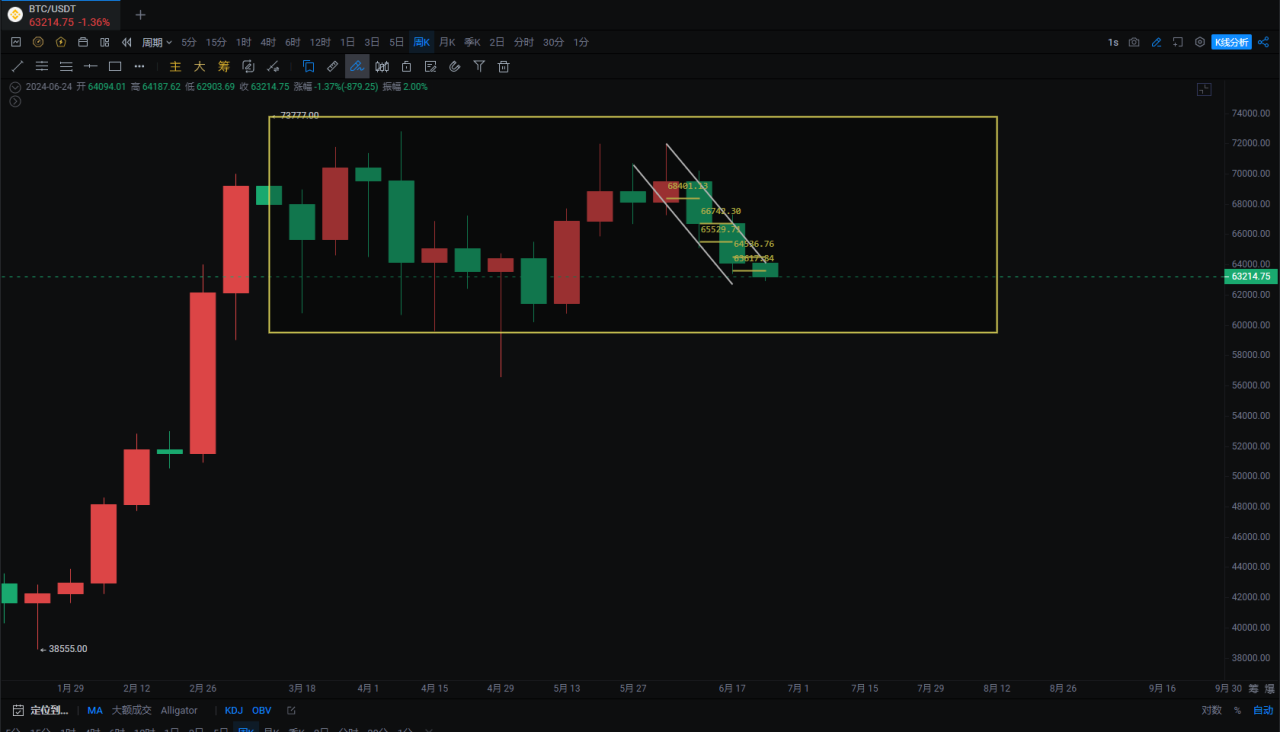

Bitcoin has been falling for more than half a month, dropping from 72000 to 62900, a decrease of more than 9000 points, or 12%. The newly opened weekly line has broken through the BOLL midline, which is a very dangerous signal. It should be noted that this is the first time it has fallen below the midline since breaking through in October. Previously, it failed to break through 72000 several times, which also reminded to reduce positions at high levels, warning of a sharp decline or a repeat of the May 19th market. However, the market has been in a continuous decline, with the second rebound attempt being blocked by resistance and leading to a fall. Near 65000, a descending wedge can be seen, but the rebound is weak and the decline continues.

06/24/07 The European Central Bank cut interest rates for the first time in five years, and BTC was rejected multiple times at 72000. Things to watch out for in the short term!

06/24/11 JPMorgan shorts gold futures worth trillions of dollars, the US dollar index continues to be tricky, how will the crypto market respond?

06/24/12 Potential M-top at the weekly level, reduce positions at high levels in spot trading, beware of a sharp decline similar to the May 19th market!

06/24/13 BTC staged a long and short battle, CRV may have a risk of a sharp decline, and the downward trend has not changed.

06/24/14 Rejected under strong pressure, the daily line shows a double negative with a positive, and a sharp decline is imminent!

Ethereum's weekly line will once again test the BOLL midline support. Ethereum's exchange rate has not shown any independent trend, and it has been brought down by Bitcoin. It will continue to test the 3355 support level for the fourth consecutive week.

Bitcoin The weekly line has formed a downward M-top by breaking through the BOLL midline. It continued to fall after breaking through the MA120 without a second rebound test, and will continue to test the 60600-62000 support range. The support strength near the bottom of the range will be relatively strong. This range is expected to see a short-term rebound first, so there is no rush for short positions.

There is still one week left for the monthly closing. It has been oscillating at high levels for 4 months, with the RSI falling below the overbought zone and the KDJ showing signs of a high-level death cross. The weekly MACD continues its downward trend, and the RSI and KDJ are turning downwards.

The long-term outlook remains bearish, with the first bottoming opportunity at 59600-62000, the second at 55000-56552, and the third at 43000-45000 (in extreme cases). Patience is required.

Support: Resistance:

Ethereum The daily line is still oscillating within a triangle and will once again test the 3355 support. The weekly line is likely to break through the BOLL midline, with the MACD showing a leak in the air. Currently, it is still being constrained by Bitcoin. Even if the ETH spot ETF is approved on July 4th, there is no absolute increase in the current trend, and it should be noted that once approved, it will be sold off like the BTC spot ETF.

It is recommended to be more cautious and less active when the US dollar index is being tricky. The global manipulation of the US dollar tide is still ongoing, so many people are guessing when the interest rate will be cut. I believe that the US dollar index will not weaken and the interest rate will not be cut in the short term. The current US dollar is once again facing pressure at 106, and the 106-107 pressure is very critical. We will continue to provide updates.

Support: Resistance:

If you like my views, please like, comment, and share. Let's go through the bull and bear markets together!!!

The article is time-sensitive and is for reference only, with real-time updates.

Focus on candlestick technical research, win-win global investment opportunities. WeChat public account: 交易公子扶苏

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。