Author: Wenser, Odaily Planet Daily

In the previous article "Tracking Smart Money on the Chain: Top 10 Meme Coin PVP Experts' Addresses and Their Records", we tracked and analyzed some on-chain addresses that have made substantial profits in the field of Meme coins. In comparison, this year's "value coin sector" (usually referring to value coins endorsed by VC institutions or possessing certain mainstream concepts) has relatively cooled down. Nevertheless, there are still some whales or high-level players who have achieved decent profits in these mainstream value coins.

In this article, Odaily Planet Daily will summarize and introduce some on-chain smart money addresses (mainly those with a profitable track record in the value coin field), and summarize the more concentrated currencies for readers' reference. In the future, we will continue to update this series of articles according to different target types, and the end of the article also includes some on-chain tracking tool websites to facilitate readers in dynamically adjusting their operational strategies.

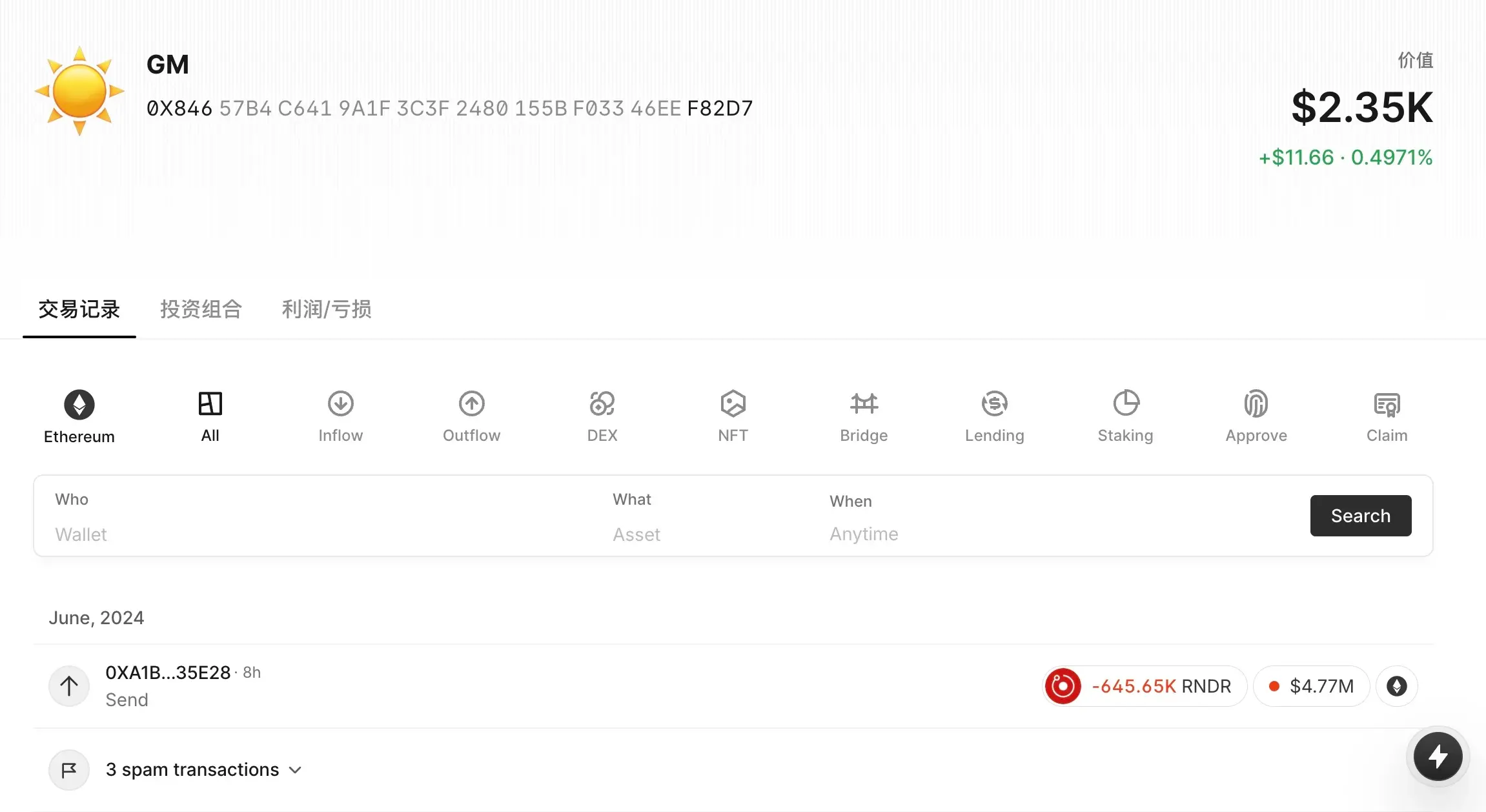

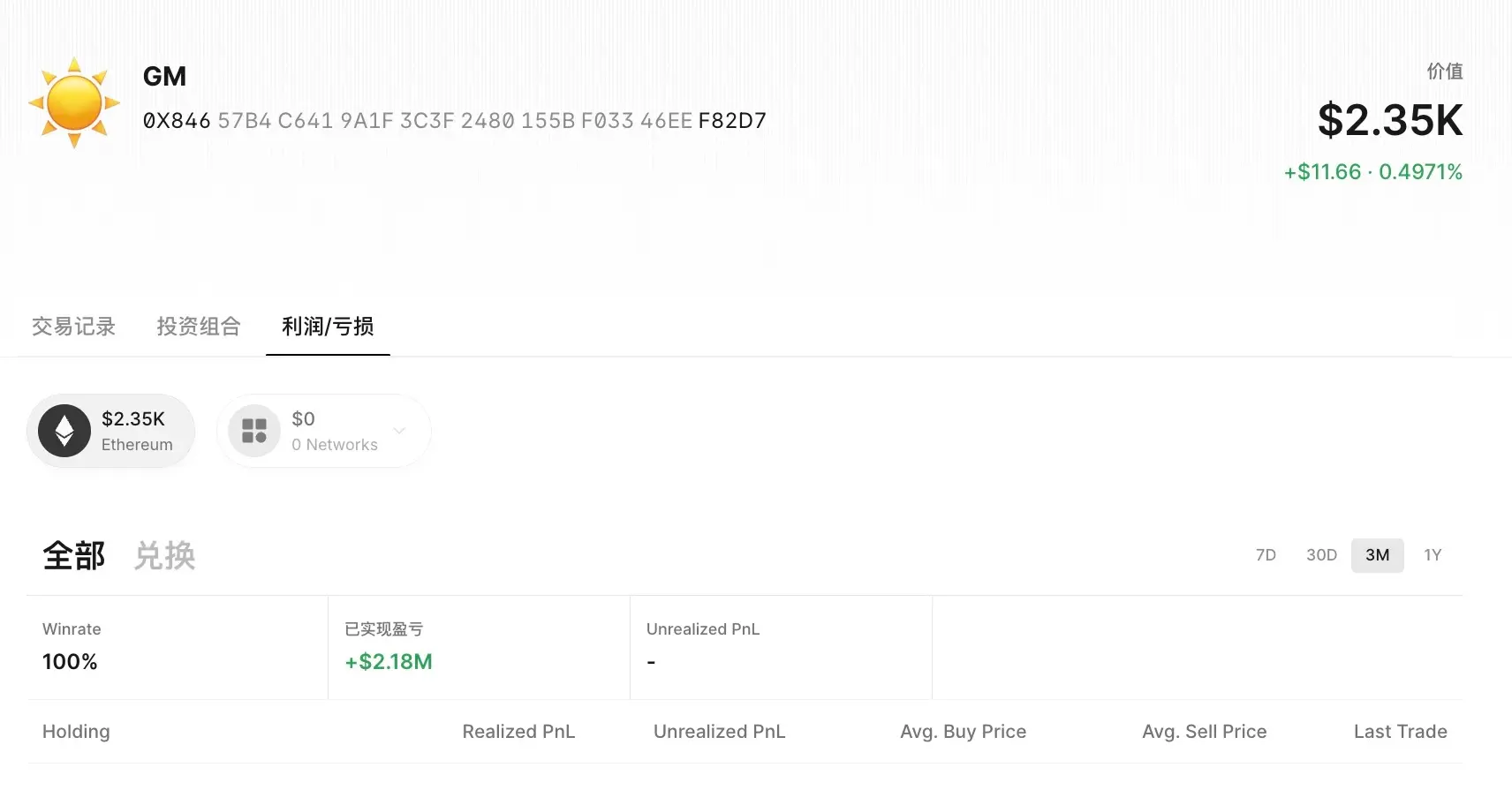

RNDR: Accumulated Profit of $2.25 Million After 5 Months of Positioning

According to on-chain analyst Ai Yi's monitoring, an address suspected of clearing the position had accumulated 640,000 RNDR five months ago. If all were sold, it would yield a profit of $2.25 million. On-chain data shows that this address withdrew 640,000 RNDR from Binance in January at an average price of $4.16 per token and has been holding the tokens without any movement. Finally, today, all the tokens were deposited into the OKX exchange when the price of RNDR was $7.65.

Wallet address: 0x84657b4C6419a1F3c3f2480155bf03346EEf82D7;

Wallet balance: Currently only 0.666 ETH remains, approximately $2350;

On-chain tracking address: https://app.mest.io/search/0x84657b4c6419a1f3c3f2480155bf03346eef82d7

