After the launch of the Ethereum ETF, RWAs may erupt.

Author: Crypto, Distilled

Translation: Deep Tide TechFlow

2024 Q3 - RWAs Watchlist

First is digital gold, now it's tokenization and real-world assets (RWAs).

BlackRock's overall plan is unfolding before our eyes.

With the possible launch of the $ETH ETF in July, will RWAs be the next explosive area?

New Narrative in Cryptocurrency:

While everyone is discussing the $ETH ETF, a bigger trend is quietly emerging: tokenization of financial assets.

BlackRock CEO Larry Fink believes tokenization will be the "next generation of the market."

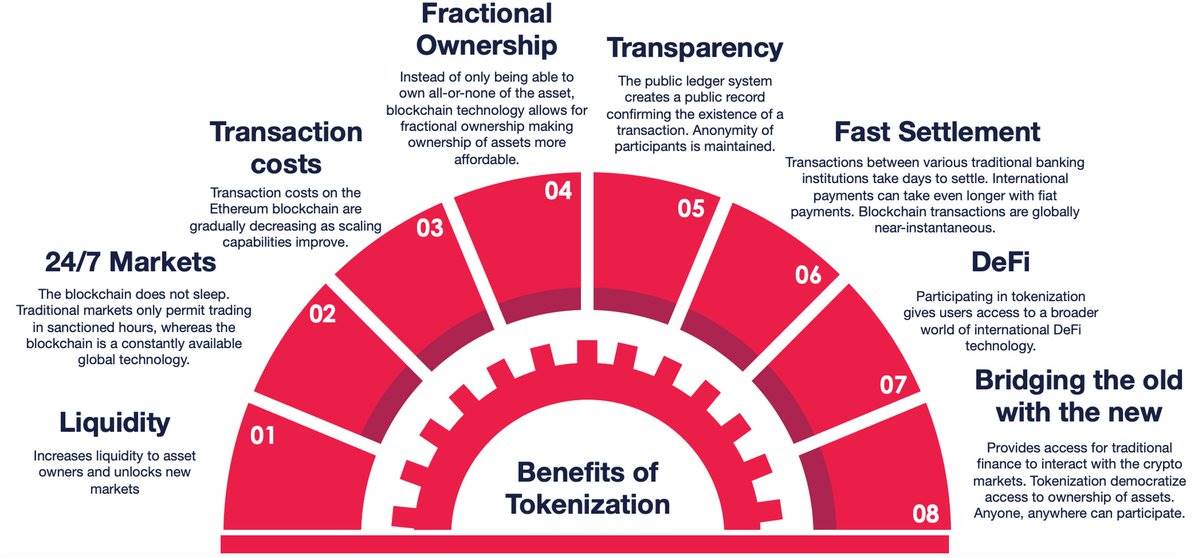

Why Tokenization?

Tokenization overcomes the limitations of traditional assets using blockchain, opening up liquidity and investment opportunities for all levels of capital.

Here's an overview of the key advantages:

Growth Potential:

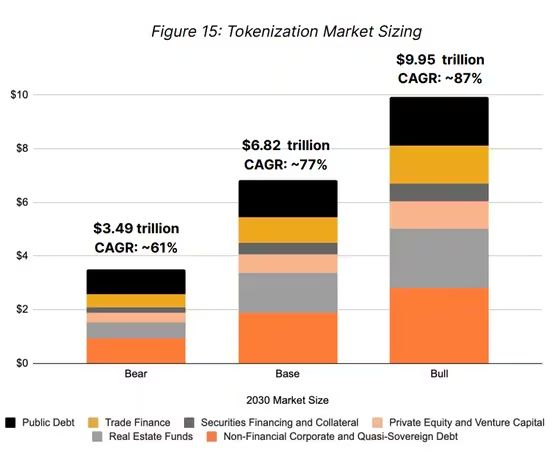

How big is the opportunity?

Experts predict that the tokenization market could reach $10 trillion by 2030.

For comparison, the current market value of $BTC is approximately one-tenth of this figure.

