Title: Prediction Markets: Bottlenecks and the Next Major Unlocks

Original Authors: Mikey 0x, 1kx

Translation: Elvin, ChainCatcher

Content Summary

- How prediction markets work

- Bottlenecks hindering wider adoption of prediction markets

- Suppliers

- Demanders

- Solutions

- Suppliers

- Demanders

- Other methods to increase adoption rates

Prediction Markets: Bottlenecks and the Next Major Unlocks

Augur, as the first on-chain prediction market, was one of the earliest applications launched on Ethereum. Its vision was to allow anyone to bet any amount on anything. Due to various issues, Augur's vision was not realized many years ago. User scarcity, poor settlement user experience, and high gas fees led to the closure of the product. However, since then, we have made significant progress: block space is cheaper, and order book design is more efficient. Recent innovations have solidified the permissionless and open-source nature of cryptocurrencies, allowing anyone to participate in the global liquidity layer by providing liquidity, creating markets, or betting.

Polymarket has become a leader in the market, with a trading volume of about $900 million to date, while SX Bet has accumulated $475 million. Nevertheless, compared to the massive scale of traditional prediction market subcategories such as sports betting, there is still significant room for growth. In the United States alone, sports betting companies processed over $119 billion in transactions in 2023. If we consider the offline and online sports betting transactions in all other countries, as well as other types of prediction markets such as politics and entertainment, this figure will be even more prominent.

This article aims to break down how prediction markets work, the current bottlenecks that need to be addressed, and some methods we believe can solve these issues.

How do prediction markets work?

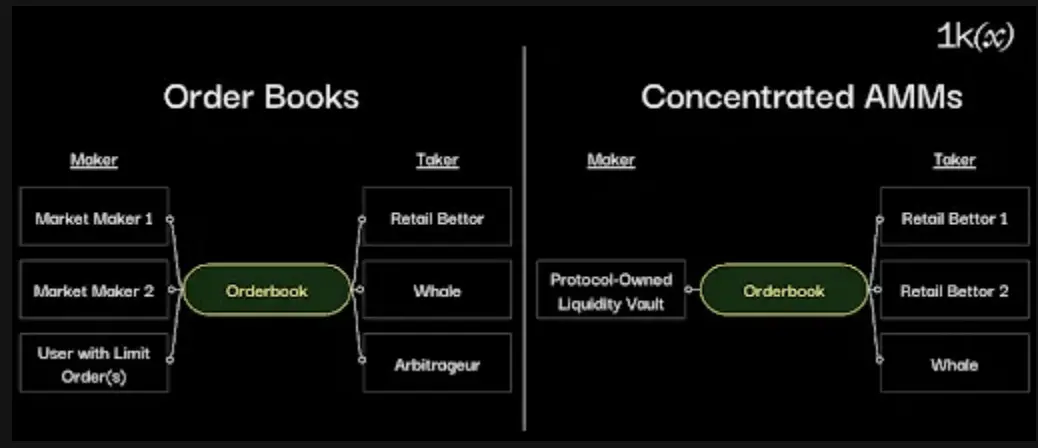

There are several ways to design prediction markets, most of which can be divided into two categories: order book model and centralized AMM model. Our view is that the order book model is a better design choice because it allows for better price discovery, achieves maximum composability, and ultimately leads to scalable trading volume.

Order Book Model

For the order book model, each market has only two possible predefined outcomes: yes (Y) and no (N). Users trade these outcomes in the form of shares. At market settlement, the correct share is worth $1, and the incorrect share is worth $0. Before market settlement, the prices of these shares may trade between $0 and $1.

For share trading to occur, there must be liquidity providers (LPs); in other words, they must provide buy and sell orders (quotes). These LPs are also known as market makers. Market makers provide liquidity in exchange for small profits in the spread.

As an example for a specific market: if the likelihood of something happening is equal, such as the result of a coin toss being heads, then theoretically, "yes" and "no" shares should trade at a price of $0.50. However, just like any financial market, there is usually a spread, resulting in slippage. If I want to buy "yes" shares, my execution price may end up close to $0.55. This is because my counterparty, a market maker, intentionally overestimates the true odds to earn potential profits. The counterparty may also sell "no" shares at a price of $0.55. The 0.05 spread on each side compensates market makers for providing quotes. The spread is driven by implied volatility (expected price movement). Prediction markets inherently have guaranteed realized volatility (actual price movement), which is due to the design that shares must ultimately reach $1 or $0 on a predetermined date.

