On the afternoon of June 27th, AICoin researchers conducted a live graphic and text sharing session titled "Mt. Gox Event - From Panic to Opportunity (with Membership)" in the AICoin PC-end Group Chat-Live. Here is a summary of the live content.

I. Background and Overview of the Event

Bitcoin, affected by the recent Mt. Gox incident, once dropped below the 60,000 mark, reaching a low of 58,400.

Mt. Gox, once the largest Bitcoin exchange, its closure and related repayment events had a huge impact on the Bitcoin market. Prior to this, there were three rumors on March 6, 2023, November 22, 2023, and January 6, 2024, which triggered the market's "fear, uncertainty, and doubt" (FUD) sentiment.

Historically, the market often recovers after experiencing major negative events, even reaching new highs. Therefore, having the awareness to see opportunities from panic can help investors make more rational decisions in the market downturn, at least avoiding unnecessary losses due to temporary panic.

A reminder, historical data can be traced using the [Locate] function in the lower left corner of the chart.

The PRO version of the K-line supports one-click positioning, allowing quick positioning by clicking on the date, helping you trace historical data. Experience it by clicking the link below: https://www.aicoin.com/zh-Hans/vip

II. Mt. Gox Event and Market Reaction

Market reaction to each rumor:

Significant panic selling occurred in the market each time Mt. Gox-related news was released, leading to a sharp decline in Bitcoin prices. However, in fact, concerns about large-scale Bitcoin sales by creditors were often exaggerated, and market sentiment often reacted more intensely than the actual situation, providing opportunities for buying at low prices.

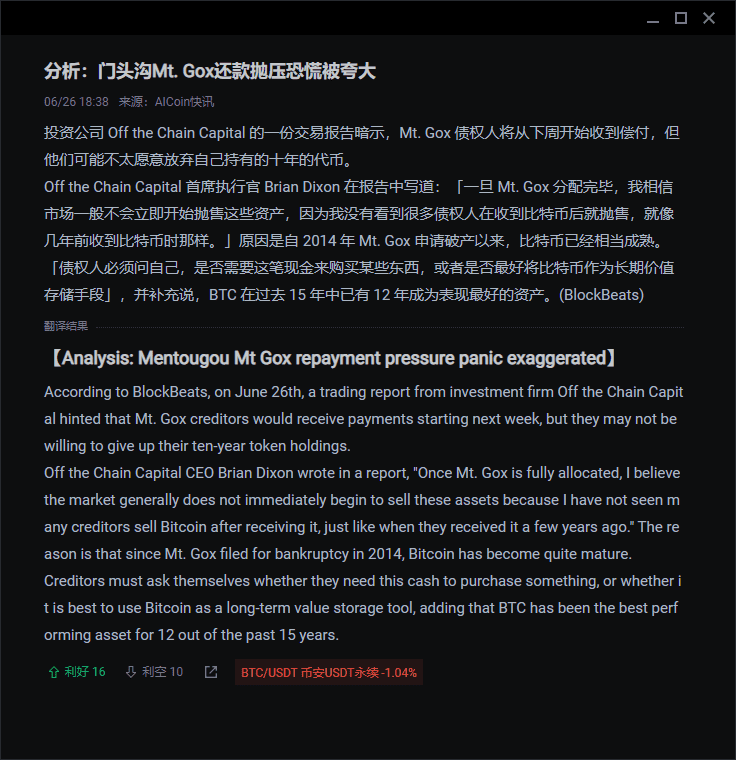

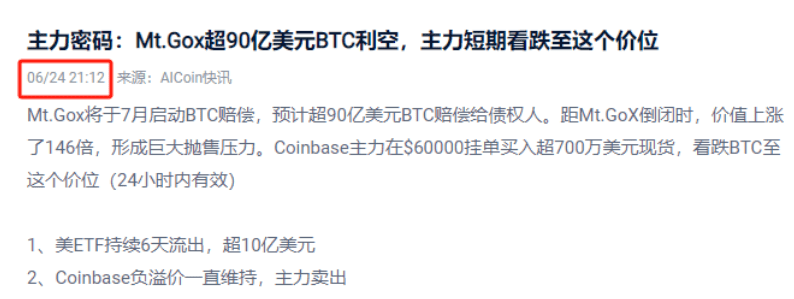

- Why is it said that concerns about selling were exaggerated? You can check the flash news to see the following image.

