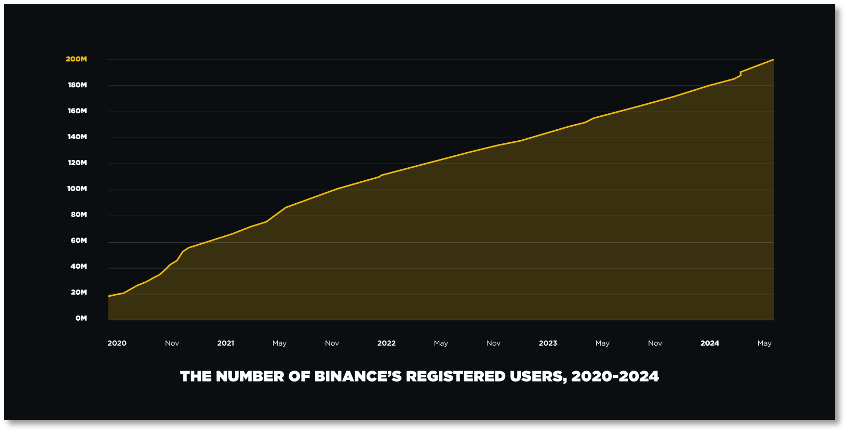

The number of registered users has exceeded 200 million, and Binance, the world's largest cryptocurrency trading platform, sees this as an important milestone. It took Binance over 4 years to reach 100 million users and another 2 years to reach 200 million.

These two years also mark the gradual recovery of the entire cryptocurrency market after entering a bear market again. Binance has experienced this period, once escaping from the "avalanche" through prudent financial management, but later encountering its biggest regulatory crisis since its establishment.

However, this giant seems to be able to emerge from each crisis. Last time, it relied on migration and innovation; this time, it relied on security and cooperation. The change in leadership and strategy may be different, but the principle remains unchanged, as they continue to emphasize "customer first."

If you review Binance's product iterations over the years, it's easy to see that from 2018 to 2021, it was the fastest 4 years for the platform to enrich its product offerings as a trading platform. Starting from 2022, user feedback and asset security have become more prominent product features, and Binance has also formed its own unique ecosystem through product layout.

After surpassing the milestone of 200 million users in June 2024, "customer first" remains a keyword that its leaders will repeatedly mention, in addition to the deepened "cooperation with regulators" learned from past lessons.

Additional information comes from Binance's co-founder He Yi, who revealed the key to Binance's new goal of reaching "1 billion users" as "being useful to the world."

"Customer First" Supports Binance's Global Leadership

In the sequence of internet giants, "200 million users" may not be eye-catching, but in the cryptocurrency market, this number already represents 34% of the overall user base.

In January 2024, a report from Crypto.com showed that the number of global cryptocurrency holders reached 580 million. This means that by June of this year, Binance has captured one-third of the global cryptocurrency users, all within less than 7 years since its establishment.

User growth curve over the past 4 years

User growth curve over the past 4 years

In fact, the past two years were not the fastest-growing years for Binance in terms of user numbers. The growth rate at the end of 2023 compared to the same period was 32.8%; while the growth from 2021 to 2020 was 400%. Of course, this was due to the boost from the previous bull market.

Instead, these two years mark the process of the cryptocurrency market transitioning from cold to warm. During this period, Binance has weathered the storm and also encountered its biggest challenge since its establishment.

In 2022, during the cryptocurrency winter, the once popular stablecoin project Terra (LUNA) collapsed, triggering a chain "avalanche," leading to bankruptcies of institutions such as 3AC and Celsius, and the collapse of the world's second-largest cryptocurrency platform, FTX. As 2023 began, the market was recovering, but industry regulations were becoming stricter, and Binance ultimately could not escape the severe penalties imposed by the US Department of Justice and other regulatory agencies towards the end of 2023.