Example of a market maker scenario:

- Market maker sells 1 "yes" share at a price of $0.55 (equivalent to buying 1 "no" share at a price of $0.45)

- Market maker sells 1 "no" share at a price of $0.55 (equivalent to buying 1 "yes" share at a price of $0.45)

- Market maker now holds 1 "no" share and 1 "yes" share, paying a total of $0.90

- Regardless of whether the coin lands heads or tails, the market maker will redeem $1, earning a spread of $0.10

Another major settlement method for prediction markets is through centralized AMM, which Azuro and Overtime both use. This article does not delve into these models in detail, but the DeFi analogy is GMX v2. Capital is pooled together, and as the sole counterparty to platform traders, the liquidity pool relies on external oracles to price users.

What are the current bottlenecks of prediction markets?

Prediction market platforms have existed and been discussed for long enough that if they truly fit the product market, escape velocity would have occurred long ago. The current bottlenecks can be simply attributed to a lack of interest from both suppliers (liquidity providers) and demanders (bettors).

Issues on the supply side include:

- Insufficient liquidity due to volatility: The most popular markets on Polymarket are often conceptually novel markets with a lack of relevant historical data, making it difficult to predict and price outcomes accurately. For example, predicting whether a CEO like Sam Altman will return to his position after potential mishandling of AGI rumors is difficult because there are no very similar past events. Market makers set wider spreads and less liquidity in uncertain markets to compensate for implied volatility (i.e., the price of the Sam Altman CEO market fluctuated dramatically, with consensus flipping three times in less than 4 days). This makes large bettors less interested in making significant bets.

Insufficient liquidity due to a lack of subject matter experts: Although hundreds of market makers are rewarded daily on Polymarket, many long-tail markets lack liquidity due to a lack of knowledgeable participants. Examples include markets such as "Will a certain celebrity be arrested or charged for something?" or "When will a celebrity tweet?" As more types of prediction markets are introduced and data becomes richer, market makers will become more specialized, and this situation will change over time.

Information asymmetry: Since the buy and sell quotes provided by market makers can be traded by any recipient at any time, the latter has an advantage in making positive expected value bets when obtaining favorable information. In the DeFi market, these types of recipients can be referred to as harmful traffic. Arbitrageurs on Uniswap are a good example of harmful recipients, as they continuously extract profits from liquidity providers using their information advantage.

In a market on Polymarket, "Will Tesla announce the purchase of Bitcoin before March 1, 2021?" a user bought "yes" shares worth $60,000 at approximately 33% odds. This market was the only one the user participated in, and it can be assumed that the user had favorable information. Regardless of the legality issue, the market maker providing quotes at the time could not know if the recipient/bettor had this favorable information, and even if the market maker initially set the odds at 95%, the recipient might still bet because the true odds were 99.9%. This puts the market maker in a certain loss situation. In prediction markets, it is difficult to predict when harmful traffic will occur and how large it will be, making it even more challenging to provide tight spreads and deep liquidity. Market makers need to price the risk of harmful traffic that could occur at any time.

The main issues on the demand side are:

Lack of leverage tools: Without leverage tools, prediction markets are relatively less attractive to retail investors compared to other crypto speculation tools. Retail investors are more likely to create "generational wealth" by betting on memecoins than by betting on capped prediction markets. For example, betting early on $BODEN and $TRUMP brought more upside than betting on whether Biden or Trump would win the presidential election in capped prediction markets.

Lack of Stimulating Short-Term Markets: Retail bettors are not interested in bets that settle months later, as evidenced in the sports betting world, where much of the retail trading volume occurs in live betting (ultra-short term) and daily events (short term). Not enough short-term markets attract mainstream audiences, at least not currently.

What are the methods to solve these problems? How do we increase trading volume?

On the supply side, the first two issues related to insufficient liquidity due to volatility and insufficient liquidity due to a lack of expertise will naturally decrease over time as trading volume in various prediction markets grows, and the number of professional market makers and those with higher risk tolerance and capital increases.

However, instead of waiting for these issues to diminish over time, it is better to proactively address the liquidity shortage issue through liquidity coordination mechanisms initially invented in the DeFi derivatives space. The idea is to allow passive stablecoin depositors to earn yield through vaults deploying market-making strategies across different markets. These vaults will act as the primary counterparty for traders. GMX is the first protocol to achieve this through pool-based liquidity supply strategies relying on oracles for pricing, while Hyperliquid is the second prominent protocol deploying native vault strategies, but with liquidity provided on a CLOB. Both vaults have been profitable over time as they can act as the counterparty to most harmful traffic (retail users who often end up losing over time).

The PNL of Hyperliquid's vault has been growing over time.

Native vaults enable protocols to easily bootstrap liquidity on their own without relying on others. They also make long-tail markets more attractive; Hyperliquid's success is partly due to the fact that newly listed perpetual assets have had significant liquidity from day one.