In addition, Alex Thorn, research director at Galaxy, said that the Bitcoin selling pressure brought by Mt. Gox would be less than expected. Mt. Gox lost about 940,000 Bitcoins, worth $424 million.

So far, they have recovered about 15%, or approximately 141,868 Bitcoins.

- How will these Bitcoins be distributed?

Approximately 95,000 Bitcoins will be used to repay claims. About 20,000 will be allocated to the claim fund, 10,000 to Bitcoinica BK, and the remaining 65,000 will be distributed to ordinary individual creditors. This quantity of 65,000 Bitcoins is significantly less than the previously reported 141,868. This structural distribution can reduce short-term market impact.

Another important reason is that most creditors chose to make early payments, which also buffered some selling pressure.

Alex Thorn predicts that about 75% of creditors chose to accept early payments (even if it means sacrificing a portion of the repayment amount). Therefore, the amount of Bitcoins entering the market has also been further controlled at a lower level. We can anticipate that, despite the intense market sentiment fluctuations, the actual situation may not be as severe as expected. Therefore, traders should stabilize their emotions and maintain rationality, not being led by one-sided voices.

- Counter-performance of altcoins

Under the Mt. Gox event, the negative correlation of BTC to the altcoin market is reflected as follows:

(1) Initial significant price fluctuations were very frightening

Mt. Gox's announcement of BTC repayment triggered market concerns about large-scale selling, leading to the spread of panic sentiment. This situation usually leads to a collective decline in the entire cryptocurrency market. As a market barometer, Bitcoin has the greatest impact on overall market sentiment. Under this panic sentiment, the altcoin market also experienced a synchronous decline. However, after this decline, the altcoin market rebounded. Among the top 200 tokens by market capitalization, except for a few, most tokens saw an increase. The most significant increases were seen in BRETT, up 26%; followed by WIF, up 23.8%; and DOG, up 22.1%.

