The US June CPI and non-farm data diverged, causing the market to be unable to form a consensus on the number of rate cuts, and could only "wait and see." Nvidia's market value once soared to the top of the world, becoming the pride of the AI era. However, the US stock market is highly differentiated, with high price-earnings ratios and evident bubbles. The crypto market experienced an inexplicable decline this month, possibly due to the selling pressure from old OGs and miners, providing new opportunities for future investments.

The latest FOMC meeting in the US in June concluded with the decision to maintain the federal funds rate between 5.25% and 5.50%, in line with market expectations. However, the overall tone of this FOMC meeting was dovish, a departure from the previous hawkish stance. In the meeting statement, Powell stated that the current inflation has made "moderate progress" towards the 2% target. Indeed, the latest CPI data for May showed a year-on-year increase of 3.3%, slightly lower than the previous and expected values of 3.4%; excluding food and energy costs, the core CPI for May increased by 3.4% year-on-year, lower than the expected 3.5% and the previous value of 3.6%, marking the lowest level in over three years.

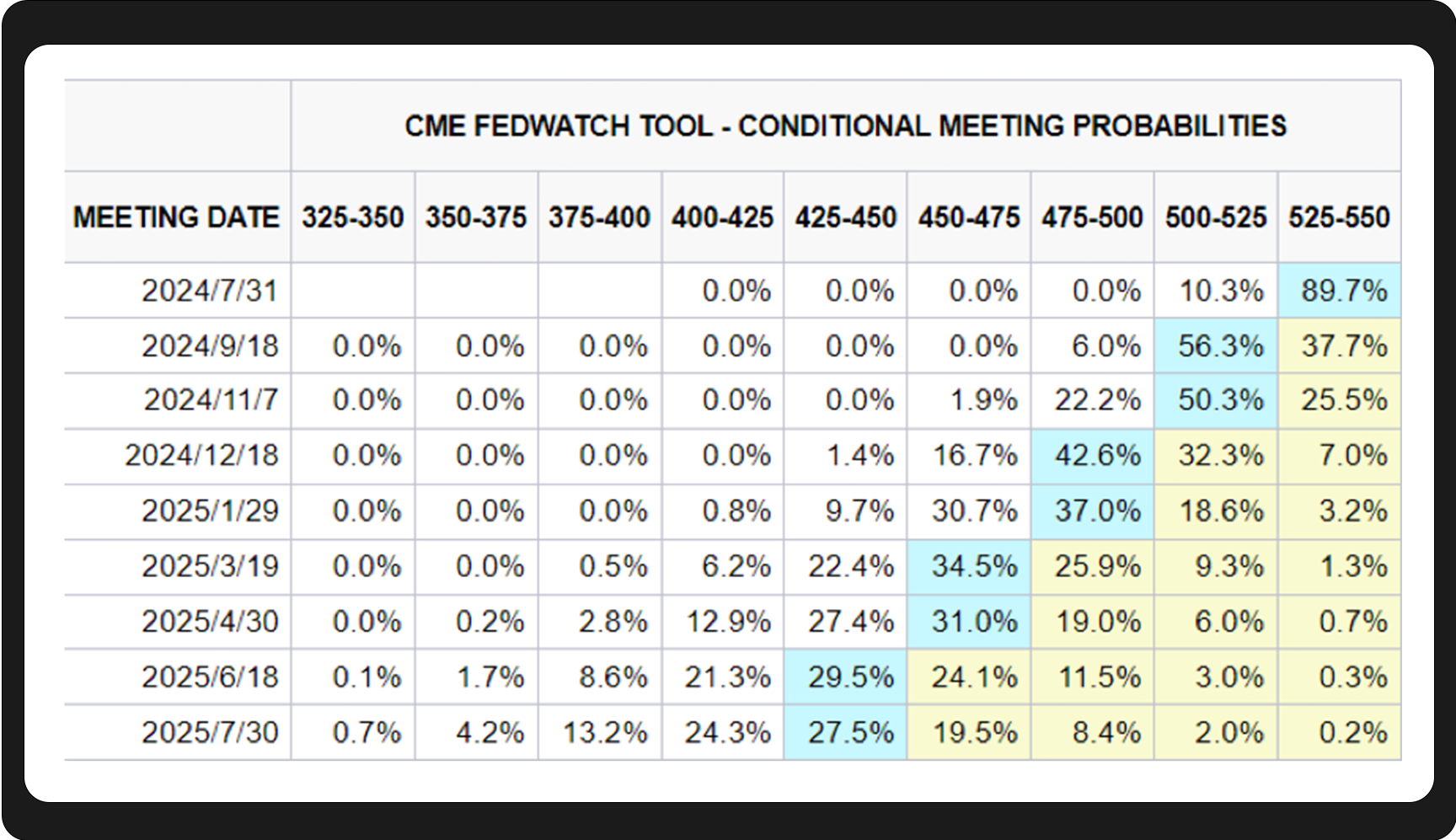

However, despite favorable inflation data, the performance of non-farm data has cast a shadow over the rate cut. The US added 272,000 non-farm jobs in May (expected 185,000, previous value 175,000), surpassing the predictions of Wall Street analysts. This divergence between inflation and employment data has led to the current inability of the market to form a consensus on the timing and number of rate cuts. The FedWatch Tool shows that the probability of the first rate cut in September is currently only 56.3%.