The challenge in building vault products for prediction markets is to prevent harmful traffic. GMX prevents this by attaching high fees to its trades. Hyperliquid employs market-making strategies with large spreads, a 2-block delay for recipient orders, giving market makers time to adjust their quotes, and prioritizing market maker order cancellations within one block. Both protocols create an environment where harmful traffic does not enter, as it can find better execution prices elsewhere. In prediction markets, preventing harmful traffic can be achieved by providing deep liquidity with wider spreads, selectively providing liquidity to markets less susceptible to information advantage, or hiring savvy strategists with information advantage to prevent harmful traffic.

In practice, a native vault can deploy an additional $250,000 in liquidity, bidding at 53 cents and asking at 56 cents. Wider spreads help increase potential vault profits, as users accept poorer odds when placing bets. This is different from setting quotes at 54 cents and 55 cents, where the counterparty may be an arbitrageur or a savvy user looking for better prices. This market is relatively less susceptible to information asymmetry issues (less internal information and insights are usually quickly disclosed to the public), thus the expectation of harmful traffic is lower. Vaults can also use oracles to provide insights into future line movements, such as obtaining odds data from other betting exchanges or gathering information from top political analysts on social media.

The result is providing bettors with deeper liquidity, allowing them to place larger bets with smaller slippage.

There are several methods to address or at least reduce information asymmetry issues. The first few are related to order book design:

- Gradual Limit Order Book (GLOB): One way to combat harmful traffic is to increase prices by combining the speed and size of orders. If a buyer is certain that an event will occur, the logical strategy would be to buy shares at a price below $1 as much as possible. Additionally, if the market eventually gains favorable information, rapid buying would also be wise.

Contro is implementing this GLOB concept and is launching as a cross-rollup on Initia.

If the Tesla $BTC market were on the GLOB model, the recipient would have to pay over 33% for "yes" shares, taking into account the slippage generated by the combination of order speed (a fraction) and size (huge). He would still profit because he knows "yes" shares will eventually appreciate to $1, but this at least includes the market maker's loss.

Some may argue that if the recipient is just executing a long-term DCA strategy, he can still tolerate small slippage and pay close to 33% for each "yes" share, but in this case, at least give the market maker some time to withdraw his quotes from the book. Market makers may withdraw for several reasons:

- Suspecting harmful traffic, as there is such a large recipient order coming in

- Being certain of harmful traffic, as it checks the recipient's profile and finds they have never placed a bet before

- Wanting to rebalance its inventory and no longer wanting to be too one-sided—perhaps the market maker initially had a $50,000 order at 33% odds on the ask side and a $50,000 order at 27% odds on the bid side—its initial goal was not directional bias, but neutral, to profit from symmetric liquidity provision

- Winner's Fee: Many markets redistribute a portion of the profits to those who have favorable information. The first example is in peer-to-peer web2 sports betting companies, especially Betfair, where a fixed percentage of a user's net winnings is redistributed back to the company. Betfair's fee actually depends on the market itself; on Polymarket, it may be reasonable to charge higher net winning fees for novel or long-tail markets.

This redistribution concept exists in DeFi in the form of order flow auctions. A frontrunning bot captures value from information asymmetry (arbitrage) and is forced to feed it back to those participating in the trade, which could be liquidity providers or users trading. Order flow auctions have seen many PMFs to date, and CowSwap* is pioneering this category through MEVBlocker.

- Static or Dynamic Recipient Fees: Polymarket currently does not have recipient fees. If implemented, the revenue can be used to reward liquidity provision for high volatility markets or markets more susceptible to harmful traffic. Alternatively, higher recipient fees can be set for long-tail markets.

On the demand side, the best way to address the lack of upside space is to create a mechanism that allows it. In sports betting, parlays have become increasingly popular among retail bettors because they offer the opportunity to "win big." A parlay is a bet that combines multiple individual bets into one wager. To win a parlay, all individual bets must win.

In native cryptocurrency prediction markets, there are three main methods to increase user's upside space:

- Parlays

- Perpetual markets

- Tokenized leverage

Parlays: Technically, implementing this on Polymarket's order book is not feasible because bets require upfront capital, and each market has different counterparties. In practice, a new protocol can obtain odds from Polymarket at any given time, price parlay bets, and act as the single counterparty for parlays.

For example, a user wants to place a $10 bet on the following:

These bets, if placed individually, have limited upside, but when combined into parlays, the implied return skyrockets to about 1:650,000, meaning if every bet is correct, the bettor can win $6.5 million. It's not hard to imagine how parlays can gain PMF (Product Market Fit) among crypto users:

- Low entry cost, you can invest a small amount and win big

- Sharing parlay tickets can go viral on Crypto Twitter, especially if someone wins big, creating a feedback loop with the product itself

Supporting parlays brings challenges, namely counterparty risk (what happens when multiple bettors win large parlays simultaneously) and accuracy of odds (you don't want to offer bets where you underestimate the true odds). The casino has already solved the challenge of offering parlays in the sports world, and it has become the most profitable part of sports betting. The profit margin is about 5-8 times higher than offering single market bets, even if some bettors are lucky enough to win big. Another added benefit of parlays is relatively less harmful traffic compared to single markets. The analogy here is: why would a professional player who lives on expected value put money into the lottery?

