Background

In the history of our industry, centralized exchanges (CEXs) such as Coinbase, Binance, and Kraken have always been the preferred choice for cryptocurrency traders. Users tend to favor these products mainly because of their strong liquidity and attractive user experience (UX), which is a well-known pain point for traditional decentralized exchange (DEX) applications.

But what if there was an exchange that combined the speed and liquidity of CEXs with the transparency, asset autonomy, and settlement of decentralized finance (DeFi)?

This is the core idea behind Orderly Network.

Orderly Network aims to address the historical shortcomings of early DeFi applications and market trading challenges by building a liquidity-aggregating trading infrastructure. Orderly has created an efficient and powerful trading ecosystem with better price discovery, lower slippage, deeper liquidity, and execution speed comparable to CEXs, while maintaining the advantages of DeFi.

Introduction

Orderly is a Layer 2 (L2) solution that provides:

Order book-based trading: Similar to CEXs, Orderly uses an order book to match buyers and sellers, ensuring smooth and efficient transactions.

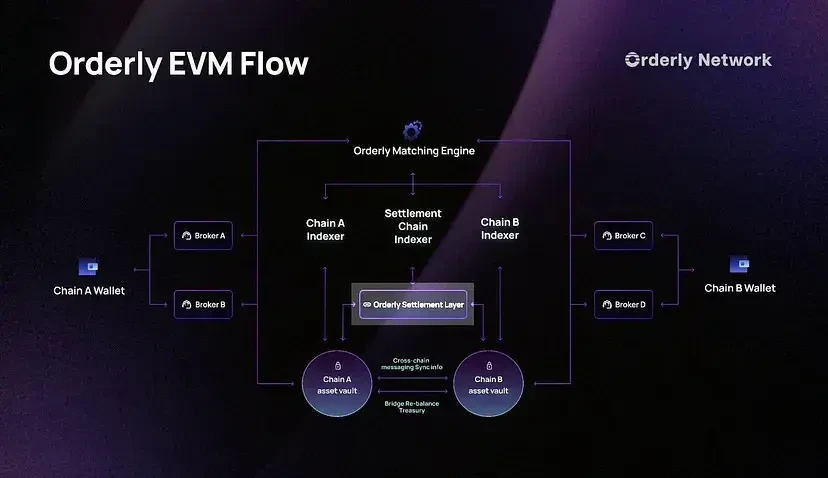

Cross-chain liquidity: Orderly aggregates liquidity from various blockchains, providing a broader asset pool and tighter spreads.

High-speed execution: Orderly prioritizes fast trade execution, minimizing transaction delays and failures.

Orderly uses a unified order book; users can trade on different chains but within the same order book, eliminating the need for bridge connections.

Orderly plays a crucial role in improving the overall efficiency and robustness of the DeFi trading environment and has quickly become one of the largest sources of liquidity for permissionless Web3 trading.

Key Achievements and Impact

Orderly Network has sparked a significant wave in the DeFi space, including:

Total trading volume exceeding $500 billion

Integration with six major public blockchains (Arbitrum, Optimism, Polygon, Base, etc.)

Total locked value (TVL) exceeding $560 million

User base of over 215,000 independent wallets

The Future of DeFi Trading

With its innovative infrastructure and strong partnerships, Orderly Network is poised to become a major player in the future of DeFi trading.

What sets them apart from existing competitors is:

Cross-chain capability: Orderly facilitates seamless transactions between different blockchains, maximizing user choice.

On-chain settlement by Orderly: All transactions settle on a secure and dedicated blockchain, ensuring transparency and finality.

Support for DeFi projects: Orderly provides institutional-grade liquidity for DeFi projects, used for spot and perpetual trading.

Their partner ecosystem includes WOOFi, LayerZero, Optimism, Arbitrum, Base, Elixir, Polygon, and others.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。