(Thanks to @21co__)

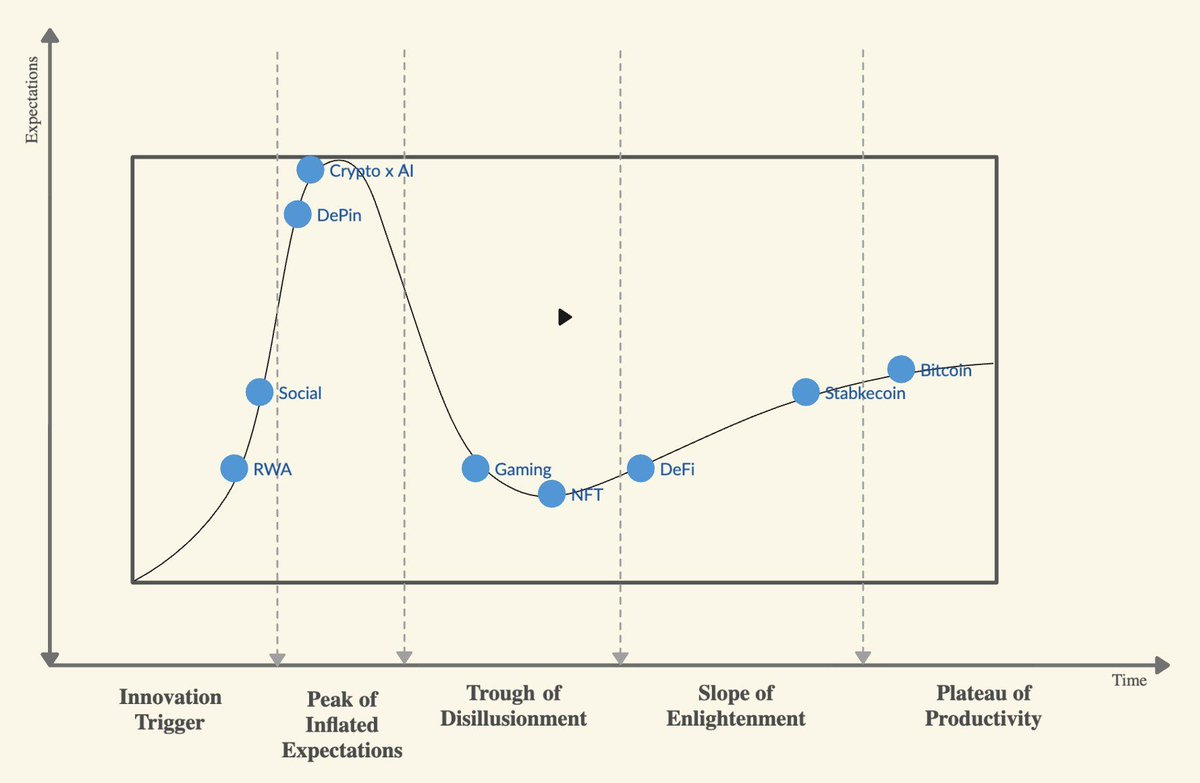

Are we in the early stages?

Yes, we may be in the early stages.

This is not just about cryptocurrency; it also involves stocks, bonds, and real estate.

RWAs are still relatively undeveloped, and many catalysts are expected to emerge in 2024/2025.

(Thanks to @QwQiao)

Opportunities for RWAs:

Real-world assets (RWAs) are the hottest area in the tokenization movement.

