Author: Wall Street News

As the debate between Biden and Trump kicks off, the impact of the U.S. presidential election on the financial markets is gradually becoming apparent.

According to Global Times, U.S. media summarized the performance of both sides in the first 30 minutes: "Biden was sometimes incoherent, while Trump lied on issues such as the economy, abortion, and NATO member defense spending, and the two also engaged in fierce personal attacks on each other."

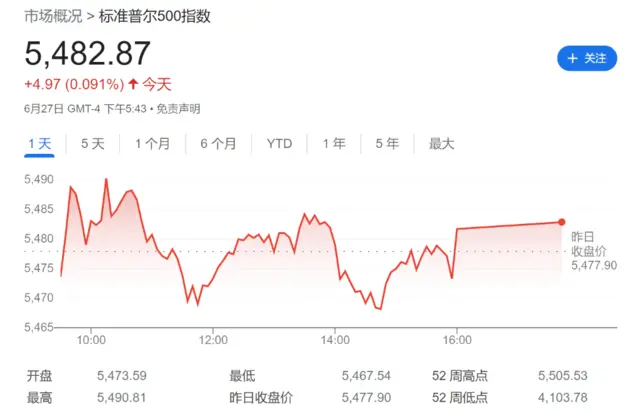

Although the S&P 500 index has not fallen by more than 2% for nearly 400 trading days, Goldman Sachs recently warned that this situation may soon change.

Goldman Sachs analyst Oscar Ostlund believes that the options market usually starts pricing in about three months before the election. Although it has not fully entered this stage yet, market volatility is expected to appear soon. As the U.S. election approaches, market volatility is expected to rise, and the market should closely monitor the potential impact of the election on the market.

The team led by Liu Gang at China International Capital Corporation (CICC) believes that with the first round of the presidential debate being brought forward from September to the end of June, and the approaching "window period" of monetary policy, election trading may start early, and the variables and impact it brings may gradually increase.

In addition, it is worth mentioning that 16 Nobel Prize-winning economists recently issued a joint letter warning sharply that: if former President Trump wins the election in November, his economic policies will reignite inflation and cause lasting damage to the global economy.

Some analysts also point out that regardless of whether Trump or Biden is elected, higher inflation is inevitable, with only differences in the pace.

Goldman Sachs: Election Risks Begin to Spread to Financial Markets

The first candidate television debate for the 2024 U.S. presidential election took place at around 9 p.m. local time on the 27th (around 9 a.m. Beijing time on the 28th), with Biden and Trump taking the stage for the first time in nearly 4 years.

Today's television debate may provide new clues on how the market views the impact of the election on asset markets.

After surveying 800 institutional investors worldwide, Goldman Sachs analysts summarized three key points:

▲ Regardless of whether the Republicans or Democrats are in power, the government will increase the freedom of expenditure for administrative departments, which is undoubtedly a negative factor for the bond market.

▲ If Trump wins, whether it is a divided House or a unified government, the market believes it will be beneficial for the stock market, as this may mean that the Federal Reserve will adopt a more dovish policy.

▲ Investors generally believe that a Democratic victory will be unfavorable for the U.S. dollar, which may lead to a depreciation of the U.S. dollar.

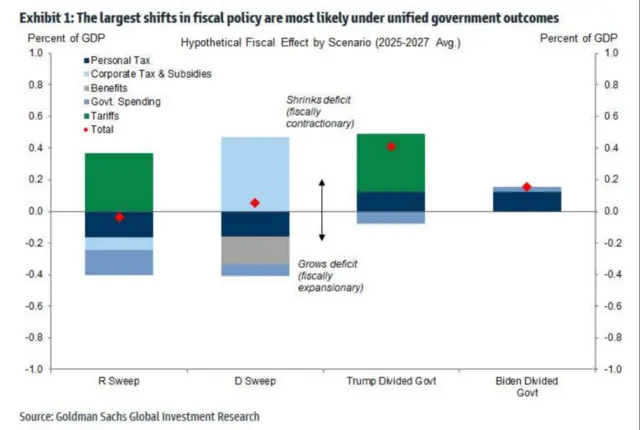

In his election preview report, Goldman Sachs strategist Dominic Wilson analyzed in detail the potential market impact of the four main election results for the U.S. president and Congress. These four scenarios are Republican sweep, Democratic sweep, Trump government split, and Biden government split.

Specifically,

- Republican sweep:

In the scenario of a Republican sweep, Wilson believes that the stock market will rebound moderately, yields will rise, and the trade-weighted U.S. dollar will appreciate. As the Republican government may continue expiring tax cuts and may further implement corporate tax cuts, bond yields may rise.

- Democratic sweep:

Wilson believes that the stock market will moderately decline, the U.S. dollar will depreciate moderately, and yields will rise. As it is expected that a Democratic government will implement larger fiscal stimulus measures, this will push up bond yields.

- Trump government split:

In this scenario, the stock market will moderately decline, yields will slightly rise, and the U.S. dollar will have significant upward potential. Strong reactions to potential tariffs combined with fiscal tightening may have a negative impact on the stock market and yields.

- Biden government split:

The stock market will perform flat, yields will decrease, and the U.S. dollar will weaken. If the reduction in new tariffs is less than expected, this will increase the upward potential of the stock market and may push up yields rather than lower them.

