Daily Sharing

Last night, Bitcoin experienced a significant pullback, dropping to 58402 after a single needle pierced through. This decline exceeded the expectations of most people. During the entire 4-hour level pullback, Mr. Wuliu initially expected a rebound to 66000 or a range of 65000 to 66000 for a 4-hour level rebound. Some people anticipated a 4-hour level rebound near 62000, while a few others predicted a 4-hour rebound near 60000. Very few people believed in a 4-hour level pullback to around 58000.

Therefore, the actual market movement is very difficult to predict. This tells us that setting stop-loss in advance is very necessary and is a basic quality of a trader. The low point you think of may not necessarily be the market's final low point. The high point you think of may not necessarily be the market's final high point. Therefore, having a stop-loss limit will prevent us from being taken away by extreme market conditions.

Of course, many of our novice friends find it difficult to understand. Every time Bitcoin experiences a sharp drop or a sudden surge, there are always people asking me how to deal with the trapped contract orders. I ask them, why didn't you set a stop-loss plan in advance? Most of the answers are, "I don't know why it suddenly dropped so much," or some say, "I thought it would continue to drop, how did it suddenly surge?"

You see, the first reaction of most people with trapped contract orders is what they thought would happen. 90% of people's first reaction is to think that the direction was wrong, rather than reflecting on their own trading methods and not considering where to place the stop-loss when placing the order.

Those who have already decided where to place the stop-loss the moment they open a long or short position are basically experienced traders who have become aware after countless liquidations that no one can accurately predict all positions and directions with 100% certainty.

Today's article emphasizes some points to note in trading, which are actually old topics. It's just that every time some friends encounter sudden market changes, they always have trapped orders. It seems that these people are always either trying to get out of the trap or waiting for a way out, as if they are always waiting to break even.

So I couldn't help but talk a little more in the article. If you find the content here too boring, feel free to skip it.

BTC

Due to the rapid changes in the market, the article can only make predictions about the market changes at the moment of publication. Short-term players should pay attention to the latest market changes and use this information as a reference only.

1H:

At the 1-hour level, in the short term, we are likely to see a 1-hour level rebound to around 63000 or 64000, followed by another 1-hour pullback to test whether it breaks below 58400. If it doesn't break, we will see a new 4-hour level rebound. The target for the 4-hour rebound is still around 66000 to 67000.

15M:

At the 15-minute level, in the short term, there is still hope for another retracement to around 66000 or 59500, to see if it provides an opportunity. After the retracement, there will be a third 15-minute level uptrend, targeting around 62500 to 63000.

ETH

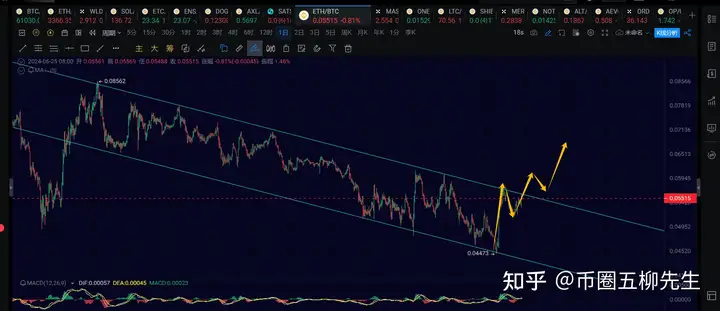

The above chart shows the exchange rate of Ethereum. Ethereum's daily exchange rate has been tightly suppressed by a descending channel. It remains to be seen whether it can break through the descending channel and rise above 0.06 in the short term.

Ethereum is expected to rebound and return to the central axis. There is hope for a direct 4-hour level rebound for Ethereum. The first 1-hour level rebound has not ended yet, and there is still a 15-minute level pullback and a 15-minute level rebound to come. The target for the 1-hour rebound is around 3450 to 3500. The next 1-hour level pullback is unlikely to break below 3240, forming a second buy. The overall target for the 4-hour level rebound is around 3700 to 3800.

Altcoins

As mentioned in our article on June 18th, altcoins have entered a resilient state, so it is expected that there will be a good rebound in the near future. It's worth paying attention to, as after a significant drop, a rise is natural.

Trend Direction

Weekly Level: Upward, with an upward target of $180,000.

Daily Level: Downward, currently undergoing a pullback from around 72000, retesting the range of 56000 to 59000.

4-hour Level: Downward, still awaiting a second buy to confirm the end of the pullback.

1-hour Level: Upward, in the short term, expecting a 1-hour level rebound to around 63000 or 64000.

15-minute Level: Upward, in the short term, it is currently uncertain whether it will retrace to around 60000.

Feel free to follow my public account for further discussion and exchange:

The article is time-sensitive, so please be cautious and note the risks. The above is only personal advice and is for reference only!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。