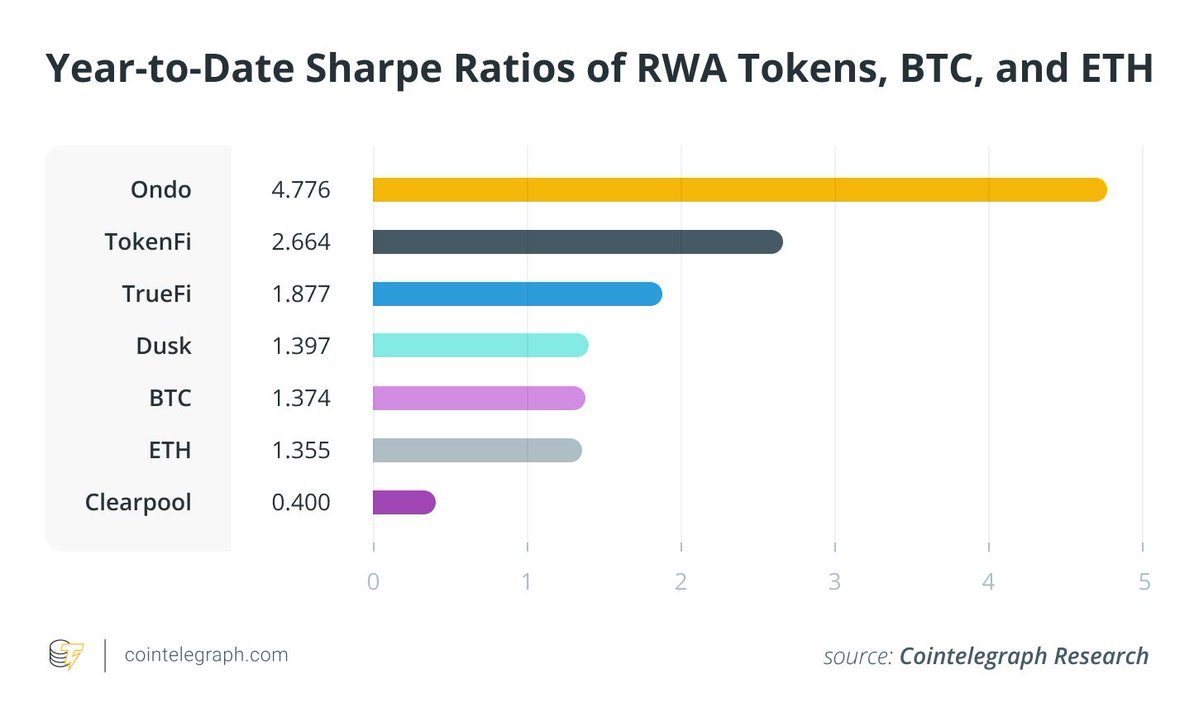

From January 1 to May 31, the Sharpe ratios of many leading RWA projects outperformed $BTC.

A higher Sharpe ratio indicates a superior "risk-adjusted" return.

(Thanks to @Cointelegraph)

Overview of the RWA Industry:

@BinanceResearch identified two key areas of RWA innovation:

a. RWA Rails - projects providing regulatory and operational tracks for RWAs.

b. Tokenization Asset Providers - focusing on creating and meeting the demand for RWAs.

(Thanks to @binanceresearch)

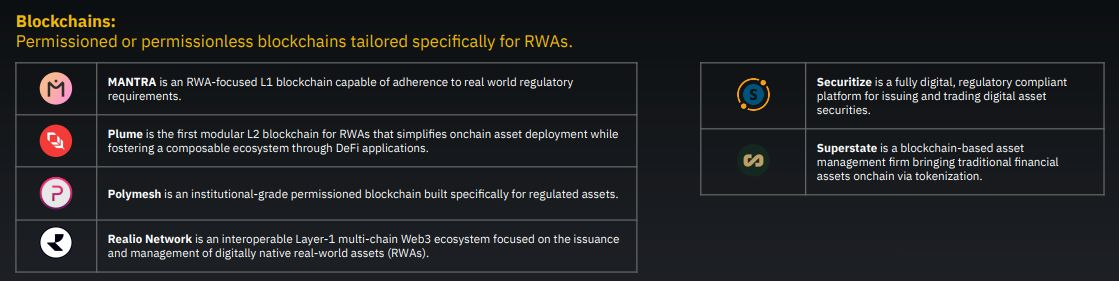

RWA Blockchain:

Blockchain is the backbone of the RWA industry.

For example, Mantra and Polymesh are specifically designed for this purpose.

