Original Author: GSR

Original Translation: Wu Shuo Blockchain

Solana has consolidated its position as one of the three giants of cryptocurrencies. With the other two giants already launching or about to launch spot ETFs, Solana is likely to launch a spot ETF in the near future, and its impact on SOL may be the largest to date.

Note: GSR holds SOL.

Solana - Synchronizing the World at the Speed of Light

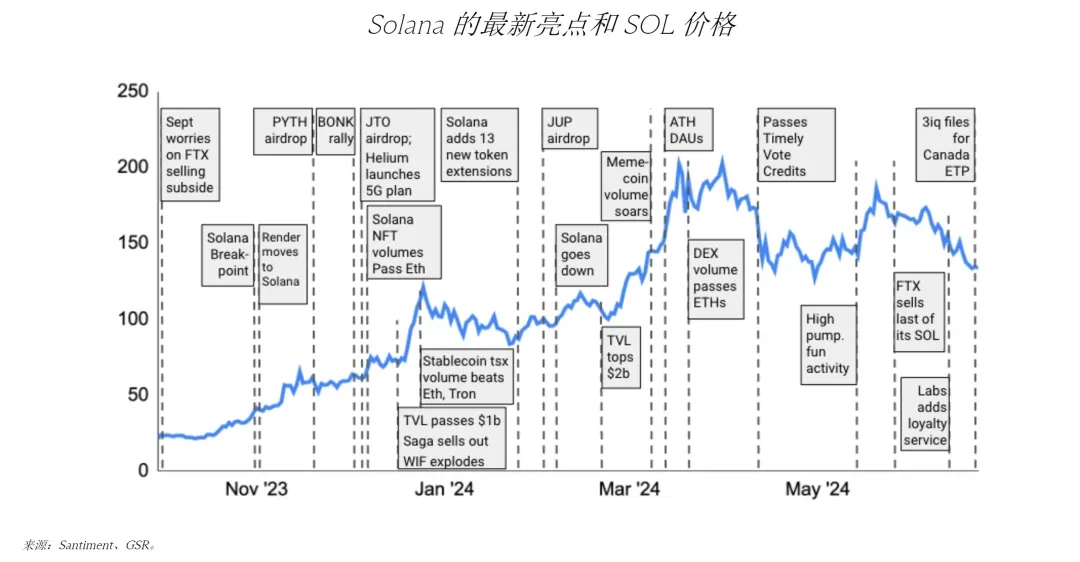

Solana was founded by Anatoly Yakovenko and Raj Gokal in 2018 and launched in 2020. It is a proof-of-stake blockchain designed for high performance and mass adoption. With extremely low transaction costs, a wide range of decentralized applications, and an active user and developer community, Solana has accumulated nearly 300 billion transactions and over 4 billion USD in total locked value. In addition, Solana continues to stand out in numerous projects, recent highlights include a large number of high-profile token launches, various projects migrating to Solana, key innovations such as token expansion releases, and unique use cases around Solana, such as order books, batch NFTs, DePINs, memecoins, etc.

The foundation of Solana's success lies in its outstanding technology, which we believe provides a sustainable competitive advantage, particularly in three particularly significant aspects. First is Solana's proof-of-history, which provides a time concept for validators. Similar to mobile signal towers alternating transmissions to avoid interference, proof-of-history allows validators to generate blocks when it's their turn without the need for the network to reach current block consensus, bringing significant speed and scalability advantages. Secondly, unlike the single-threaded virtual machine behind the current cryptocurrency field, Solana supports parallel transaction processing, significantly increasing throughput and leveraging the primary source of computational speed improvement. Finally, while Solana's historically high hardware and bandwidth requirements have to some extent sacrificed decentralization to optimize speed and security, with the cost reduction (Moore's Law), Solana will naturally benefit from it, perhaps becoming the first project to truly solve the blockchain trilemma and ultimately achieve its vision of synchronizing global states at the speed of light.