Transaction Records

Profit and Loss Records

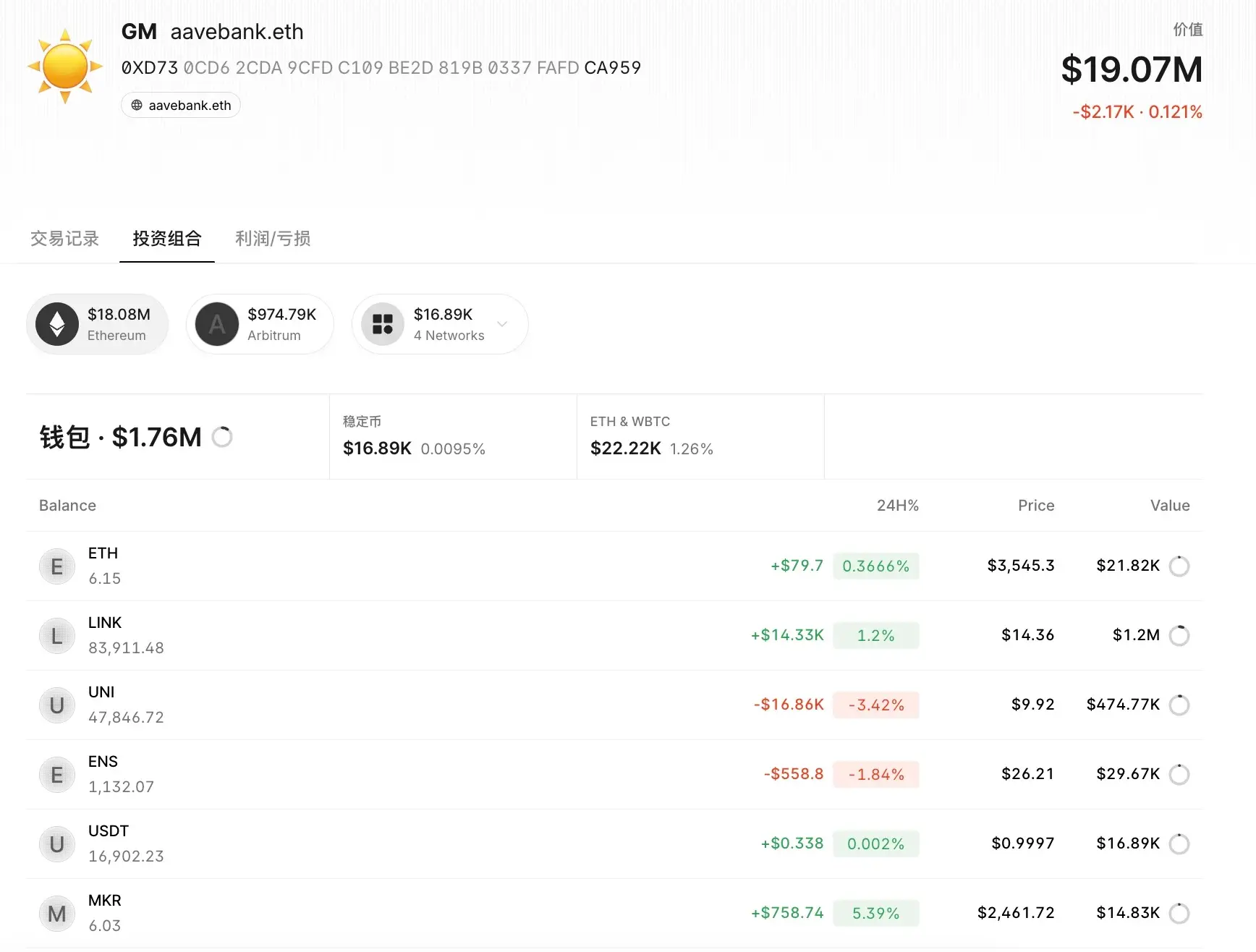

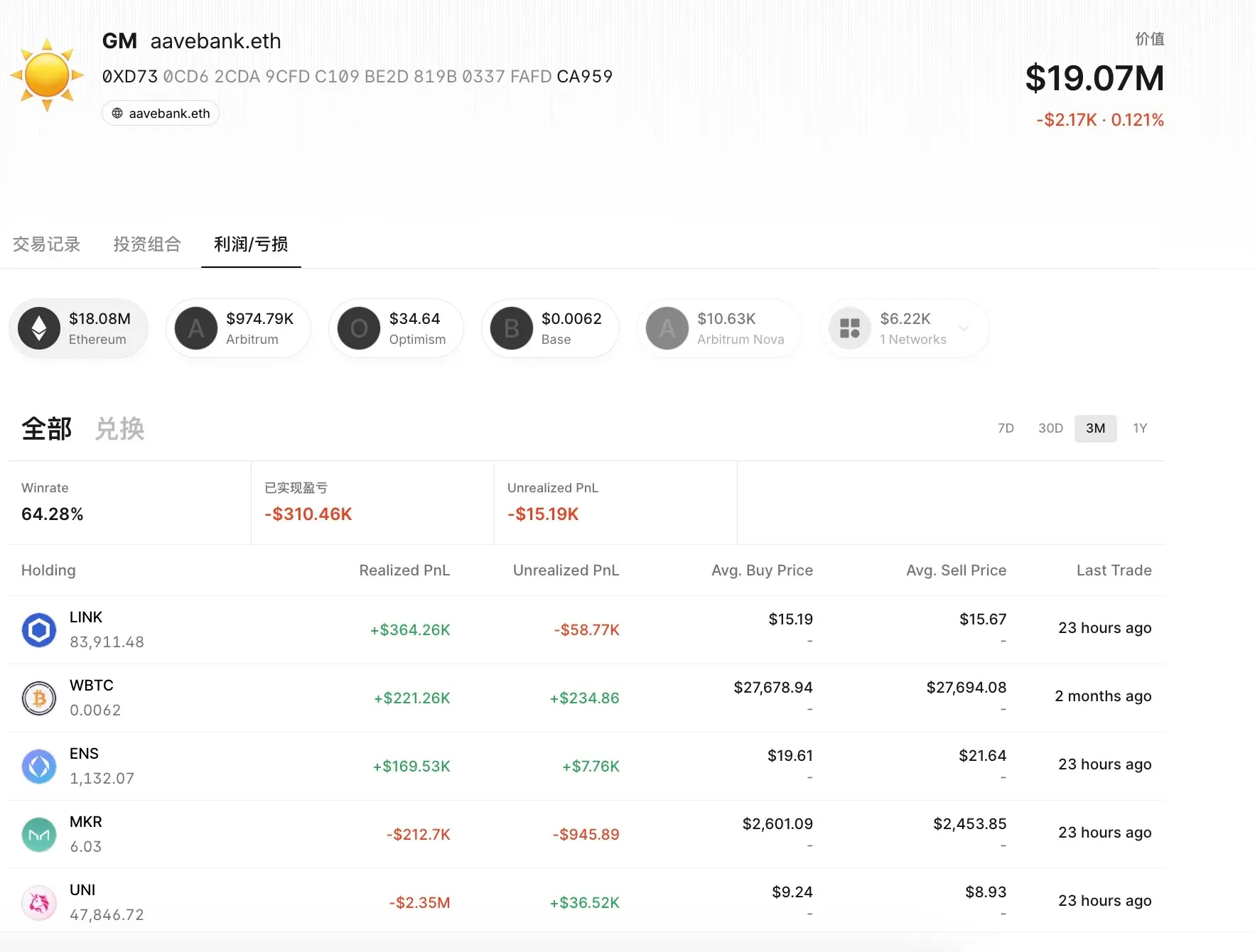

Renowned Whale aavebank.eth: Positions in Multiple Currencies, Expected Profit of $1.13 Million

On June 19, the whale aavebank.eth transferred a total value of $6.84 million worth of altcoins to Binance within four hours, including:

- UNI: 390,000 tokens, worth $3.98 million;

- LINK: 100,000 tokens, worth $1.43 million;

- MKR: 360 tokens, worth $0.89 million;

- ENS: 360 tokens, worth $0.53 million.

According to on-chain data, these value coins were accumulated by the whale from May 5 to 21, and have been held for about a month. If all were sold, it would yield a profit of $1.13 million.

Wallet address: 0xD730cd62CDA9cfdc109Be2d819B0337fafdCA959;

Wallet balance: The address currently holds various amounts of ETH, LINK, UNI, ENS, MKR, and other value coins, with remaining assets valued at $19.07 million;

On-chain tracking address: https://app.mest.io/wallets/0xd730cd62cda9cfdc109be2d819b0337fafdca959

