On May 19, 2021, the global cryptocurrency market experienced a severe crash, known as the "519 Incident." On that day, the price of Bitcoin plummeted from around $43,000 to about $30,000, a drop of over 30%. The decline of other cryptocurrencies such as Ethereum even exceeded 40%.

Historical data analysis: Historical data shows that after a crash similar to the 519 Incident, the market usually needs some time to consolidate and recover. If history repeats itself, this round of decline and consolidation is expected to last for about 3 weeks. Fibonacci time prediction: According to Fibonacci time analysis, it is expected that this downturn cycle will last until late July. Therefore, investors should patiently hold their chips and wait for the market to warm up.

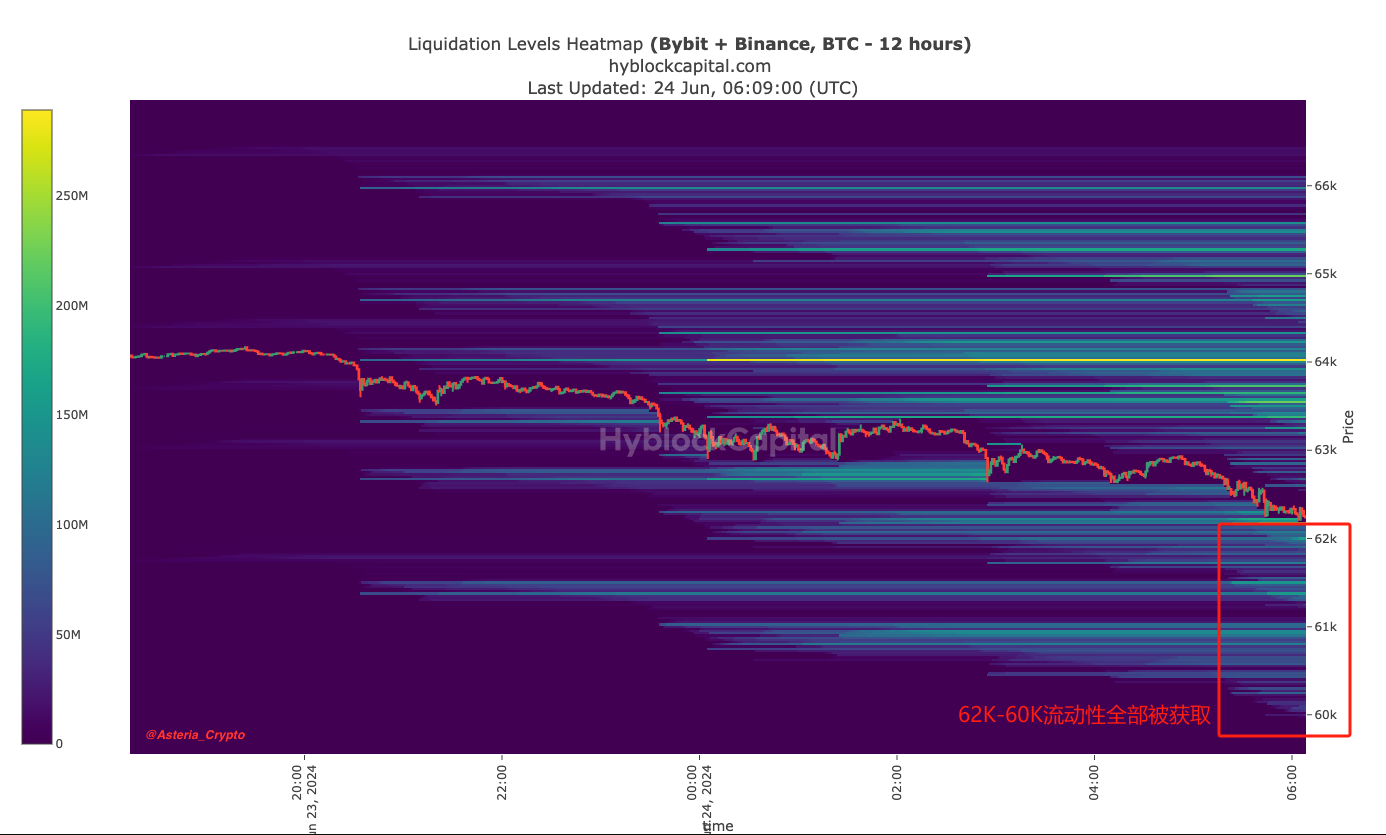

On the daily chart, the liquidity of the 59K defense range is being intercepted, and all the liquidity of the 12-hour chart has been taken!