Goldman Sachs advises that although the baseline estimate may not provide a strong reason to hedge stock market risks, investors should remain vigilant in the face of fiscal expansion and tariff risks. A stronger U.S. dollar is considered a more reliable way to reduce the downside space of the stock market, but bond yields may also be affected by tariff risks.

CICC: How the U.S. Election Affects the Economy and Markets

After reading Goldman Sachs' analysis, let's take a look at CICC's viewpoint.

CICC points out that compared to the current President Biden, the market is obviously more concerned about Trump's policies, both because they may bring about change and because some of the proposals may be more "extreme." Comparing the policy proposals of Biden and Trump, it is found that there are certain similarities in policies related to trade and investment expenditure, while the main differences are focused on fiscal and tax, immigration, and industrial policies.

From an economic and policy impact perspective:

1) Most policies that boost the U.S. economy also have inflationary attributes, such as trade, investment expenditure, subsidies, and even immigration policies, which may make it difficult for inflation to sustain a significant decline after the election.

2) The monetary policy space may be suppressed, and support for growth or inflation may mean that the Federal Reserve does not need to cut interest rates too much.

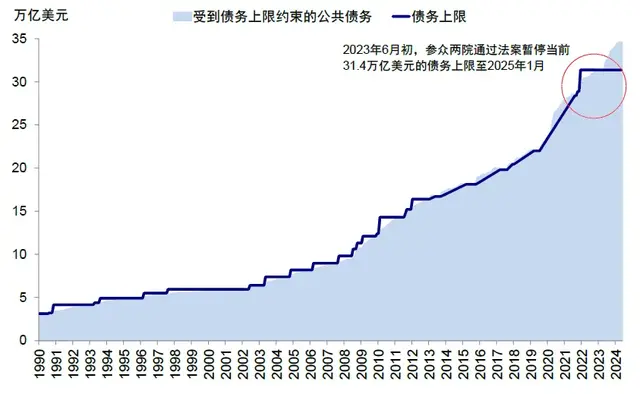

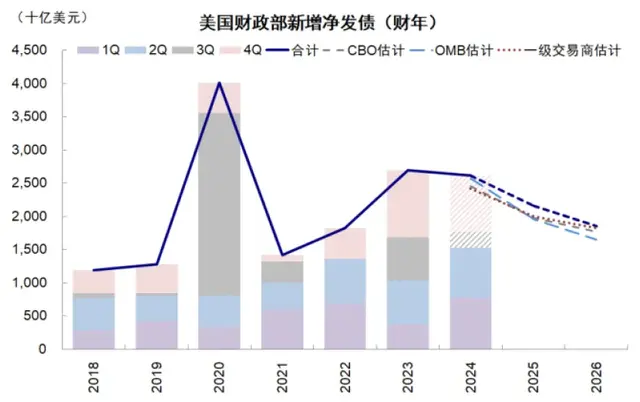

3) The debt ceiling will take effect in January 2025, which may increase the volatility of government bond supply and bond yields.

From a market and asset impact perspective:

1) U.S. Treasuries: Expectations of policy stimulus after the election and the recovery of growth and inflation will bring more upward pressure on U.S. bond yields, while attention needs to be paid to the approaching debt ceiling or the uneven issuance of bonds. The supply of U.S. bonds in 2025 may be low at first and then high, reproducing the situation in October 2023 when term premiums drove U.S. bond yields to a high point.

The overall judgment is that the central point of U.S. bonds is 4%, with a range of 4.7%-4.2% before the rate cut. Loose trading can still be carried out, but when the rate cut is realized, it may also be close to the end of the rate cut trading.

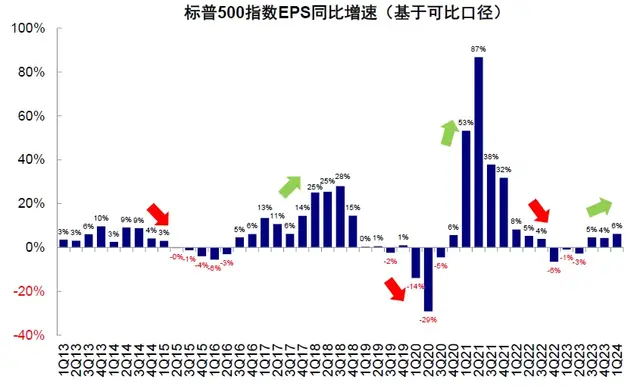

2) U.S. Stocks: Overall performance is not bad. Trump and the Republican Party's proposal for large-scale tax cuts will boost corporate profits, but the subsidy for high-tech industries may be reduced, which may be favorable for cyclical sentiment.

The large-scale tax cuts proposed by Trump in 2018 boosted corporate profits

The large-scale tax cuts proposed by Trump in 2018 boosted corporate profits

3) Commodities: Under Trump's policy proposals, the performance of oil prices may be relatively neutral, and the accelerated issuance of exploration permits for oil and natural gas may lead to an increase in U.S. oil production.

4) U.S. Dollar: There is no basis for a significant weakening of the U.S. dollar in the short term. After Trump was elected in 2016, tax cuts and infrastructure policies quickly raised growth and inflation expectations, and the U.S. dollar showed a trend of appreciation. However, this time, Trump proposed a "weak dollar" policy to "boost" U.S. exports, and attention needs to be paid to its potential impact.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。