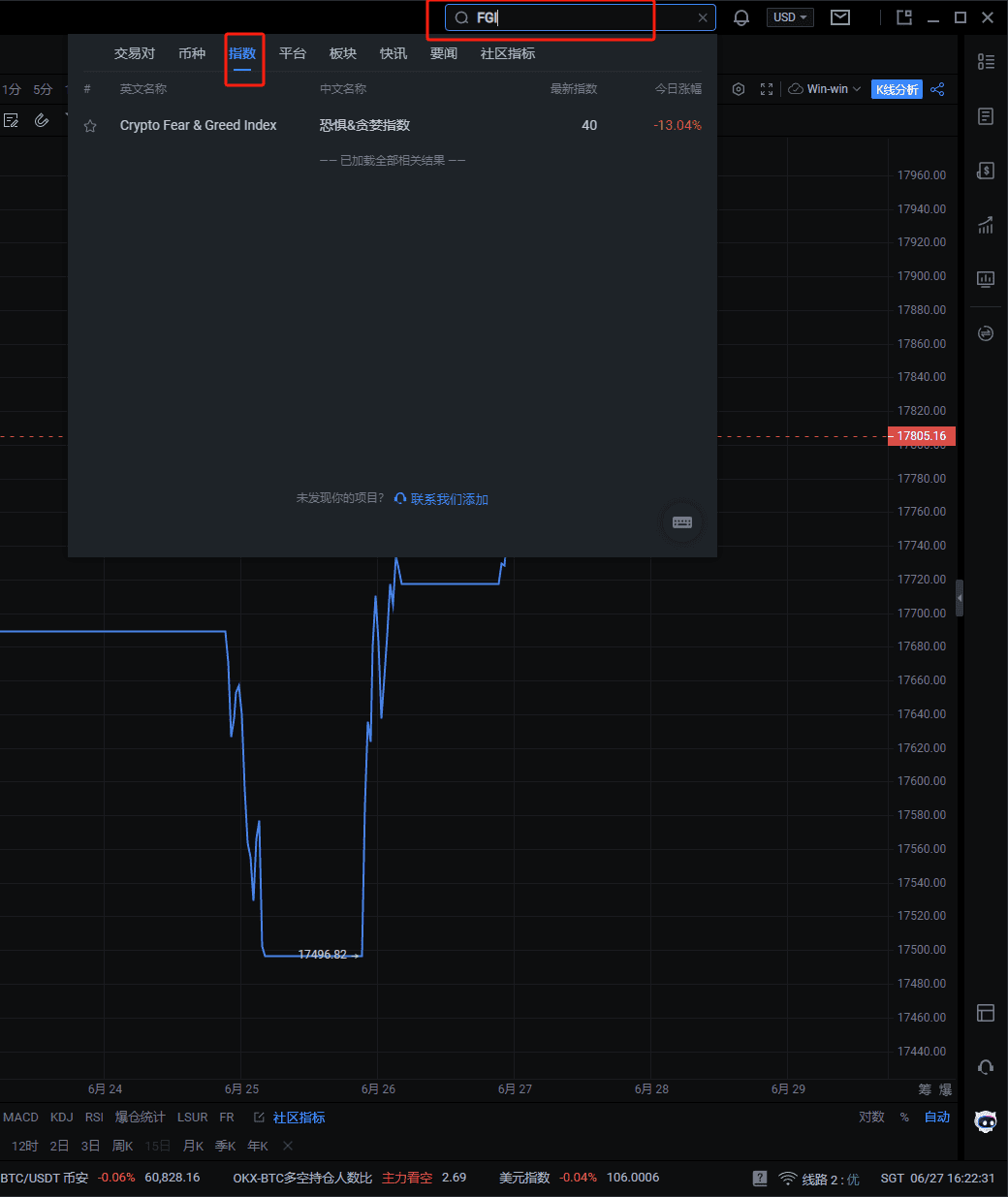

From the data, the total market value of cryptocurrencies is approximately $2.32 trillion, with Bitcoin accounting for 52.23% of the market. The fear and greed index is 46, and these indicators all saw significant declines on the 24th, but are now slightly rebounding.

