On the afternoon of June 20th, AICoin researchers conducted a live graphic and textual sharing session titled "Short-term Must-See, Conversations with Mainstream in the Market" in the AICoin PC End-Group Chat-Live. The following is a summary of the live content.

I. Main Force Large Order Related Concepts

Main force large orders refer to transactions conducted by institutional investors or large fund holders, usually with a significant trading volume and strong market influence. The appearance of main force large orders often signifies the bullish or bearish sentiment of institutional investors towards a certain coin, thus attracting close attention from market participants.

- Characteristics of Main Force Large Orders:

- Large trading volume, stable prices, strong continuity, concentrated transaction time.

- Definition and Differentiation Standards of Large Orders:

Large and small orders mainly refer to the single transaction quantity or amount of buying and selling contracts/spots, divided according to real-time trading data during trading hours. Generally, large and huge orders represent institutions, while medium and small orders represent small and medium investors.

Huge order: 500+ Large order: 35-500, etc.

Different trading software may have variations in the classification of super large, large, medium, and small orders.

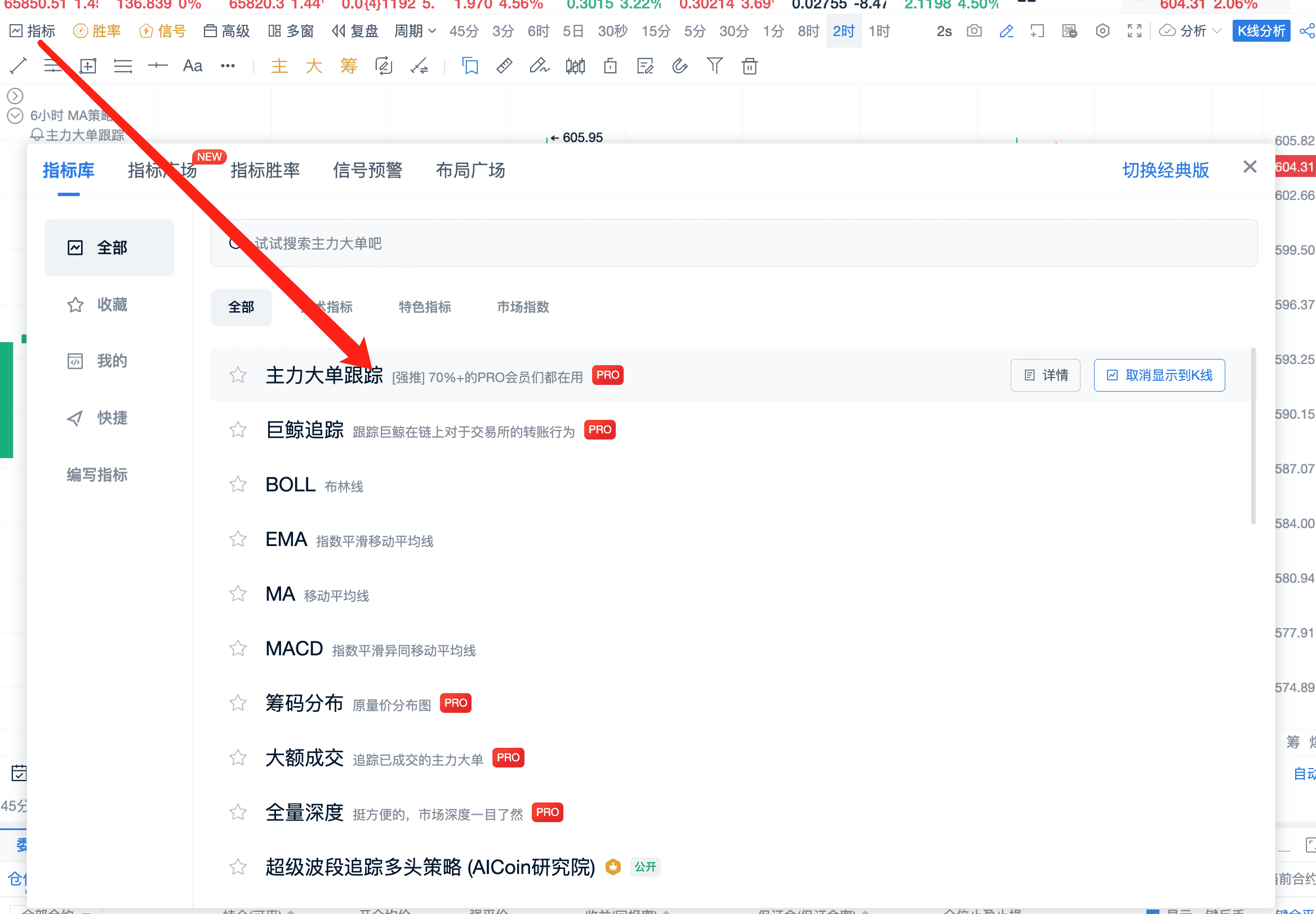

- Tracking Main Force Large Orders Supports Custom Parameters

Specifically distinguish BTC and ETH, customize large order parameters, and set alerts.

(1) Clicking on large orders to display candlestick charts

(2) Setting the amount of large order commission as shown in the image below

(3) Can track across the entire platform based on custom settings

As a PRO member, you will gain access to visual representations of main force orders and large volume transaction analysis, allowing you to intuitively observe the real actions behind the market. Real-time updated trading data enables you to respond quickly at any time. Furthermore, we provide real-time analysis and guidance to help you navigate this complex investment environment. Click the link to experience: https://www.aicoin.com/zh-Hans/vip

