"Weekly Editor's Picks" is a "functional" section of Odaily Planet Daily. In addition to covering a large amount of real-time information every week, Planet Daily also publishes many high-quality in-depth analysis contents, which may be hidden in the information flow and hot news, passing by you.

Therefore, our editorial department will select some high-quality articles worth reading and collecting from the content published in the past 7 days every Saturday, bringing new inspiration to you in the encrypted world from the perspectives of data analysis, industry judgment, and opinion output.

Now, let's read together:

Investment and Entrepreneurship

On-chain Behavior Analysis: How Far Could BTC Fall in Extreme Situations?

According to STH-MVRV, the limit value of BTC price retracement in this bull market cycle is around $43,129. During the bull market process, when STH-MVRV is below 1, it usually means that opportunities outweigh risks (only for BTC, not including ALT).

On June 21, the "real market fair price" evaluated by the TMMP model was $44,940.

The so-called super black swan must have an impact that reaches the level of challenging human life (such as a nuclear war between Russia and Ukraine); obviously, "US economic recession" is not of that level. Since it is a limit value, it means "probably won't happen" rather than "might happen."

Market Liquidity Remains Dry, When Will the "Rising Tide" Come?

Volatility is not a flaw, but an ideal characteristic for profit. A large amount of money is made in short-term outbreaks. Sideways oscillation will shake off ordinary investors, and the market will rise when you give up.

Prediction of Future Trends in the Cryptocurrency Market: BTC and ETH's Dominance Will Strengthen

BTC's dominance is generally on the rise; blue-chip dominance will further increase; ETH/BNB/TON are rising against the trend; the impact of ETH spot ETF may be exaggerated; once the market's attention hits bottom, altcoins will also hit bottom.

Detailed Explanation of Fear and Greed Index: What Role Does Market Sentiment Play?

The market sentiment index is calculated through 5 major weights: volatility, momentum and trading volume, social media, BTC dominance, and Google Trends. The two emotions of fear and greed correspond to the inherent supply and demand in the market.

If the orange fear mark in the above picture does not sustain for more than 3 weeks, and BTC re-enters the greedy state, it often heralds the arrival of a bull market frenzy.

Using this emotional analysis method, although it cannot perfectly avoid the peak, it can almost accurately catch the bottom of the range; at the same time, the first green greedy mark that appears at the end of the bear market often represents the beginning of a new bull market. When the price is low, the force driving the price up must come from the greed of traders who want to buy at a low level, and when the price is high, the force causing the price to fall often comes from the fear of traders who want to cash out at a high level.

Insight into Data 01 | AICoin & OKX: How to Quickly Perceive the Cryptocurrency Market and Build a Data Methodology?; Insight into Data 02 | OKX & CoinGlass: How to Mine Valuable Data and Cultivate Mature Trading Thinking?

This series of articles summarizes some data and indicators worth paying attention to and helpful for grasping trading opportunities.

The current market cycle is more driven by macroeconomic factors rather than by new native cryptographic innovations. This makes the market feel different from before, lacking new applications that can attract retail and institutional investors.

Due to the higher valuation of projects before public sales, and many projects distributing tokens through airdrops, the potential returns for retail investors are greatly reduced. This change in market structure makes it difficult for retail investors to obtain huge returns through early investments.

FDV limits the upside potential of the market, linking the nominal value of tokens obtained by retail investors to a higher FDV, further compressing the market's growth space.

There is a huge liquidity mismatch between the primary and secondary markets.

Inventory of the Top Ten New Coins with the Highest Unrealized Gains for VCs (with Next Unlock Time)

Retail investors should be cautious:

Be wary of projects with small market capitalization but high leverage contracts, which give a significant competitive advantage to large holders over retail investors. When users choose to buy spot and open long contracts together, they accumulate enough buyers for the project party/market maker/institutional large holders to start harvesting retail investors in batches.

Projects with high absolute funding rates.

Market makers do not do charity; the cost of pulling up the market will be profitable through smashing the market. Be cautious about becoming the market maker's bag holder. When the thought of "this coin is a valuable coin, I want to hold it for the long term until the next bull market" arises, the market maker's smashing is not far away. Their purpose in pulling up the market is to cultivate this user psychology for themselves to take over.

The most noteworthy aspects of the BTC ecosystem in the past two months, besides UTXO Stack, are the launch of Fractal, Arch Network, and Quarry by Unisat.