Position Interface

Profit and Loss Records

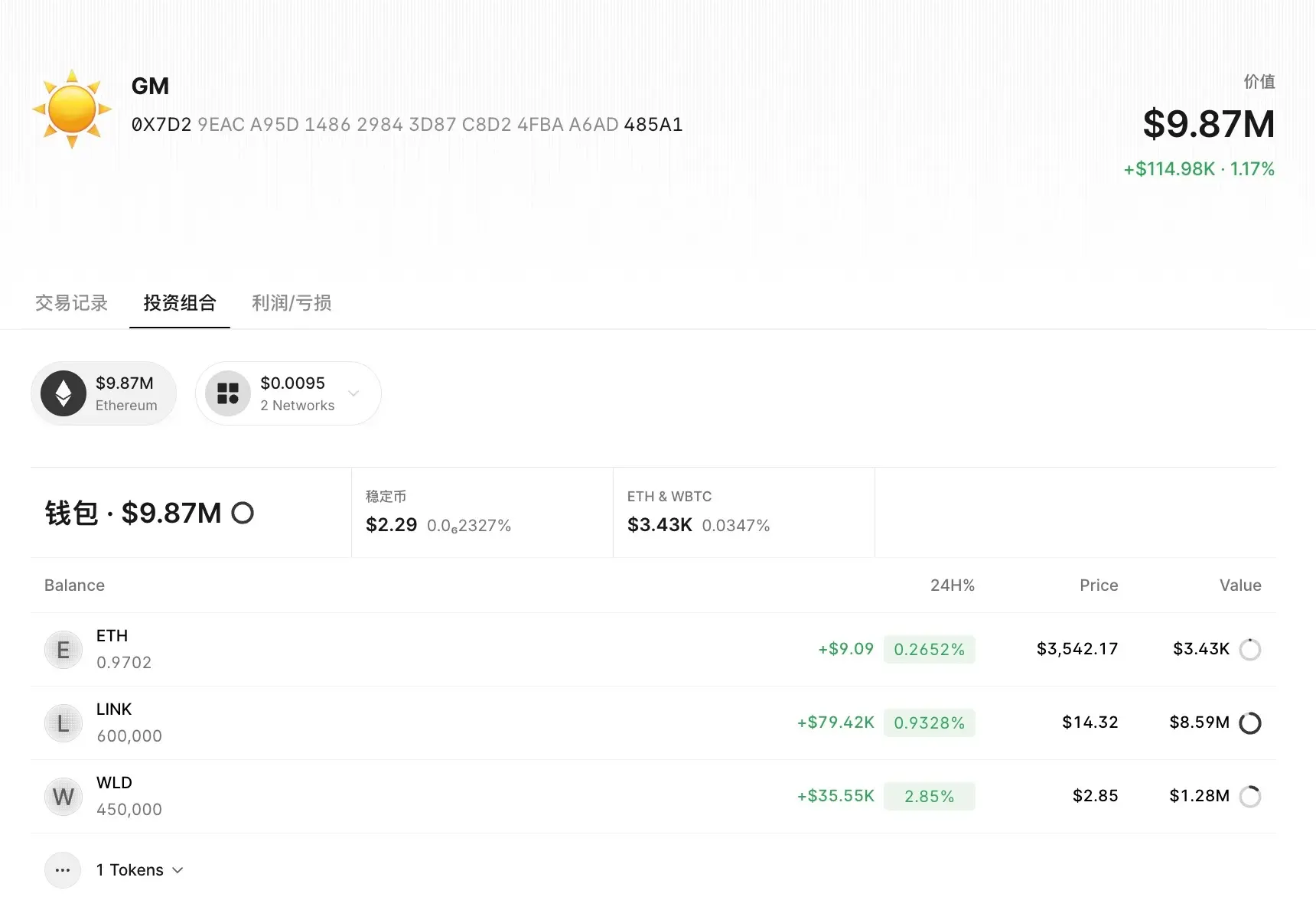

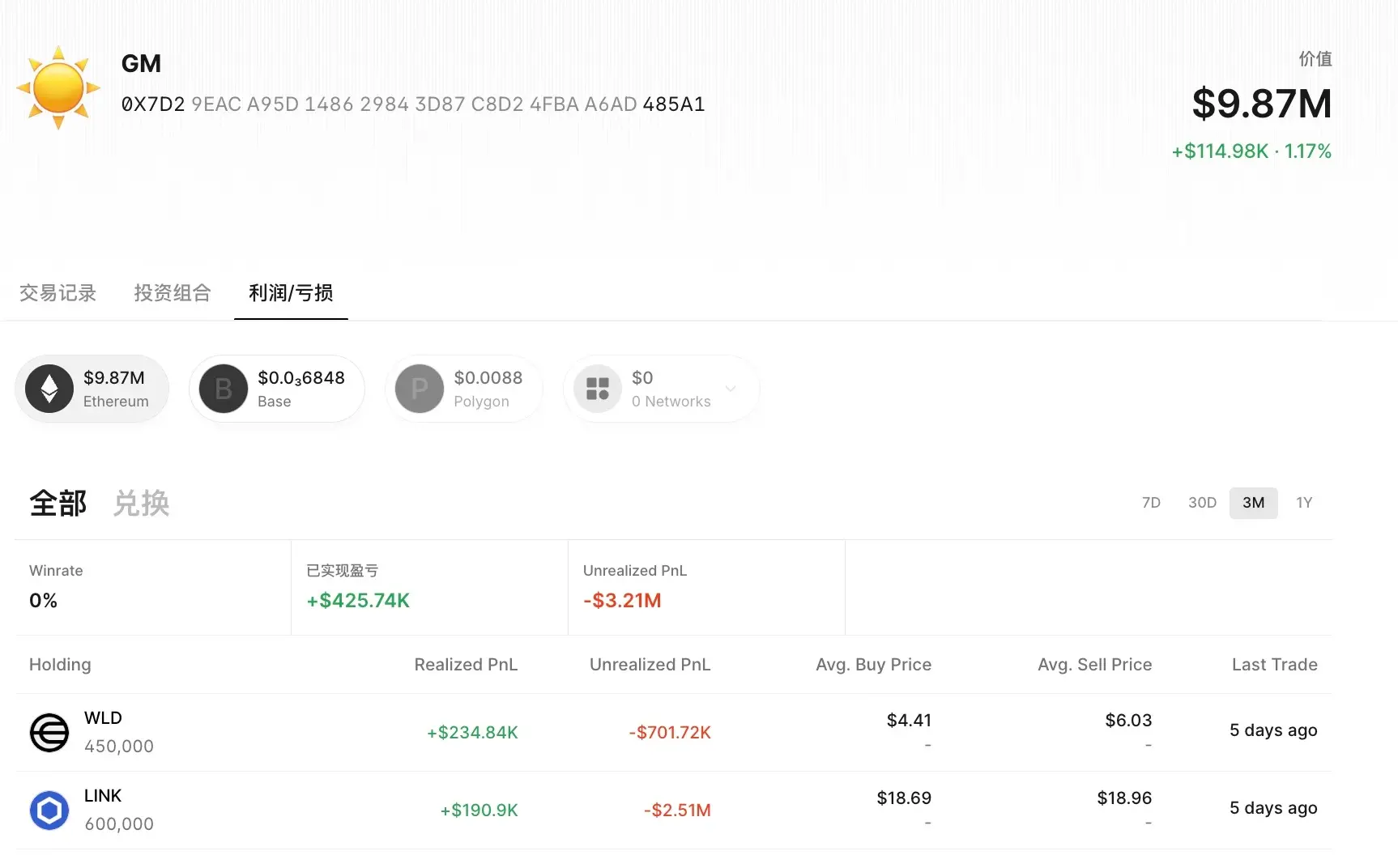

LINK & WLD: Positions Worth $3.54 Million, Accumulated Profit of $425,000 in 3 Months

On June 12, a whale who had previously made a profit of $1.65 million through swing trading LINK in January, accumulated a total value of $3.54 million worth of LINK and WLD within an hour, including:

- LINK: 113,000 tokens, worth $1.80 million;

- WLD: 430,000 tokens, worth $1.73 million.

At that time, the whale held a total of 510,000 LINK, with a total value of $8.17 million, making it the top asset in their wallet.

Currently, the address holds 600,000 LINK and 450,000 WLD.

Wallet address: 0x7D29EAca95D148629843d87C8D24FbaA6Ad485a1

Wallet balance: Including ETH, LINK, WLD, the total value is $9.87 million;

On-chain tracking address: https://app.mest.io/public/wallets/0x7d29eaca95d148629843d87c8d24fbaa6ad485a1

Position Interface

Profit and Loss Records

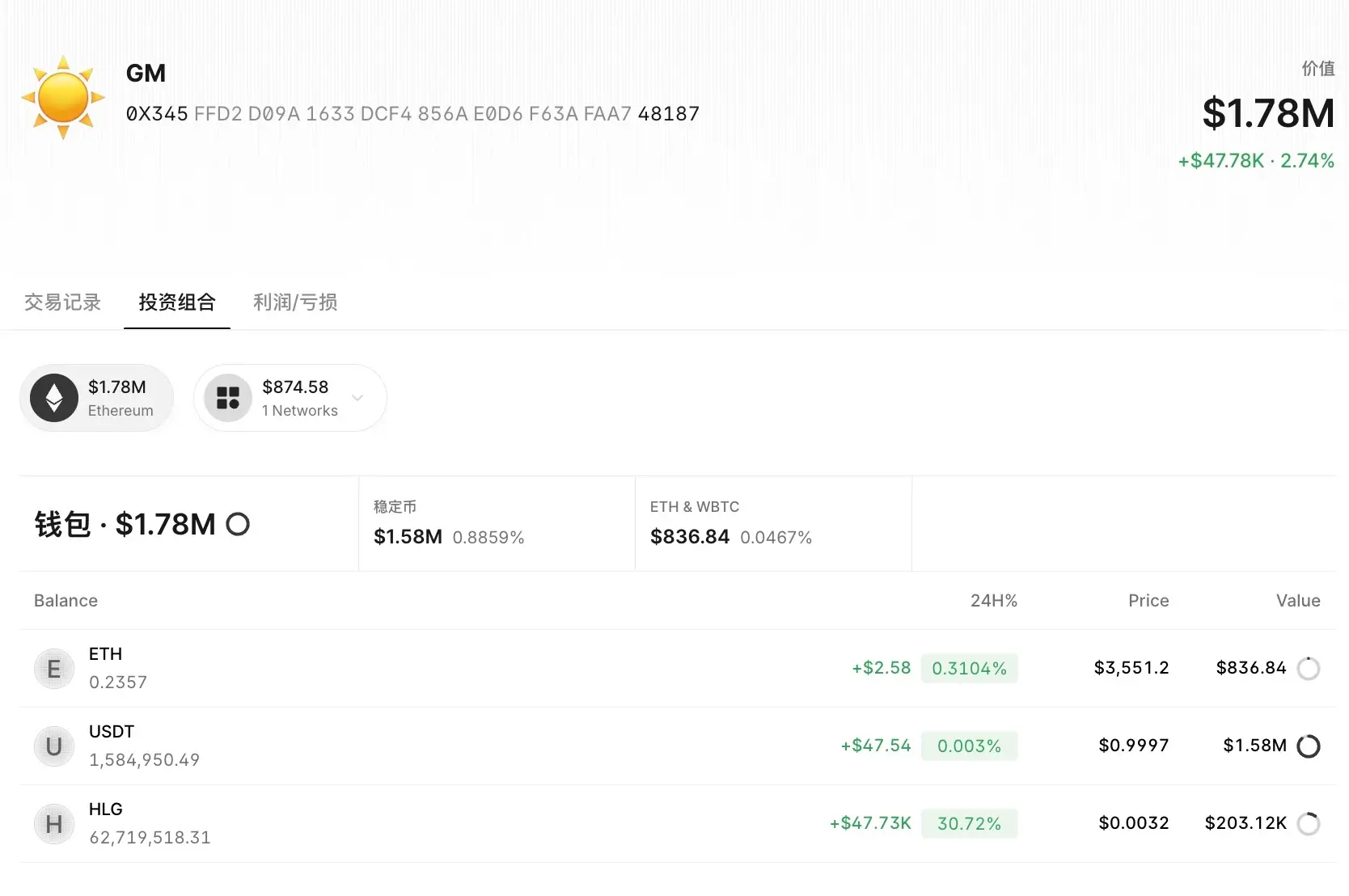

ENA: Positions in 5.11 Million ENA, Total Value of $5.02 Million

On June 5, a whale accumulated 5.11 million ENA, with a total value of $5.02 million, at a price of $0.9804 per token when transferred out of the exchange. According to on-chain data, this was the first transaction of ENA for this address. After about a month, the price of ENA had risen by 18% to $0.9575 per token.

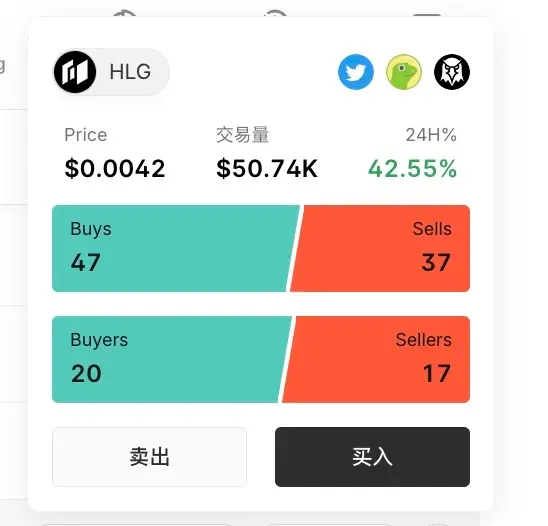

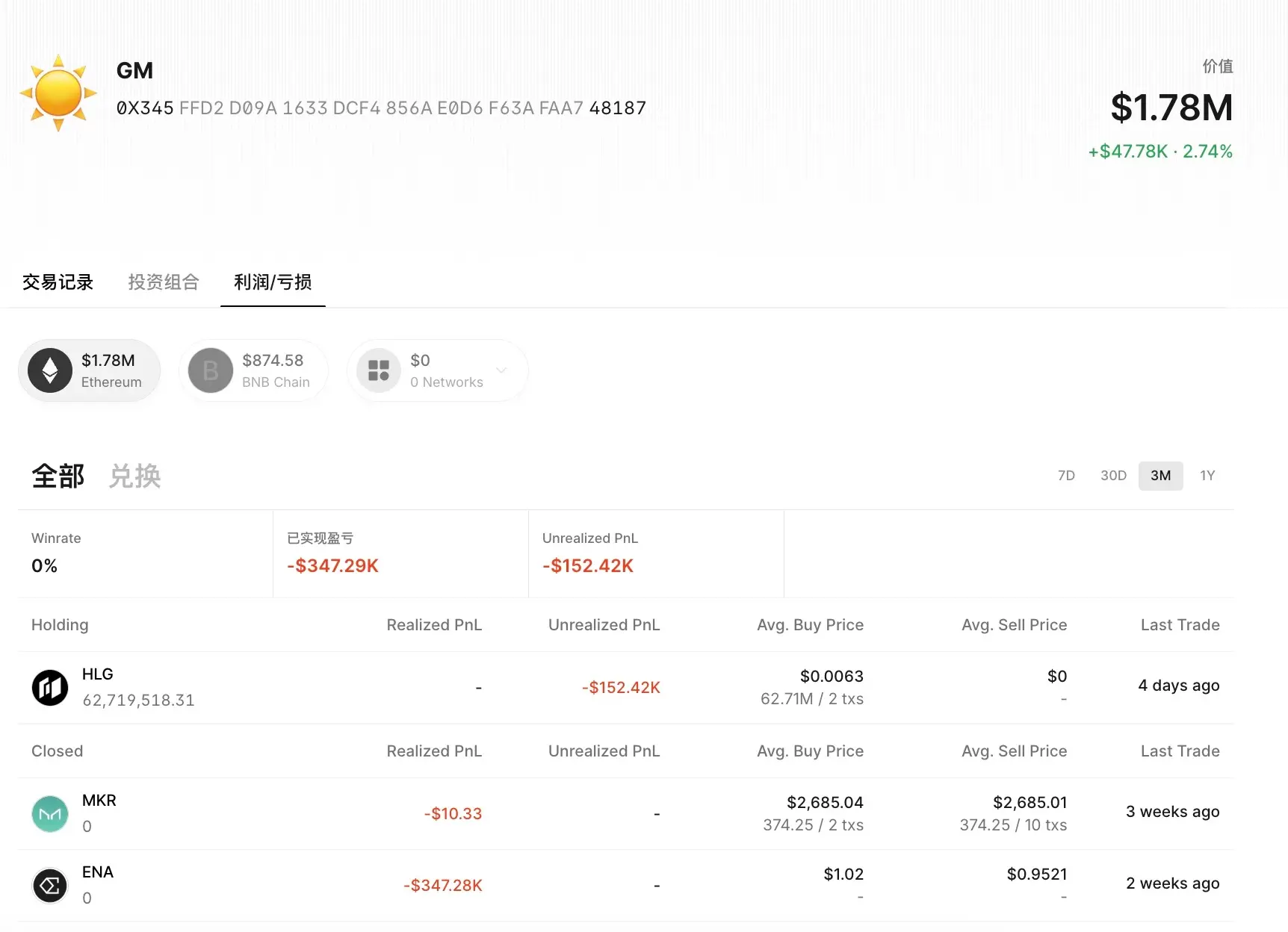

It is worth noting that the address currently mainly holds over 62.71 million HLG in addition to a small amount of ETH and mostly USDT stablecoins. This asset was transferred to the address from 0xCe30091ed07D08eD756E6F11F79E7114cdC90F3C on June 15, valued at $397,000 at the time, but has now dropped to $203,000.