Underestimated possibility of further increase in cryptocurrency ETFs

As Solana establishes its position after Bitcoin and Ethereum, and with Bitcoin and Ethereum already (or about to) launch spot ETFs in the United States, a natural question arises - will Solana be next? In the current cycle, spot ETFs are the main driving factor for prices, making this question particularly important.

Simply put, under the current framework, the path to launching spot digital asset ETFs in the United States is clear, requiring a federally regulated futures market (currently there are no other futures markets besides Bitcoin and Ethereum), the futures market needs to exist for many years to demonstrate sufficient relevance, and the futures ETF needs to be approved before considering spot products. In other words, there will be no additional spot digital asset ETFs in the near future. However, we believe this severely underestimates the possibility of change.

In fact, change is already underway, with Donald Trump's recent support for the crypto industry leading the Democratic Party to relax its stance on digital assets in a tense election year. While it was hard to imagine a month ago, we have seen both houses of Congress pass a bipartisan measure to overturn the controversial SEC cryptocurrency accounting policy (SAB 121), and the House of Representatives pass a comprehensive digital asset regulatory framework (FIT21). Although the current legislative and regulatory structure is unlikely to adopt rules allowing for the launch of various spot digital asset ETFs, the Trump administration and liberal SEC commissioners may achieve this goal, especially through the Digital Asset Market Structure Act defining securities and commodities. Not only is this scenario possible, it may even become a reality.

Key determinants of the next spot ETF

Under more relaxed laws and regulations, we believe that the two key determinants of the next spot ETF are the degree of decentralization and potential demand. As for the former, whether FIT21 creates a new digital asset category with key decentralization tests to bypass the Howey test, or the SEC's suggested "sufficiently decentralized" may affect the classification of securities, the degree of decentralization may be crucial for digital assets to obtain an ETF. As for the latter, potential demand for any new ETF is equally important, as it will be the biggest factor affecting profitability. Here, issuers may weigh reputational risks, the ability through various internal committees, and the best interests of clients while considering potential demand. Overall, while native cryptocurrency issuers may apply for a large number of spot ETFs, we believe larger issuers are more likely to focus on one or two digital assets with sufficient decentralization and high potential demand.

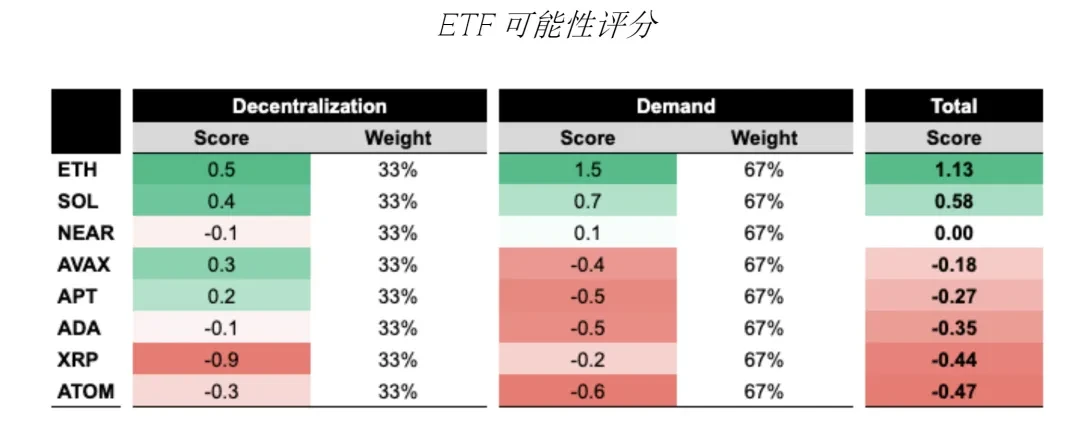

Next, we provide a brief analysis, attempting to quantitatively determine decentralization scores and demand scores, and add them together to form an ETF feasibility score. Note that we convert various category indicators into Z-scores for ease of merging categories, and then take the simple average of the Z-scores for each category to calculate the final decentralization and demand scores. Finally, note that many of the indicators used have flaws and a certain degree of subjectivity, but we believe these indicators still have reference value for the current task.