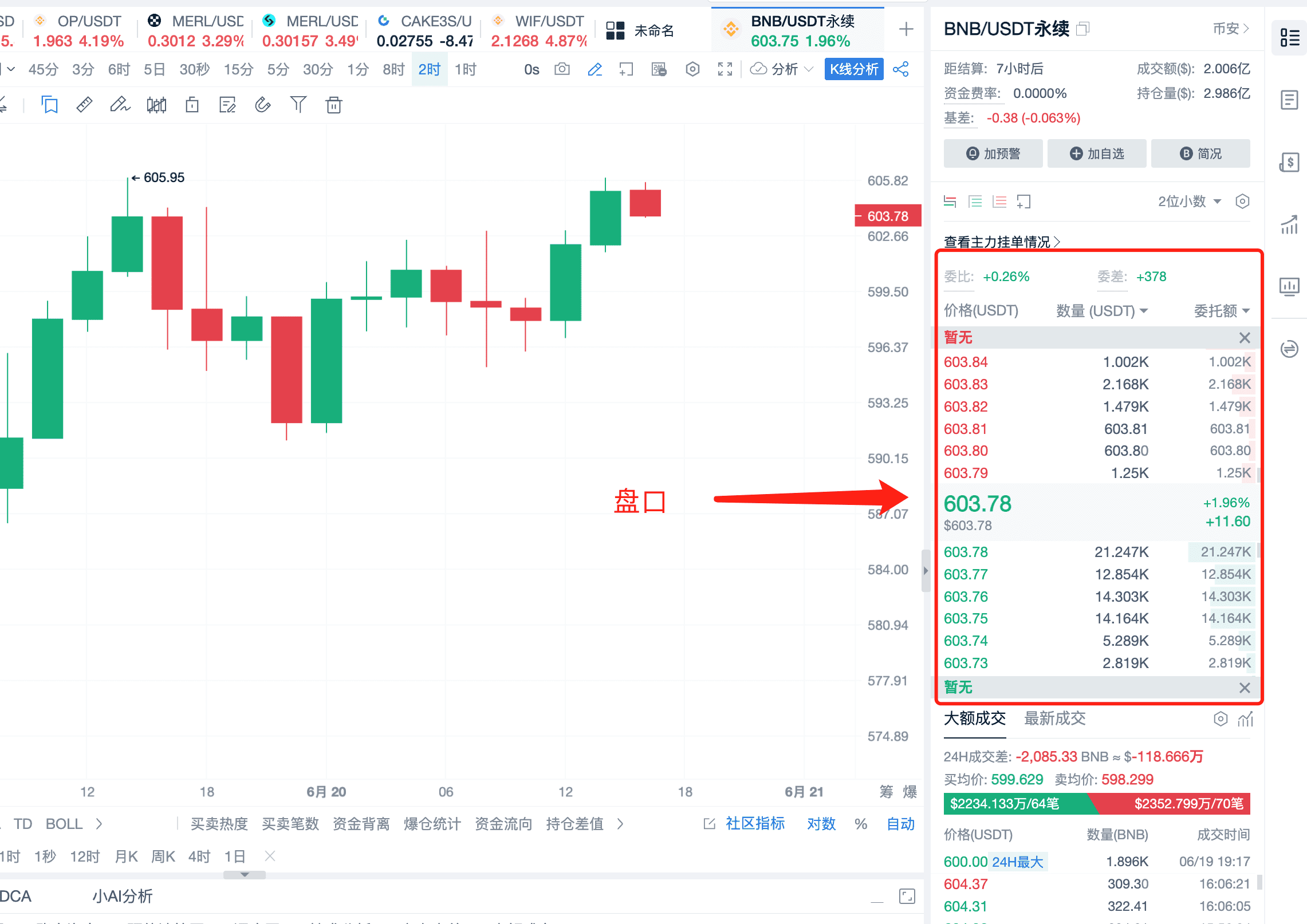

II. Understanding the Order Book

Understanding the order book data of a project, including the number of super large orders, large orders, small orders, etc., has a certain reference value for investors to judge market trends.

Huge and large orders are considered the main behaviors in the market, or actions of large funds, generally held by institutions, and have an impact on the price of the project, which retail investors are unable to handle large or super large buy orders.

Continuously buying or selling large orders can represent a direction, with large orders representing both buying and selling. However, the trend of the project still needs to be observed based on trading volume, as well as the length of time and the shape of the chart.

- Order Book Theory

"Order book" is a common term for observing trading trends during the trading process.

These trading trends include: the intraday trend of a project after opening; each transaction of the buy and sell orders; the trend of large transactions; the intentions behind the rise and fall, etc. However, data is not the only indicator of the order book. Observing the "order book" requires accumulated experience, long-term observation, continuous analysis, and most importantly, constantly improving through trading experience.