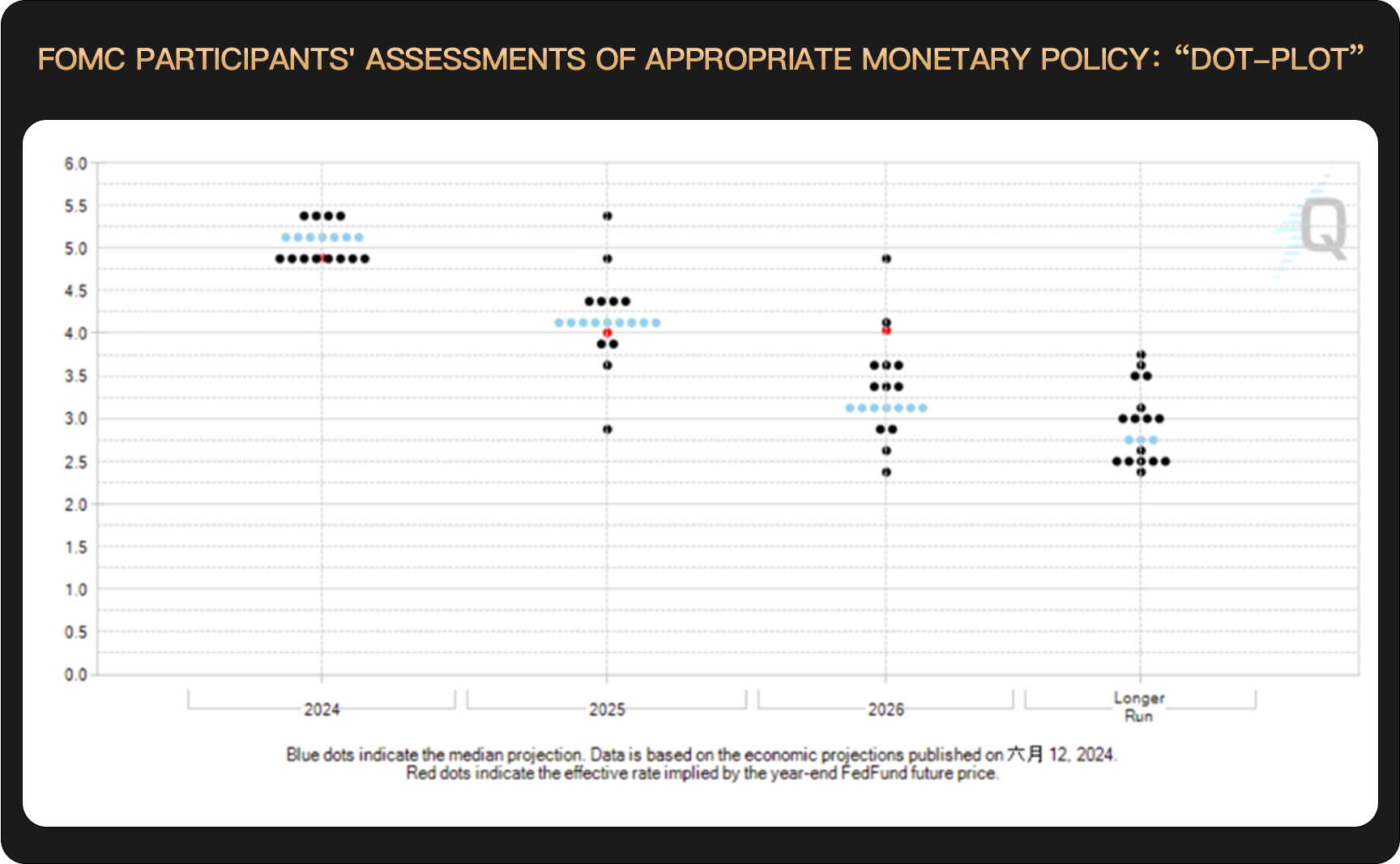

The dot plot shows that 11 committee members believe that the interest rate will remain above 5% for the rest of the year, equivalent to a maximum of only one rate cut; 8 committee members believe it can be reduced to 4.75%-5%, equivalent to two rate cuts. Therefore, there is currently no clear consensus on the number and extent of rate cuts, and it can only be "wait and see."