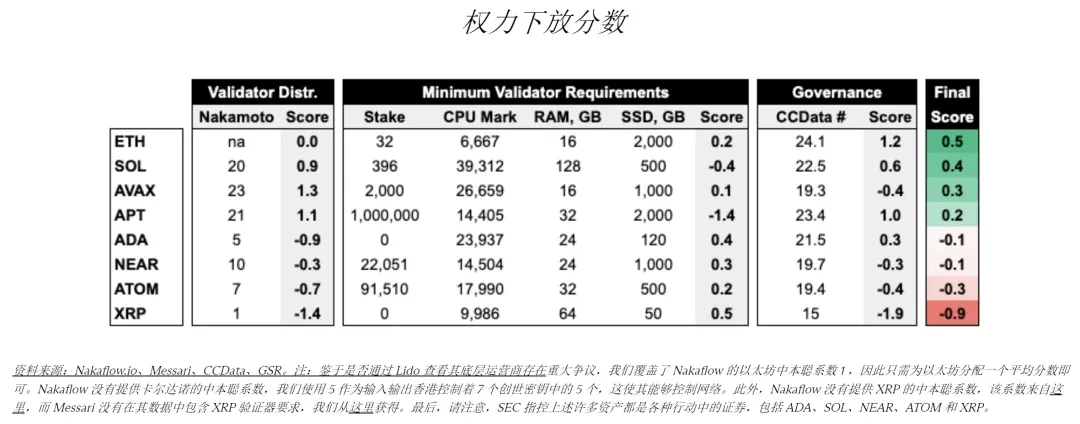

Decentralization Analysis

Analyzing the degree of decentralization of blockchains is difficult because there is no universally accepted definition, many indicators are still unsatisfactory, and the topic is overall highly complex, technical, and even philosophical. In addition, decentralization encompasses many concepts, such as permissionless participation, development control, influence of key figures, token distribution, share characteristics, and software and hardware diversity. Finally, note that most public chains become more decentralized over time, as evidenced in the following groups, such as Cardano's upcoming Voltaire era, which will substantially decentralize governance, or Solana's upcoming Firedancer client, which will make Solana the only network besides Bitcoin and Ethereum to have a second independent client on the mainnet. In summary, we believe some more robust and valuable decentralization indicators are:

· Nakamoto Coefficient, measuring the minimum number of independent entities that could collude to attack the network, with higher values indicating higher decentralization.

· Staking requirements, measuring the ease of anyone participating as a node operator or validator in the network, including minimum staking requirements and hardware requirements, with less staking and lighter hardware contributing to higher decentralization.

· CCData governance rating, including various governance measures such as participation, transparency, and decentralization.

As shown below, four blockchains with decentralization scores above the average are Ethereum, Solana, Avalanche, and Aptos.

