Author: SlowMist AML Team

Preface

SlowMist Technology has released the "Blockchain Security and Anti-Money Laundering Report for the First Half of 2024" (referred to as the "Report" below). This report summarizes the key regulatory compliance policies and dynamics of the blockchain industry in the first half of 2024, including but not limited to the multi-dimensional regulatory stance on cryptocurrencies and a series of core policy adjustments. We have reviewed and outlined the blockchain security events and anti-money laundering trends in the first half of 2024, interpreted some common money laundering tools and phishing theft techniques, and proposed effective prevention methods and response strategies for these issues. In addition, we have also disclosed and analyzed major phishing criminal organizations Wallet Drainers and hacker group Lazarus Group, in order to provide references for preventing such threats.

Due to space limitations, only the key contents of the report are listed here. The complete content can be obtained through the link PDF Download.

I. Background

According to data from CoinMarketCap, as of June 30, 2024, the total market value of the global cryptocurrency market has reached approximately $23.4 trillion, fully demonstrating the increasingly strong momentum of the global blockchain market. However, with its growing momentum, the blockchain security is facing increasingly severe challenges. As blockchain applications expand and deepen, attackers have become more sophisticated and clever, continuously exploiting vulnerabilities in blockchain systems, resulting in huge losses.

In this context, this report focuses on two major aspects: blockchain ecosystem security and anti-money laundering (AML) security, to provide a comprehensive understanding of the current and future security risks in the blockchain industry.

II. Blockchain Security Situation

2.1 Overview of Blockchain Security Events

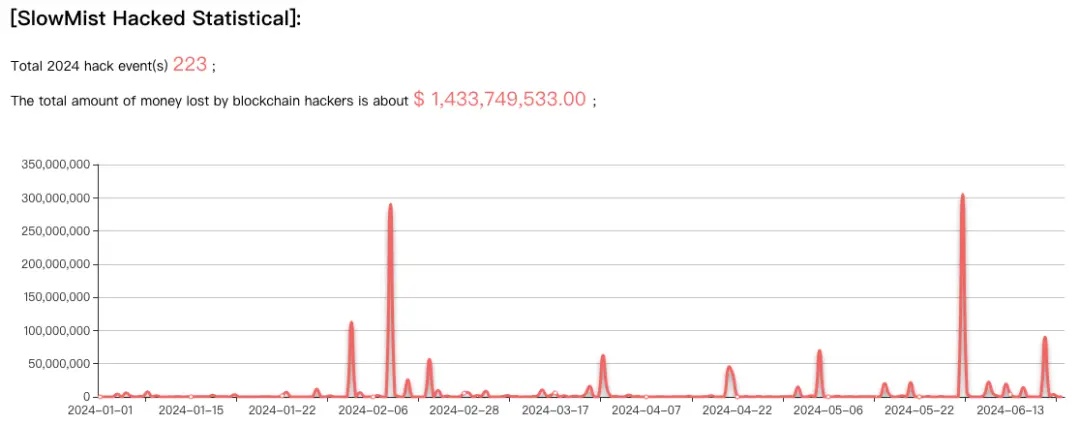

According to the incomplete statistics from the SlowMist Hacked database, there were a total of 223 security events in the first half of 2024, with losses amounting to as high as $1.43 billion. Compared to the first half of 2023 (185 events with losses of approximately $920 million), the losses increased by 55.43% year-on-year. (Note: Personal losses are not included in this report)

(https://hacked.slowmist.io/)

