"Weekly Editor's Picks" is a "functional" section of Odaily Planet Daily. In addition to covering a large amount of real-time information every week, Planet Daily also publishes many high-quality in-depth analysis contents, which may be hidden in the information flow and hot news, passing by you.

Therefore, our editorial department will select some high-quality articles worth reading and collecting from the content published in the past 7 days every Saturday, bringing new inspiration to you in the encrypted world from the perspectives of data analysis, industry judgment, and opinion output.

Now, let's read together:

Investment and Entrepreneurship

In-depth Research: The Delicate Relationship Between BTC Spot ETF and CME Massive Short Positions

At the end of 2017, when CME officially launched BTC futures trading, it coincided with the end of the bull market in 2017.

As of now, CME's total open interest in BTC futures has reached 150,800 BTC, equivalent to about 10 billion US dollars, accounting for 28.75% of the entire BTC futures trading market. The current BTC futures market is not controlled by traditional cryptocurrency exchanges and retail investors, but has already fallen into the hands of professional traders in the United States.

CME's futures premium shows a regular fluctuation pattern as each month's contract is rolled over to the next month, similar to the premium of perpetual contracts on traditional cryptocurrency exchanges. They will have a higher premium at the time of contract generation, and the premium will gradually be smoothed out as the contract approaches expiration.

Hedge funds or institutions have been buying a large amount of US stocks ETFs while opening an equal amount of short positions on CME, conducting a risk-free fixed arbitrage once a month, achieving a stable return of at least 12.7% annually.