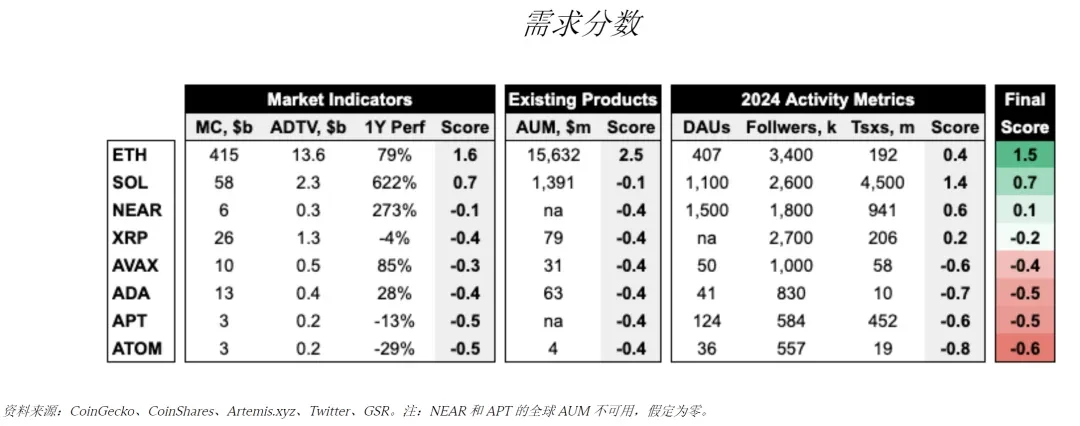

Demand Analysis

Potential demand is another key determinant, and issuers may look at various indicators when evaluating future fund inflows. The most important of these is token market capitalization, but overall, we believe the following three categories are particularly valuable:

· Market indicators, with higher market capitalization, higher trading volume, and strong token performance possibly indicating strong future demand.

· Existing product management assets under management (AUM), with high AUM of tokens in existing investment products globally possibly indicating high demand for spot ETF products.

· Activity indicators, with a strong, active community and widespread usage also possibly signaling strong future demand.

As shown in the figure below, the three major blockchains with above-average demand scores are Ethereum, Solana, and NEAR.

After adding our decentralization score and demand score, we obtain the final ETF feasibility score. It is important to note that we have set the decentralization weight to 33% and the demand weight to 67%, as we believe decentralization may be a threshold factor, while potential demand may be the primary criterion used by issuers. Overall, Ethereum received critical approval for a spot ETH ETF 19b-4 filing in May and is expected to launch multiple spot ETFs with a significant advantage this summer. Next is Solana, which also has a significant advantage over other digital assets, being the only one besides Ethereum with positive scores in both decentralization and demand. Ranking third is NEAR, due to its strong performance in both categories. Overall, the results clearly indicate that if the United States allows additional spot digital asset ETFs, Solana will be the next one.