Earlier news reported that on June 13, the Holograph protocol suffered an illegal malicious attack, with the attacker increasing the total supply of HLG and transferring 1 billion HLG to various CEXs for sale. After reporting the situation to the exchanges, approximately 200 million HLG were successfully frozen, and efforts are currently underway to recover them through legal procedures. The remaining circulating supply of HLG is approximately 800 million tokens. Following extensive discussions with the community, the plan to restore the total supply of HLG to 10 billion tokens has been initiated. The first batch of 53,249,975 HLG has been destroyed, with 946,750,025 HLG remaining to be destroyed. Possibly influenced by this news, the price of HLG has risen by approximately 42.55% in the past 24 hours.

HLG Price Increase Interface

Wallet address: 0x345fFd2D09A1633dcf4856Ae0d6f63aFaa748187;

Wallet balance: Currently holds 1.584 million USDT, $203,000 worth of HLG, and a small amount of ETH, with a total value of $1.78 million;

On-chain tracking address: https://app.mest.io/wallets/0x345ffd2d09a1633dcf4856ae0d6f63afaa748187

Position Interface

Position Interface

Profit and Loss Records

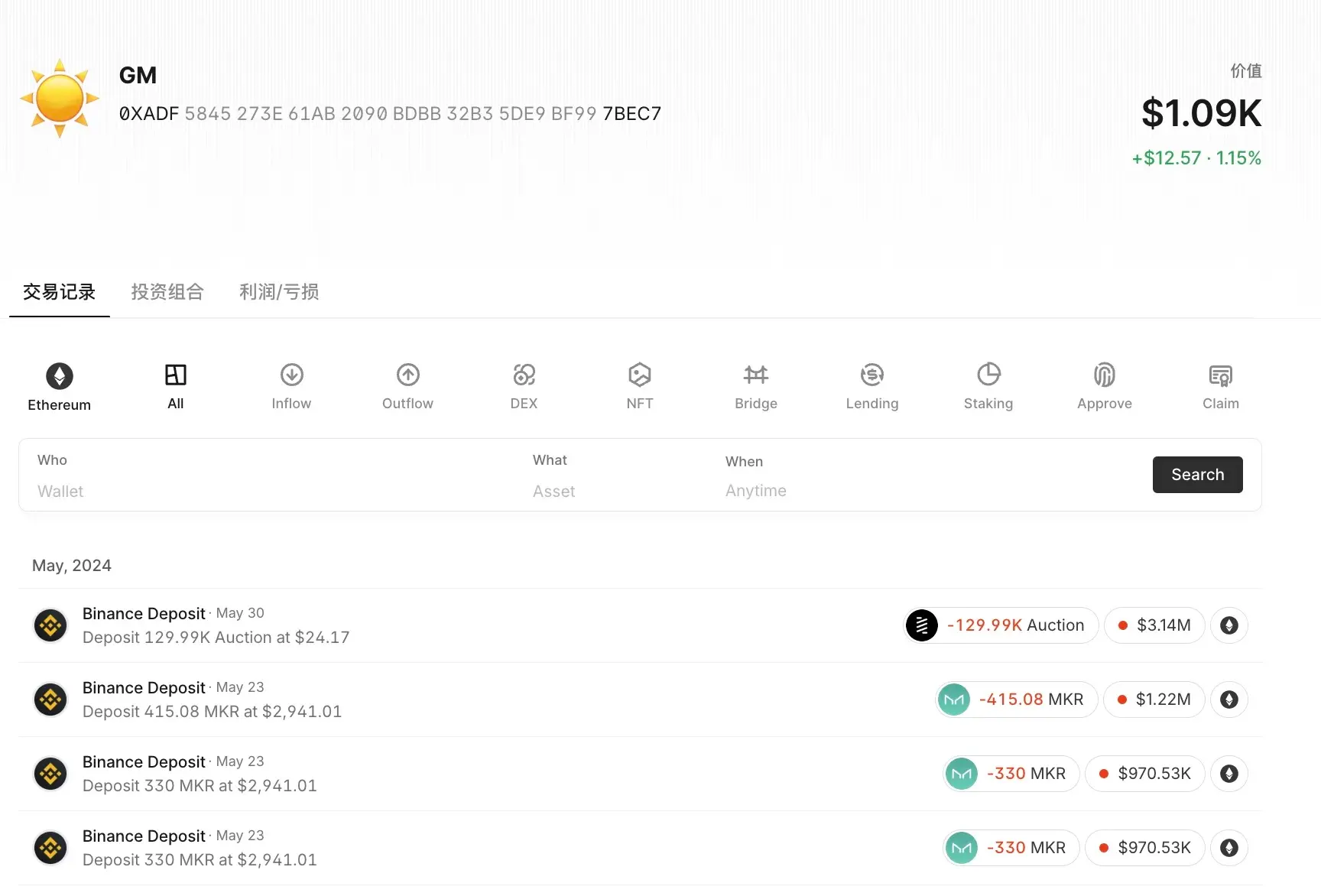

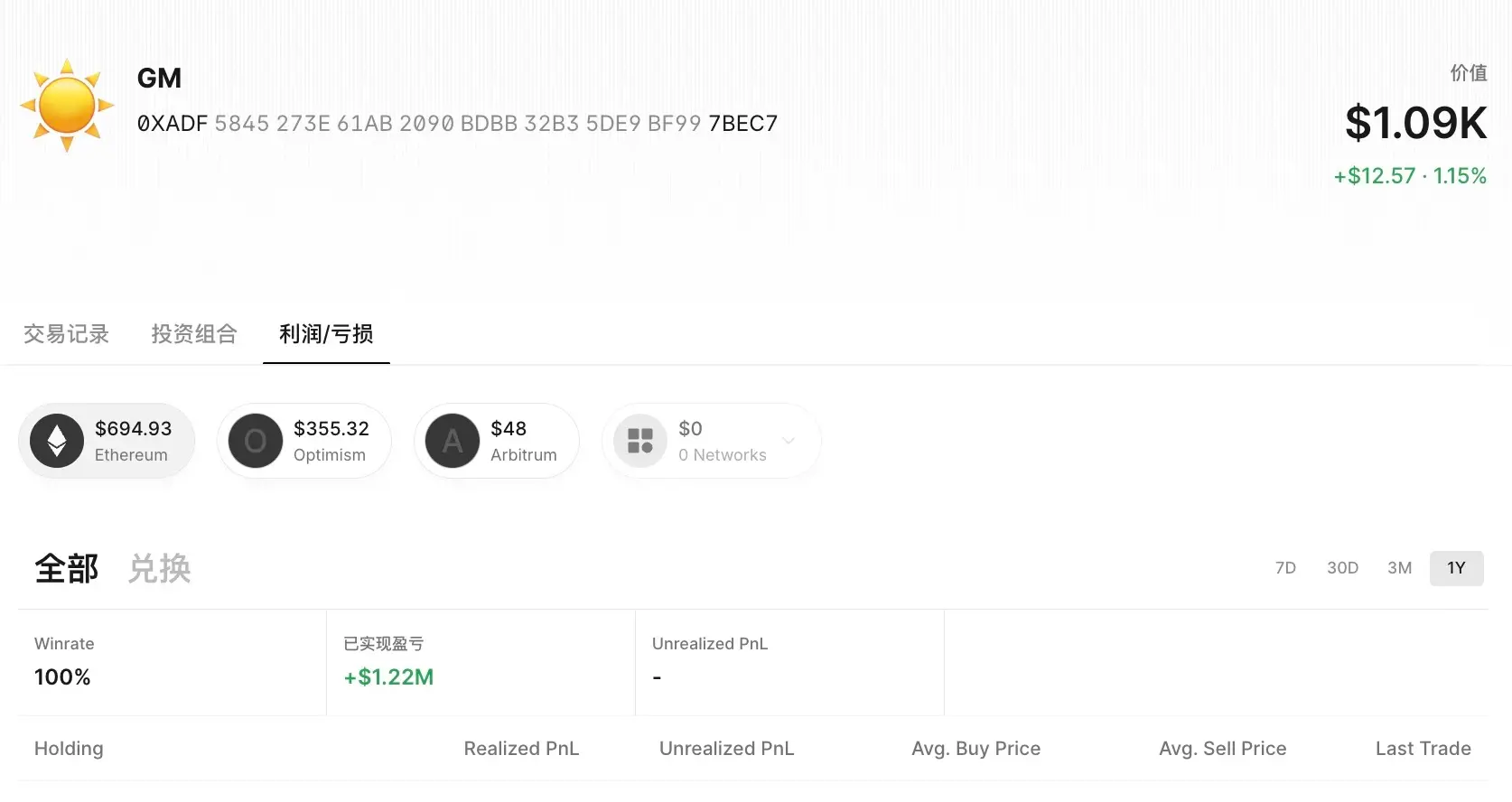

AUCTION: Accumulated 13,000 Tokens, Initially at a Loss, Later Profited $390,000

On May 30, an address successfully transferred 130,000 AUCTION tokens bought on April 9 at a price of $24.11 to Binance, valued at $3.42 million. It is understood that the address initially suffered a 45% loss after buying AUCTION, but after nearly 2 months of "ordeal," it finally turned the loss into a profit when the price surged after the "Upbit listing," ultimately earning $390,000. The address has now cleared all assets, accumulating a total profit of $1.22 million.

Wallet address: 0xAdf5845273e61AB2090BdBB32B35DE9BF997Bec7;

Wallet balance: Including 0.2 ETH, totaling approximately $1000;

On-chain tracking address: https://app.mest.io/wallets/0xAdf5845273e61AB2090BdBB32B35DE9BF997Bec7