In the next 6-12 months, Solana's infrastructure should be an interesting observation. In addition to the warming of modular narrative, the launch of the simplified version of FireDancer by the end of the year and the complete version next year will bring improvements to Solana's TPS and stability.

Purely in terms of functionality: Babylon+Chakra/SatLayer = Eigenlayer.

Brief Analysis of pump.fun Data: Degen's "Non-zero" Internal Reference

Only about 1.4% of tokens are ultimately deployed on Raydium. If the token is not deployed on Raydium within 1 hour, consider exiting early; otherwise, the probability of your investment going to "zero" exceeds 99%.

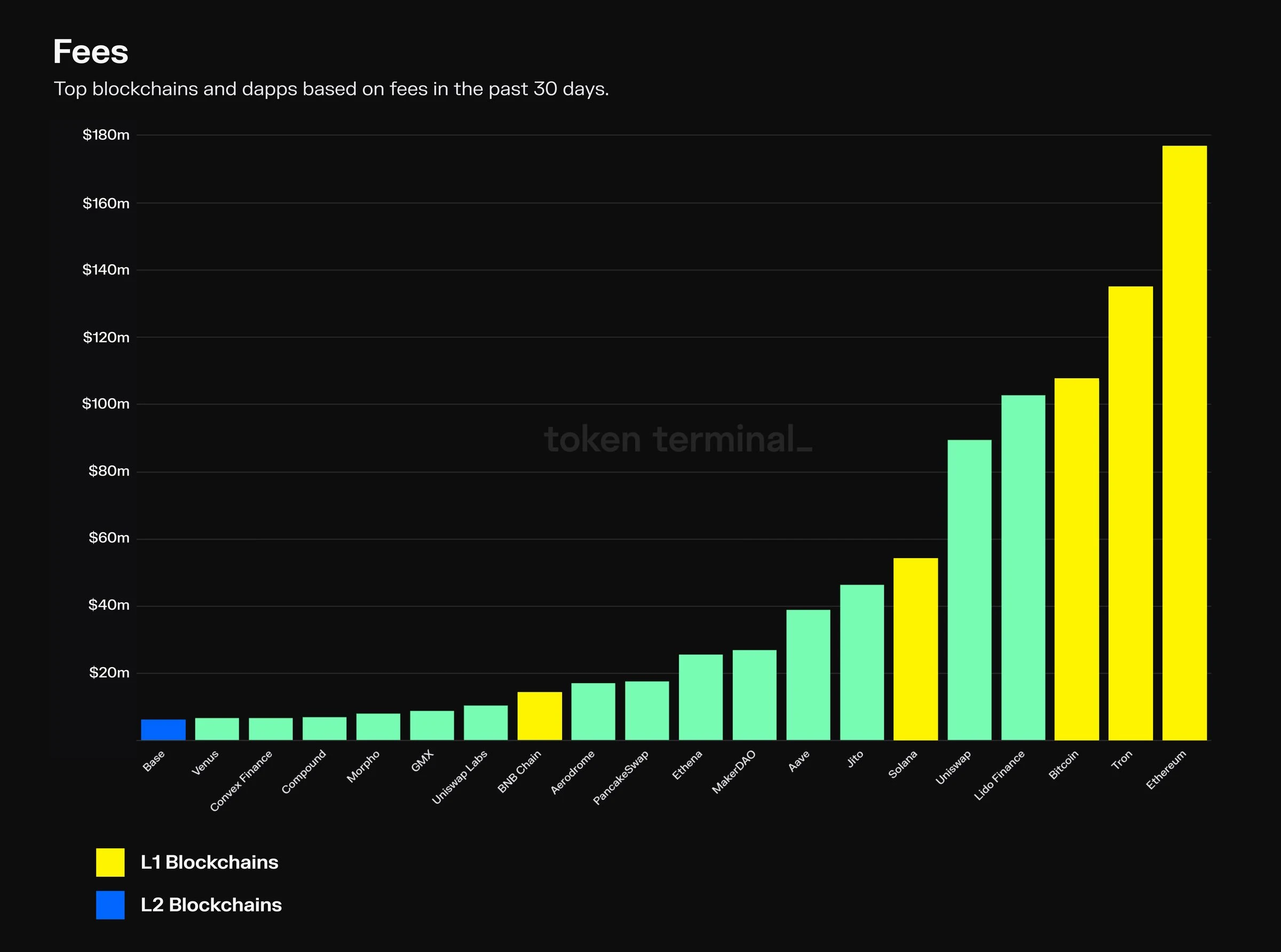

Rainmakers in the Cryptocurrency Market: Inventory of Top Fee Protocols

Airdrop Opportunities and Interaction Guides

Recommended: "The Era of High-Quality Interactive Content, What is the Best Solution for Scroll?" and "Nearly 20 Million Registered Users, Step by Step Guide to Participate in the TON Ecosystem's Explosive GameFi 'Catizen'".