From a trading perspective, the market seems to have already started betting on a Fed rate cut. The US bond yields have been on a downward trend for the past few months.

The price of gold has also been trading at high levels, indicating that the market's risk preference is gradually increasing, and the attractiveness of safe-haven assets is gradually decreasing.

Currently, US inflation seems to be heading in the right direction. The latest Markit manufacturing PMI for the US is 51.7 (expected 51.0, previous value 51.3); the GDPNow model from the Federal Reserve Bank of Atlanta shows an estimated GDP growth rate of 3.0% for the second quarter of 2024. Therefore, WealthBee believes that investors do not need to worry too much about the US economy, and only need to wait quietly for the decline in inflation and the Fed rate cut.

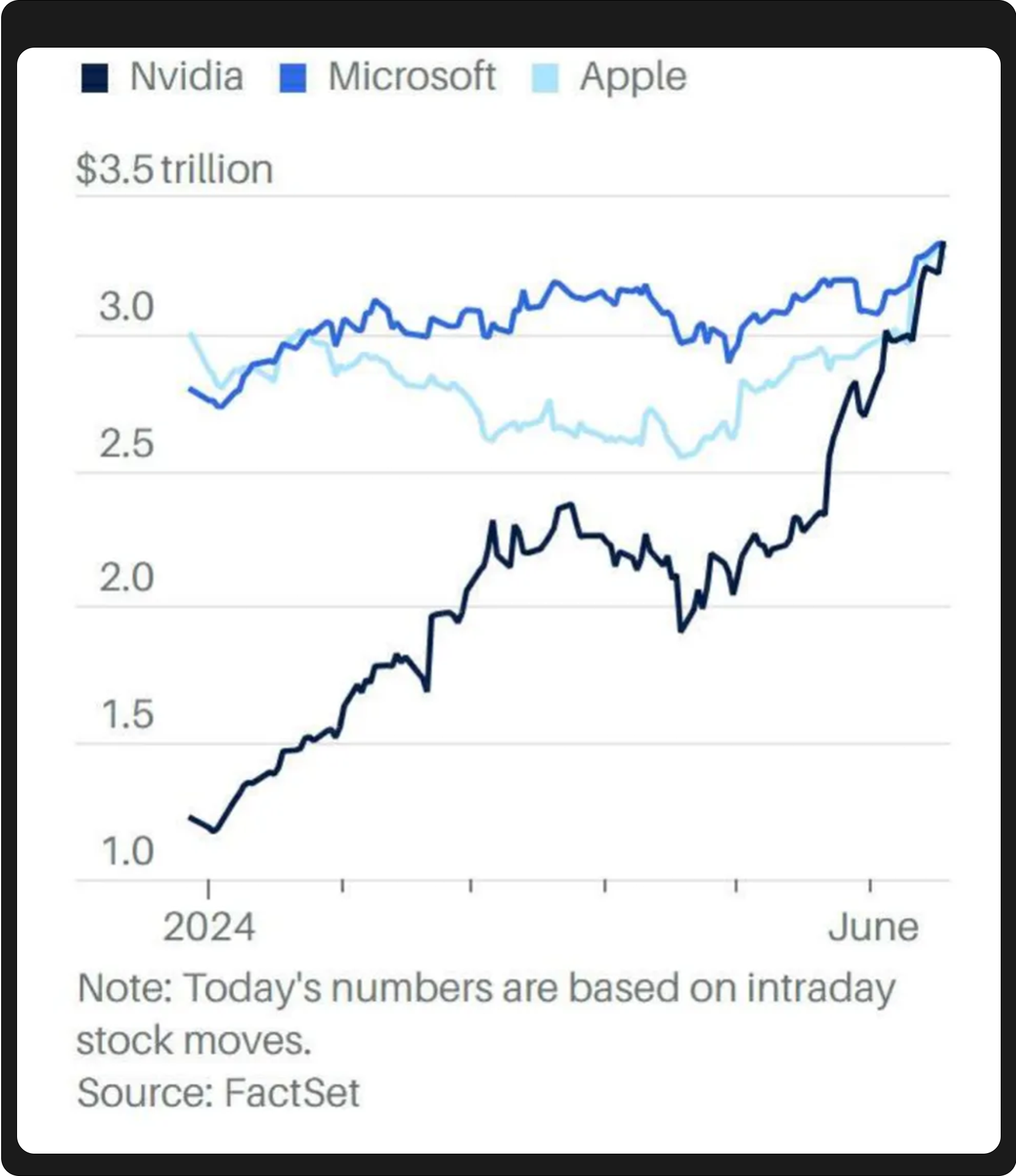

On June 18th, Nvidia (NVDA) stock rose by 3.51%, reaching a market value of $333.53 billion, surpassing Microsoft and Apple to become the world's largest company by market value. Just under two weeks had passed since Nvidia's market value surpassed $3 trillion and became a member of the $3 trillion market value club on June 5th. Undoubtedly, in this narrative of disruptive AI transformation, Nvidia has reaped the benefits and become the pride of the era as voted by the market with real money.