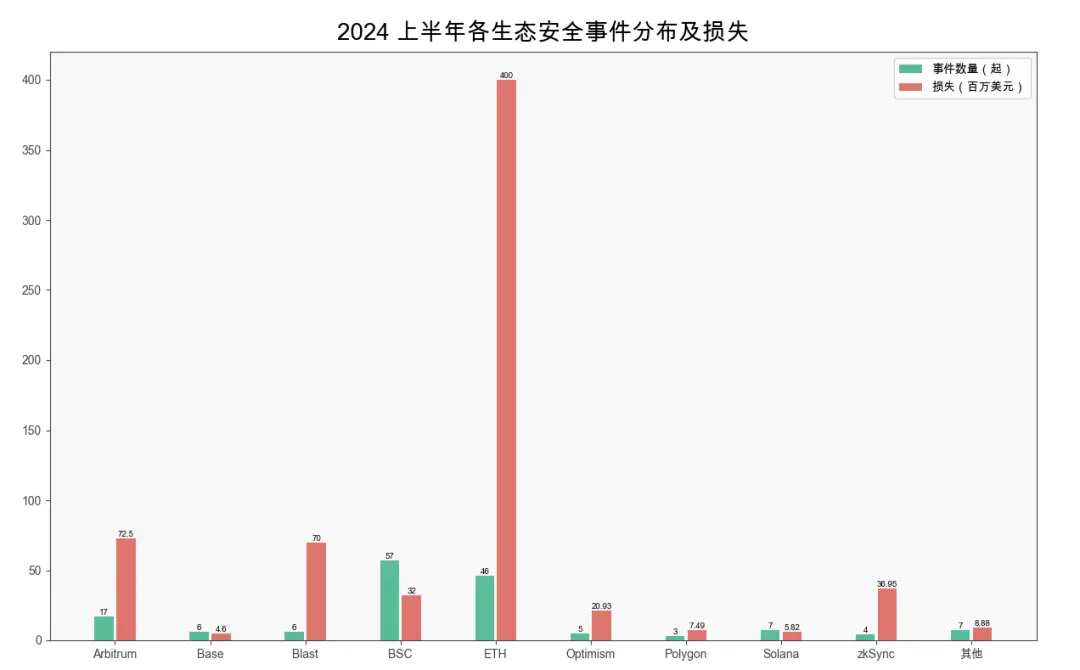

From an ecological perspective, Ethereum suffered the highest losses, reaching $400 million. Next is Arbitrum, with approximately $72.46 million, followed by Blast, with about $70 million. In addition, BSC had the most security events, with 57 cases and losses of approximately $32.12 million.