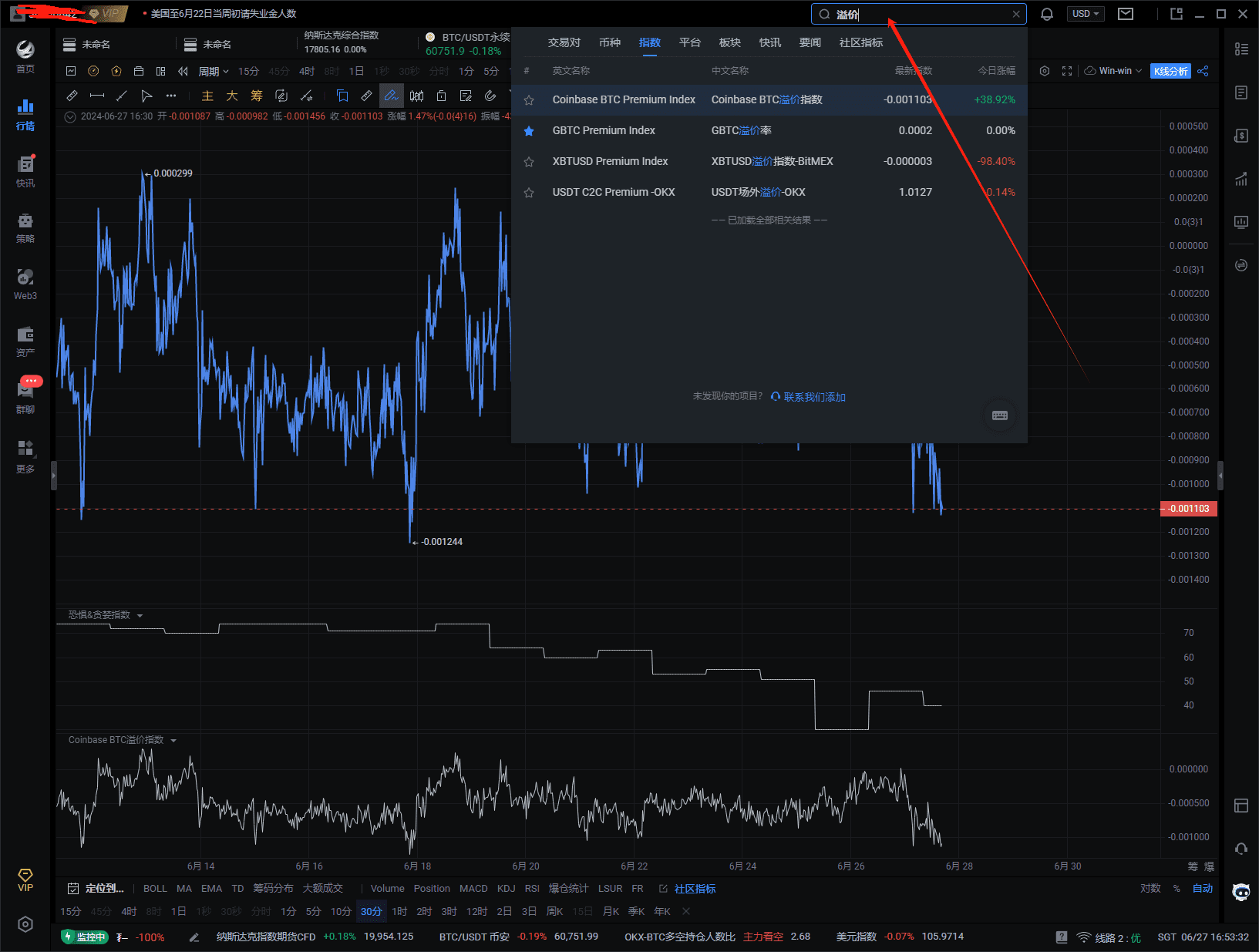

You can directly search in the upper right corner to view the latest index situation.