However, after briefly topping the world, Huang Renxun began to reduce his holdings and cash out, and the stock price subsequently declined. Currently, it has fallen back to third place in the world after Microsoft and Apple.

While the Fed has been slow to cut rates, the US stock market has been able to repeatedly reach new historic highs, and the powerful momentum brought by the AI narrative is leading the US stock market to break free from macro cycles and enter an independent market trend. This month, the Nasdaq and S&P 500 continued to reach new historic highs, while the Dow Jones Industrial Average remained in a high-level consolidation phase.

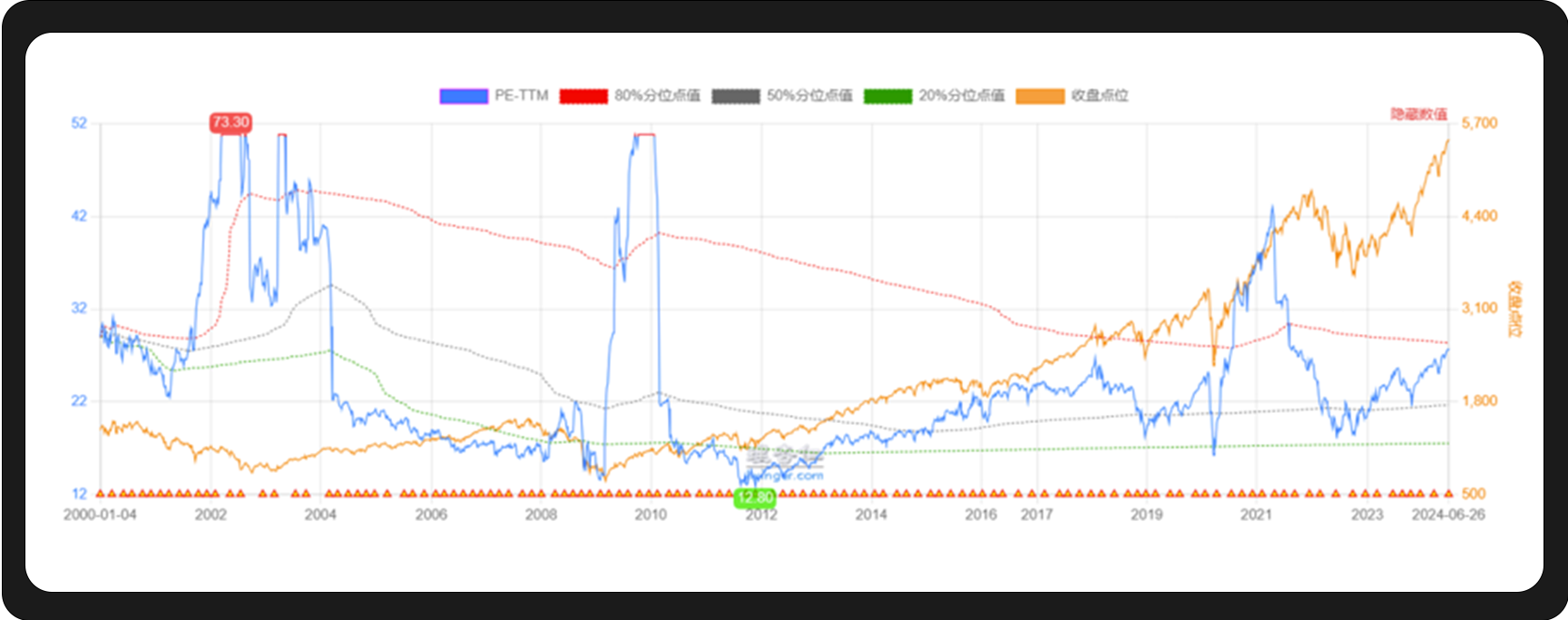

Since the beginning of the year, the discourse on the "bubble in the US stock market" has been getting louder and louder, but the US stock market has continued to reach new highs. If WealthBee were to analyze based on the price-earnings ratio, although the price-earnings ratio of the S&P 500 has been rising over the past year and is close to the 80th percentile since the 21st century, it is still much lower compared to the price-earnings ratio during the dot-com bubble burst around 2002. Therefore, it can be said that there is indeed a bubble, but it is not as serious.