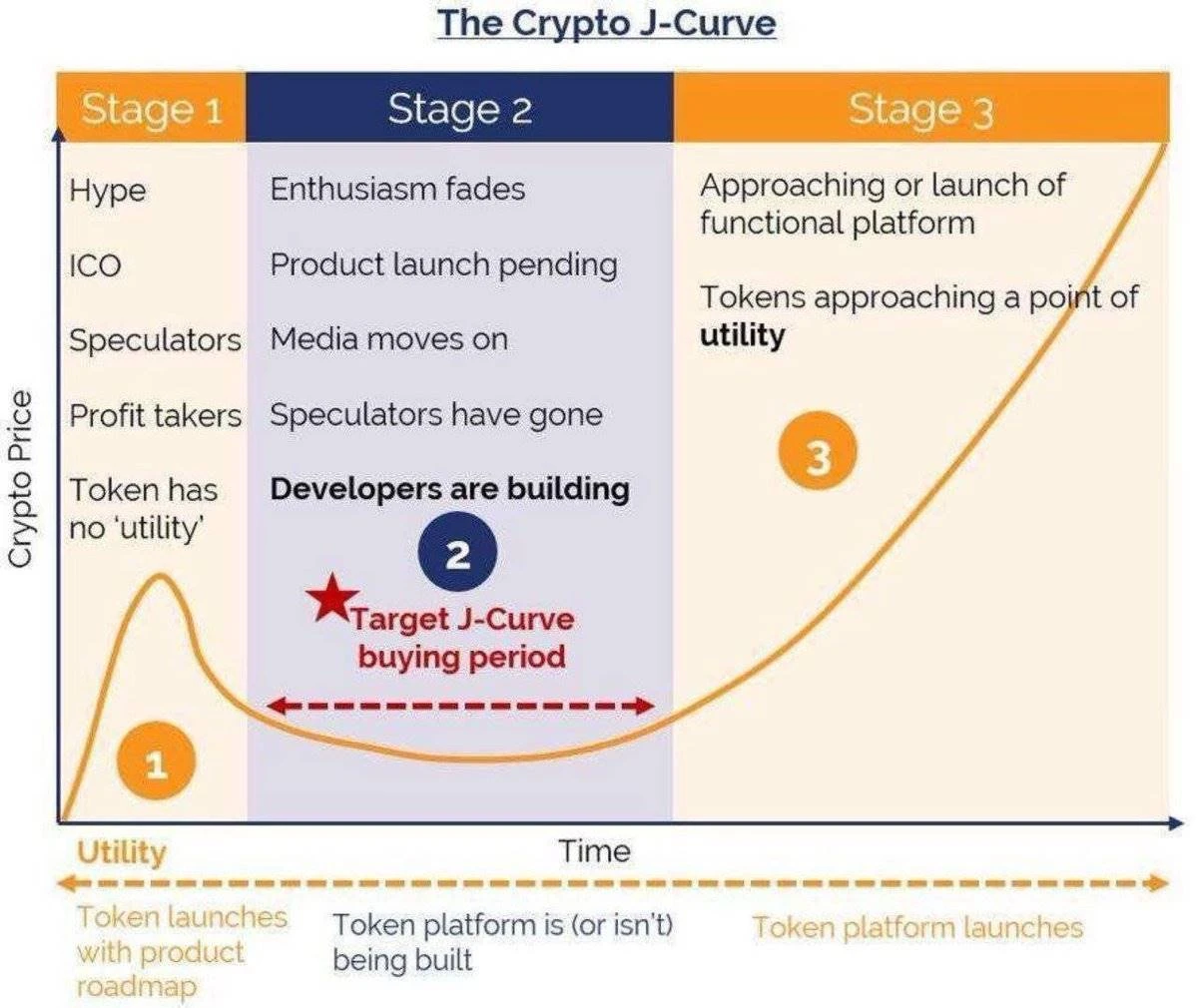

Crypto Investment J-Curve Rule: Achieving Maximum Returns When Enthusiasm Fades

Top-Out Guide: How to Seize the Selling Opportunity in a Major Bull Market?

When users flock to download Coinbase to buy coins, the top features have become apparent.

BTC's monthly chart is struggling to break the historical record of 7 consecutive rises.

Observing BTC unrealized profit/loss, HODL supply, long-term trend indicator MVRV Z-Score, Bitcoin futures open interest, Ethereum Gas fees, social media activity, integer resistance points, etc.

Who Really Profited from This Bull Market?

Bitcoin holders, CEX, Tether, some public chain, DeFi product operation teams, and coin issuance projects with high market value as the main purpose (retail investors should avoid).

Why Are Altcoins Performing Poorly in This Cycle?

Concerns about token inflation behind the surge of new projects. The insufficient new liquidity entering the market brings huge dilution and selling pressure upon unlocking.

In response, exchanges can strengthen the fairness of token distribution; teams can prioritize community distribution and larger fund pools for real users; higher percentages can be unlocked during token issuance (possibly implementing measures such as tiered sales tax to prevent selling).

When the Market is Dull, Take This Stablecoin Appreciation Strategy

The article mainly introduces using major DeFi protocols to implement a relatively low-risk, high-yield interest strategy with stablecoins, covering Ethereum, Solana, Starknet, Scroll, Aptos, and Sui ecosystems.

Also recommended: "LUCIDA: How do Crypto Quantitative Fund Managers Obtain Alpha?" "Coin Hunting Strategy: How do Meme Coin Snipers Achieve Hundredfold Returns?" "On-Chain Smart Money Tracking: Collection of Addresses of Top 10 Value Coin Investors".

Deciphering Airdrops: How Does FDV and Token Economics Affect Token Prices?

In recent years, the launch of FDV varies: the median value in 2020 was 140 million US dollars (DeFi protocols), soaring to 1.4 billion US dollars in 2021 (NFT, games), dropping in 2022 (8 billion US dollars for L2). It rebounded in 2023 and 2024 (24 billion US dollars and 10 billion US dollars) with alt L1 and Solana projects as features.

FDV overlooks short-term market shocks; therefore, the circulation (public supply) is crucial. Tokens with high FDV and low circulation, such as World Coin (8 billion US dollars vs. 340 billion US dollars FDV), may distort the true valuation.

Airdropped tokens distributed to promote protocol adoption are usually quickly cashed out by recipients. Although the initial profits are lucrative, most airdropped tokens will depreciate in the long term, with exceptions like BONK (with a return rate of about 8 times).

Airdrops

Controversy Over ZKSync Airdrop: Understanding the Dilemma of Web3 Project Cold Start

Looking back at Optimism and Arbitrum, in specific activity settings, the number of interactions is often used as an important reference indicator, and users with more frequent interactions usually receive more rewards. However, this unspoken rule seems to have been abandoned by ZKSync. ZKSync's reward calculation does not involve the number of interactions, but focuses more on the amount of funds in a single account and the willingness to allocate risk assets.

High interaction brings the problem of front-running, while proof of stake brings the problem of monopoly. For Web3 projects, when designing cold start mechanisms, it is important to carefully consider the value user profile for their own products and design corresponding mechanisms based on the current environment, effectively incentivizing valuable users while avoiding front-running as much as possible.

Which Projects Invested by VCs Are More Likely to Distribute Airdrops?

a16z: 15/169=8.87%; Paradigm: 10/92=10.86%; Binance Labs: 19/216=8.79%; Coinbase Ventures: 25/394=6.34%; DragonFly Capital: 25/149=7.38%.