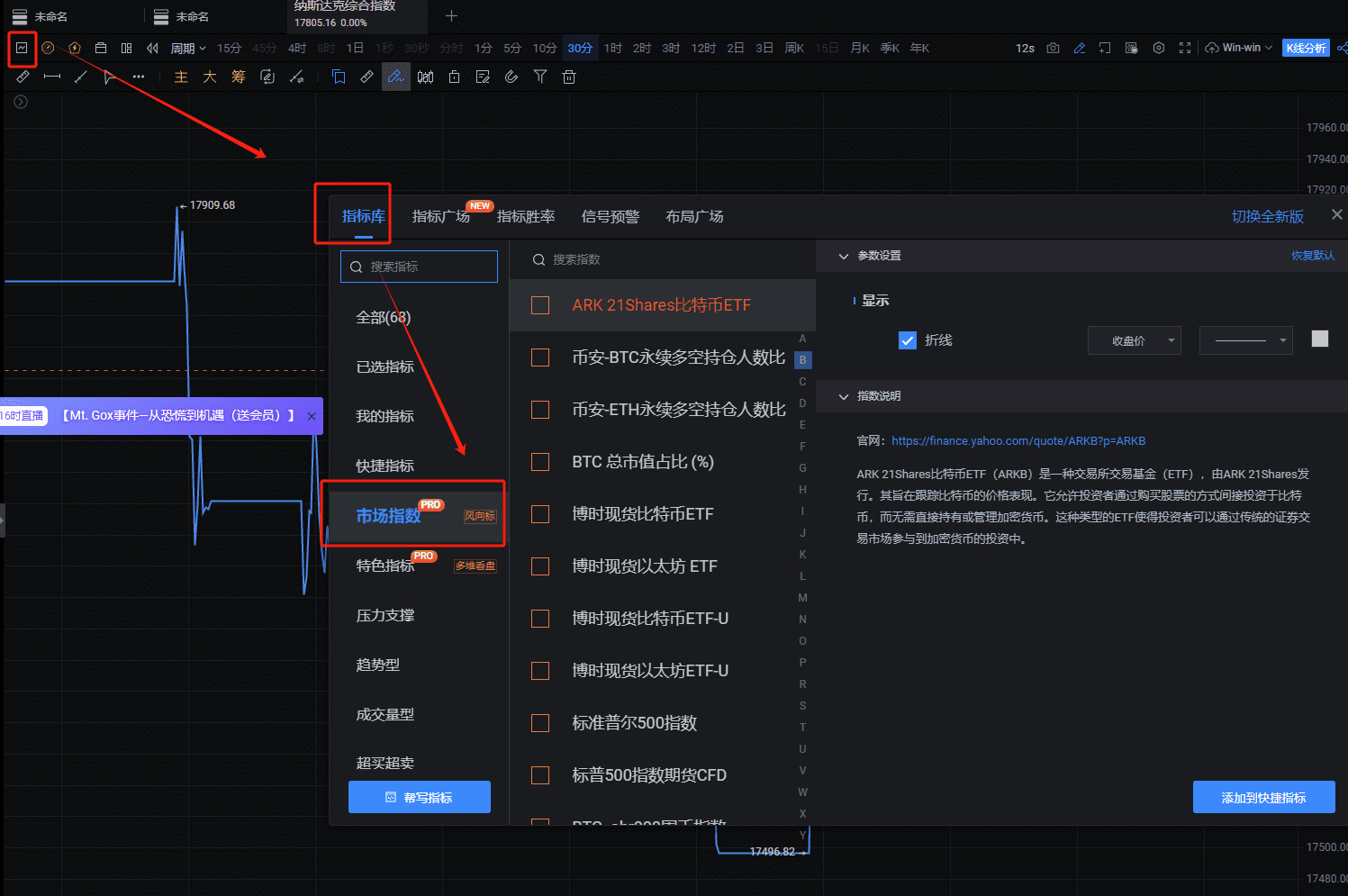

You can also add indices here.

The [Multi-screen] feature was used to view data, allowing for custom window sizes and positions, suitable for multi-currency and multi-index comparative analysis. The multi-screen feature supports displaying up to 9 K-line charts at the same time (non-PRO users can display 4 K-line charts). Click here to immediately open the PRO version K-line

(2) Inflow of funds during the rebound

After the Bitcoin price touched a low of $58,400, it quickly rebounded by 5%, indicating that the market had absorbed some negative news in a short period. This rebound is usually due to the entry of bottom-fishing funds and the gradual easing of previous panic sentiment.

When Bitcoin starts to rebound, some funds may quickly shift to the altcoin market as people begin to seek higher return opportunities. Additionally, due to the smaller size and larger price fluctuations of the altcoin market, the rebound speed may also be faster.

Here, a small tip after a significant BTC pullback: the pin insertion method for reclaiming chips (applicable after a significant BTC pullback)

Condition 1: When BTC experiences a large decline, does this small token also follow the decline?

Condition 2: After the decline, can this small token quickly recover from the decline? For example:

Corresponding to the market affected by the Mt. Gox incident on the 24th, this method also proved effective in the current market.