Transaction Records

Transaction Records

Profit and Loss Records

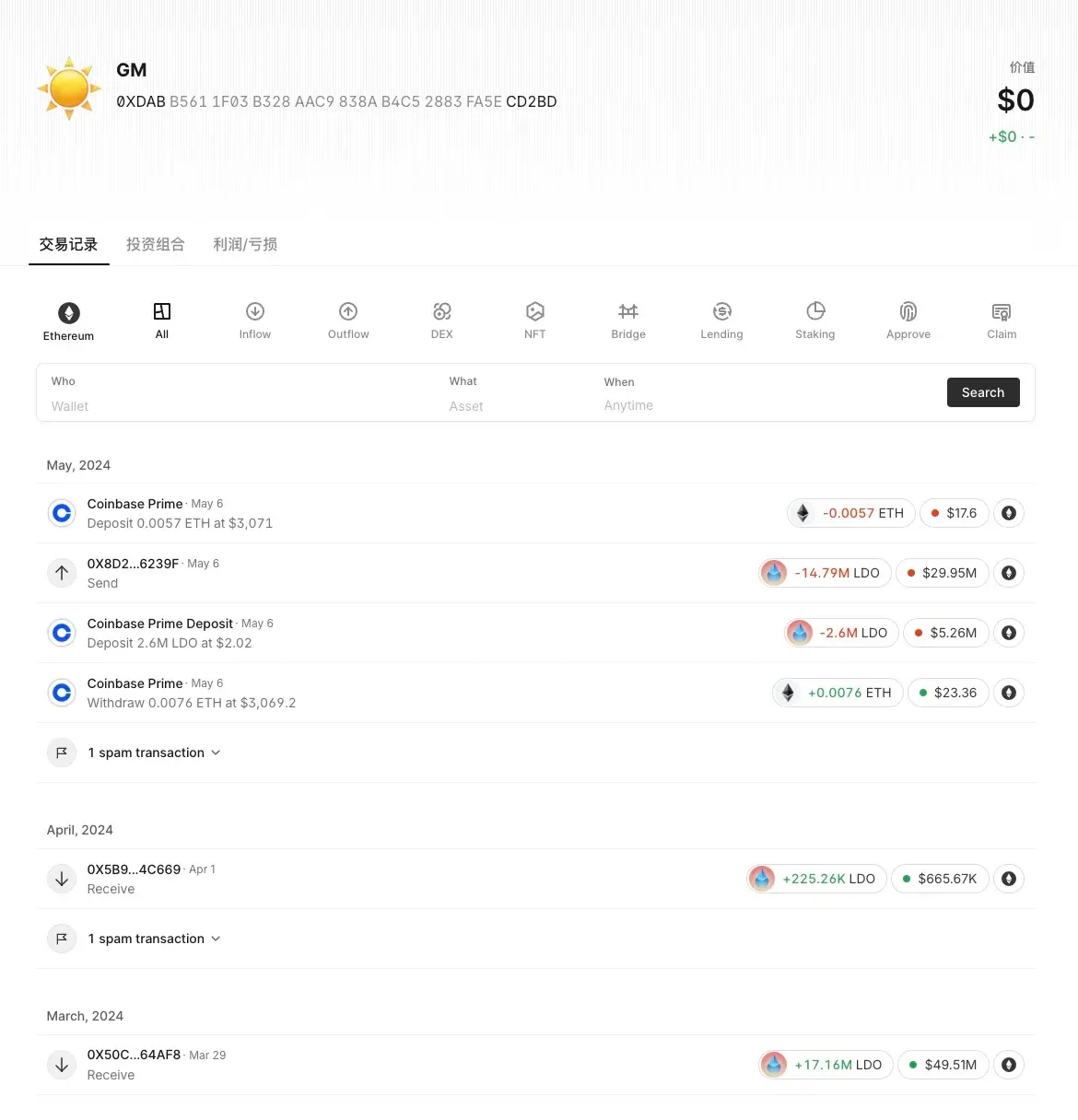

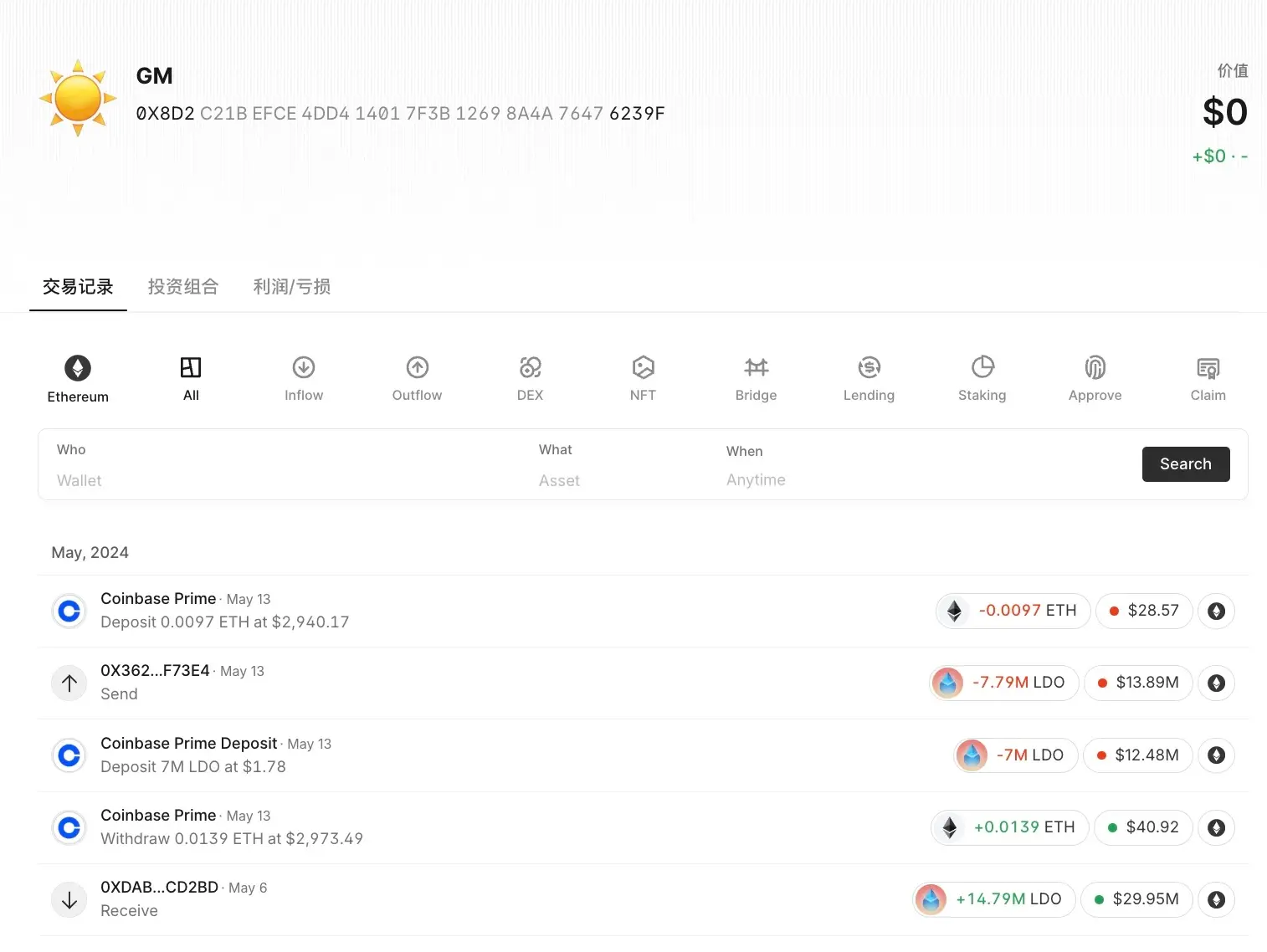

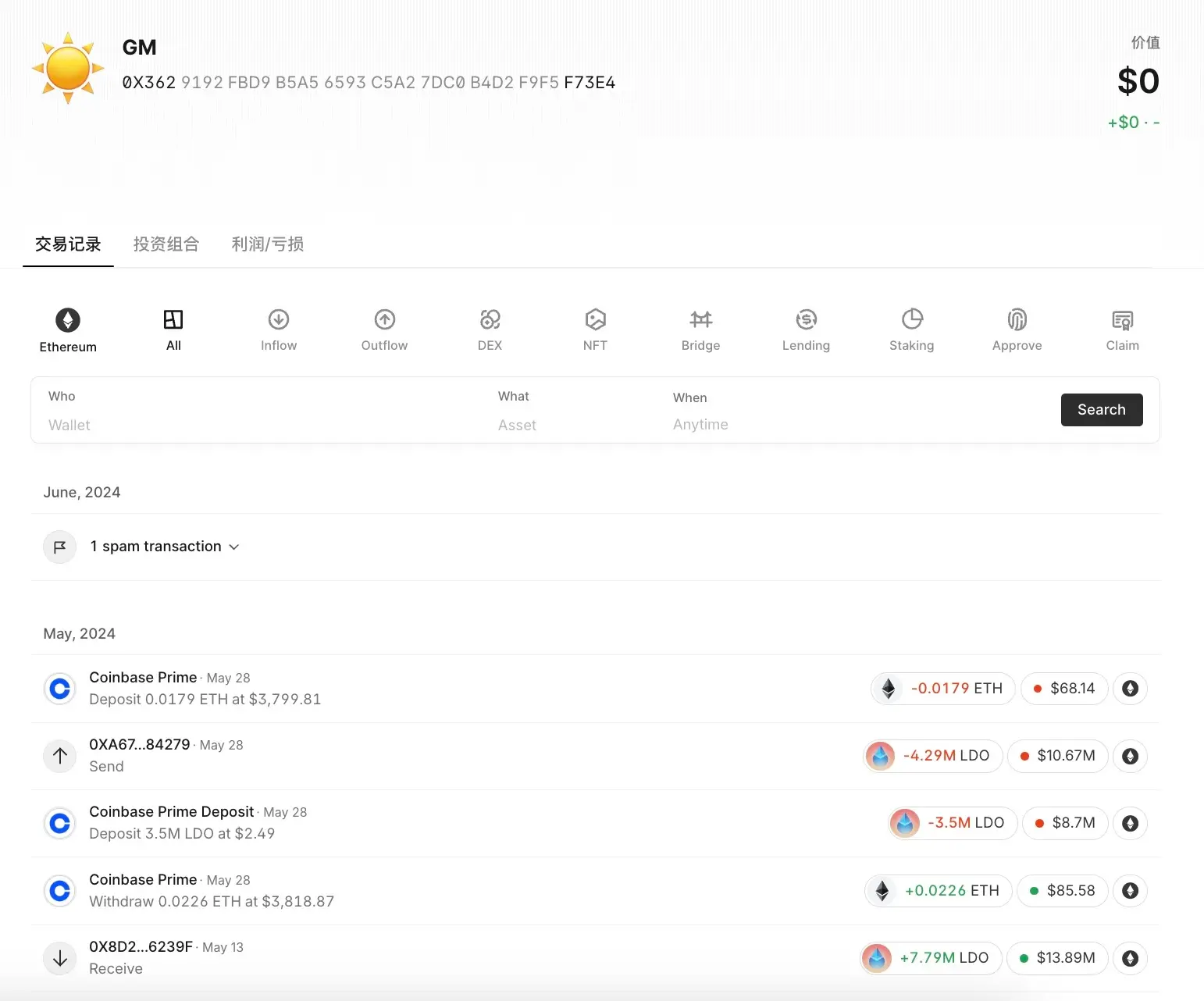

LDO: Accumulated Nearly 32 Million Tokens, Sold 7 Million for a Profit of $2.17 Million

From October 2022 to May 2023, an address accumulated 31.76 million LDO tokens and deposited 7 million LDO tokens (valued at $13.01 million) into Coinbase, earning a profit of $2.17 million after selling all. The address's average cost of acquiring one LDO token was $1.36. Currently, the address has deposited a total of 96 million LDO tokens into exchanges and earned $3.17 million, with the remaining 77.9 million tokens transferred to a new address, 0x3629192FBd9B5A56593C5a27dC0b4d2F9F5F73E4. It is worth noting that the related addresses of this address include 0x50C93635477B646Fc3f3A7FE3f1BC1290f964Af8 and 0xDabb5611f03B328AAC9838ab4C52883fA5ECD2bD, which are the initial wallets that transferred LDO to this address.

Wallet address: 0x8d2C21beFcE4dD414017F3B12698a4a76476239f;

Wallet balance: Cleared.