Another recommended story: "The Development History of the Crypto Industry in the Past Four Years".

Bitcoin and Its Ecosystem

Can Bitcoin Become a Productive Asset?

Bitcoin is undergoing a remarkable evolution, and there are multiple viewpoints regarding its nature.

Considering the ideal Bitcoin-based income product, the gold standard product will combine the following three characteristics: local Bitcoin consensus, local Bitcoin assets, and local Bitcoin income. Such a product will mimic the closest perfect fit for Bitcoin.

Ethereum and Scalability

Deciphering Pectra: Ethereum's Next Upgrade

Pectra is planned to be launched in the fourth quarter of 2024 or the first quarter of 2025, combining two previous planned upgrades: Prague (for the execution layer) and Electra (for the consensus layer).

By merging, Pectra aims to bring multiple ambitious improvements to Ethereum, making it more flexible and optimized than ever before. Regular Ethereum accounts will be more programmable, L2 will be more affordable, smart contracts will be more efficient, and validators will manage more flexible.

Investing in L2 vs. Investing in ETH: Which Has a Brighter Future?

Although the number of listed L2s has increased, their total fully diluted valuation (FDV) as a proportion of ETH remains unchanged.

Each new L2 token listing actually dilutes the valuation of previously listed L2 tokens.

Multi-Ecosystem and Cross-Chain

Comprehensive Discussion on Solana Ecosystem Development: How Do L2 and Application Chains Impact?

Application chains do not pay fees in SOL or use SOL as the transaction fee token, so they do not directly contribute value to SOL unless used for economic security purposes of re-staking SOL, but their benefits to the SVM ecosystem are obvious. Just like the network effect of EVM, more SVM forks and application chains will strengthen the network effect of SVM.

For Solana, Rollup will be largely abstracted for end users.

Unlike Ethereum, the Solana mainnet does not intend to be a "B2B chain"; it has always been and will always be a consumer chain.

Amid Traffic Dividends, Can New Players Still Emerge in the Solana Wallet Space?

There is not much space left for new players in the Solana wallet space. The positions of Phantom and Backpack are difficult to shake. The new opportunities for Solana wallets lie in directions that leading projects are unwilling to try, narrowing the user base, such as focusing on embedded scenarios, developer-oriented, serving enterprise users, and Web2-friendly vertical directions.

Apart from wallets, the "traffic entry" dividend is still present. During the process of the prominent meme coins BOME and SLERF in the Solana ecosystem, the tg bot of the Solana ecosystem has received a huge dividend.

Compared to Ethereum and Solana, What Does TON's DEX Still Need?

TON's performance and scalability are the only ones that can stand shoulder to shoulder with Solana among all public chains at present, but TON's ecosystem is a combination of Web2 and Web3 modes, which will fade Web3 in usage and delve deeper into Web3 technically.

If the Telegram Wallet takes on the CEX experience, TON Space and DEX can interact on both PC and mobile, and finally, Telegram's Mini App and Bot will also serve as the trading front end for DEX or CEX functions. These designs optimize the trading experience, but the backend on-chain native interaction is clearly lagging behind.

DeFi solutions designed for Telegram Mini App and LayerPixel incubated by TON's launchpad TonUP are expected to supplement the functionality of TON DEX.

CeFi

Towards Mass Adoption, In-Depth Analysis of the Intrinsic Logic of Paypal Stablecoin Payments

Paypal's shift to Crypto is simple: it meets the demand and is practical (fast, cheap, global payments). PYUSD is building a truly stablecoin commercial scenario, providing the frictionless and trustworthy payment experience that mainstream consumers and merchants expect.

Paypal divides the evolution of Mass Adoption into three stages: cognitive awakening (concept introduction); payment utility (integration); ubiquity (stablecoin payments).

Understanding Tether's New Platform Alloy: A New Synthetic Dollar Platform Supported by XAU₮

Tether announced the launch of the open platform "Alloy by Tether," allowing the creation of different bound assets supported by Tether Gold. Vaults are the core of Alloy by Tether, used to store user collateral, unissued aUSD₮, and user collateralized minting positions (CMP) information. Vaults will set specific liquidation thresholds based on liquidation points or maximum MTV settings, with a liquidation point of 75%.

The uniqueness of aUSD₮ lies in its over-collateralization by Tether Gold (XAU₮) backed by physical gold stored in Switzerland, meaning users can use XAU₮ as collateral through Ethereum smart contracts to mint aUSD₮.