However, this month, the difference between the S&P 500 index return rate and breadth index has reached a 30-year extreme, meaning that despite the index repeatedly reaching new highs, the number of rising stocks has continued to decrease. This indicates that market funds are all concentrated in large-cap stocks, while small-cap stocks are almost "unwanted." This phenomenon is not conducive to the overall liquidity of the US stock market, and institutional clustering may cause the decline of clustered stocks to lead to a market crash. Therefore, the risks in the US stock market currently exist and are significant. WealthBee believes that it may be necessary to wait for the release of Nvidia's second-quarter financial report for the 2025 fiscal year, to see if Nvidia can continue to exceed market expectations, combined with changes in rate cut expectations, at which point the style of the US stock market may undergo some changes.

Apart from the US stock market, the Asia-Pacific market has once again shown impressive performance this month, with the Mumbai SENSEX approaching 80,000 points and the Taiwan Weighted Index reaching a historic high. Despite the yen exchange rate falling below 160, the Nikkei 225 has remained in a high-level consolidation phase, with strong performance.

While the US stock market has reached new highs, the crypto market has inexplicably declined. This month, despite no apparent macro negative news, the crypto market has continued to decline, with Bitcoin falling below $58,500 and Ethereum dropping to around $3,240.

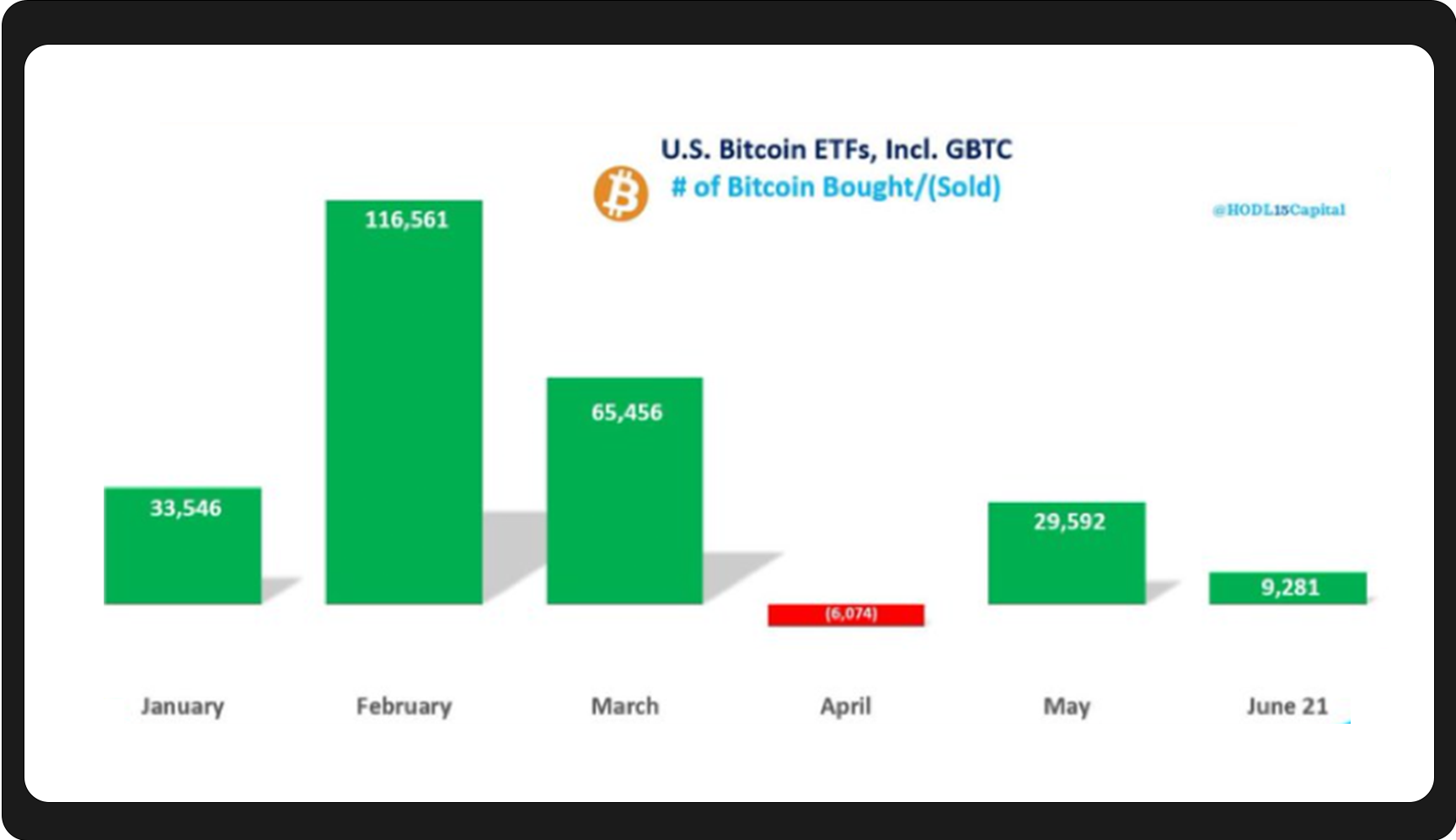

The macro situation in June was actually quite good, with the Fed's statements turning dovish. However, the volatility in the financial markets is often inexplicable. Monitoring data from HODL15Capital shows that in June, the US spot Bitcoin ETF saw a net inflow of 9,281 BTC, indicating a net inflow state for the Bitcoin spot ETF, which is contrary to the market trend and the behavior of major institutions.