On-chain tracking address: https://app.mest.io/wallets/0x8d2C21beFcE4dD414017F3B12698a4a76476239f

Initial Wallet Transaction Records

Initial Wallet Transaction Records

Target Wallet Transaction Records

Target Wallet Transaction Records

New Address Transaction Records

New Address Transaction Records

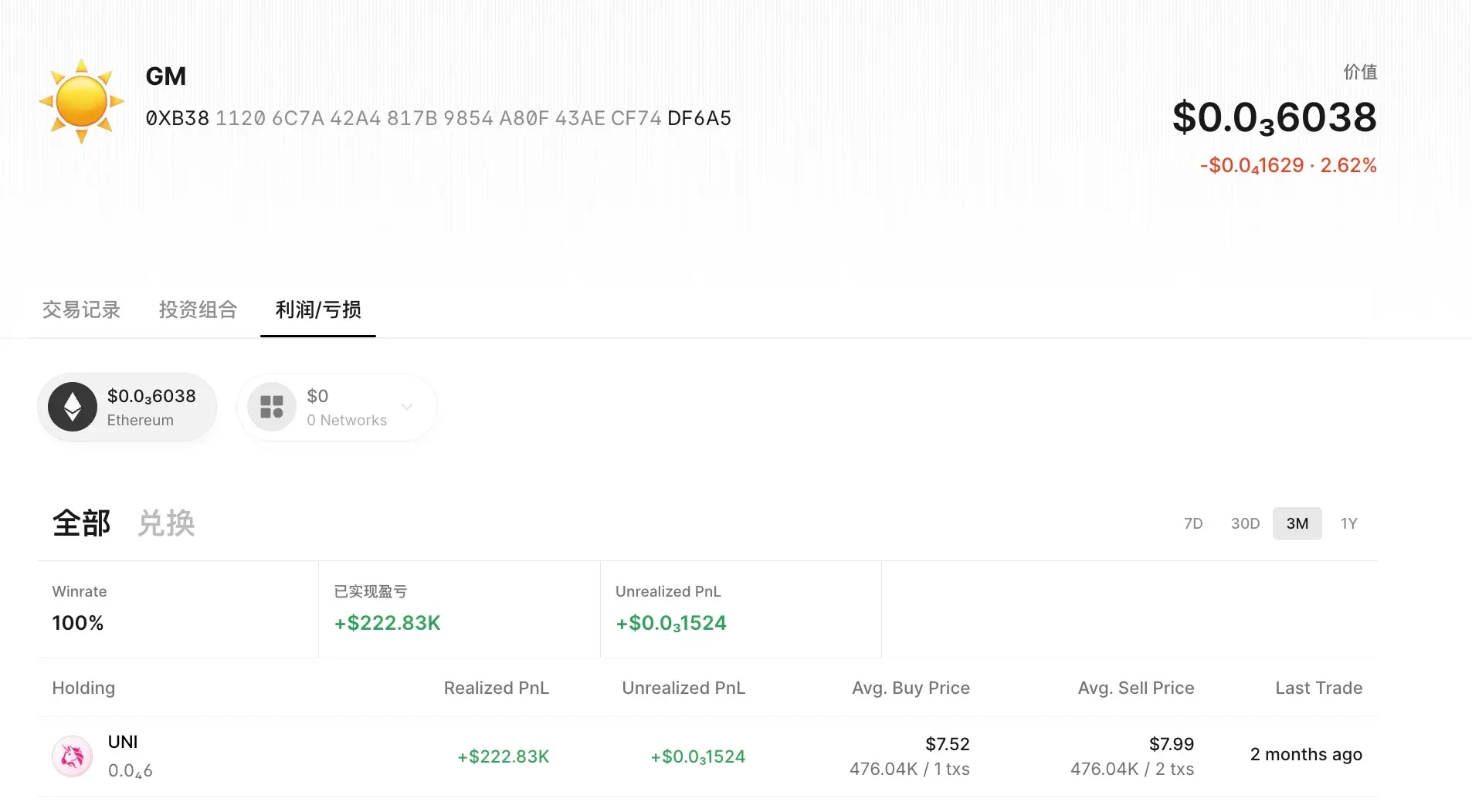

UNI: Accumulated 476,000 Tokens, Profited $385,000

On April 15, an address transferred 476,000 UNI tokens previously accumulated to Binance (valued at $3.9 million). The address's average acquisition price for UNI was approximately $7.38. After selling all, the address accumulated a profit of $385,000. The address has now completely cleared its position.

Wallet address: 0xb3811206c7A42a4817B9854a80f43AeCF74dF6a5;

On-chain tracking address: https://wallets.mest.io/0xb3811206c7a42a4817b9854a80f43aecf74df6a5

Profit and Loss Records

Profit and Loss Records

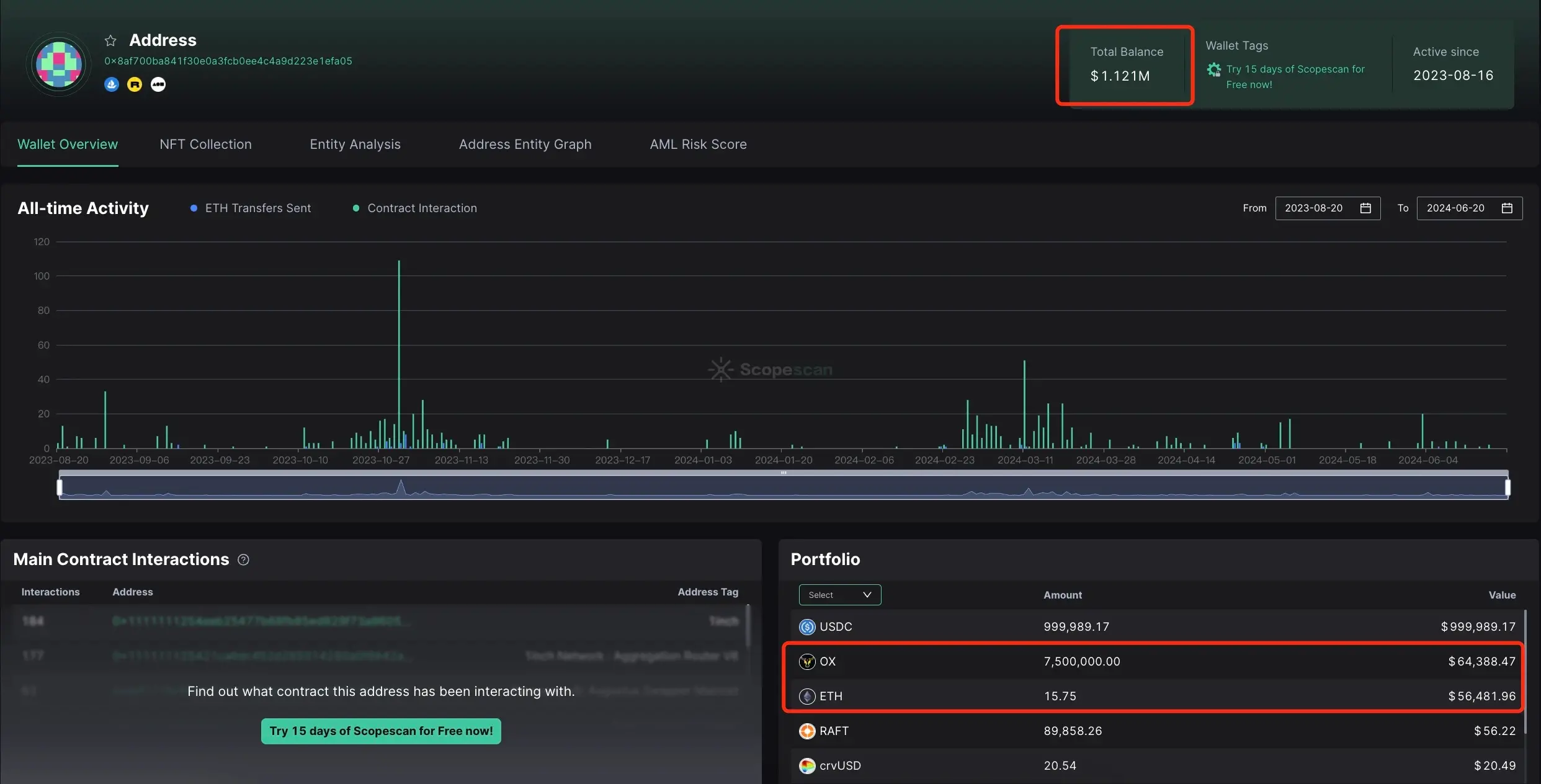

MKR: Accumulated for 5 Months, Sold 1720 Tokens for Approximately $4.64 Million

On March 11, a whale who had accumulated MKR in November 2023 sold a total of 1720 MKR tokens, valued at approximately $4.64 million. The whale's average selling price for MKR was $2698 (acquisition price was approximately $1446), with some already earning $2.15 million, and the remaining 2078 MKR accumulating a floating profit of $2.45 million.

Wallet address: 0x8af700ba841f30e0a3fcb0ee4c4a9d223e1efa05;

Wallet balance: Approximately $1 million USDC, 64,000 OX, and 56,000 ETH, totaling around $1.12 million;

On-chain tracking address: [https://scan.0x scope.com/address/0x8af700ba841f30e0a3fcb0ee4c4a9d223e1efa05? network=eth](https://scan.0x scope.com/address/0x8af700ba841f30e0a3fcb0ee4c4a9d223e1efa05? network=eth)

Asset Records

Asset Records

WLD: Profited $1.05 Million by Buying Low and Selling High

On February 19, a whale who had previously accumulated 200,000 WLD tokens at an average price of $2.52 from January 8 to January 31, ultimately earned $1.05 million by buying low and selling high. At that time, influenced by the OpenAI video generation model SORA, the AI sector surged, with WLD's price increasing by over 188% in the past 30 days.

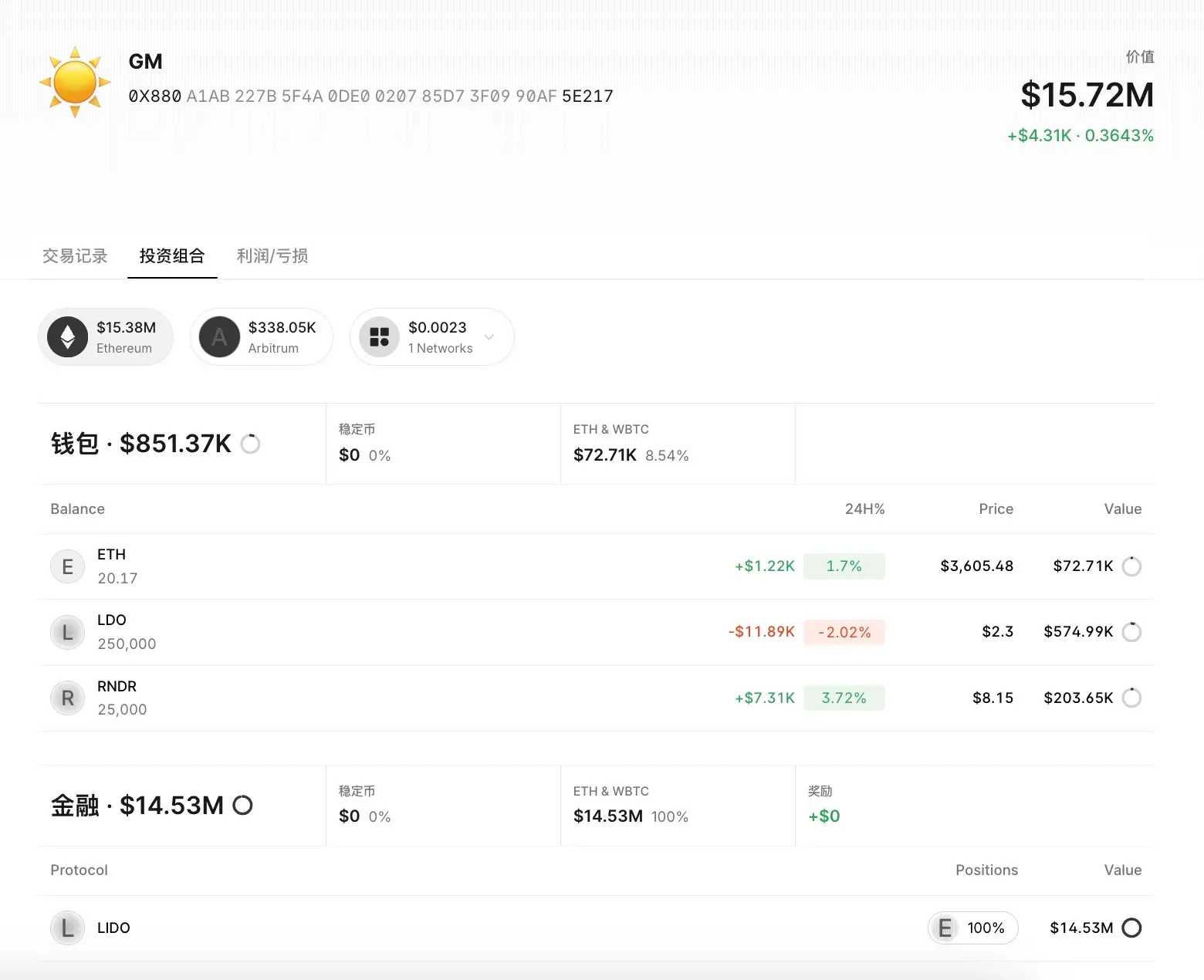

Wallet address: 0x880A1AB227B5F4A0dE0020785D73f0990af5E217;

Wallet balance: Including 20 ETH, 250,000 LDO, 25,000 RNDR spot, and $14.53 million worth of LIDO, totaling $15.72 million;

On-chain tracking address: https://app.mest.io/wallets/0x880A1AB227B5F4A0dE0020785D73f0990af5E217

Position Records

Position Records

FET: Accumulated 1.38 Million AI Concept Tokens, Profited $2.27 Million

On March 7, a whale who had accumulated FET sold all of its holdings, earning $2.27 million with a high return rate of 392%. It is understood that the address transferred 1.38 million tokens from Binance at an average price of $0.41 on April 18, 2023, and gradually deposited them into exchanges between February 20 and March 7, 2024, at an average price of $2.06.