GameFi

IOSG Ventures: Delving into the Crypto Game Market, Exploring the Competitiveness Behind Ronin

There are significant differences in the perceptions of project parties, VCs, players, and retail investors: VCs think it's a full-chain game, a ground-breaking gameplay innovation; project parties think it's 3A; exchanges think it's Web2 user increment; players think it's about earning in-game rewards; retail investors think it's about high multiples.

Crypto natives turn a blind eye to this very Web2 logic. The real core competitiveness of chain games lies in the ground promotion channels/localized operational capabilities in Southeast Asia. Apart from game players, there is a very complex business ecosystem around P2E games, such as internet cafes, gold farming guilds, chain game education media, software and hardware developers, and more. Players access new game information and mature player communities through these very localized channels and have very localized/offline organizational connections because they may come into contact with a certain game due to friends/neighbors/teachers/colleagues playing it.

Ronin is like an isolated island, firmly capturing users' attention and money within the ecosystem. P2E never dies, it only grows in suitable soil. The cake of the sinking market is the elephant in the room. The real competitiveness behind Ronin is the localized distribution and operational capabilities of Sky Mavis.

Web3

Bankless: Reigniting the Market? Key Events in the Recent AI+Crypto Track

The latest iPad Pro showcases OctaneX, a 3D design software supported by Render Network.

Dynamic TAO, as one of the most anticipated proposals in Bittensor's history, has brought fundamental changes to the network: empowering TAO holders and opening up dynamic markets for subnets.

NEAR is adding "user-owned AI" to its roadmap for the next phase.

Weekly Hot Topics Recap

In the past week, Biden will participate in a Bitcoin roundtable; the US CFTC is investigating Jump Crypto;

In policy and macro market news, the US SEC is demanding Ripple to pay a $1.026 billion settlement, opposing its $10 million fine request; the Australian Securities Exchange ASX will list the first Bitcoin spot ETF; the governor of Oklahoma signed a bill to exempt Bitcoin miners from electricity sales tax;

In opinions and statements, the former Speaker of the US House of Representatives: USD stablecoins may become one of the largest buyers of US debt, helping the US avoid a debt crisis; Tether CEO: USDT is one of the top three buyers of US short-term treasuries globally; Circle CEO: Stablecoins are expected to account for 10% of the global economic currency in the next ten years; Glassnode: Market volatility is high, but ordinary BTC investors are still profitable; Analysis: ETH exchange balances reach an 8-year low, and the listing of spot ETFs may trigger a supply shock; Consensys: SEC will end its investigation into Ethereum 2.0 and will not charge ETH sales as securities transactions; 21Shares co-founder: Lack of collateral will not affect the demand for Ethereum spot ETFs, liquidity management is crucial; Forbes: Estimated current net worth of CZ is $61 billion, possibly holding 94 million BNB; 10x Research: Large unlocks of altcoins are dragging down Bitcoin; ZKsync Chinese community: Matter Labs' uncompromising principles will ruin ZKsync; Curve founder: Fully repaid a $10 million bad debt on the Curve lending platform, clarifying misinformation related to the UwU Lend hack and CRV token burn; Farcaster co-founder: Warpcast's target customers are English users, with no plans for international expansion; Tether CEO: The stability mechanism of aUSDT is different from USDT, requiring collateralization with Tether Gold to create; Arthur Hayes: A Dogecoin ETF will be approved before the end of this cycle, currently increasing positions in PENDLE and DOGE; speculation on the sale of US bonds by Japanese banks may lead to a new bull market for cryptocurrencies; He Yi: Binance's listing strategy does not affect fund flows, and many VC players in the crypto circle are not doing well;

Institutional, major company, and top project news, Tiger Brokers is launching virtual asset trading services for retail investors in Hong Kong; Paradigm has open-sourced the EVM compiler Revmc to improve EVM performance; Binance will launch a HODLer airdrop for BNB holders; Coinbase is launching pre-market trading services; LayerZero has announced its token economic model, sparking controversy, as users need to donate $0.1 for each ZRO to receive the airdrop; Ethena Labs, Symbiotic, and LayerZero are piloting a universal re-staking framework; ZK Nation has announced the open application for the ZK airdrop;

In the meme domain, the Trump-themed meme coin DJT briefly surpassed TRUMP in market value; Arkham is offering a $150,000 reward to find the creator of the Trump-themed coin DJT, and ZachXBT has completed the task;

In terms of security, Kraken and CertiK have publicly confronted a series of serious security vulnerabilities on social media… Well, it's been another eventful week.

Attached is the "Weekly Editor's Picks" series link.

Until next time~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。