Potential Impact of a Spot Solana ETF on Price

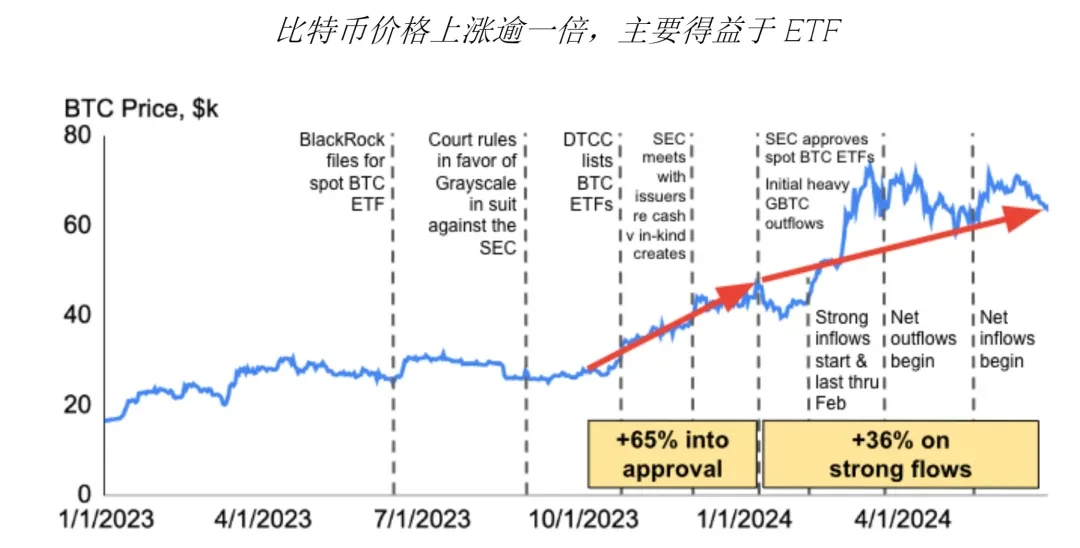

To assess the potential impact of a spot Solana ETF on the price of SOL, we can simply refer to the impact of a spot Bitcoin ETF on Bitcoin. After all, the approval of a spot Bitcoin ETF and the subsequent massive inflow of funds were the main factors that pushed Bitcoin from around $27,000 when market participants began to believe that a U.S. spot ETF approval was actually possible in October, to its current level of around $63,000, achieving a 2.3x increase. This 2.3x will be our baseline.

Next, we need to adjust the analysis, considering that the inflow of funds for a spot Solana ETF is significantly smaller relative to Bitcoin. Ultimately, we will adjust our relative inflow estimate by estimating the inflow of funds for a spot Solana ETF relative to Bitcoin. Here, we consider three simple scenarios.

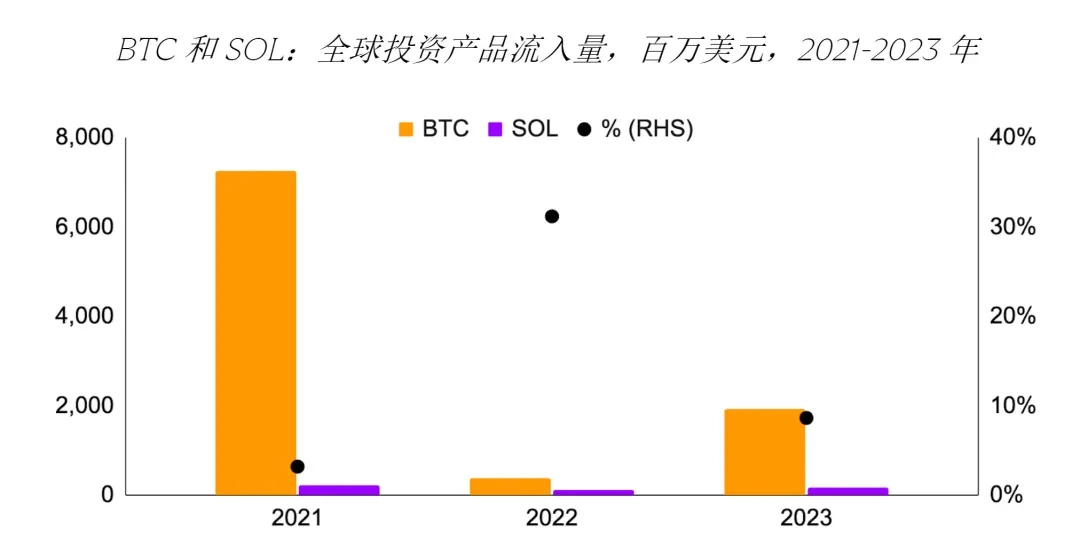

· Pessimistic Scenario: The assets under management of global investment products for Solana account for 2% of Bitcoin. We believe this underestimates the potential inflow of a Solana ETF, as this metric gives Bitcoin a significant lead, with the Grayscale Bitcoin Trust Fund being launched as early as 2013, while Solana was only launched in 2020. Therefore, we take 2% as the inflow for the pessimistic scenario.

· Baseline Scenario: We refer to actual recent inflow data to assess Solana's performance. Here, we use the inflow data from 2021 to 2023, as Solana was not well known before 2021, and up to 2024 to exclude the impact of the spot Bitcoin ETF (launched in January). Over these three years, the cumulative inflow of funds for Solana investment products relative to Bitcoin is 5%. We take this 5% as the baseline scenario.

· Optimistic Scenario: In the past two years, Solana has had a higher relative inflow, accounting for 31% and 9% of Bitcoin inflows in 2022 and 2023, respectively. Although we do not expect Solana to fully keep up with the exceptionally high Bitcoin inflows in 2021 and 2024, we take an average of 14% relative inflow per year over the three years as a potential optimistic scenario.