FET tokens were the second crowdfunding project issued by Binance IEO, with the underlying encryption protocol Fetch.ai focusing on the field of artificial intelligence, aiming to create a self-learning blockchain network to facilitate economic activities/combinations among offline AI agents. Previously, Fetch.ai received a $40 million investment from DWF Labs. Recently, FET is expected to merge with two major artificial intelligence concept tokens, OCEAN and AGIX, and is scheduled to go live on July 15.

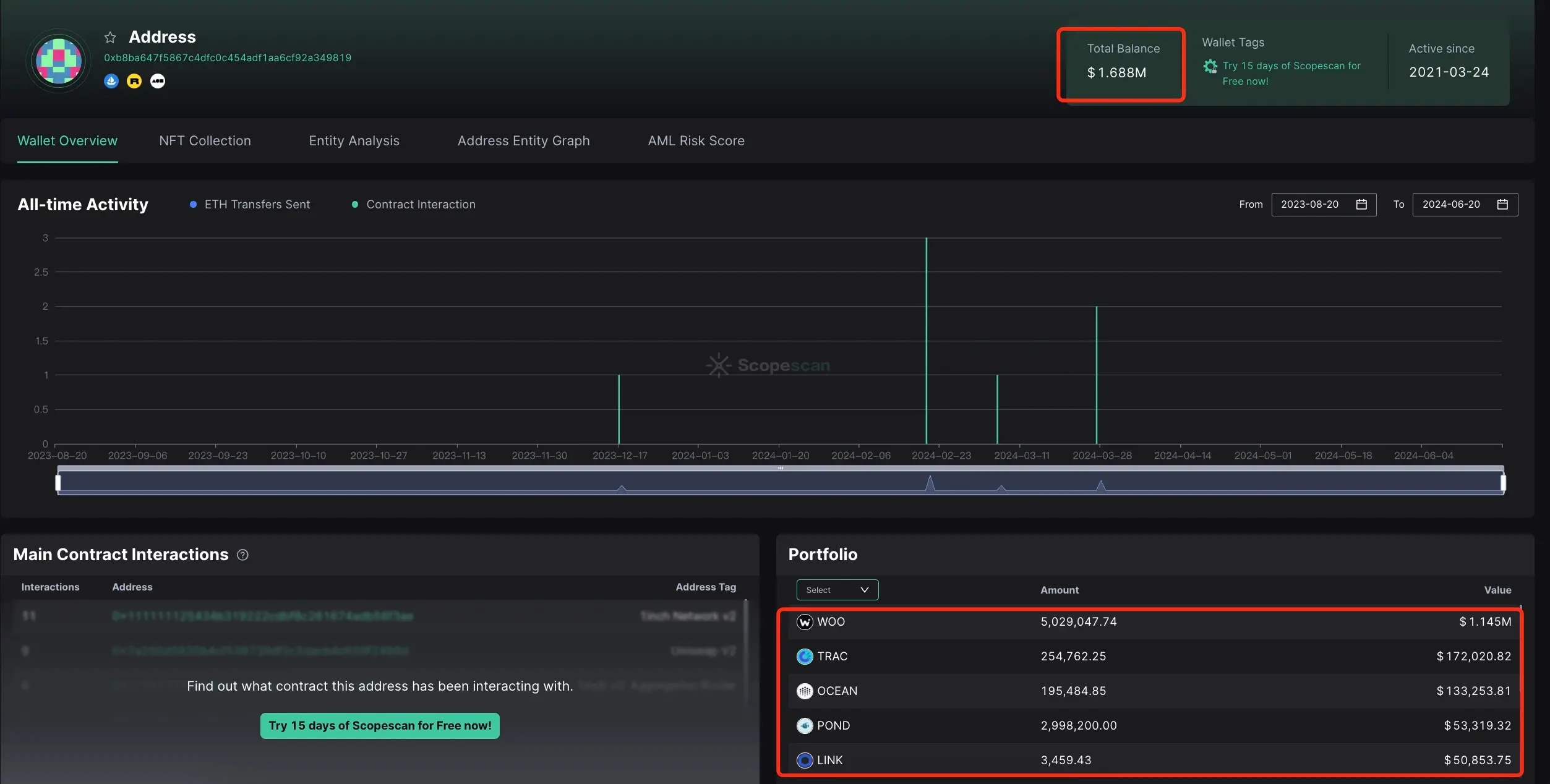

Wallet address: 0xb8ba647f5867c4dfc0c454adf1aa6cf92a349819;

Wallet balance: Including $1.145 million WOO, $172,000 TRAC, $133,000 OCEAN, $53,000 POND, and $50,000 LINK, totaling $1.688 million.

On-chain tracking address: https://scan.0xscope.com/address/0xb8ba647f5867c4dfc0c454adf1aa6cf92a349819?network=eth

Position Records

Position Records

AXL: Accumulated 480,000 Tokens, Profited $566,000

On March 6, a whale who had previously accumulated AXL transferred 480,000 AXL tokens to Coinbase (approximately $1.02 million) and earned $566,000 after selling all. The address acquired 480,000 AXL at an average price of $0.95 from the exchange between December 12, 2023, and January 14, 2024. AXL was listed on Binance on March 1, and the address sold it when the price rose to $2.1365 on March 6. The address has now completely cleared its position.

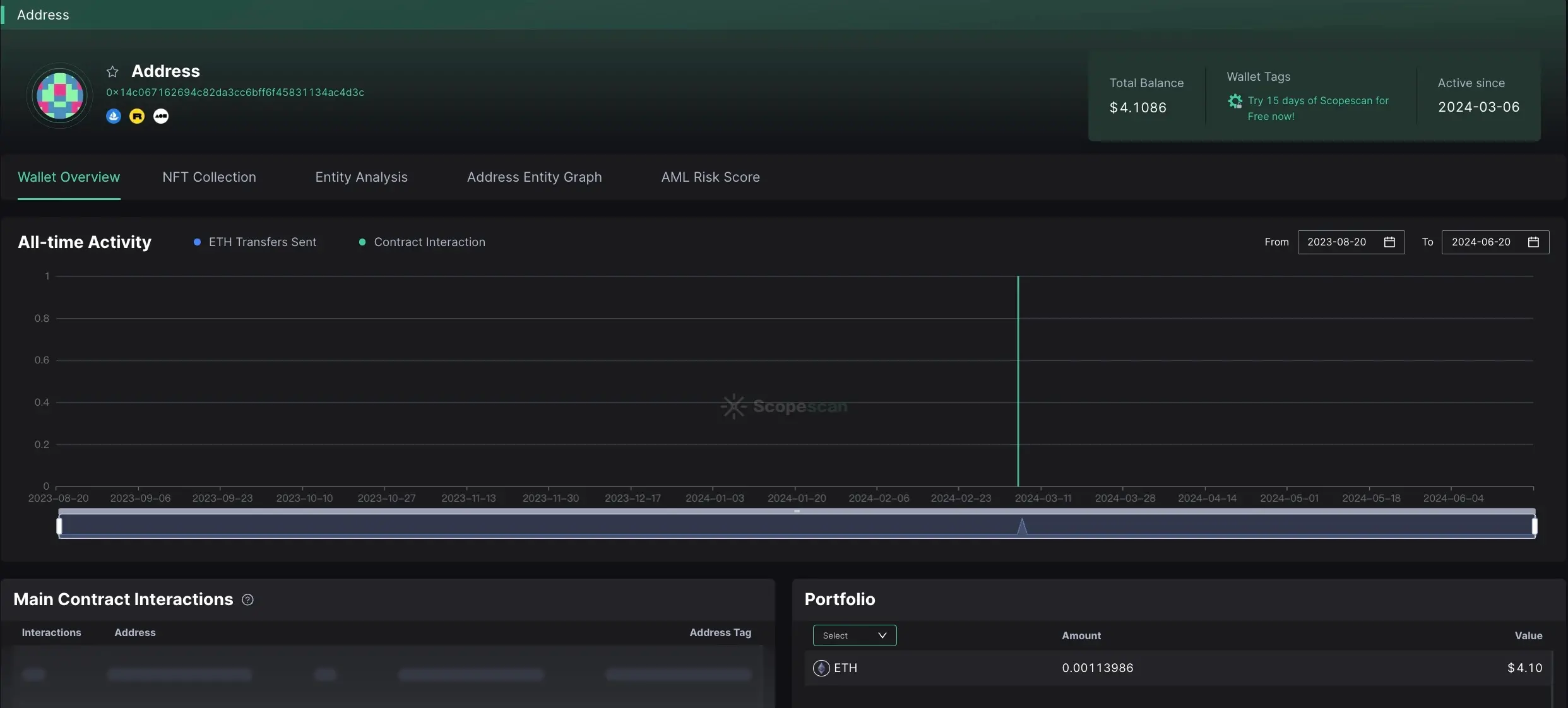

Wallet address: 0x14c067162694c82da3cc6bff6f45831134ac4d3c;

On-chain tracking address: https://scan.0xscope.com/address/0x14c067162694c82da3cc6bff6f45831134ac4d3c?network=eth

Asset Records

Asset Records

IMX: Consolidated 1.62 Million Tokens, Profited $1.4 Million

On February 12, according to on-chain analyst Ai Yi's monitoring, six new wallets transferred a total of 1.62 million IMX tokens to Coinbase, approximately $4.48 million. These addresses are suspected to belong to the same whale/institution, all accumulating IMX in late January 2024 with a cost of approximately $1.89 per token. Selling all will result in a profit of $1.4 million.