Meme

These types of tokens often come with significant volatility and risk, and often experience reversals of events as well as account theft and counterfeiting controversies.

The article briefly introduces some election concept tokens that have gained attention, including PEOPLE, MAGA, DJT, MAGAHAT, BODEN, STRUMP, etc., and selects notable election concept tokens from different chains for discussion, as well as researching their investment value and where they can be traded.

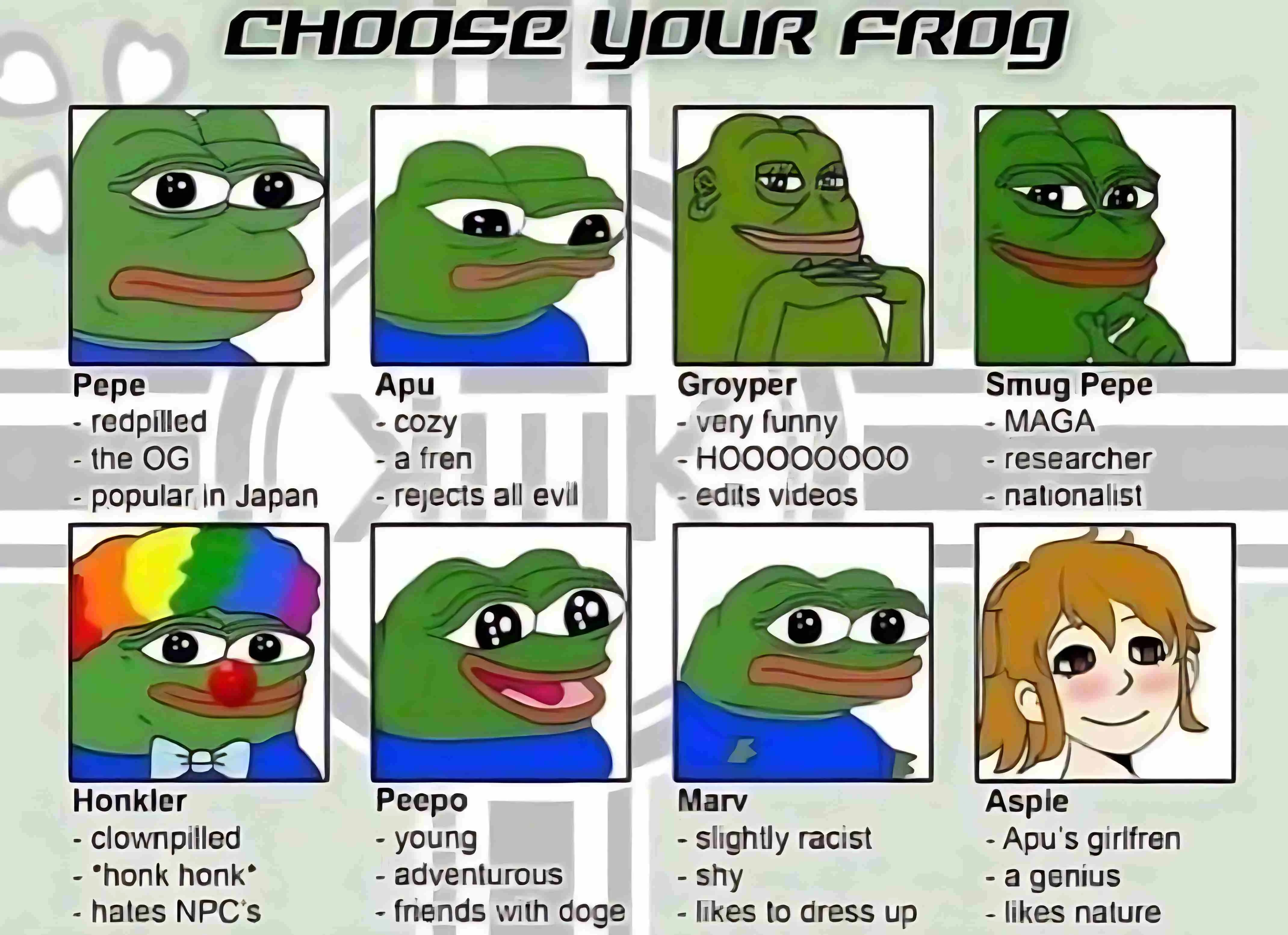

Pepe's Big Rebound, an Overview of the Frog Meme Family Tree and the Culture Behind It

