Author: Jessy, Golden Finance

On June 28th, Beijing time, VanEck launched the VanEck Solana Trust and submitted a Solana spot ETF application to the SEC.

Interestingly, this application for a spot ETF for SOL has not previously been approved for futures ETF trading. Is the release of this Solana spot ETF application just a form of hype?

No futures ETF launched, and considered a security

VanEck, the issuer of previously approved BTC and ETH spot ETFs in the United States, submitted the Solana spot ETF to the SEC. Based on the remarks of VanEck's head of digital asset research on X, the reason for VanEck's application for the Solana spot ETF is largely due to its strong belief in Solana's technology and its potential widespread use as a digital commodity with a large customer base.

According to the application documents, the VanEck Solana Trust is expected to be listed for trading on the Cboe BZX Exchange, with specific details pending issuance notice.

Interestingly, VanEck did not follow the usual pattern this time, applying for a spot ETF for SOL without first applying for futures, which may affect the SEC's approval process. This also indicates that the approval of the Solana spot ETF is still highly uncertain. Another uncertainty is that the SEC has previously explicitly stated in litigation that SOL is an unregistered security.

Other factors that may affect the SEC's judgment of the Solana spot include its insufficient decentralization. Solana's decentralization is not as strong as that of Bitcoin and Ethereum, especially considering that FTX previously held a large amount of Solana. Additionally, its market value is significantly lower than that of Bitcoin and Ethereum, indicating poor liquidity.

From this perspective, is VanEck's submission of the Solana spot ETF to the SEC just a form of hype? Not necessarily.

Institutional support and potential reversal of the situation in the US election

Firstly, Solana, as the dark horse of this bull market, has attracted attention and is highly favored by Wall Street capital. Analysts have pointed out that Solana's high throughput, low transaction costs, and security make it a potential target for ETFs.

Why Solana and not other coins? Previously, LTC, BCH, and DOGE were seen as strong candidates to impact the next wave of spot ETFs. The reason is simple: the approval process for a typical virtual currency spot ETF usually involves the CFTC first regulating the coin's futures, then the futures ETF, and finally the spot ETF.

Currently, besides BTC and ETH, the only coins that have submitted compliant futures data to the CFTC are LTC, BCH, and DOGE. However, these three coins are not traded on CME, but rather on Coinbase's derivative exchange. Furthermore, these three tokens have not been classified as securities by the SEC, so the industry believes that the next step may be the approval of spot ETFs for these three coins.

However, we seem to have only focused on the compliance process and have not realized the important role that capital plays in spot ETFs.

Robbie Mitchnick, head of digital assets at BlackRock, has explicitly stated that the demand of institutional clients determines BlackRock's advancement of cryptocurrency products. This means that if institutional clients favor a particular token, fund companies will vigorously promote the spot ETF for that token.

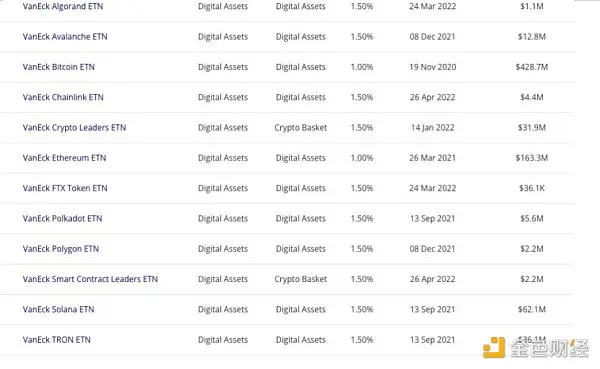

Analysis of the cryptocurrency-related ETNs (exchange-traded notes) issued by Vaneck shows that the Solana ETN, apart from Bitcoin and Ethereum, has the largest user demand (asset management scale). This helps to understand why Vaneck and other fund companies are vigorously promoting the Solana spot ETF, rather than those tokens that seem more correct in terms of the process.

Although the launch of the Solana spot ETF currently faces significant uncertainty, if there is a change in the leadership of the US government, especially under the leadership of the SEC that supports cryptocurrencies, there is a chance for the approval of the Solana spot ETF. The US election is currently having a real impact on the cryptocurrency market.

If the Solana spot ETF is approved, how will the price of SOL change? GSR's report evaluation indicates that in bear, benchmark, and ideal scenarios, the proportion of funds flowing into the Solana spot ETF compared to Bitcoin's inflow is 2%, 5%, and 14% respectively. Additionally, Solana's market value has averaged 4% of Bitcoin's market value over the past year. In a bear market, SOL may increase by 1.4 times, in a benchmark scenario it may increase by 3.4 times, and in an ideal scenario it may increase by 8.9 times.

Next year, perhaps with a new leadership team at the SEC, the Solana spot ETF will be launched? But everything is unknown.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。