During both major events, Binance's former CEO, Zhao Changpeng (CZ), has consistently emphasized "customer first," stating that users are the strongest driving force behind Binance's innovation. This has been a principle he has adhered to since founding Binance, and it has been implemented throughout the entire Binance product line as much as possible.

Before 2022, Binance's product lineup almost revolved around building whatever users needed, making it the fastest-growing 4 years for a cryptocurrency trading platform.

From early cryptocurrency trading platforms lacking spot trading to leading the IEO concept with LaunchPad; from spot leverage products to the futures trading system; from supporting BNBChain to becoming an independent community, and empowering BNB HODLers through airdrops. Among these, some are creative products that were not available elsewhere, while others are "better than others" products that enrich user experience.

Listening to users has been an action that Binance has adhered to for 7 years, and trust has been built through various actions.

In October 2017, Binance voluntarily refunded BNB to users from its cash reserves, which resulted in gaining 120,000 early users. This was the first release of the "customer first" principle's energy.

Since then, CZ has regularly conducted CEO "Ask Me Anything" (AMA) sessions on various social media platforms or offline events, answering various questions from users about products, trading rules, controversies, and even personal life. Co-founder He Yi has also acted as the chief customer service officer, bonding with community users, debunking rumors, and directly helping users resolve specific difficulties, including but not limited to recovering assets sent to the wrong address and intercepting stolen assets on the blockchain. Today, the tradition of AMAs has been retained by the new CEO, Richard Teng.

In He Yi's words, Binance is a "compliant" trading platform, meaning that they will study user complaints and observe what is happening in the market. In this process, they are constantly reflecting, but there are no black-and-white answers. When users criticized them for listing too many projects on LaunchPool, they listened and continued to raise the standards for project selection, observing what is happening in the market and what they can do.

In the past two years, Binance has not introduced many new products, but a prominent feature is that it has become "more compliant," with protecting user assets and iterating experiences becoming a significant part of its operations. This includes asset listings and delistings.

Before 2022, many community-based tokens were listed, a move that Binance had to follow due to market competition. However, this seemed to imply to project teams that community projects with high volume and high on-chain activity could be listed on Binance.

As a result, false prosperity projects that generated volume and data began to appear in large numbers with the participation of "pump and dump" studios. Binance received feedback through observation and listening to users, and after research, began to upgrade its standards and delist projects with abnormal data fluctuations.

"Many project teams would come to argue with Binance as soon as their tokens were delisted," He Yi believes that Binance should strive to delist accurately, "We try to remain objective and maintain relative rigor in listing and delisting."

In 2022, Binance introduced the Proof of Reserves (PoR) system, allowing anyone to verify at any time whether the platform's user funds are 1:1 reserved. In the same year, it launched the "Product Feedback and Suggestions" platform, receiving over 21,000 suggestions within a year, with hundreds of them being incorporated into product iterations.

Binance CTO Rohit Wad referred to the various communication activities organized around user suggestions as "Binance Build," stating that many detailed improvements resulting from user needs and feedback may not appear in announcements or media, but they are updated continuously. These small, continuous improvements are an important force in building Binance.

In April of this year, data from The Block Pro showed that Binance's spot market share exceeded 78% among major centralized cryptocurrency exchanges, and it had been rising for three consecutive months, further widening its lead as the industry leader.

The reason Binance has been able to grow despite its ups and downs is simply the result of putting "customer needs first." In other words, "customer first" has shaped its own first place.

Crossing the "200 Million Users" Milestone, He Yi Sets Sights on "1 Billion"

For a company in a leading position in the industry, it is not only about having an absolute dominant market share, but also about assuming the appropriate industry responsibilities. The saying goes, "With great power comes great responsibility."

Binance and its leaders' actions in the past two years indicate that they are increasingly realizing this: when in a more advantageous competitive position, it is even more important to hear criticism from the outside world.

This cryptocurrency giant has indeed foreseen the waves that its massive presence could bring to the market in some industry events, as well as the backlash that could result from not taking it seriously.

In May 2022, when Luna collapsed along with UST, Binance temporarily suspended trading of these two assets, but soon resumed, causing dissatisfaction among users.

