This article is only a personal market view and does not constitute investment advice. If you operate according to this, you are responsible for your own gains and losses.

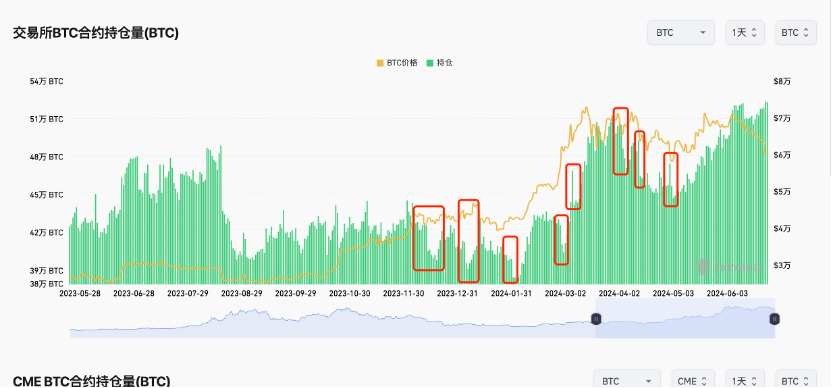

In the early morning, BTC plummeted to a low of 58,000+, and the trading volume also increased. The dollar-denominated position has decreased to some extent, but if switched to a coin-denominated basis, it has not actually decreased. In a bull market, especially during a bull market correction, paying attention to the coin-denominated contract position has a better effect.

If you are a coin-denominated long position, as the market retraces, the coin-denominated position must increase during the price decline process, until the position is liquidated or actively closed, at which point this part of the position disappears. Then the entire coin-denominated position data will show a significant drop in a certain price range in a guillotine-like manner.

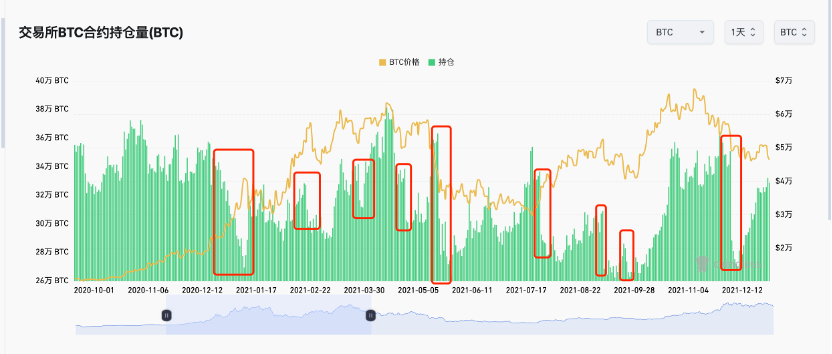

This is common in a bull market environment. Let's take a look at the trend of coin-denominated contract positions during the last bull market correction. Between January and November 2021.

Now let's take a look at the trend of coin-denominated contract positions during the retracement since October last year. Similarly, whenever there is a retracement, there will be a greater or lesser guillotine-like decline in the position. Since June, especially during the recent retracement process, the coin-denominated position has been increasing, indicating that the price range that would trigger liquidation or forced closure has not been reached. The retracement is not over. However, the specific form of the decline is uncertain; it could continue to fall or rebound before falling again. In any case, pay attention to the changes in the coin-denominated position. Do not assume the specific form that may cause the position to decline, just focus on the result.

It is worth mentioning that several sentiment indicators I often follow have shown pessimism after yesterday's drop. This is actually a good thing. What we fear is that after the drop, the market is still optimistic and bullish. But the pessimistic sentiment is not enough. Yesterday was only the first day of pessimistic sentiment appearing in the indicators, and this sentiment needs to be maintained for a while to be ideal.

The noise-reduced profit rate has returned to the negative range. Subsequently, pay attention to the 7-day average. If the 7-day average is negative, it can basically be judged as the price bottom.

The funding rate has also dropped below zero. Subsequently, pay attention to the 7-day average. If the 7-day average is negative, it can basically be judged as the price bottom.

At the same time, the fear and greed index has dropped to a new low, 30.

Yesterday, everyone should have seen the news that Mentougou will start compensation in July. Before the compensation is completed, the probability of BTC unilaterally rising is not high. We can't just watch the selling pressure and rush to buy in.

For the compensation in Mentougou, everyone can pay more attention to the self-media. When there are many reports of forced wealth in the media, the Mentougou incident will probably be over, and there should be less attention afterwards.

Looking at the BTC's candlestick chart, the drop corresponding to the top rectangle has already reached the bottom. The several price levels worth paying attention to in the near future are 60,000 (Fibonacci support level, mainly pay attention to the daily closing price), 57,700—200-day moving average, and finally the previous low of 56,500—breaking through this level would be a very ugly trend from a technical analysis perspective.

In summary, at least in terms of time, I don't think the retracement market has ended. The best case scenario in the future is probably a oscillating recovery market after mid to late April, the worst case is another major drop. After repeated bottom testing, we can determine where the true bottom is. Subsequently, continue to pay attention to several sentiment indicators and the coin-denominated contract position.

Follow me and maximize trend profits with minimal operations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。