The article introduces Pepe, the namesake token Pepecoin, Smug Pepe, MonkaS, Apustaja (Apu), Ashbie, Peepo, and Groyper.

Bitcoin Ecosystem

BTC Ecosystem Tool Guide: Tracking Smart Money Movements, Seizing the Next Hundredfold Rune

Forging tools: Ybot, GeniiData;

Data analysis tools: GeniiData, satosea.xyz;

Mempool Snipe tools: Rune Blaster, Goldmine, Magicsat.io.

DeFi

Can DeFi Experience a Revival?

Farming points and airdrop hunting seem to have evolved into a new form of DeFi.

"In this bull market, I am looking forward to EigenLayer, Pendle, Gearbox, Hivemapper, as well as sports betting and prediction market protocols; I also dream that after this bull market ends (perhaps during the low point of the next bear market), we can have a stablecoin that is both secure like USDT/USDC and provides at least 5% sustainable returns. This market undoubtedly has enormous potential."

Weekly Hot Topics Recap

In the past week, Mt.Gox will begin distributing BTC and BCH repayments in early July (Key Q&A on Mt.Gox Incident); Analysis: MicroStrategy's purchase of BTC offsets selling pressure from the German government; Trump is planning to speak at the Bitcoin 2024 conference in July; VanEck submits application for Solana Trust fund;

In addition, in terms of policies and macro markets, Gary Gensler: the approval of an Ethereum spot ETF is progressing smoothly, pending appropriate disclosures from the issuer, current securities laws apply to the cryptocurrency field, and a large number of industry entities are not complying with regulations; Coinbase's Chief Legal Officer: requests the US SEC to provide the closing investigation documents that ETH is not a security; the US Federal Accounting Standards Advisory Board will consider confiscated cryptocurrencies as "non-monetary assets"; Cathie Wood plans to vote for Trump due to his excellent economic performance.

Viewpoints and voices: Bloomberg ETF analyst James Seyffart: This is an ETF bull market; Andrew Kang: The impact of an Ethereum spot ETF on the market is far less clear than Bitcoin, limited upside for ETH; Mechanism Capital co-founder Andrew Kang: ETH/BTC needs to fall for another year; GSR bullish on SOL report: can rise 8.9 times in a bull market, 1.4 times or 3.4 times in a bear market or normal market conditions; Delphi Labs CEO: FDV is not a meme, high unlock does not mean the project goes to zero, the structural shorting opportunities for cryptocurrencies will be more than any other asset class; He Yi: Trading platforms do not have pricing power, the era of easy profits may be ending; Jupiter co-founder: Airdrops are gifts, not rewards, loyalty programs, or growth tactics; Wormhole Foundation co-founder: Supporting point plans, which can reduce the team's anti-witch work; Scroll co-founder: Disappointed whales can hold Scroll, we won't PUA; Jupiter co-founder Meow calls for building a PPP-type mutual aid community.

Institutions, large companies, and leading projects: Japanese listed company Metaplanet plans to issue 1 billion yen in bonds to increase Bitcoin holdings; Solana launches ZK Compression; Solana releases new feature Blinks; Blast distributes airdrops (token distribution details); Dexscreener releases pump.fun competitor Moonshot.

From a data perspective, LayerZero's daily trading volume has plummeted by over 95% from its peak; Polymarket's prediction market on Trump's win has reached 65%, reaching a new historical high.

Security: Renowned rapper 50 Cent's X account was hacked, promoting the Meme coin GUNIT and rug earning $300 million; CoinStats was attacked, affecting 1590 crypto wallets, urging users to transfer funds immediately, with its CEO stating that all security measures are being taken to restore service and isolate attackers; Official X account of DeFiance Capital was hacked; Farcana clarifies: Third-party market maker attacked, official wallet, FAR smart contract not affected… Well, it's been another eventful week.

Attached is the "Weekly Editor's Picks" series portal.

Until next time~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。