SEC accuses Consensys of "engaging in the issuance and sale of securities" through its digital asset wallet MetaMask.

By Mary Liu, BitpushNews

Regulatory headwinds have been relentless recently. On June 28th local time, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Consensys in the Brooklyn federal court, less than two weeks after notifying Consensys to end its investigation into Ethereum 2.0.

Unregistered Broker-Dealer

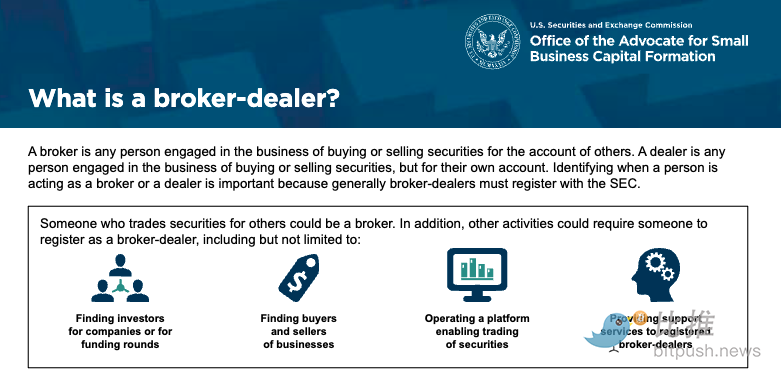

The SEC alleges that the company engaged in the issuance and sale of securities through its digital asset wallet MetaMask, making it an "unregistered broker-dealer," and claims that Consensys earned over $250 million in fees from this activity.

The SEC stated that Consensys "positions itself as a venue for buying and selling crypto assets (including crypto asset securities), recommends trades with 'best' value (as Consensys itself claims), accepts investor orders, routes investor orders, handles customer assets, executes trade parameters and instructions on behalf of customers, and receives compensation based on trades."

The court documents stated: "Consensys failed to register as a broker-dealer and failed to register certain securities for issuance and sale, in violation of federal securities laws."

Targeting Staking

Regulators claim that Consensys sold thousands of unregistered securities through staking providers Lido and Rocket Pool, which in turn issued tokens called stETH and rETH in exchange for staked assets.

The agency stated that investors provided ETH to Lido and Rocket Pool, which was then pooled and staked on the blockchain to earn returns that investors might not otherwise have access to.

The SEC stated: "Upon receipt of an investor's ETH, Lido and Rocket Pool issue a new crypto asset to the investor, stETH or rETH, respectively, representing the investor's pro rata interest in the staking pool and its rewards." The agency added that Lido and Rocket Pool sold and offered these investments in the form of investment contracts, falling within the category of securities.

The SEC also stated that Consensys itself "acted as an agent in the trading of crypto asset securities" and listed MATIC, MANA, CHZ, SAND, and LUNA as securities, which have been classified as securities in past enforcement actions.

The court documents stated: "From the date of the initial offer or sale, these crypto asset securities were offered and sold on the Conensys platform and continued to be investment contracts, and therefore securities."

According to DeFiLlama data, Lido and Rocket Pool are the two largest liquidity staking protocols on Ethereum, with a combined staked TVL of $37.6 billion. The native tokens of the protocols experienced rapid declines after the news, with LDO plummeting 12% in 30 minutes.

This is not the first time the SEC has sued staking service providers. In February of this year, cryptocurrency exchange Kraken reached a $30 million settlement with the SEC and subsequently shut down its staking service for U.S. customers. Another major company in the industry is Coinbase, which has been disputing the SEC's classification of staking as securities in court.

Do the Charges Hold Up?

Nick Almond, CEO of Factory Labs, stated that the SEC's argument to force open-source crypto wallets to register as broker-dealers is flawed.

He said: "To me, this is about custody rights - the degree of control users have over their assets. If they have no custody rights at all, they are not a broker-dealer." Traditionally, a broker-dealer is a party that conducts securities transactions on behalf of others.

For example, according to the official definition of the SEC, a "broker-dealer is any person engaged in the business of buying and selling securities for the accounts of others," but MetaMask's Swap service is essentially a "robot" controlled by users who want to execute their own trades.

This view aligns with the explanation of U.S. District Judge Katherine Failla, who rejected similar charges against Coinbase Wallet by the SEC on March 27th. The judge stated that because it is a self-custody wallet, users have control over their funds, so neither Coinbase nor Coinbase Wallet can be considered brokers.

Jorge Izquierdo, founder of Tuyo, stated that Consensys and MetaMask are in the same situation. In a post on the X platform, he stated that there is no difference between providing non-custodial smart contract support and "providing UI for any random exchange." The only issue is that Consensys charges a fee for providing exchange services.

The same reasoning applies to the allegations against MetaMask's staking service, which acts as an "intermediary" between users and decentralized protocols Lido and Rocket Pool, but in reality does not exist. Nick Almond described the staking service as more of a "UI interface."

Almond stated: "Equating UI frontends to banks or similar things is a bit silly, because anyone can interact directly with smart contracts, and even run the frontend locally."

In other words, as long as Ethereum continues to operate, MetaMask is just one way to access the protocol, which will exist indefinitely.

Since the beginning of this year, the SEC has issued notices, filed lawsuits, or reached settlements with several crypto companies focused on Ethereum and DeFi, including Wells, ShapeShift, TradeStation, and Uniswap. According to Bloomberg, the agency is also investigating the Ethereum Foundation.

Consensys responded to the new lawsuit by stating: "We firmly believe that the SEC is not granted the authority to regulate software interfaces like MetaMask, and we will continue to vigorously seek a ruling on these issues in Texas, as it is not only important for our company, but also for the future success of web3."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。