III. Understanding the Three Major Operating Techniques of Main Force through the Order Book

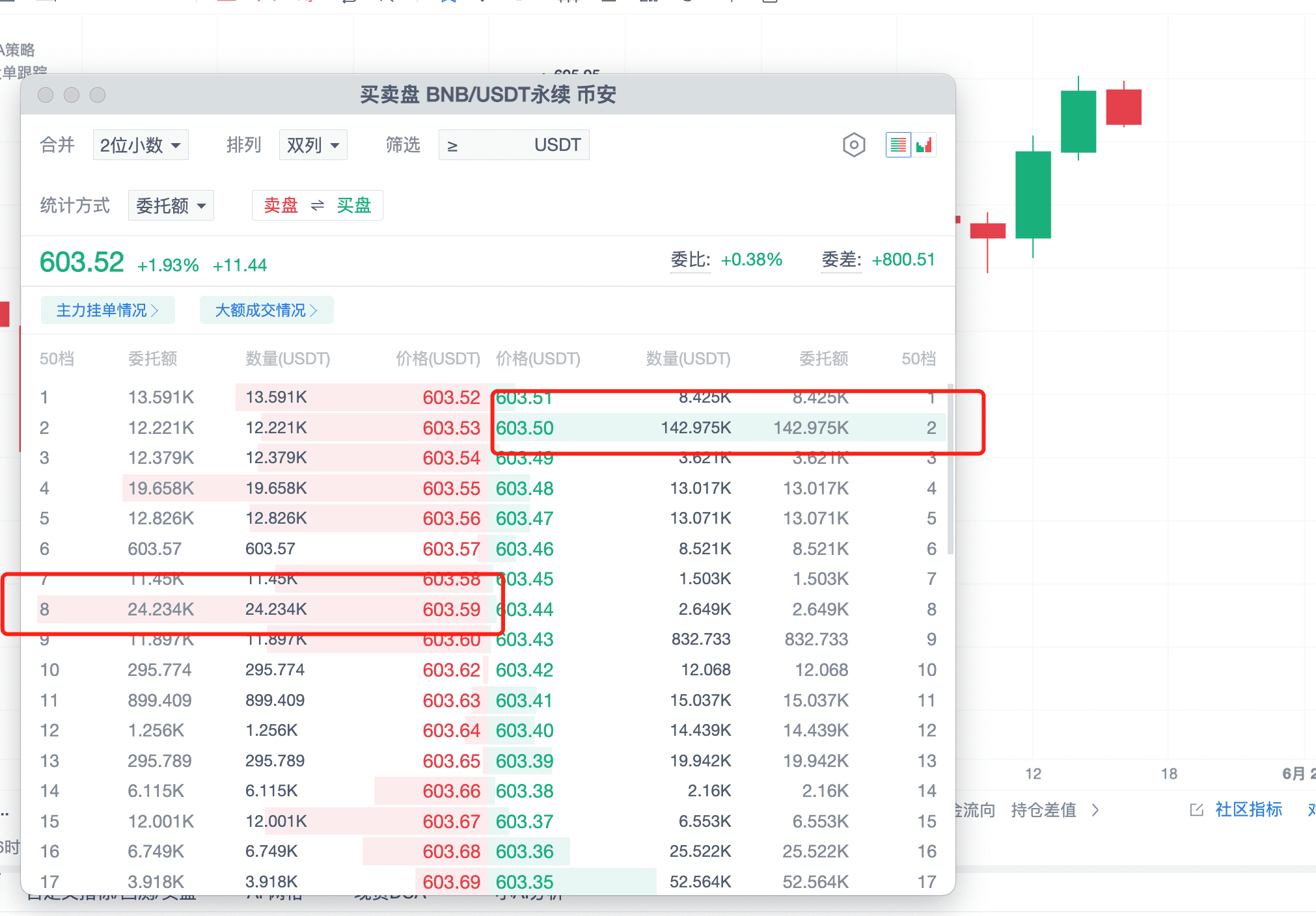

- Operating Technique 1: Pressure and Single Pressure

The performance of the order book is usually an important tool for investors to monitor and judge market trends, especially for short-term traders, understanding and interpreting changes in the order book is crucial. Pressure refers to a large amount of selling. Main force investors intentionally lower the price to a lower level by selling a large amount, usually to suppress the price increase, allowing the main force to accumulate or absorb more chips at a lower price range, thereby reducing their purchase cost.

Simply put, large orders pressure the book by using a large amount of funds to suppress the price to a lower position, making it easier for them to accumulate at a low level and reduce their buying cost. In the order book, you will see a large number of sell orders, especially concentrated at a certain price point, often far exceeding the buy orders. These sell orders will create significant downward pressure on the price, causing the price to linger or repeatedly test that price point, making it difficult to break through effectively.

(1) The long red bar in the image below represents a large quantity

These sell orders will create significant downward pressure on the price, causing the price to linger or repeatedly test that price point, making it difficult to break through effectively.