SX Bet, a web3 sports betting app chain, has launched the world's first peer-to-peer parlay betting system and achieved $1 million in parlay trading volume in the past month. When a bettor "requests a parlay," SX creates a private virtual order book for the parlay. Programmatic market makers listening through APIs then have 1 second to provide liquidity.

Perpetual Prediction Markets: This concept was briefly discussed in 2020 when leading exchange FTX offered perpetual contracts for the US election results. You could go long at $????? price, and if he won the US election, each share could be redeemed for $1. As his actual winning probability changed, FTX had to change margin requirements. Creating perpetual mechanisms for volatile markets like prediction markets brings many challenges for margin requirements, as prices could change from $0.90 to $0.10 in a second. Therefore, there may not be enough collateral to cover the losses of those who go long in the wrong direction. Some of the order book designs discussed above can help mitigate the fact of rapid price changes. Another interesting aspect of the FTX $TRUMP market is that we can reasonably assume Alameda is the primary market maker for these markets, and without locally deployed liquidity, the order book is too thin for a large amount of trading. This highlights the value of native liquidity vault mechanisms for prediction market protocols.

LEVR Bet and SX Bet are currently developing perpetual sports betting markets. One advantage of sports betting is that the price fluctuations of "yes" or "no" shares are relatively small, at least most of the time. For example, a player making a shot may increase the team's chances of winning the game from 50% to 52%, as on average a team may take 50 shots per game. A 2% increase in any given shot is manageable from a clearing and margin call perspective. Offering perpetual contracts at the end of a game is another matter, as someone may hit a "game-winning shot," and the odds may flip from 1% to 99% in half a millisecond. One possible solution is to only allow leveraged bets to a certain extent, as any event thereafter could cause the odds to change too much. The feasibility of perpetual sports betting also depends on the sport itself; a hockey goal is more likely to change the expected game result than a basketball shot.

Tokenized Leverage: A lending market that allows users to borrow against their prediction market positions, especially those in long-term positions, may increase trading volume among professional traders. This can also lead to more liquidity, as market makers can borrow against a position in one market to make a market in another. Tokenized leverage may not be an interesting product for retail bettors unless there is an abstract circular product, like the ones Eigenlayer has gained attention for. The entire market may still be too immature to support such abstract layers, but these types of circular products will eventually emerge.

In addition to pure supply and demand, there are other small ways to increase adoption:

From a user experience perspective: switching the settlement currency from USDC to an interest-bearing stablecoin will increase participation, especially in long-tail markets. This has been discussed several times on Twitter; holding market positions with year-end expiration has a significant opportunity cost (e.g., earning 0.24% annual interest by betting on Kanye West winning the presidential election instead of earning 8% annual interest on AAVE).

Furthermore, adding gamification aimed at increasing retention can truly help attract more users in the long run. In the sports betting industry, simple things like "daily winning bets" or "daily competitions" have worked well.

Some industry-level tailwinds will also increase adoption in the near future: the growth of virtual and on-chain environments will unlock a whole new level of speculative demand, as the number of short-term events will eventually be infinite (think AI/computer-simulated sports), and the level of data will be rich (making it easier for market makers to price outcomes). Other interesting native crypto categories include AI games, on-chain games, and general on-chain data.

Accessible data will lead to an increase in non-human gambling activity, more specifically, betting activity by autonomous agents. Omen on the Gnosis Chain is at the forefront of the concept of AI agent betting. As prediction markets are a game where outcomes are defined, autonomous agents will become increasingly proficient in calculating expected value, possibly more accurate than humans. This reflects a view that artificial intelligence may struggle to predict which meme coin will take off, as there are more "emotional" elements in what makes them successful, and humans are currently better at sensing emotions.

In conclusion, prediction markets are a fascinating user product and design space. Over time, the vision of allowing anyone to bet on anything at any scale will become a reality. If you are building something in this space, whether it's a brand new protocol, a liquidity coordination platform, or a new leverage mechanism, please contact us. I am an enthusiastic user and am very willing to provide feedback.

Thanks to Peter Pan, Shayne Coplan, Sanat Kapur, Andrew Young, taetaehoho, Diana Biggs, Abigail Carlson, Daniel Sekopta, Ryan Clark, Josh Solesbury, Watcher, Jamie Wallace, and Rares Florea for their feedback and review of this article!

Disclaimer:

* denotes 1kx portfolio investment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。