Original | Odaily Planet Daily ( @OdailyChina )

Author | Wenser ( @wenser2010 )

Editor's note: Recently, Andrew Kang, co-founder of Mechanism Capital, made bearish comments on ETH. Prior to this, senior author Azuma of Odaily Planet Daily translated his comments, as detailed in the article "Ethereum's Big Short Declaration: ETH/BTC needs to fall for another year". Perhaps many people have limited understanding of him, but he has been deeply involved in the cryptocurrency industry for many years, having invested in high-quality projects with market values of tens of billions, such as Thorchain, Pancakeswap, and Frax Finance, and has also achieved considerable success in trading. Odaily Planet Daily, in conjunction with user @Atlas on the Pionex platform, will introduce Andrew Kang in this article for readers' reference.

Recent views: Limited upward space for ETH, BTC may reach new highs in 2025

In the current market with uncertain bull and bear trends, everyone has different opinions. However, the perspective and views of Andrew Kang (hereinafter referred to as Kang), who holds multiple roles as a capital partner, crypto KOL, and legendary trader, may be more valuable.

On June 24th, Kang stated on X: "I began to realize that this is the first complete bull market cycle that many cryptocurrency investors have experienced. In this bull market, the multi-day decline of BTC is very limited, restricted to within 20%, and many people seem to have increased leverage in the last pullback in April. However, in the previous cycle, the market often experienced liquidation due to leverage, resulting in a total evaporation of hundreds of billions, with pullbacks ranging from 30% to 60%. Different cycles have different paradigms, but when people become too comfortable and believe that certain things are impossible, it is usually when disaster strikes. Although I hold a bearish position, this does not mean telling you to short the market or sell everything. You must pay attention to investment risks, not put all your bets on one trade, and if faced with market volatility greater than expected, having more reserve capital is invaluable."

Subsequently, perhaps out of consideration to avoid "losing face," or perhaps feeling that the risk warning was not clear, he added: "The current market environment reminds me of May 2021, not June 2021, let alone December 2020. At that time, we were already accustomed to only rising, scrambling to buy the dip. We experienced a major adjustment from $64,000 to $45,000, but everyone expected a rebound in the market. But the end result was a continuous decline. We held hope; for example, more retail investors are about to come, $40,000 is strong support, super cycles, and so on. The current environment is the same, all in the 9-10 months after the start of the bull market. Except this time it's Ethereum ETF—legendary trader GCR has expressed bullish views. I believe GCR's timeframe over the years is correct, we will see BTC reach new highs in 2025 (but not all altcoins will do the same). This does not mean that the market will not experience extreme corrections within a few months. After all, the market can humble every stubborn person, making them as humble as they were at the beginning."

On June 23rd, Kang previously analyzed the potential impact of Ethereum spot ETF on the market, stating that the Bitcoin spot ETF provides a channel for many new buyers to allocate Bitcoin in their portfolios, but the impact of the Ethereum ETF is far less clear. Unless Ethereum creates a convincing path to improve its economic situation, its price will not see significant upward space due to the approval of the spot ETF.

On June 20th, Kang's view remained clear: "Although the market momentum has turned from rise to fall due to the lack of a large influx of ETF funds, I firmly believe that Bitcoin remains strong and will not fall below $50,000; for Ethereum, I predict that its price may remain stable until the ETF is listed, but the upper limit of this year's rise is expected to be around $4,000."

It is evident that Kang is more bullish on the future of Bitcoin compared to Ethereum, and this is based on his rich experience accumulated in the cryptocurrency market.

Multiple roles: Dual life of a crypto KOL and crypto investor

As of now, Kang's personal account on the Pionex platform has over 260,000 followers. Previously, he was the co-founder of the cryptocurrency mining operator MinerUpdate and stated: Most mining businesses currently do not use derivatives. This presents a huge opportunity for derivative exchanges such as Deribit, BitMEX, and Binance. With the intensification of mining competition and declining profit margins, mining operators will need to start venturing into the derivatives market for survival and thriving. The resulting trading activities can generate returns several times that of mining activities.

In June 2020, the official account of @Mechanism Capital was officially established, and Kang, transitioning from a trader and crypto KOL, officially became a crypto investor. "Invest where you excel"—this is often a major feature of the cryptocurrency industry. As mentioned in a previous article "Deciphering the top KOL investment list, seeking new Alpha", when the influence of a KOL reaches a certain level, along with the increase in personal wealth, there comes an increase in investment opportunities. Becoming an angel investor in the cryptocurrency industry is a natural progression for some, while others choose to establish an institution to operate the corresponding investment fund. Kang chose the latter. Previously, Mechanism Capital successfully invested in well-known blockchain project NEON.

