This article is only a personal market view and does not constitute investment advice. If you operate according to this, you are responsible for your own gains and losses.

The recent market trend is in line with the previous article's expectations. Since early June, I first issued a risk warning, and later expressed my bearish view on BTC, which as expected, broke below the 120-day moving average last week. On June 17th, I also warned about the breakout risks of dot, avax, ada, and apt on Twitter, and the next day the entire market experienced a pullback. The recent rhythm has been well grasped.

Returning to the market, it is clearly in a favorable position for the bears recently, and I have also noticed a particularly bad signal. During the process of continuous liquidation and the price decline, the open interest of the futures contracts did not decrease, but instead slightly increased.

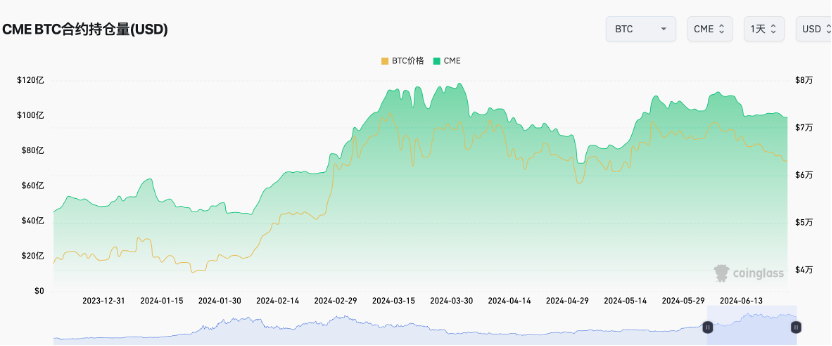

The following chart shows the BTC futures contract open interest on CME. It can be seen that as the price dropped from 67,000 to 63,000, the open interest slightly decreased. Considering the decrease in liquidation, in fact, both long and short positions increased during the decline.

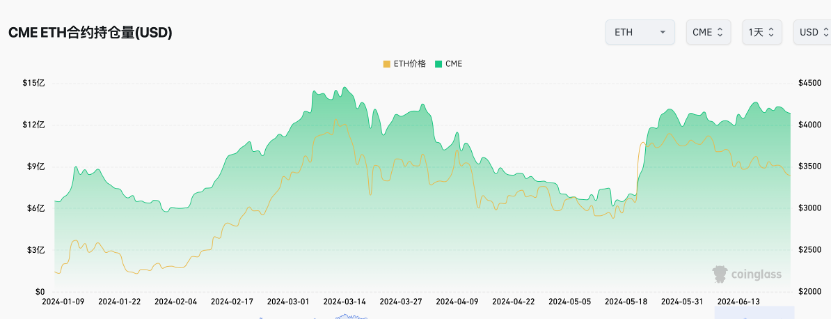

The performance of ETH in the following chart is even more significant. During the process of the price dropping from 3900 to 3400, the open interest actually showed a slight increase. Therefore, whether it is BTC or ETH, both long and short positions increased during the decline, which generally indicates a continuation of the trend. An increase in open interest during an uptrend is bullish, while an increase in open interest during a downtrend is bearish. So I say this is an unfavorable signal.

Based on experience, there will definitely be corresponding leverage clearing before a real market takes off, as well as a process of accumulating chips at the bottom. Currently, it seems that there should be a big wave ahead, aiming to reduce the current open interest of the contracts and liquidate one side. Considering the open interest, the trend of the candlesticks, and technical indicators, in the absence of sudden positive news, I personally believe that the probability of the bulls suffering is greater. If there is positive news, it will probably be in early July when ETH is approved. My advice is not to bet on the bulls. Just hold spot positions if you are bullish, stay away from leverage, and definitely do not go long with high leverage, as it is truly nerve-wracking.

Looking at the downtrend since early June on the daily chart, the difference in volume between bullish and bearish candlesticks is too large. Before this downtrend ends, we need to see at least one significant increase in volume, which is a necessary condition for a trend reversal. A significant decrease in open interest along with a large increase in volume basically represents the end of a downtrend, which will then turn into a phase of oscillation and repair.

Looking at the 3-day technical indicators for BTC, there is still some distance from the zero axis. I personally estimate that this round of pullback and subsequent oscillation should restore the 3-day technical indicators to near the zero axis, in order to gather strength for a future rise.

In general, I do not believe there will be a new uptrend in the near future. However, as shown in the chart below, due to the sustained bullish divergence and wedge pattern on the 4-hour chart, if it breaks above the upper boundary of the wedge, there may be a short-term rebound, but it is only a rebound.

Overall, continue to patiently wait for the end of the pullback. We need to see signals that the pullback trend is about to end, but for now, there are none.

Follow me and earn maximum trend profits with minimal operations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。