Contract trading is nothing more than two directions, and the first consideration for long and short entry decisions is the overall direction. Following the major trend and taking a reverse position will never go wrong! There are several points to the trading mechanism: do not operate frequently; do not hold positions in two different currencies in the same direction at the same time; the initial position should not exceed 5%, with 1-2 times of replenishment opportunities reserved; replenishment should not be too close, and replenishing at support and resistance levels will never go wrong. Stop loss is a must for the second break; learn to wait for opportunities to enter the market, and only with patience can you find the most suitable entry point. It's better to miss out than to make mistakes; after exiting, learn to review and identify the problems and strengths of the trades; make good use of distributed position building, reducing positions, replenishing, and taking profits; review market technical indicators more often, and look for signals of rebound and retracement; continue to improve and maintain good trading habits, stay away from arrogance and impetuosity, and only then can you continue to profit in the industry in the long term! Li Hui will continue to uphold professional knowledge, meticulous analysis, unique position building techniques, and a calm spirit to assist every coin trader in successfully gaining valuable wealth and continuously realizing their own value in the coin circle! I hope everyone can achieve financial freedom in 2024! Keep it up!

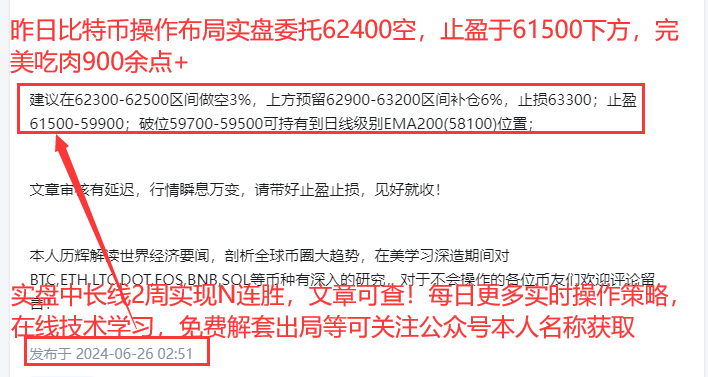

Yesterday's Bitcoin operation layout gained 900 points + profit. According to the article, a 3% short position was entered in the 62300-62500 range, and the order to short at 62400 was successfully executed.

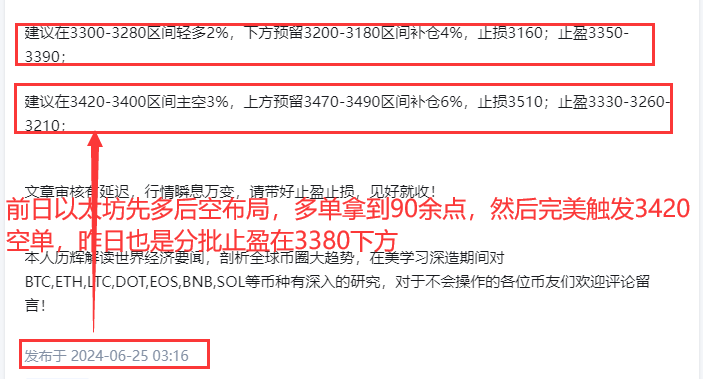

Take profit below 61500; Ethereum was also successfully triggered for a short position at 3420 as per the previous day's article. Due to the small fluctuations in the first half of the night, it was successfully closed below 3380, and the short position was able to sleep peacefully. So, it's still easy to profit from shorting in a major downtrend! Following Li Hui to seize the high short position can both profit and have little risk, so why not do it!

Analysis and operational suggestions for Ethereum on June 27th:

Looking at the current 1-hour chart, Ethereum rebounded to the current EMA120 after a downward spike at 3325 in the early morning, and then fell again. From the KDJ three lines, it has started to turn at the top; DIF and DEA are closing at the low level, which may form a divergence again, and the Bollinger Bands channel is open, indicating large fluctuations in the intraday market.

Looking at the 4-hour chart, the coin price just rebounded to the EMA30 and then fell below the EMA15. KDJ is starting to turn downwards in the battle zone between long and short, and the distance between DIF and DEA at the low level has not widened, indicating that the bearish trend has not been relieved.

On the daily chart, the Bollinger Bands channel still maintains a downward oscillation, and the recent high points in the past 3 days are all above the EMA80. The short-term moving averages above the coin price are still in a downward trend, and the EMA15 and EMA30 indicators are slightly stronger than the EMA60. It is worth paying attention to the speed and posture of the downward breakthrough of EMA60, because the daily EMA15 and EMA30 of the coin are already below EMA60, which is also an important indicator to refer to for the decline and rebound of Ethereum.

In general, as the saying goes, if the bearish trend in the overall market has not been relieved, all other coin indicators are in vain. Li Hui suggests that it is still mainly focused on high short positions, and the entry points for long positions need to be combined with actual market spikes for layout.

It is recommended to short 3% in the 3385-3415 range, reserve 6% for replenishment in the 3500-3520 range, stop loss at 3535; take profit at 3335; and hold the position until the daily EMA150 (3210-3230) level is broken at 3300-3300.

There may be delays in article review, and the market is ever-changing, so please set your stop loss and take profit, and take profits when you see them! For more real-time trades, you can follow the public account under my name to obtain them, and you can also learn about technical analysis of the market and how to get out of a predicament online!

I, Li Hui, interpret world economic news, analyze the global trend of the coin circle, and have in-depth research on BTC, ETH, LTC, DOT, EOS, BNB, SOL, and other currencies while studying in the United States. For those who do not know how to operate, you are welcome to comment and leave a message!

You can follow the author by scanning the code below!

This article is exclusively published by (WeChat public account: Zhang Lihui) and does not represent any official position. The points mentioned above are for reference only, and the risk is at your own discretion! May we always carry humility and courage in this complex and chaotic coin circle, fear no challenges, and dare to explore. Just as the road ahead is long, "the road is long and far-reaching, and I will seek and explore." May we read thousands of books, keep pace with the times, and draw wisdom from the fountain. Travel thousands of miles, experience wind and rain, witness the scenery, and understand life. With Li Hui's guidance, may we listen attentively, play to our strengths, and create value together. May we always remember the baptism of the market, not forget our original intentions, and move forward. In the wave of digital currency, holding onto faith with Li Hui, forging ahead with determination. May we jointly create a brilliant future and share the joy of success. Let us gather in the turbulent world of digital currency, make the most of our time, and create brilliance together. Li Hui is willing to embark on this challenging and opportunistic investment journey with you.

Friendly reminder: The content above is created by the author's public account, and the advertisements at the end of the article and in the comments section have nothing to do with the author. Please discern carefully, and thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。