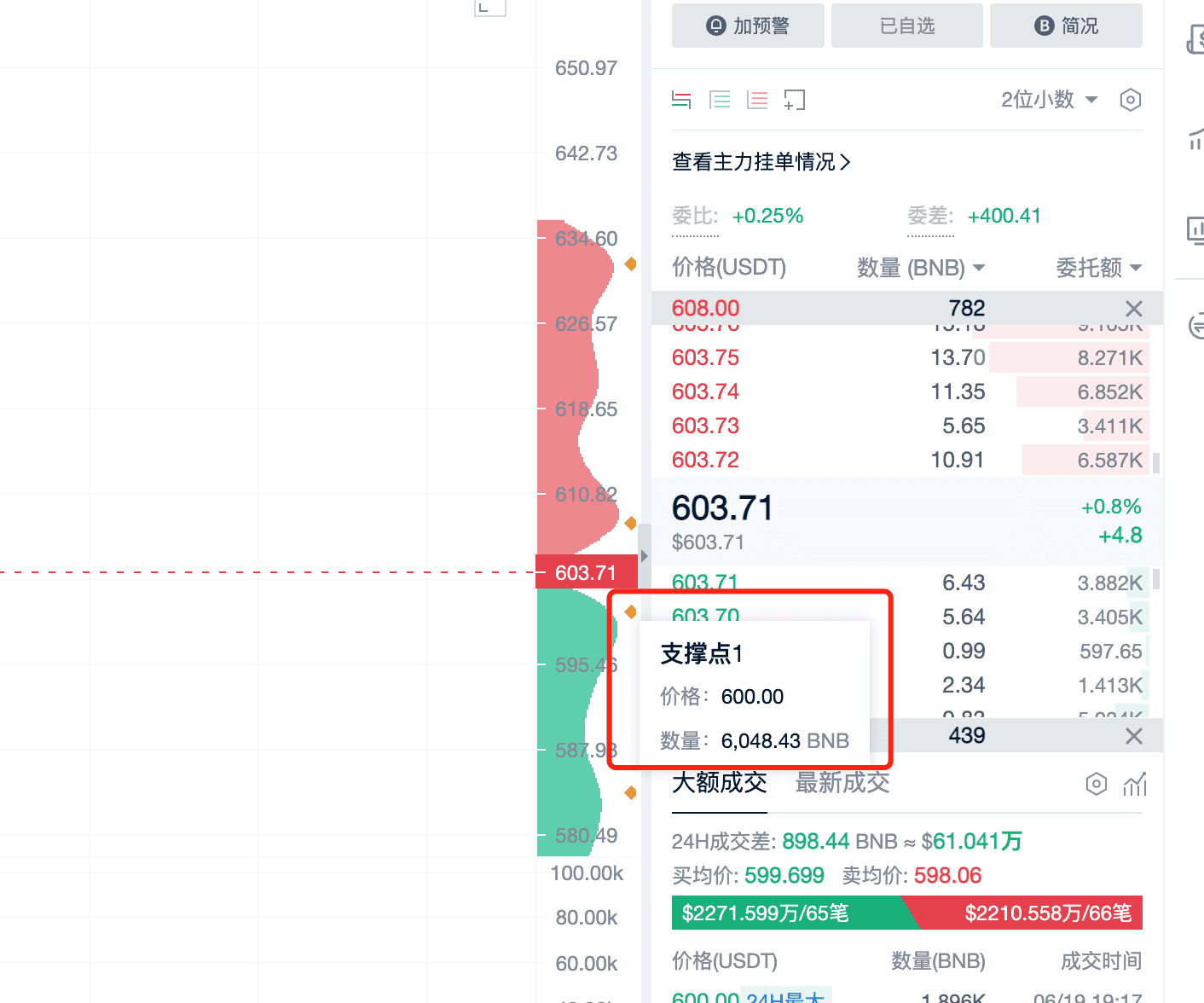

(2) Full Depth The order book data is related to pressure and support levels and full depth, as shown in the red box in the image below

We have created exclusive "full depth" visualized data for the order book

Right-click on the price axis to see all the pending orders, and members can check the box to display them on the coordinate axis

Even in the member data of the full depth, you can still see the intraday full depth. If you are doing a few minutes of short-term trading, refer to the 1-hour, do hourly level, and refer to the full depth chart support and pressure points, combined with some data of the main force large orders, open the PRO version of the candlestick chart directly using full depth: PRO version candlestick chart membership service | AICoin - for value · more efficient

- Operating Technique 2: Washing the Book

In the process of raising prices, the manipulator intentionally causes price fluctuations, allowing previously purchased chips to be sold, a technique known as washing the book. Washing the book is a strategy commonly used by manipulators to manipulate prices. The purpose is to clear out floating chips in the market before a significant price increase, so that they can hold at a lower cost and subsequently profit significantly when pushing up the price.

(1) Main Principles of Washing the Book: a. Market Sentiment Oscillation: Manipulators will first create frequent buying and selling operations within a certain price range, causing price fluctuations to remain within a certain range. This fluctuation can make investors in the market feel uncertain or uneasy, fearing a potential price drop.

b. Encouraging Investors to Sell: During the price fluctuation, manipulators may intentionally create some negative news or display technical indicators indicating a potential short-term price drop, prompting indecisive or loss-wary retail investors to sell their chips.

c. Collecting Chips at Low Prices: After washing out most of the chips that investors want to sell from retail investors, manipulators can buy a large amount at lower price levels, thereby accumulating enough chips to prepare for the next price increase.

d. Reducing Upper Pressure: Because a large number of chips intended for sale have been washed out of the market during the process of washing the book, when manipulators start to raise prices, the quantity willing to be sold in the market decreases, and the selling pressure at the upper level also decreases, making it easier to push up the price.