(Thanks to @binanceresearch)

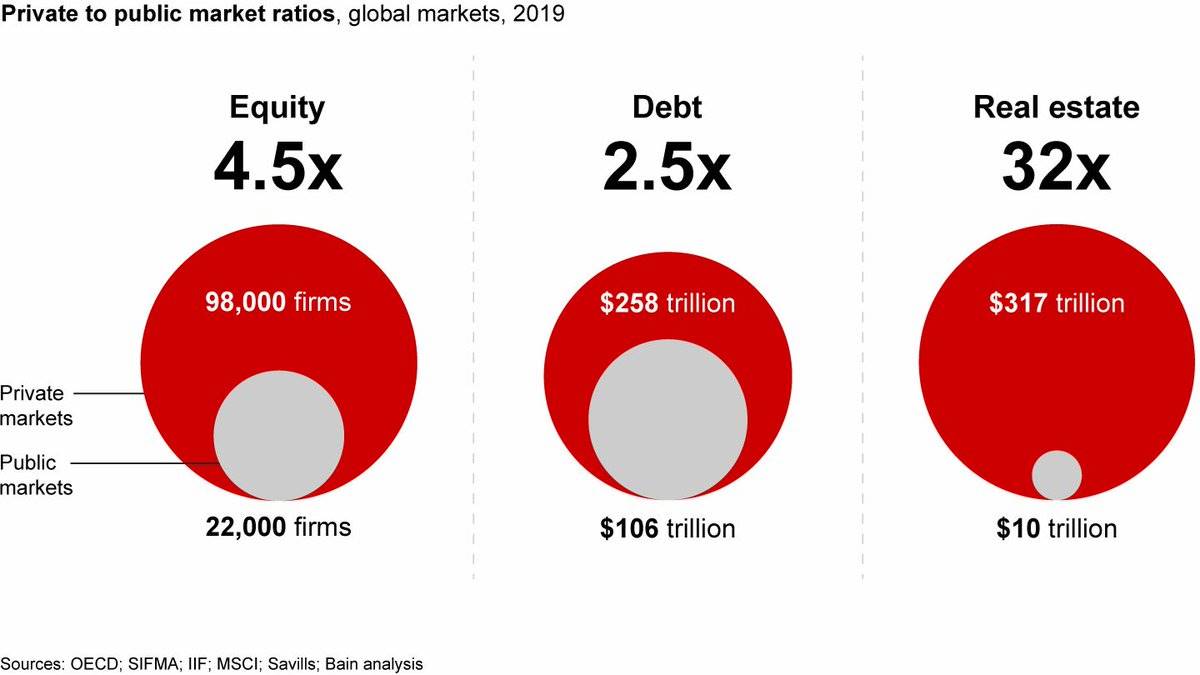

Public Markets vs. Private Markets:

Most platforms prioritize public markets, but the real opportunity lies in private markets.

They have 2.5 times more equity and 32 times more RWAs than public markets.

(Thanks to @BainandCompany)

Dark Horse RWA Chain:

$DUSK uniquely addresses the issues of the private market, integrating privacy and compliance to ensure secure on-chain trading of private RWAs.

We reported on $DUSK in the June issue of Crypto, Distilled Pro. Check it out.