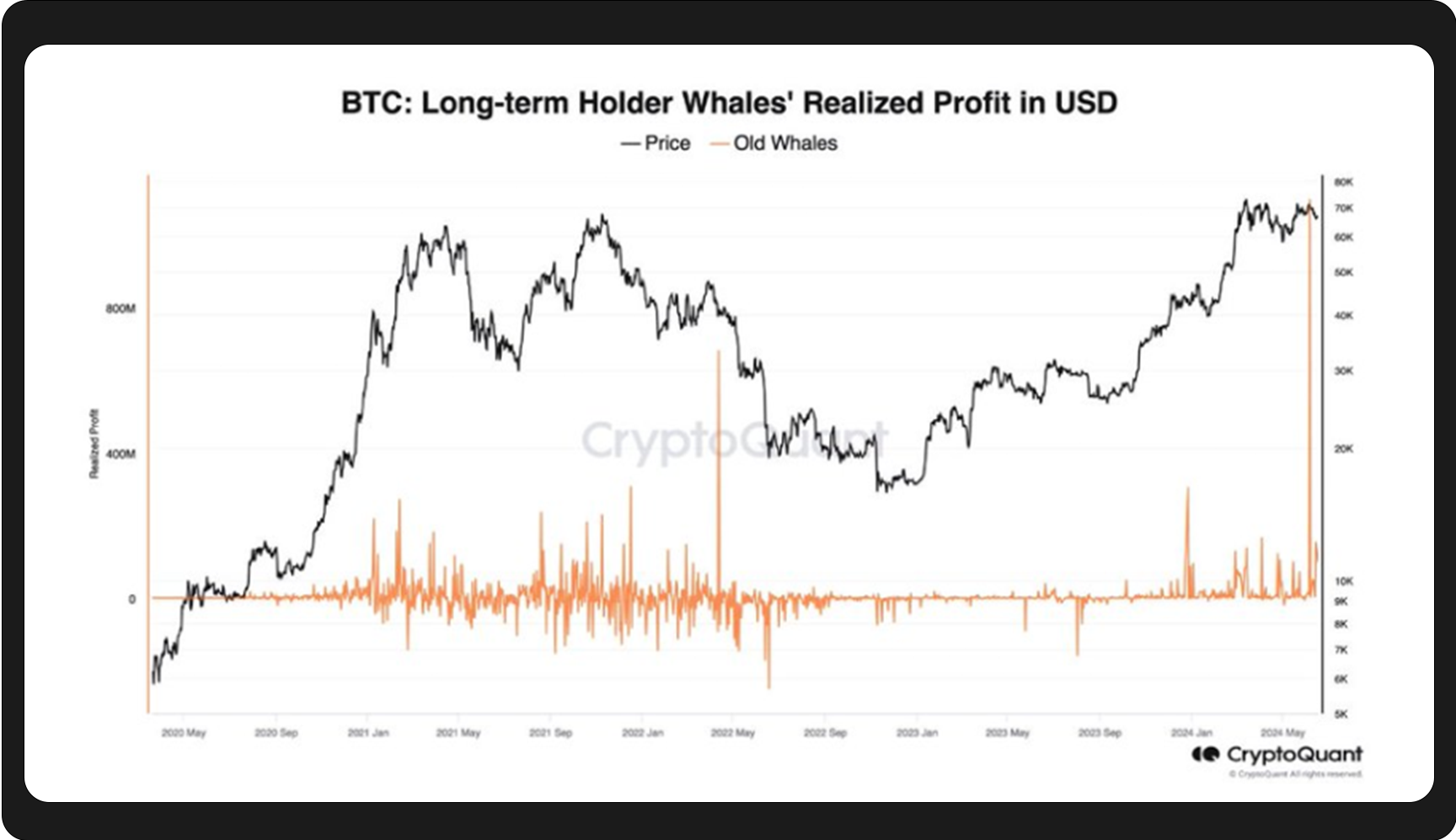

Currently, the direct cause of the market downturn is still due to the selling pressure from old OGs and miners (for example, miners and whales have already sold $4.1 billion). As for why there was a concentrated selling during this period, it is probably "just because."