On-chain tracking address: https://app.mest.io/discover/lists/nvboqw

Consolidation Records

Consolidation Records

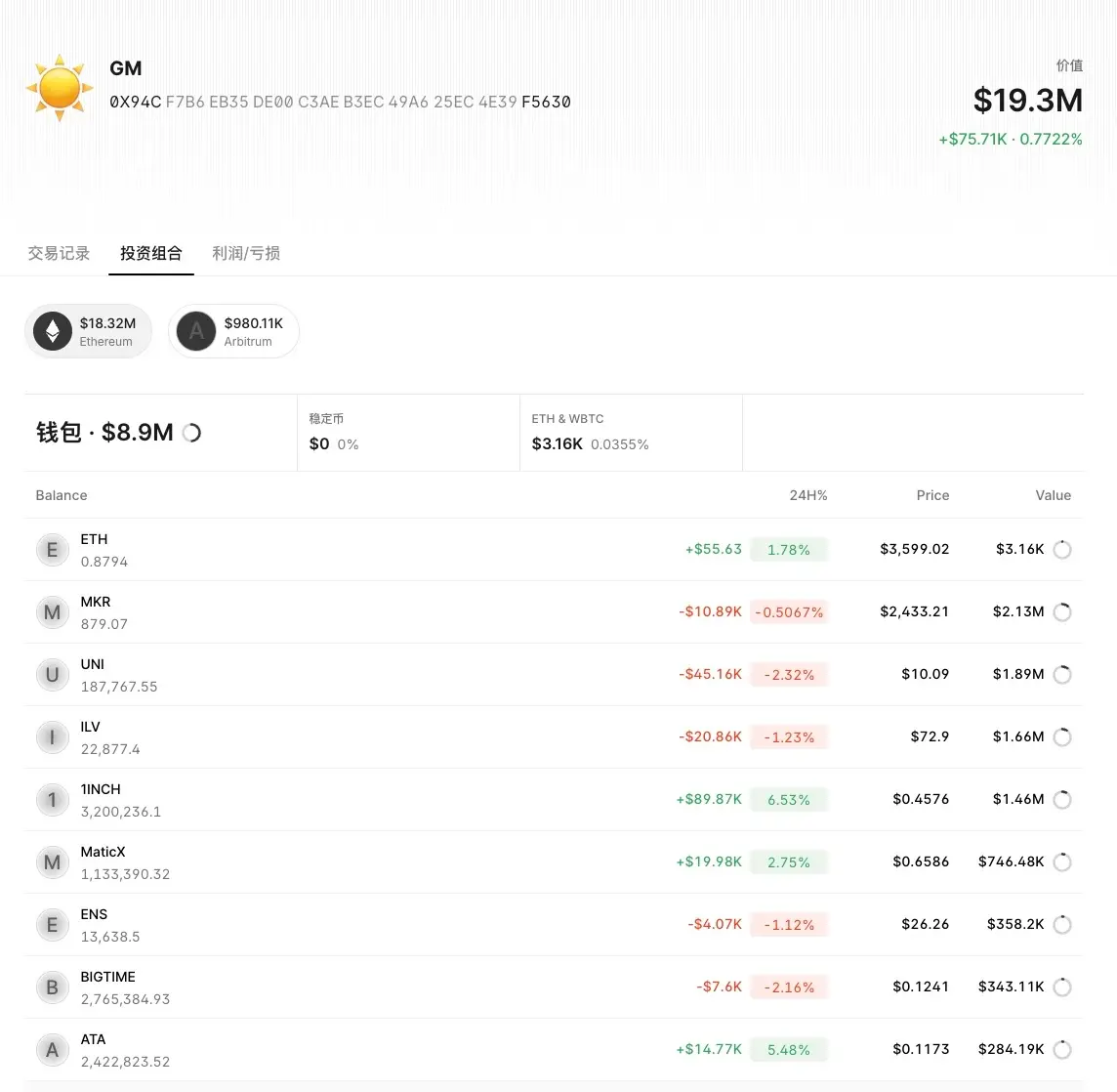

MATIC, ENS, 1INCH, UNI: Short-term Whale Buys $2.69 Million in Assets

On January 29, a whale who had previously accumulated 2609 MKR in November 2023 and earned $720,000 transferred assets worth $2.69 million from Binance, including:

- 240,000 MATIC;

- 38,000 ENS;

- 1.6 million 1INCH;

- 58,000 UNI.

It is worth noting that this address's purchase of MATIC was the first, and its previous short-term trading of ENS, 1INCH, and UNI was profitable, with a relatively high overall success rate.

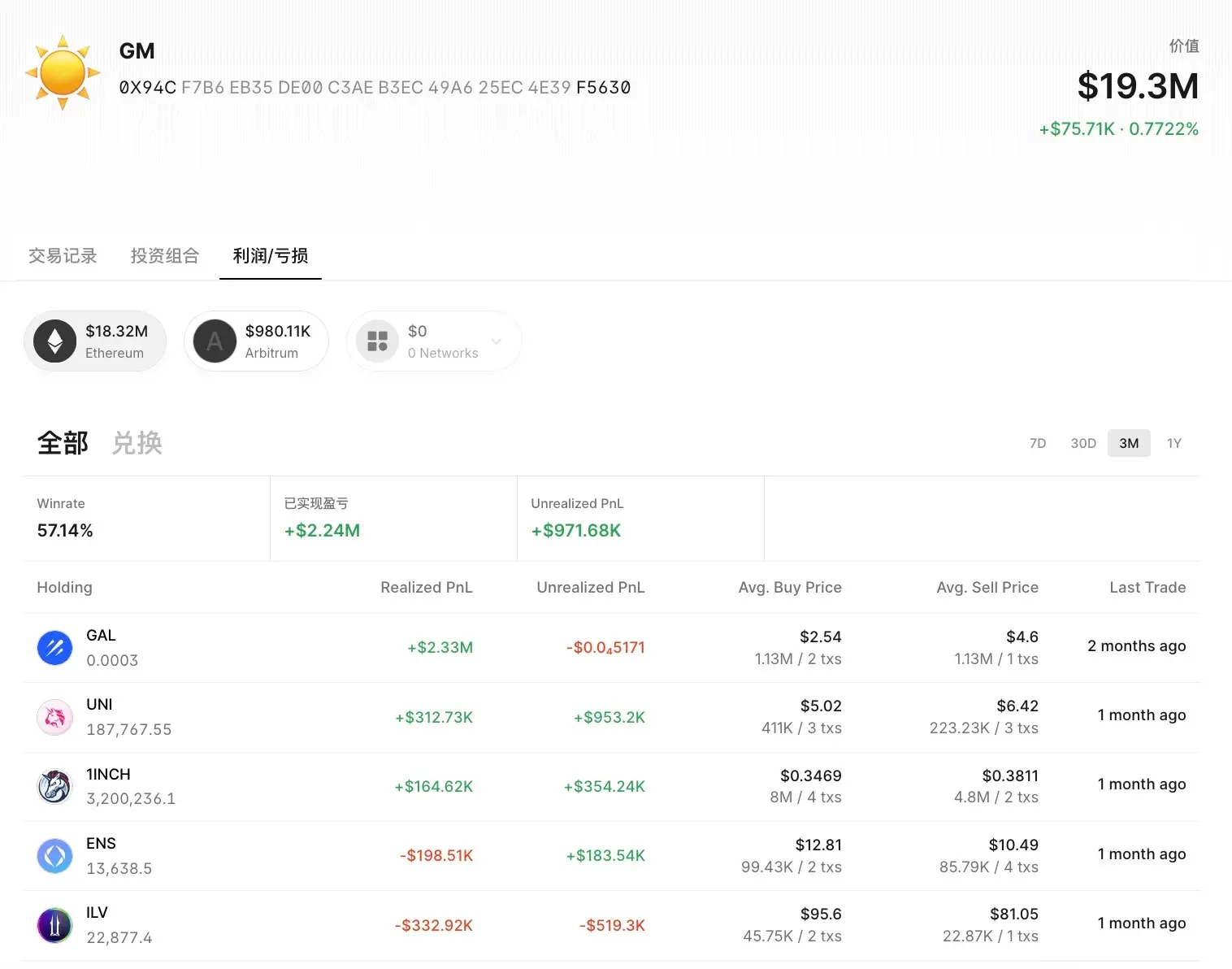

Wallet address: 0x94cF7b6eB35dE00C3aeb3EC49a625EC4e39f5630;

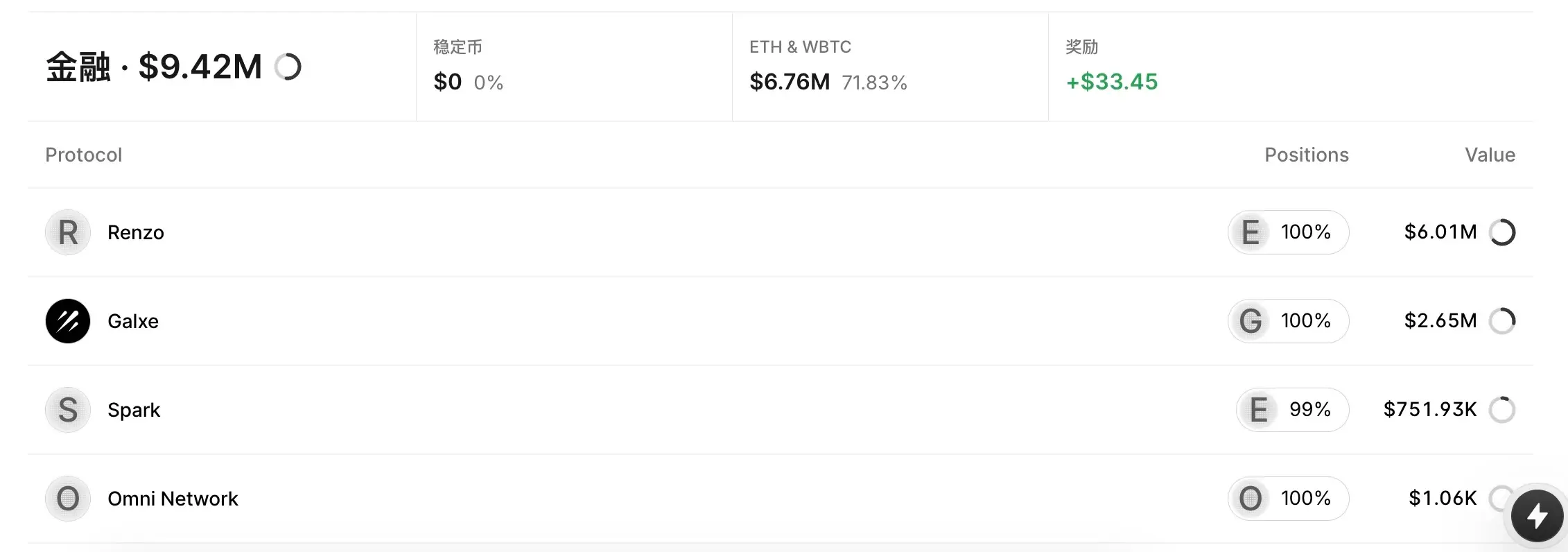

Wallet balance: Including spot holdings of ETH, MKR, UNI, ILV, 1INCH, Matic, ENS, BIGTIME, ATA, valued at $8.9 million; financial assets including RENZO, GLAXE, SPARK, OMNI, valued at $9.42 million, totaling $19.3 million;

On-chain tracking address: https://app.mest.io/wallets/0x94cF7b6eB35dE00C3aeb3EC49a625EC4e39f5630

Spot Holdings Records

Spot Holdings Records

Financial Holdings Records

Financial Holdings Records

Profit and Loss Records

Profit and Loss Records

Summary: Value Coins Share Commonalities, UNI and LINK Are Preferred Targets

Due to space limitations, this article only selected some smart money addresses for tracking analysis. However, it is evident that compared to meme coins with lower unit prices and larger total supplies, value coins are more favored by whales and institutional players as investment targets.

To some extent, this also highlights the higher entry barriers for ordinary players and market retail investors in value coins.

Among these value coins, UNI and LINK are the choices for many whales for short-term trading or long-term holding, perhaps due to their "infrastructure construction" status or their relatively large market capitalization, which can accommodate larger fund volumes. Whether ordinary players should "dance with the whales" is a matter of personal choice.

It is certain that value coins are still the mainstream cryptocurrencies for trading in the industry, and whether they can stand out and find a way out in the market environment or during fluctuations not only tests the project behind the tokens but also the patience and consensus of the majority of holders.

Finally, the main on-chain tracking tools are provided for reference:

- gmgn.ai website: sniper new coins, buy and sell, and Pi Xiu detection, click to register;

- Solscan: Solana network blockchain browser, enter the wallet address or contract address to view relevant information;

- Mest: One-stop blockchain information website for wallet tracking, popular projects, security information, enter the address for tracking;

- Arkham: EVM ecosystem's mainstream AI-driven on-chain data tracking platform, with ARKM already issued and listed on Binance;

- Cielo: On-chain data tracking platform tool, can also bind Telegram account, relatively can be used as a supplement.

- Scopescan: On-chain data tracking platform developed by the Scope Protocol team, subscription-based with some analysis functions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。