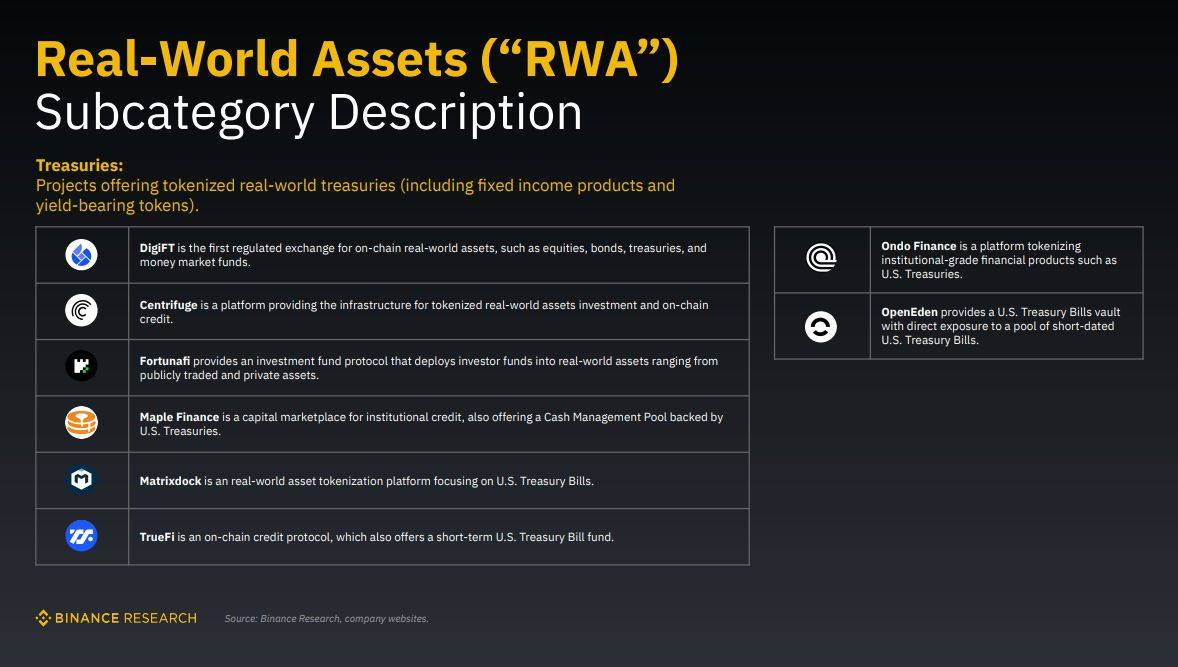

Government Bonds:

The demand for tokenized government bonds, including fixed-income products and income-type tokens, has surged.

The market recently surpassed $1.5 billion, compared to just $114 million in January 2023.

(Thanks to @binanceresearch)

BlackRock's Dominance:

Traditional financial giants dominate the on-chain government bond market. Currently, BlackRock leads the market with its $BUIDL fund, with nearly $2 billion in total value locked (TVL).

(Thanks to @rwa_xyz)

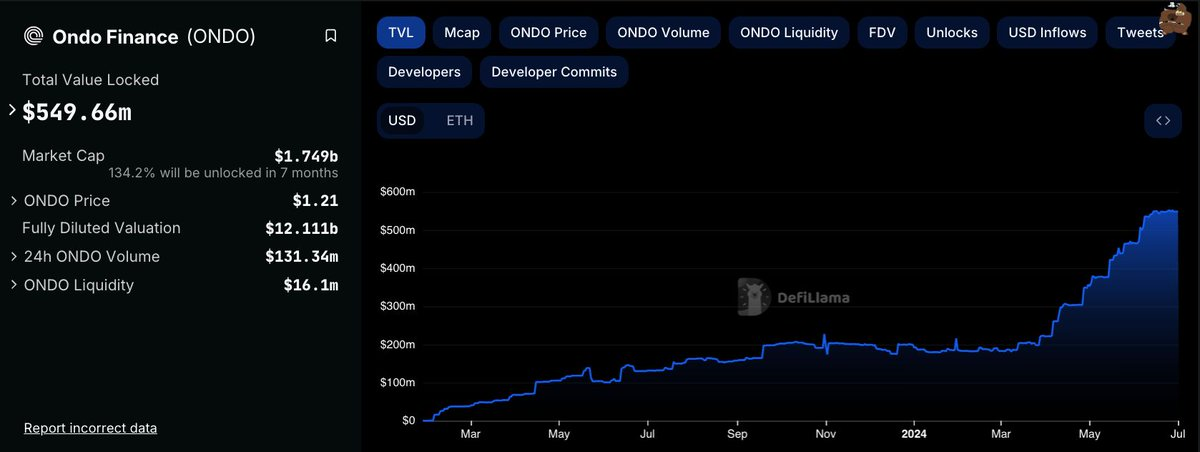

Ondo Finance:

In the cryptocurrency space, $ONDO has performed well, with total value locked (TVL) more than doubling this year.

Ondo Finance also holds a stake in BlackRock's tokenized fund $BUIDL.

It is currently unclear how much of the valuation of $ONDO is governance-driven and how much is speculation-driven.