Looking at it from another perspective, the emergence of a large number of financial instruments in the Bitcoin market has greatly increased market volatility. Since the introduction of Bitcoin futures trading in 2017, increasingly complex financial derivatives have continued to emerge. Without futures trading, everyone freely trading spot in the market, except for miners increasing the supply by producing new Bitcoins, all other trades in the market would be neutral. The introduction of futures has led to the emergence of naked short selling in the market, resulting in a large amount of "paper BTC," thereby increasing market supply and exacerbating the volatility of Bitcoin prices. Spot, futures, options, and other financial instruments are intertwined, making the entire Bitcoin market increasingly chaotic, and the simple and beautiful "classical era" of Bitcoin is gone for good.

Since there are no apparent risks, the downturn is probably a good opportunity to increase positions, and the selling by whales also provides an opportunity for other investors to buy in at a low price.

Moreover, the increasing diversification of financial instruments is the key path for the gradual acceptance of the crypto market by the public. Just this month, the crypto market received two important pieces of news. First, the arrival of the Ethereum spot ETF is expected to be approved earlier than expected, possibly as early as the beginning of July. Bloomberg ETF analyst Eric Balchunas expects the Ethereum spot ETF to be approved as early as July 2nd.

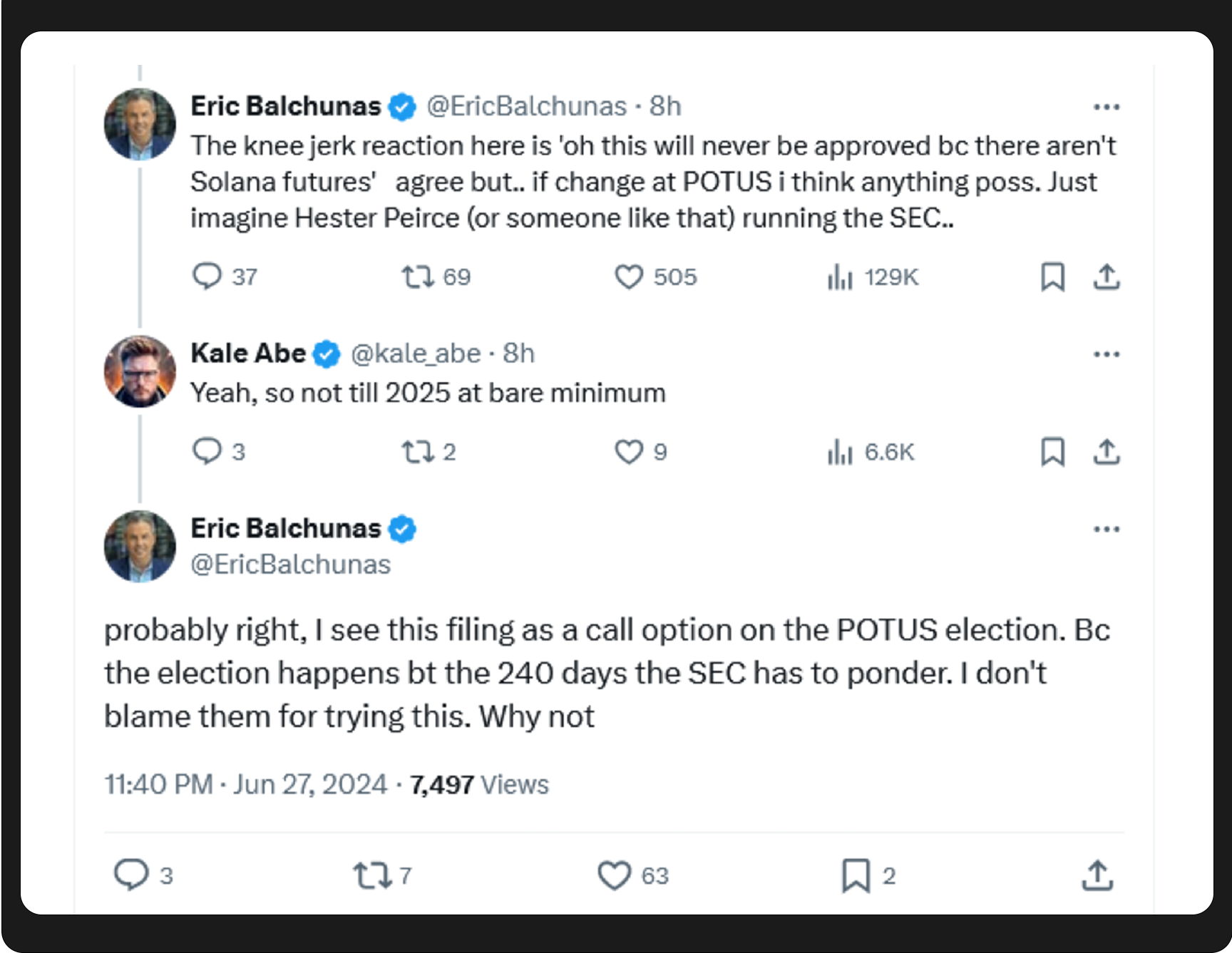

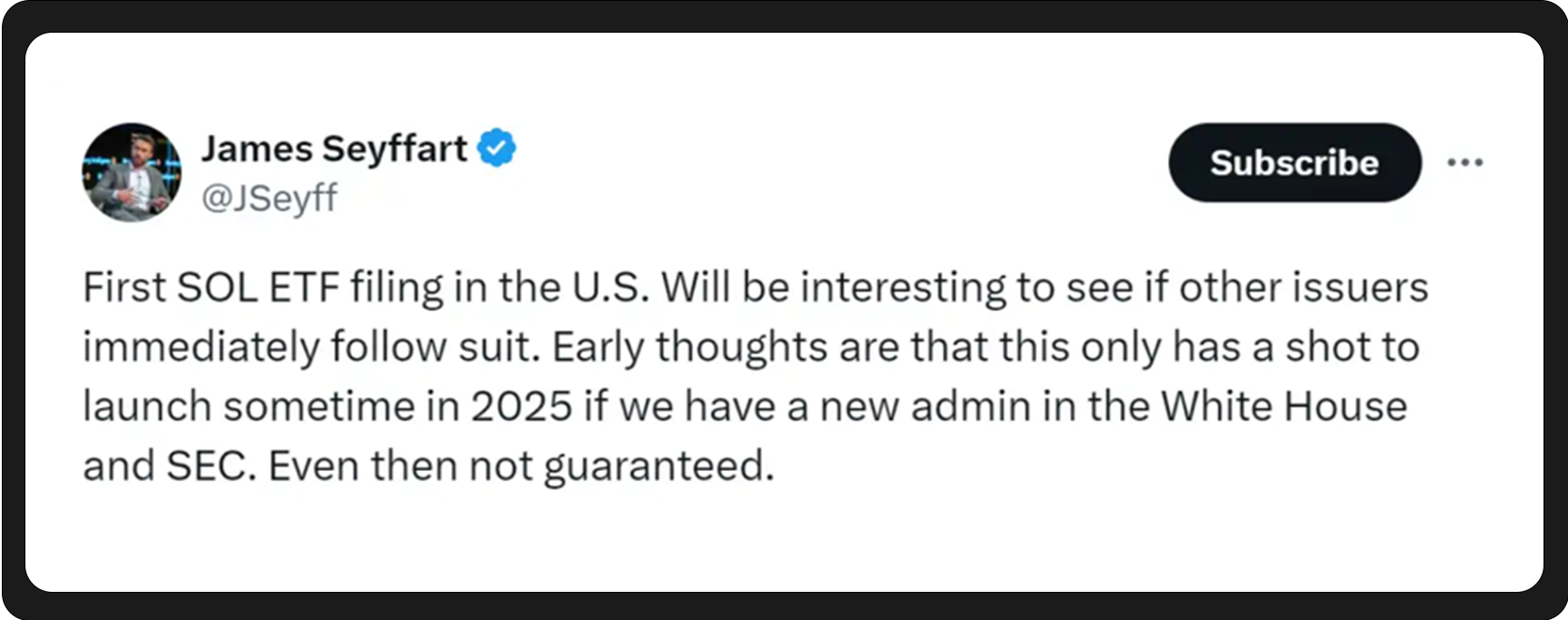

In addition, on June 27th, Matthew Sigel, Director of Digital Assets Research at VanEck, stated that they have applied to the SEC for a Solana ETF and indicated that it may be launched in 2025.