(3) Reversal of market sentiment Fear and greed are slightly warming up

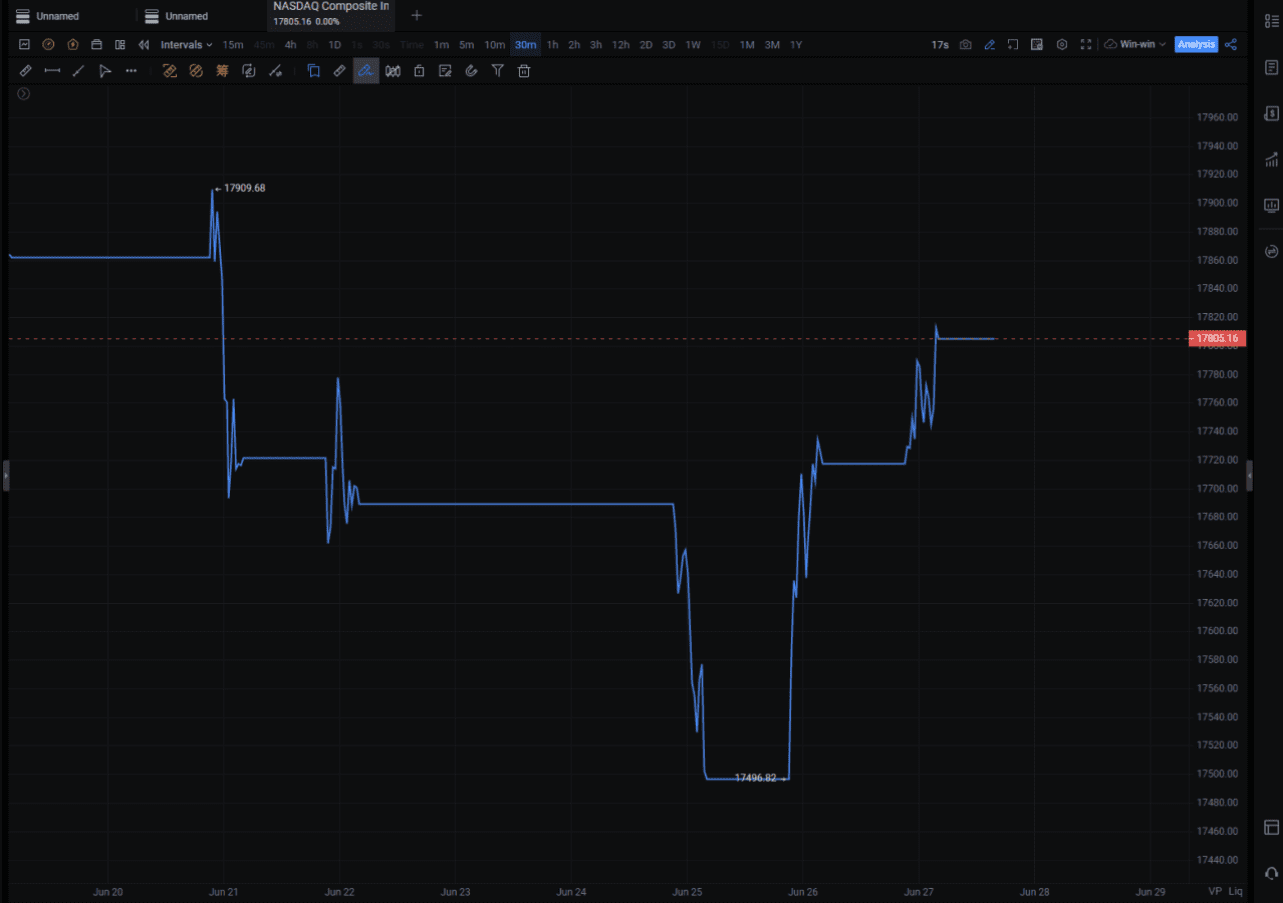

External market pressure has decreased recently, and from some indicators, the blood-sucking effect in the U.S. capital market has slightly cooled down, with a small pullback in the Nasdaq.