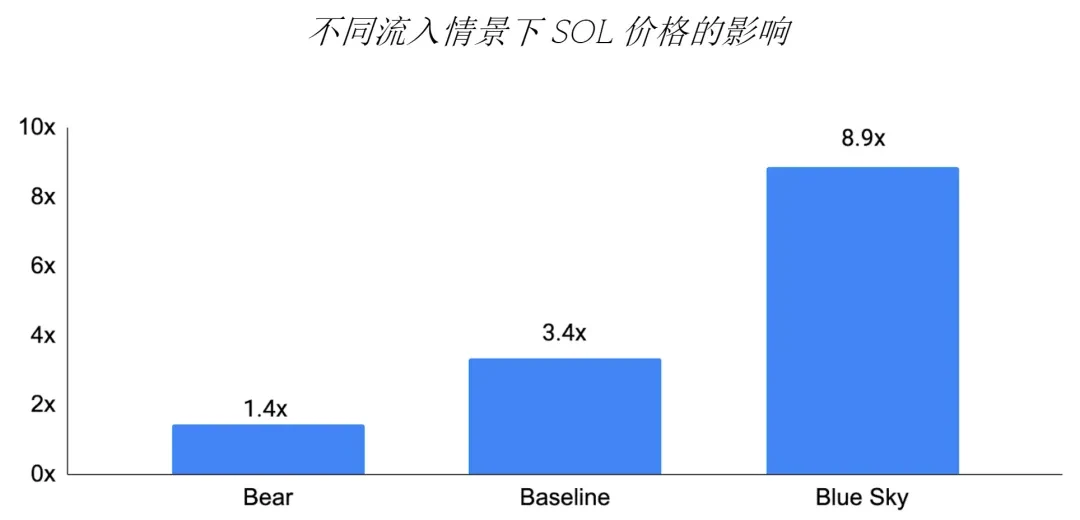

Although in the pessimistic, baseline, and optimistic scenarios, the inflow of funds for a spot Solana ETF may account for 2%, 5%, or 14% of Bitcoin, we must now adjust the impact of the spot ETF on SOL based on its smaller scale, which will be done through market capitalization. Specifically, over the past year, Solana's market capitalization has averaged only 4% of Bitcoin's.

Taking all factors into account, we can adjust our relative inflow estimates based on Solana's 2.3x increase relative to Bitcoin in different scenarios. As a result, in the pessimistic scenario, Solana may increase by 1.4x; in the baseline scenario, it may increase by 3.4x; and in the optimistic scenario, it may increase by 8.9x. Furthermore, there is reason to believe that the impact may be higher than these estimates, as unlike Bitcoin, SOL is actively used in staking and decentralized applications, and the relationship between relative inflow and relative scale may not be linear. Finally, it is important to note that the potential reflection of a spot Solana ETF on the price of SOL may be much less than that of Bitcoin, as evidenced by the deviation of the Grayscale Trust from its net asset value. If this inference is correct, the significant potential upside for SOL with a spot ETF can be seen as a "free option." In conclusion, if the United States allows more spot digital asset ETFs, Solana will be prepared for a spot ETF, and the price impact may be the largest to date.

Due to the lack of a real-time creation and redemption mechanism, the price of the Grayscale Trust may deviate from its underlying net asset value (NAV), but when the trust is converted to a spot ETF, this deviation will disappear, as spot ETFs have such a mechanism. On January 1, 2023, the Grayscale Bitcoin Trust (GBTC) traded at a 45% discount to its net asset value (before BlackRock applied for a spot Bitcoin ETF on June 15, 2023, and before Grayscale won its lawsuit against the SEC on August 31, 2023), but by early October, this discount had decreased to 21%, indicating that the price of Bitcoin may have already incorporated the increased opportunity for a spot Bitcoin ETF when we began measuring the price impact.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。