From Bitcoin to Ethereum, and then from Ethereum to Solana, crypto assets are being accepted by the traditional market at an unexpectedly fast pace, and the resulting incremental funds are likely immeasurable.

Despite the US June CPI data showing a cooler-than-expected inflation, the strong performance of non-farm data has made the market's expectations for a Fed rate cut more complex. In addition, the divergence between CPI and non-farm data, as well as the easing measures already underway in Europe, have further exacerbated the divergence in global monetary policies. In the stock market, the drastic fluctuations in Nvidia's market value and the differentiation between large and small-cap stocks reflect a divergence in the market's outlook on AI technology, while also exposing an increase in market concentration.

The significant drop in the price of Bitcoin to below $60,000 in the crypto market this month, decoupled from the trend in the US stock market, may be related to the selling behavior of miners and long-term holders. The increased market volatility may be partly due to the emergence of complex financial derivatives related to Bitcoin. Nevertheless, the launch of spot ETFs is seen as a stabilizer for the market, providing hedging tools for investors. In particular, the expected launch of the Ethereum spot ETF in early July is expected to bring new vitality and stability to the market. Despite the uncertainties in the macroeconomy and traditional financial markets, the crypto asset market has shown its independence and resilience, and is expected to play an increasingly important role in diversified investment portfolios, providing new growth opportunities for investors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。