In response to community criticism, CZ mentioned that in the decentralized field, there are many other trading platforms, "If we suspend trading, other trading platforms will experience price fluctuations. How do you think holders would feel?" He pointed out that when validators paused block production, Binance briefly suspended trading, "Even so, this also led to many complaints, but our proactive action forced the validators to restore the network within a few hours."

The "leader" flexed its muscles.

However, CZ later apologized for Binance's official account deleting tweets related to a certain coin's API data and for approving a certain voting event, stating, "Looking back, this was a mistake (the voting event)… We all make mistakes and learn from them."

"Leaders" are not always tough; they will apologize when they make mistakes, just as He Yi often uses a phrase, "stand at attention and take the hit," then "correct and improve" when Binance is caught in a problem.

Binance's most brutal "hit" was undoubtedly the settlement with the Department of Justice in November 2023. For this, it paid a heavy price, admitting to violations and announcing a resolution, paying a $4.3 billion fine, with CZ resigning, and its market share briefly falling below the 50% mark.

At that time, not only did BNB drop by 10%, but the entire cryptocurrency market experienced panic selling, indicating the impact of Binance's turmoil on the entire market.

However, this incident also resolved a hidden "bomb" for the subsequent development of the cryptocurrency market into a bull market. Three months after the largest cryptocurrency trading platform, considered a "threat" by US regulators, was driven out of the country, a Bitcoin spot ETF was approved in the United States.

Binance's "admission of guilt" to some extent accelerated the early 2024 bull process and laid the groundwork for BNB to rebound above $600, with BNB briefly breaking through $700 in June of this year.

After the regulatory incident, this trading platform has repeatedly emphasized the importance of "compliance" to the outside world, causing other platforms to pay more attention to the operational risks in the US market.

In a recent AMA attended by He Yi, when asked about further increasing Binance's growth, she once again mentioned the attitude towards regulation, "If our industry really wants to serve 1 billion users, I think we need to cooperate with regulators, build consensus and trust, and find a way to survive."

How to interact with regulators is a question that a company aiming for long-term success must face. This is the path that global Web2 internet companies have also taken, including Google, Apple, Alibaba, and even OpenAI today. They all need to consider the regulatory responsibilities taken by various governments to protect their citizens and national interests, and the cryptocurrency industry involving blockchain and finance is no exception.

As for the methodology of breaking the external impression of the cryptocurrency industry and thereby increasing the industry's scale, Binance's own experience is "self-evolution until it is useful to society." This has been the value that Binance has been practicing since it grew to become the "largest in the world" during the previous bull market (2020-2021).

BNBChain gradually transitioned from a trading chain to an application chain, Binance Academy used rewards to help crypto novices enter the world of crypto, Binance Square provided a dedicated social platform for the crypto community, and Binance Charity channeled cryptocurrency aid into various global disaster events…

As He Yi said, "As a more mature industry leader, we need to know how cryptocurrencies can make the world a better place, how to complement the existing financial system and make it more efficient, and how to coexist peacefully with traditional finance."

Binance CEO Richard believes that in the current blockchain and cryptocurrency market, apart from regulation, a new cycle of elimination has also begun.

The high FDV projects that advocate Meme over VC investment are an example of this. In He Yi's view, this is a long-term manifestation of the market's failure to produce useful projects.

She even specifically stated, "Registered users do not equal active users, and registered users do not necessarily engage in trading," to remind Binance that its current achievements are not as dazzling as they seem, and the market's potential is still enormous.

The next target for Binance is a market size of 1 billion, and He Yi has pointed out the direction for it and its peers, which is to "bridge the gap." She provided a more specific description, "Make blockchain as easy to use as the internet, allowing ordinary people to use it directly." In her view, when the basic user scale expands by 10 or 20 times, it will no longer be a challenge.

(Disclaimer: Readers are strictly required to comply with local laws and regulations. This article does not represent any investment advice.)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。