In February this year, Kang shared his investment philosophy on social media platforms—"The method to achieve a thousand-fold increase lies in early discovery of teams with outstanding product potential."

He mentioned, "In 2018, I had a portfolio worth $50,000, and by mid-2021, I had developed this portfolio to the same scale as many well-known cryptocurrency funds in the field, without attracting any external funds. The only way to achieve this possibility is to early discover S-tier teams with outstanding product potential, accumulate most of the ownership of projects in the open market, and fully support them until they appreciate by over 100 times, some even appreciating by over 1000 times. Support methods include token incentives/issuance design, marketing/community development strategies, DeFi integration/partnerships, exchange connections, product design, introduction of other signals/value-added funds/investors/users/developers, becoming high-energy users of the protocol, and more. Many projects I have followed from the early stages with a market value of less than $50 million have grown to over $2 billion, some even exceeding $5 billion, including Thorchain, Pancakeswap, Frax Finance, and others."

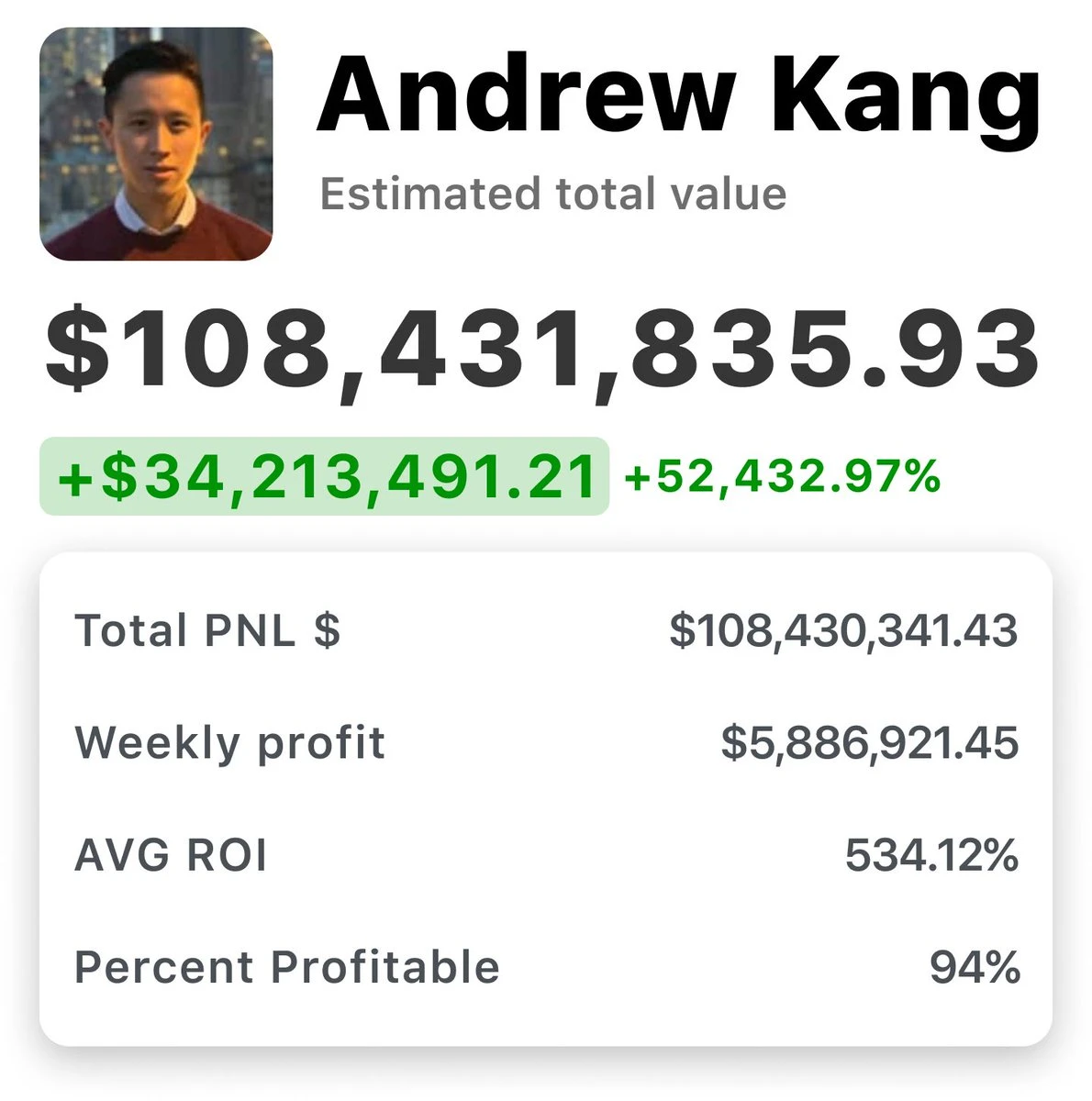

A glimpse of Kang's assets

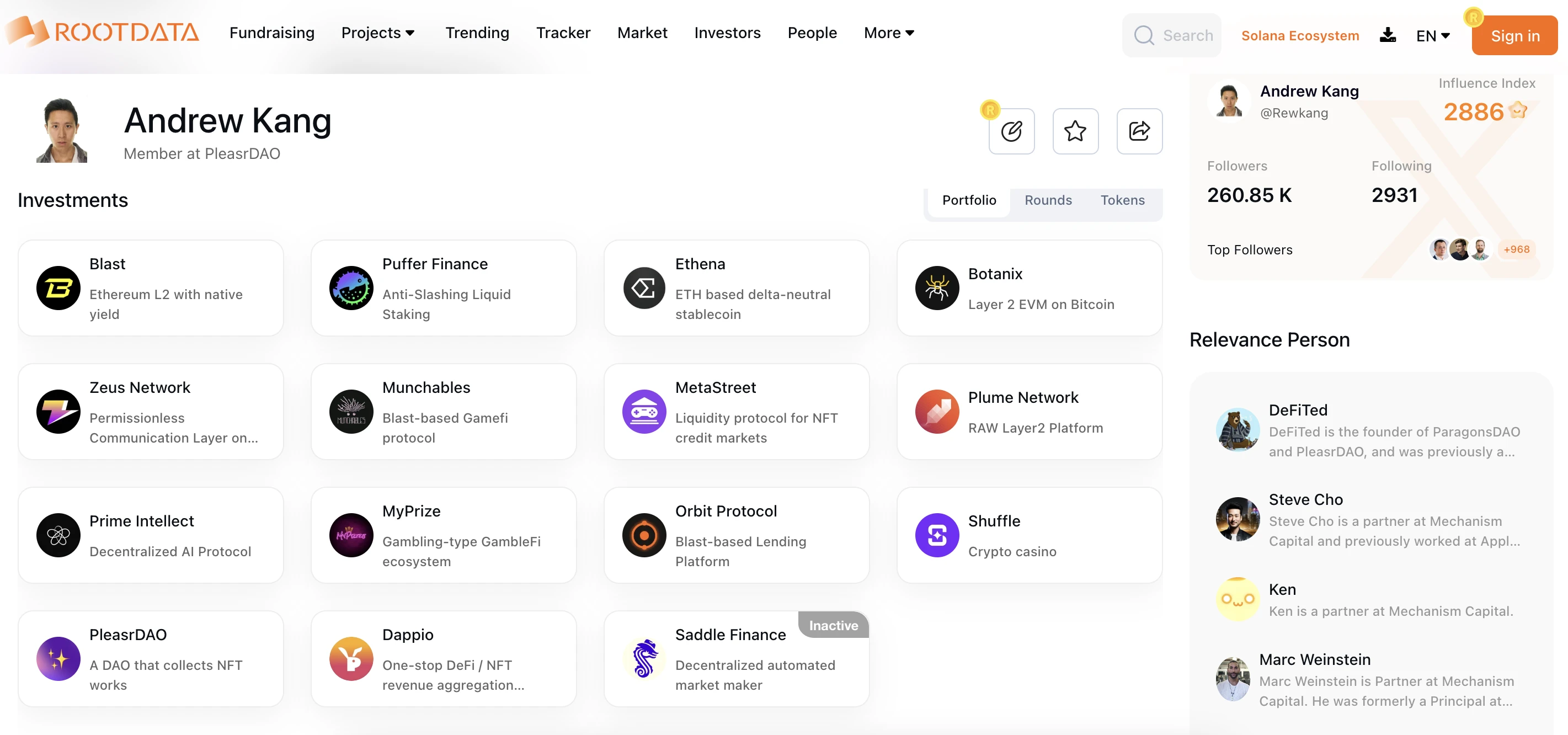

According to data from @CryptoRankio website, Kang's latest and quite well-known investments are @BlastL2 and @puffer_finance. In addition, he has also invested in NFT collateral lending platform MetaStreet, Solana ecosystem cross-chain communication network Zeus Network (and is the lead investor), crypto gaming gambling platform Shuffle, Blast ecosystem lending project Orbit Protocol, RWA Layer 2 network Plume Network, and many other projects.

Furthermore, according to Rootdata website data, Kang has invested in 12 projects over the past year, with 15 recorded projects, including his deep involvement in NFT crowdfunding DAO organization PleasrDAO.