(Thanks to @DefiLlama)

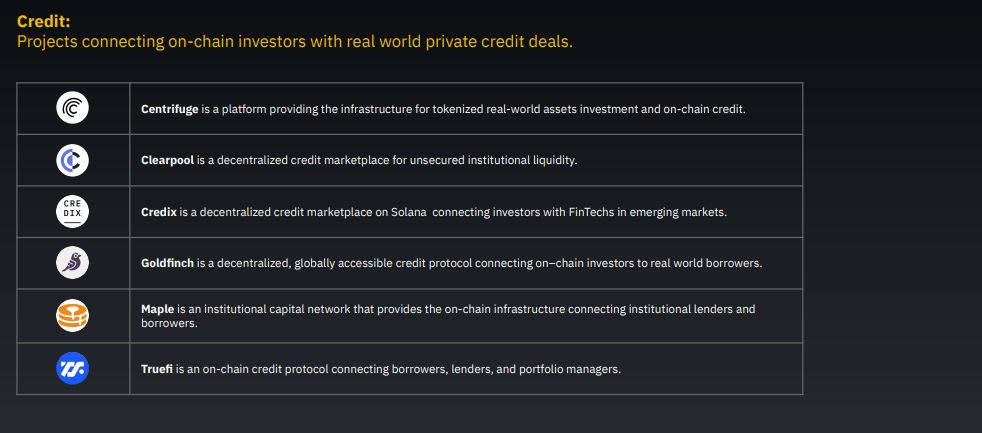

Credit:

Another key direction in the realm of Real-World Assets (RWAs) is decentralized credit projects.

These projects connect on-chain investors with real-world private credit, with leaders including $MPL and $CFG.

(Thanks to @binanceresearch)