Meaning of Selling Pressure: Selling pressure refers to a significant amount of sell orders in the market, leading to price declines or difficulty in rising. If the selling pressure is low, it becomes easier for manipulators to push the price higher.

e. Profiteering: After controlling enough low-priced chips through the above steps, manipulators begin to gradually push up the price. Due to the low holding cost, when the price is pushed to a high level, manipulators start to gradually sell, gaining differential profits.

Inserting needles may be a way for manipulators to wash the book, creating significant buying or selling pressure at a certain price level.

(2) Washing the Book Techniques

A. Direct Suppression a. Rapid Decline: Manipulators or large holders may rapidly push down prices in the cryptocurrency market through large sell-offs. The purpose of this suppression is to create panic, forcing holders to sell their positions out of fear of further declines, allowing manipulators to collect more coins at lower levels.

b. Panic Selling: Retail investors often have a low tolerance for price fluctuations. Manipulators can effectively trigger panic selling by quickly suppressing the market.

c. Creating Buying Points: After a rapid decline, if manipulators assess that market panic has reached a peak, they may start to gradually buy and build positions. Manipulators may choose to accumulate at 3%-5% below the average price, waiting for market sentiment to stabilize before pushing up prices.

d. Using Late Sell-offs: In the cryptocurrency market, although there are no strict opening and closing times, specific time periods may still be used to execute similar strategies. For example, a sudden price drop in the cryptocurrency market a few hours before the US stock market closes may be aimed at influencing market psychology and creating trading opportunities.

B. Wide Oscillation a. Rapid Surges or Declines: If an asset experiences a sharp increase or decrease in price within a short period, it may be due to large holders or operators intentionally pushing up or pulling down prices with a small number of large orders, creating space for price oscillation in subsequent trades.

b. Price Returning to the Average: After sharp price fluctuations, there is often a process of returning to the average price. This process may be accompanied by more price fluctuations, and large holders use this fluctuation to wash the book, getting rid of weak positions while attracting new buy orders from retail investors.

c. Using Averages as a Reference: In the wide oscillation washing pattern, averages (such as moving averages) can serve as an important reference point, helping investors identify suitable buying or selling opportunities. When the price moves away from the average and then returns, it can be seen as a signal to enter or exit. EMA looks at 120, and the dean has previously published several EMA indicators in the indicator community. Publicly available for free.

Or search for EMA to find other user-analyzed EMA and other indicators.

(3) Summary of Washing the Book Characteristics

a. Significant oscillations, mixed arrangement of bearish and bullish candles, and uncertain market trends.

b. Irregular trading volume, but with a decreasing trend.

c. Often accompanied by doji candles with upper and lower shadows.

d. Prices generally remain above the manipulator's holding cost area. If uncertain, pay attention to the 10-day moving average, or the 30-day moving average for non-short-term trading.

e. According to the theory of candlestick combinations, the washing process is also a consolidation process, so the shapes generally appear as triangle consolidation, flag consolidation, and rectangle consolidation.

3. Operating Technique 3: Pressure and Chip Absorption

(1) Pressure and Chip Absorption

a. Attracting Attention with Large Sell Orders: Manipulators or large holders place an unusually large sell order at a specific price level on the trading platform, which appears to be a signal of price suppression but actually induces retail investors to sell their positions at that price or lower.

b. Secretly Accumulating: At the same time, manipulators actively collect cheap chips with small buy orders at lower price points. Therefore, the intraday price chart may show jagged fluctuations, with a seemingly active buy side but actually controlled by manipulators.

(2) Analysis of the Nature of Pressure

a. Genuine Sell Orders: Manipulators genuinely sell, possibly due to a change in strategy or the need for capital outflow.

b. Display Orders: Mainly to show large sell orders in the market, but manipulators do not intend to actually sell, aiming to influence market psychology and stabilize their control.

(3) Large Transaction and Large Order Tracking

Tracking main force orders and large transactions: one tracks the number of pending orders, the other tracks the transaction quantity. Comparing the two can reveal false signals.

Tracking main force orders and large transactions correspond to tracking pending orders and transaction quantities.