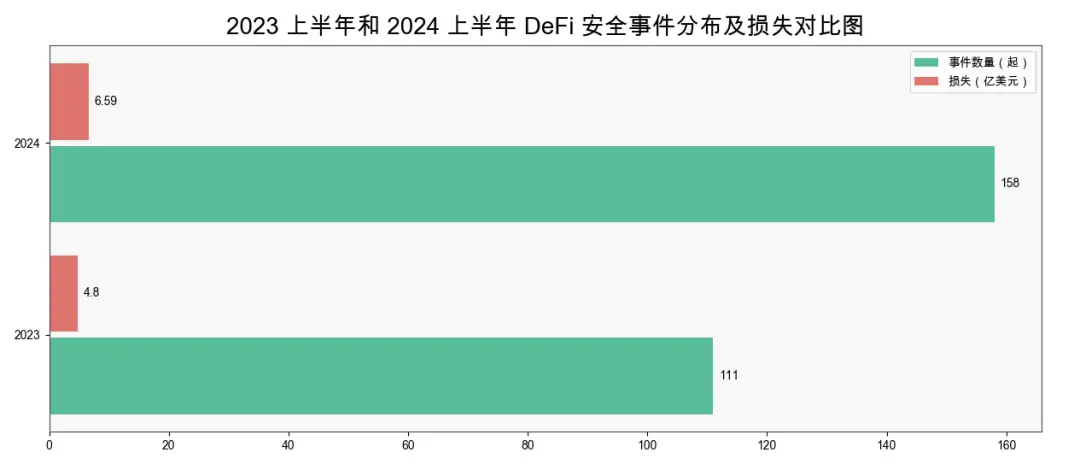

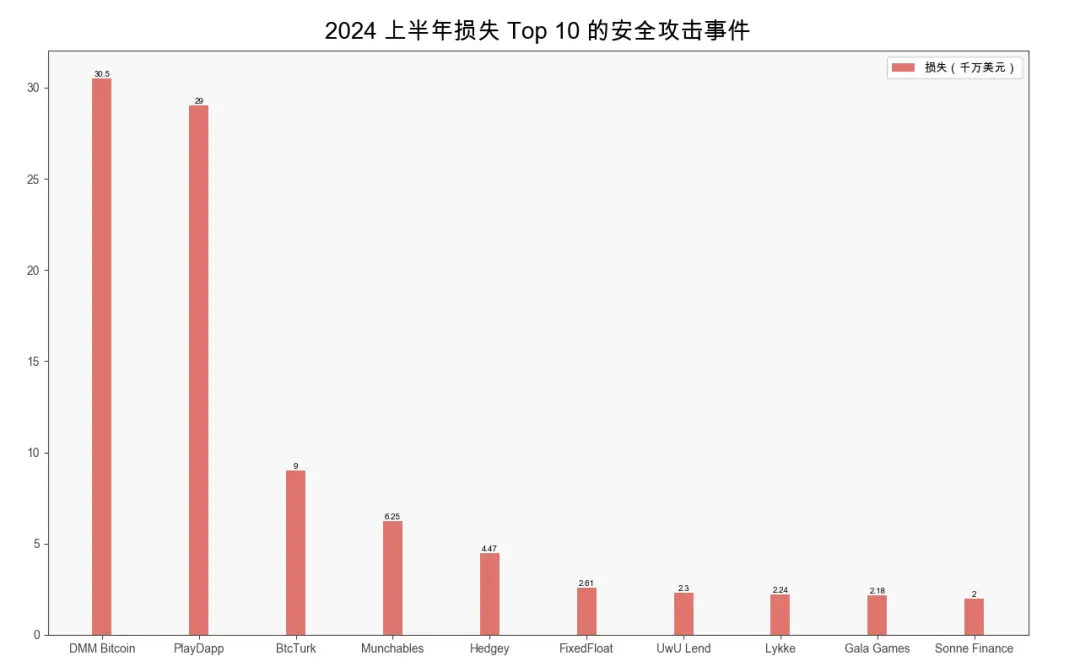

In terms of project categories, DeFi was the most frequently attacked area. In the first half of 2024, there were a total of 158 DeFi security events, accounting for 70.85% of the total events, with losses amounting to as high as $659 million. Compared to the first half of 2023 (111 events with losses of approximately $480 million), the losses increased by 37.29%. Next, security events on trading platforms resulted in losses of $524 million, with the DMM Bitcoin incident accounting for $305 million, making it the largest security event in the first half of 2024.

In terms of loss situations, there were two events with losses exceeding $100 million. The following are the top 10 security attack events with the highest losses in the first half of 2024:

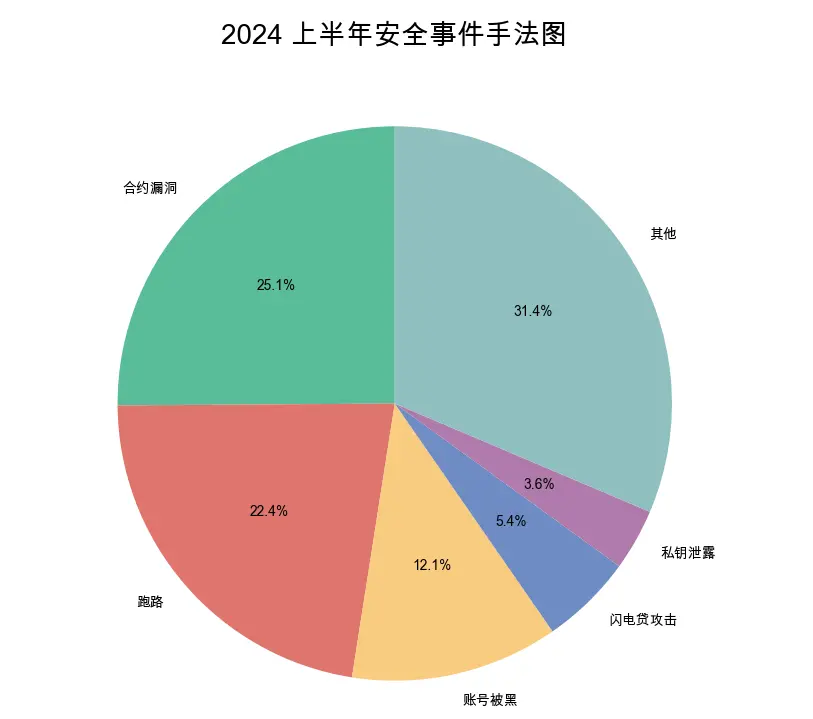

In terms of the causes of security events, the most common were contract vulnerabilities, with 56 cases and losses of approximately $104 million. This was followed by security events caused by exit scams, with 50 cases.

