Original Authors: 0xTodd, Ebunker Co-founders

I am pessimistic mainly because:

- The ETF fee is too low.

- The market value of $SOL is also low.

- The number of institutions/retail investors willing to hold SOL naked is small (Staked SOL APR is as high as 8%, while ETF is -0.2%).

The product of these three factors may not be enough to cover the expenses of these ETF issuing institutions. If everything goes smoothly, it can be launched, but once it encounters significant resistance, it will probably have to be withdrawn. After all, without making money, there is no motivation to push forward. An analogy that is not very appropriate is that it is like preparing to retake the college entrance examination after the first attempt, but it does not prevent you from applying to Tsinghua University and Peking University as your first choice.

Regarding the pessimistic view of the Solana ETF, 0xTodd gave a more detailed explanation in early June. The full text was reprinted by BlockBeats as follows:

Why is it difficult to wait for the SOL ETF? Because it may not be profitable. Last week, Cathie Wood's Ark Fund decided to withdraw the application for an ETH ETF.

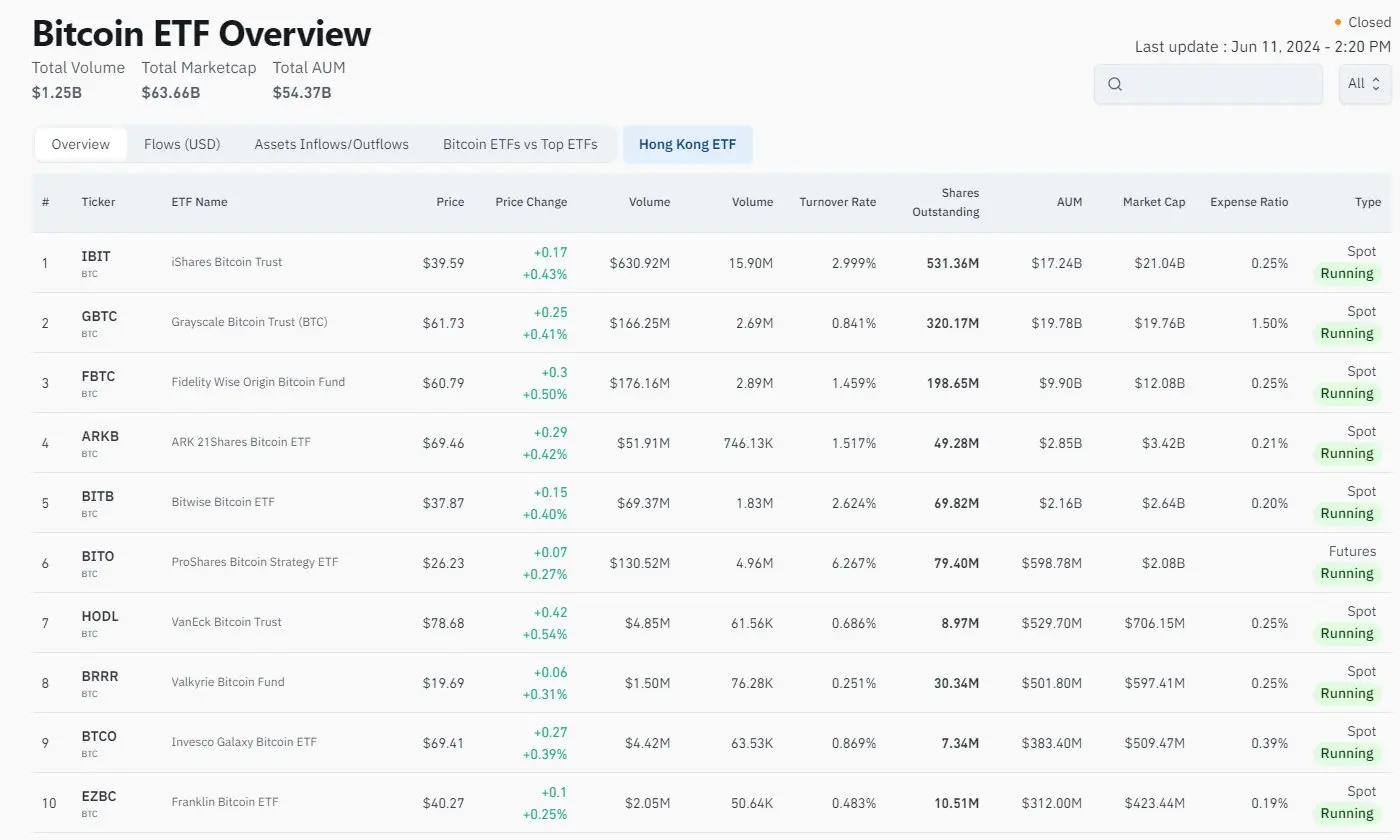

The Ark BTC ETF ranks 4th (with a market share of 6%, the top 3 are BlackRock, Grayscale, and Fidelity), but it is speculated to be "not very profitable".

The main reason is that the fee rate of the BTC ETF is relatively low compared to traditional ETFs, with many in the range of 0.19-0.25%, and the ETF is also engaged in a "fee competition".

A simple estimate based on the current scale of the Ark BTC ETF shows that it can earn approximately $7 million in management fees per year, so the corresponding cost is also of a similar magnitude. Therefore, if the Ark BTC ETF is still hovering near the breakeven point, then for Ark, aggressively promoting the ETH ETF may become a loss-making transaction. So even for Ark, they can only reluctantly give up the ETH ETF.

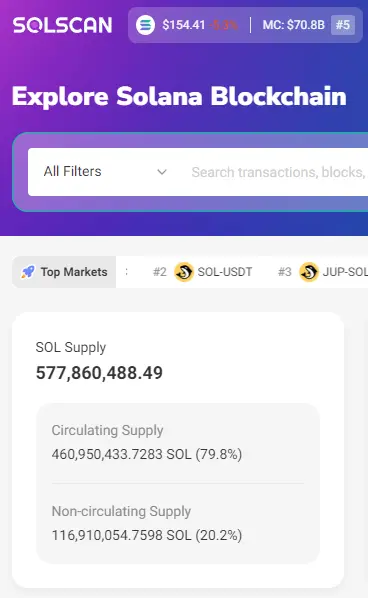

Purely from a business perspective, for mainstream coins with lower market value, such as $SOL, with a market value of 5% of $BTC, in order to recoup the $7 million annual cost, an ETF would need to manage at least 20 million $SOL.

Currently, the leading cryptocurrency ETF manager BlackRock only manages 1.5% of the entire BTC market, while 20 million $SOL would mean holding 4.5% of the nominal circulation of $SOL.

In addition, considering:

(1) SOL is naturally more difficult to raise than BTC, which has no interest. The on-chain yield of SOL can reach approximately 8%, but ETFs prohibit including staking functions. Holding SOL ETF is naturally underperforming the on-chain SOL by 8%, while Bitcoin only underperforms by 0.2% management fee.

Taking Grayscale as an example, G BTC peaked at 600,000 coins, while the peak of SOL is only 450,000 coins, a proportion significantly lower than BTC.

(2) The nominal circulation of SOL is 460 million, which may actually be much lower than this, as everyone understands.

A lower circulating market value requires bearing higher interest and regulatory pressure while achieving larger holdings. Therefore, with the current market value and circulation of SOL, it is probably difficult for these institutions to make money.

In business terms, who has the motivation to push forward transactions that do not make money?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。