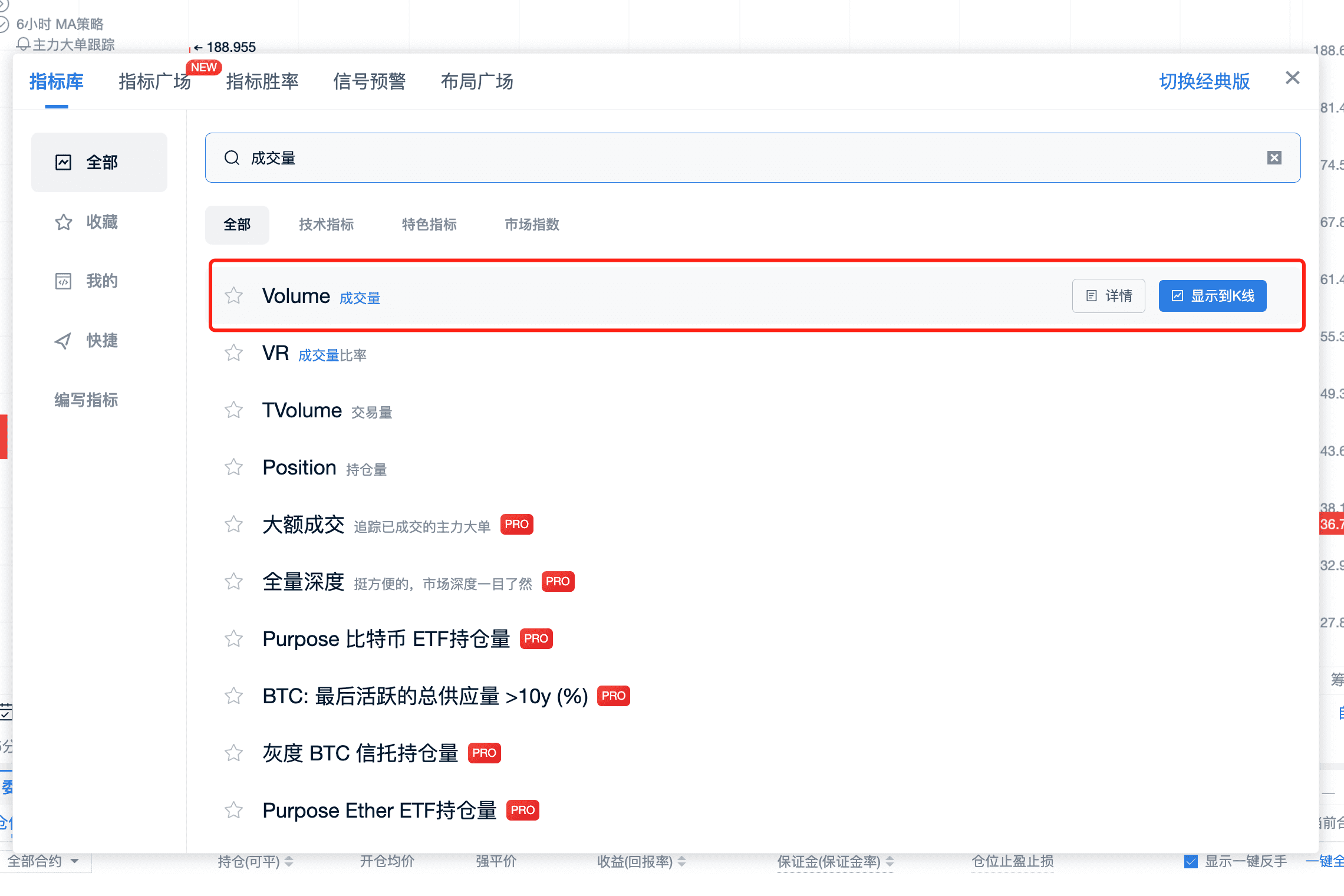

You can see the transaction volume indicator.

Continuously monitor the pending orders of large orders and combine them with transaction volume! Following the main force, our PRO members have a very powerful feature, main force large orders. Main force large order monitoring, rapid order withdrawal monitoring, all visualized indicators on the candlestick chart. Click the link to experience: https://www.aicoin.com/zh-Hans/vip

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。