The liquidity at 60K has been seized

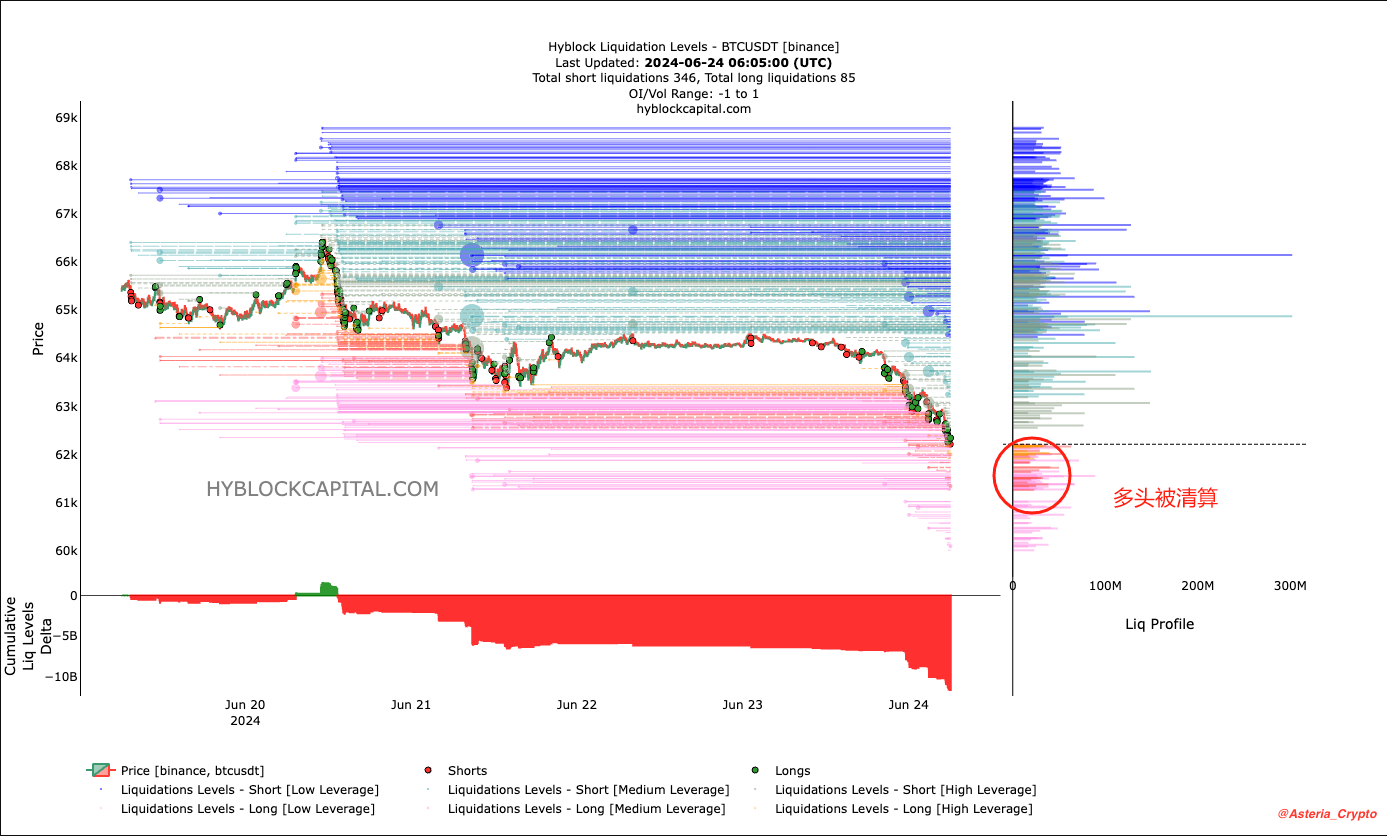

Long positions have been liquidated

Current market situation and investment strategy: Currently, the market is showing weakness, especially in Bitcoin. Investors can choose to wait and see for now, waiting for clearer market signals.

Capital flow: The outflow of funds from Bitcoin dominance (BTC.D) indicates that funds may be flowing into Ethereum (ETH) and some high-quality altcoins. Some altcoins have shown strong resilience in this major drop, possibly because they had already experienced significant declines and are now at relatively low points, attracting the attention of smart money.

Investment advice, observation, and waiting: In the current weak market conditions, investors should remain cautious and wait for clearer reversal signals in the market. Focus on ETH and high-quality altcoins: As funds flow out of BTC, investors can focus on Ethereum and well-performing high-quality altcoins to find investment opportunities.

Risk management: Despite the Fibonacci time prediction as a reference, market uncertainty still exists. Investors should pay attention to risk management and avoid bearing excessive losses in market fluctuations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。