2.2 Phishing / Theft Techniques

This section includes some phishing and theft techniques disclosed by SlowMist in the first half of 2024:

- Same prefix and suffix phishing

- Malicious browser extensions

- Malicious Trojan programs

- Malicious bookmark phishing

- Signature authorization phishing

III. Anti-Money Laundering Situation

3.1 Anti-Money Laundering and Regulatory Dynamics

This section will focus on the major developments in the field of anti-money laundering (AML) and regulatory dynamics in the cryptocurrency sector:

- Chinese courts

- Hong Kong, China

- Singapore

- U.S. regulation

- European Parliament

- Middle East region

3.2 Security Event Anti-Money Laundering

- Frozen funds data

Tether: In the first half of 2024, a total of 374 ETH addresses were blocked, and the USDT-ERC20 assets on these addresses were frozen and unable to be transferred.

Circle: In the first half of 2024, a total of 28 ETH addresses were blocked, and the USDC-ERC20 funds on these addresses were frozen and unable to be transferred.

With the strong support of SlowMist's InMist intelligence network partners, SlowMist assisted clients, partners, and publicly hacked events to freeze approximately $24.39 million in funds in the first half of 2024.

- Fund return data

In the first half of 2024, there were a total of 16 incidents where all or part of the stolen funds were recovered. In these 16 incidents, the total stolen funds amounted to approximately $113 million, of which nearly $98.64 million was returned, accounting for 87.3% of the stolen funds.