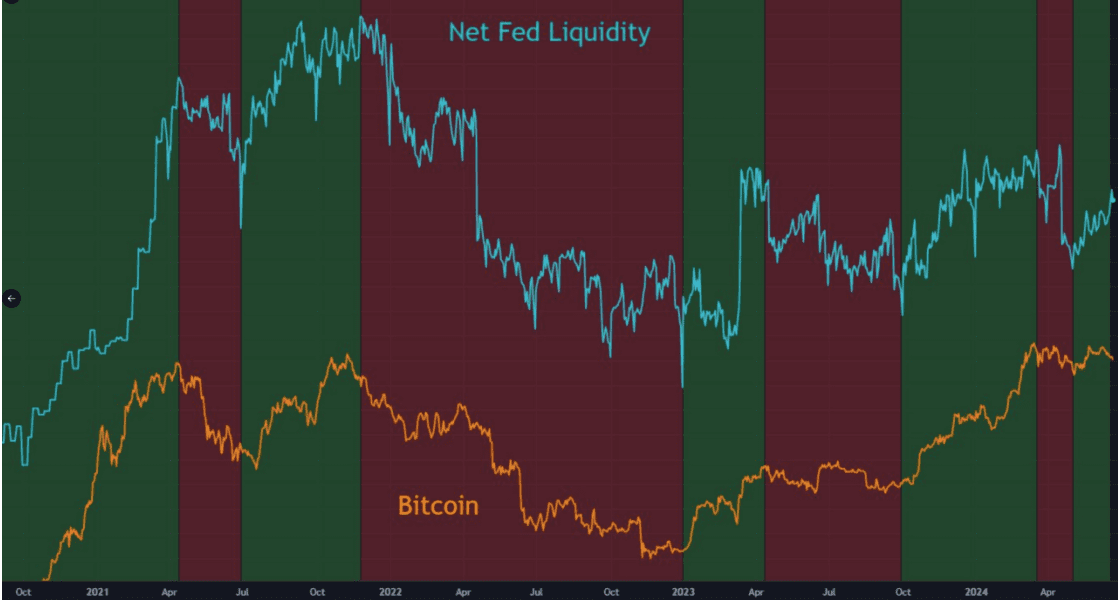

In addition, the Fed net liquidity index increased by $400 billion in the past week, the last time it experienced a short-term surge was during the Silicon Valley bank crisis, which gradually stabilized the overall market sentiment. It is advisable to pay close attention to the Fed net liquidity index, as its correlation with BTC is astonishing. Through the Fed net liquidity index, investors can assess the market's liquidity level. It is one of the important driving factors for the prices of risk assets.

Bitcoin's latest historical high of $73,800 in mid-March was also accompanied by a surge in liquidity.

III. How to Deal with Market Fluctuations

- Check the flash news, all of which can be manually searched.

- Shortly after the Mt. Gox incident, a large order reminder was issued, using the monitoring tool - Major Orders.

It specifically monitors large trading activities in the market. These indicators help us discover the buying and selling activities of major forces in the market, such as institutions or large fund holders.

You are welcome to subscribe to the PRO version of the K-line: PRO K-line Membership Service | AICoin - Value for Efficiency

Coinbase's major players placed orders to buy over $7 million in spot transactions at $60,000. This indicates that the major players are bearish on Bitcoin at this price, and for now, we consider this to be a bottom signal in the market. Additionally, in the current Mt. Gox scenario, the outflow of U.S. ETFs has exceeded $1 billion for 6 consecutive days, and the negative premium phenomenon on Coinbase continues.

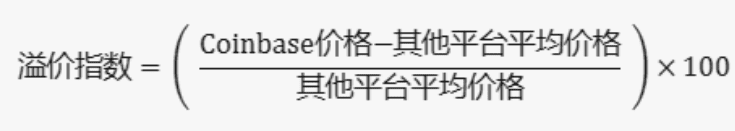

(1) Understand the Coinbase BTC Premium Index?

It measures the price difference of Bitcoin on the Coinbase trading platform relative to other trading platforms (such as Binance, Bitfinex, etc.). In simple terms, this index helps investors understand whether the trading price of Bitcoin on Coinbase is higher or lower than on other platforms.

(2) Premium Usage

A positive premium indicates that the price of Bitcoin on Coinbase is higher than the average price on other trading platforms, indicating that traders on Coinbase are willing to pay a higher price to buy Bitcoin, possibly reflecting higher demand or liquidity overflow. A negative premium indicates significant selling pressure on Coinbase, possibly reflecting traders' eagerness to sell Bitcoin or insufficient liquidity. The major players being bearish on Bitcoin, the outflow of U.S. ETFs exceeding $1 billion for 6 consecutive days, and the negative premium phenomenon on Coinbase continue. These signals combined tell us that the market lacks confidence.

(3) Check the position in the image

The negative premium is currently continuing.

However, a friendly reminder, do not rush at the bottom or near the bottom. Don't rush to buy all at once, enter in batches based on your research and signals, gradually increasing your position. The market is ever-changing, and we need to remain flexible! In the world of trading, true skill lies in combining multiple tools and indicators and strictly implementing risk management strategies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。