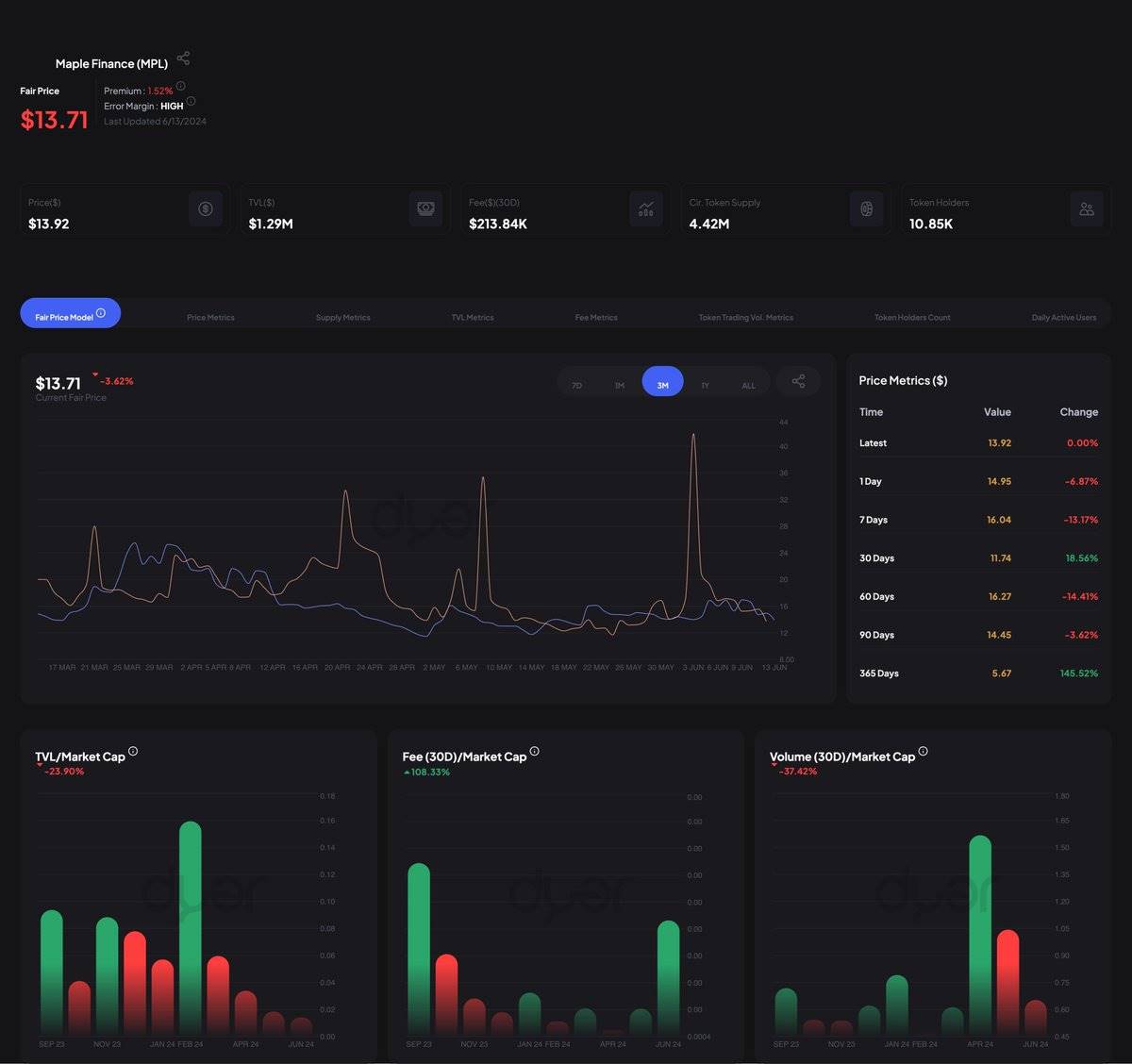

Maple Finance - Fundamental Improvements:

As of June 13th, $MPL has performed well:

TVL/MC ratio increased by 108% in the last 30 days

Fees increased by 208% in the last 90 days

Trading volume increased by 196% in the last 7 days

Token holders increased by 5.61% in the last 30 days

(Thanks to @dyorcryptoapp)

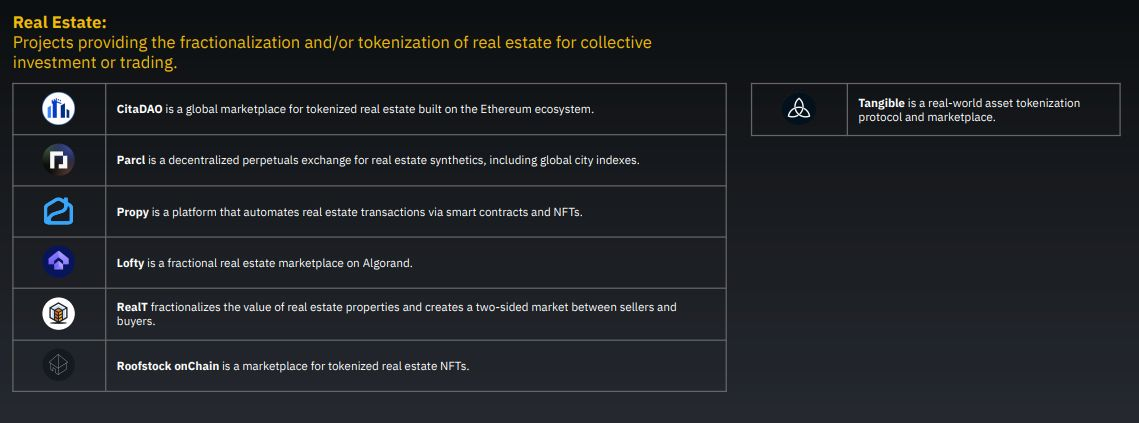

Real Estate:

As the largest asset class globally, real estate is being fragmented and tokenized.

However, this area is still quite early-stage.

(Thanks to @binanceresearch)

Key Risks:

Despite the positive outlook for RWAs, the field still faces several key risks:

Many regulatory barriers and bottlenecks.

Weak value accrual to governance tokens.

Government blockchains as competitors.

Lack of standardization and low liquidity.

Security vulnerabilities.

Summary:

Tokenization presents a $10 trillion opportunity.

After the launch of the Ethereum ETF, RWAs may erupt.

Traditional financial giants are bringing assets onto the blockchain.

Key directions: government bonds, credit, real estate.

Private RWAs are still largely undeveloped.

Regulatory and weak value accrual are major risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。