3.3 Profile and Dynamics of Hacker Groups

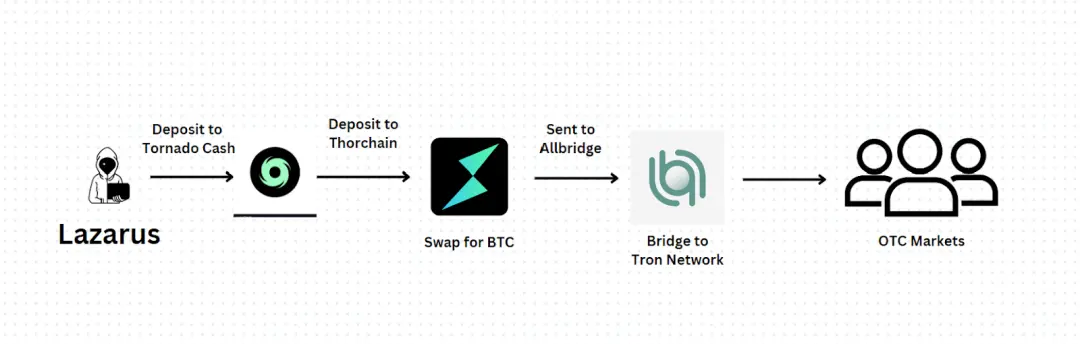

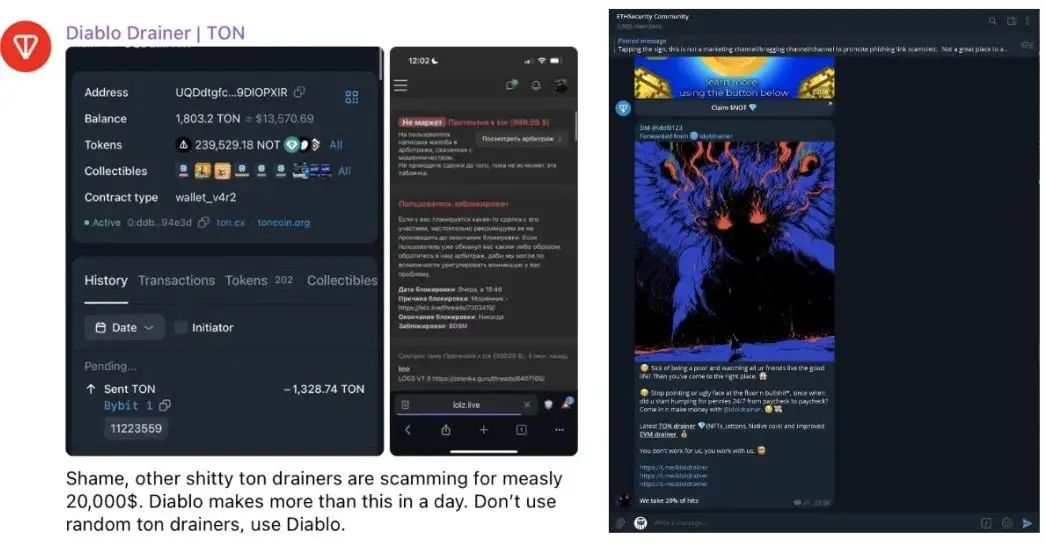

This section provides a detailed analysis of the modus operandi of the hacker groups Lazarus Group and phishing service Drainers.

- Lazarus Group

- Drainers

3.4 Money Laundering Tools

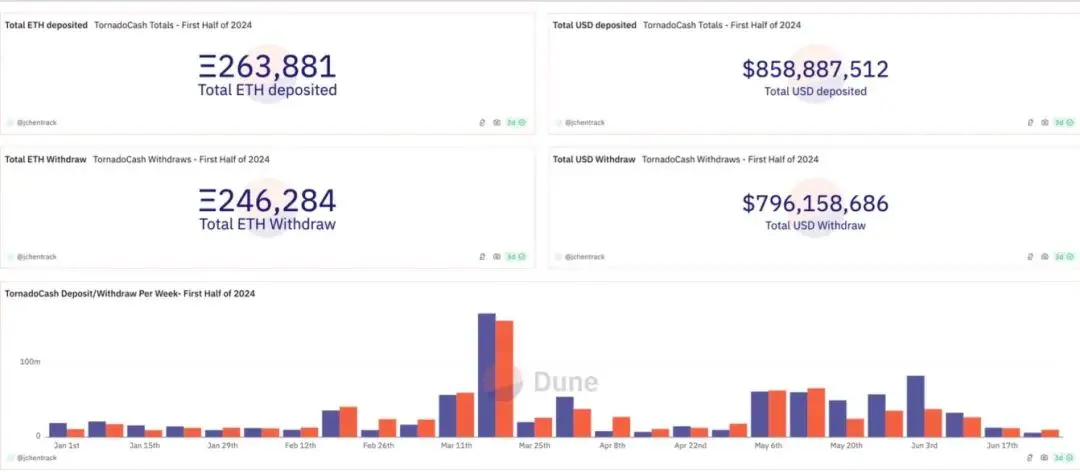

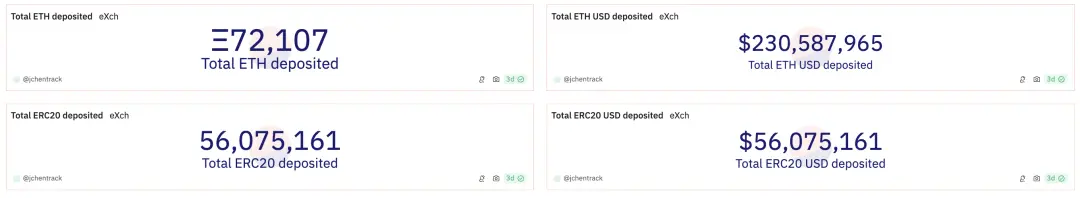

This section provides statistical analysis of the fund flow and direction of money laundering tools Tornado Cash and eXch.

(Tornado Cash: https://dune.com/misttrack/first-half-of-2024-stats)

(eXch: https://dune.com/misttrack/first-half-of-2024-stats)

IV. Conclusion

In conclusion, we hope that this report will provide readers with an analysis and interpretation of the current state of security in the blockchain industry, helping readers to have a more comprehensive understanding of the security and anti-money laundering situation in the blockchain industry, and contribute to the development of blockchain ecosystem security.

Finally, we would like to express our gratitude to every ecological partner, including our service clients, media partners, contributors to the black handbook, and SlowMist's partners. It is your strong support that has strengthened our determination to continue to strive for excellence and continue to be good guardians of the blockchain. We hope to continue to work together and make joint efforts to bring more light to the dark forest of the blockchain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。