It is worth mentioning that according to the Rootdata website, his network of contacts includes several partners of Mechanism Capital, including Steven Cho, Ken, Marc Weinstein, as well as PleasrDAO founder DeFiTed.

This leads to Kang's other multiple identity: senior NFT collector and active participant in meme coins.

Culture enthusiast: Azuki was once a favorite, meme coins are a new asset class

As early as 2021, Mechanism Capital had invested in the NFT project Kanon. At that time, the project launched its first sub-project, K21, which was a closed art machine gun pool that would provide liquidity exposure to the works of 21 influential contemporary, digital, and crypto artists, and integrate DeFi to combine the artists' motivations and investors' returns, reshaping funding, charity, curation, and custody models.

In September 2022, Kang purchased Azuki #4978 through the NFT trading market X2Y2 for 105 ETH (valued at approximately $143,000 at the time).

In October 2022, Kang purchased Azuki #5558 through the NFT trading market X2Y2 for 200 ETH.

In June 2023, according to data from the crypto data monitoring platform Nansen, Kang held 299 Azuki and 580 Elementals, both being the largest holdings in the related series at the time. Additionally, he also held 436 BEANZ.

In March 2024, Kang purchased the original 3AC (Three Arrows Capital) Pepe NFT from Sotheby's auction house, which was the first Pepe NFT authorized by the first Pepe creator Matt Furie, initially sold for 420 ETH on April 17, 2021, and later acquired by 3AC's Starry Night Capital for 1000 ETH on October 5, 2021.

Furthermore, Kang has a high opinion of meme coins and has made multiple purchases. He even changed his X platform account avatar to the IQ50 meme character.

In February of this year, Kang made a high-profile statement: his cryptocurrency fund Mechanism Capital had bet on Trump concept tokens and related NFTs. Subsequently, Nansen monitoring data showed that on January 19, Mechanism Capital's wallet purchased approximately 500,000 TRUMP tokens at a cost of about $0.506, and on the same day, purchased an additional 23,900 TRUMP tokens. Of these, 136,200 TRUMP tokens were allocated to Mechanism Capital's wallet, 135,800 TRUMP tokens were sent to Mechanism Capital team-related wallets, and 58,400 TRUMP tokens were sent to partner Marc Weinstein's wallet.

In March, Kang once again made a public statement, stating, "Meme coins have become a global speculative liquidity focus. Compared to traditional equities, global users now have easy access to meme coins. This is why the increase in Dogecoin's value exceeded the increase in Gamestop's stock price. In the previous cycle, the total market value of meme coins reached $100 billion, and the peak market value in each cycle usually experiences multiple growth. In addition to retail investors, HWN traders and hedge funds are gradually entering the market, and there is still a long way to go in the future." He then stated, "New funds will continue to buy meme coins" in order to achieve excess returns in the market, and boldly predicted, "Meme coin 2.0 or 'culture coins' will emerge, targeting specific audiences/ideologies/groups. Every celebrity/influencer will have their favorite collaborative token, mainly not on CEX tokens, which means new dollars will appear to purchase a large amount of SOL tokens on-chain, just like the ETH and NFT season in the past."

Subsequently, the market development indeed came true as expected, with popular Solana meme coins such as BOME, NAP, SLERF emerging, and old projects like PEPE, PEOPLE, WIF, BONK, FLOKI, along with meme coin projects from celebrities like JENNER and MOTHER, being examples.

At that time, unlike other market views, he gave a highly positive evaluation of meme coins, stating, "Meme coins are not a zero-sum game, but a new asset class."

Conclusion: Investors who dare to make judgments are good traders

Looking back at Kang's past investment experience and social media platform tweets, we can see a highly charismatic individual who dares to make judgments in a complex market environment. He is able to timely react to the market and provide corresponding analytical basis, while also actively supporting investment projects and favored narrative tracks. It can be said that his success from starting from scratch to becoming a wealthy asset holder is definitely not accidental.

It's no wonder that in February of this year, Chris Burniske, former ARK Invest crypto lead and current Placeholder VC partner, expressed an open attitude towards Kang's view that the price of Bitcoin would reach a new all-time high in March. Subsequently, the market trend indeed followed suit.

Of course, Kang's investment experience has not been smooth sailing all the way. For example, he once built a position in CELR in 2021 and put forward the highly forward-looking view that "Layer 2 is not a winner-takes-all field." Although the token has now faded into obscurity, his views have many valuable lessons to learn from.

Kang's personal experience tells us that daring to express opinions and making one's own judgments is the only way to find one's own "mechanism principle" in the turbulent crypto market and grow into a capital giant.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。