains, AssetHub, and Hydration, which are available for immediate use by the treasury;

Unhosted liquidity supply: 1 million DOT (approximately 6.4 million US dollars), mainly referring to the 1 million DOT unilateral liquidity provided by Polkadot on the Hydration Omnipool;

Designated assets: 7.3 million DOT (approximately 47 million US dollars), which can only be used for specific purposes such as compensation and sponsorship;

Accounts receivable: 5.8 million DOT (approximately 3.7 million US dollars), referring to short-term loans provided by Polkadot to ecosystem projects such as Bifrost and Pendulum.

Overall, despite facing expenditure pressure, the Polkadot Treasury still has a relatively ideal signal in terms of reserve structure — the overall liquidity situation is very good, with the vast majority of reserves available for immediate use.

As for whether the Polkadot Treasury can further generate income, the report also explicitly mentions that direct income from network fees is still insignificant. Apart from earning nearly 300,000 DOT due to the short-term inscription craze in the second half of 2023, regular fee income is quite stable — approximately 20,000 DOT per quarter.

The report also specifically mentioned passive income from DOT inflation (staking rewards), but the two authors of the report, Alice und Bob and Jeeper, both believe that although the treasury can "profit" from the current 10% income, the current high inflation rate is "destructive" and is not conducive to the long-term development of the Polkadot protocol and the stability of the DOT price.

The community's doubts are not without reason

Combining the analysis of the income and expenditure situation and the remaining reserves mentioned above, it can be seen that the Polkadot Treasury is indeed facing certain sustainability pressures. Although the reserves of over 200 million US dollars are still substantial, the high expenditure and almost negligible income pose a real challenge.

The focus of the community's doubts is generally centered on the astronomical level of Polkadot's expenditure and its composition, especially the "marketing" expenditure, which accounts for nearly half of the total — it is understandable that development requires funding, and the combined expenditure for operations, research, and education is not significant. The direction of economic incentives even seems to be somewhat lacking. The marketing expenditure, which consumes 37 million US dollars, not only raises questions about the scale of investment itself, but also seems to have only "minimal" effectiveness.

In response to this, well-known overseas KOL @Ignas questioned, "Polkadot spent 37 million US dollars on marketing, but they have almost no presence on X and other social media platforms."

Although @Ignas's description may be somewhat exaggerated, it is not without merit. Looking back over the past two years, concepts such as Layer2, modularity, chain abstraction, and Restaking have captured the market's attention one after another. As a former top-tier project, Polkadot's presence on social media seems to be diminishing… Whether it's Jam or Coretime, how many people know what they mean if they are not actively following the developments in the Polkadot ecosystem?

Ironically, today's controversy about the "excessive marketing expenditure" of Polkadot has become the biggest exposure for Polkadot's recent heavy investment in marketing on social media.

A few months ago, a community member who has long been involved in the Polkadot ecosystem mentioned to us, "For community participants, the greatest value of Polkadot lies in the Treasury."

If the Treasury continues to be consumed in this questionable manner, the next thing to be questioned may be the future of Polkadot.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。