After more than a month of witch cleansing activities, the LayerZero Foundation announced today on the X platform that the airdrop eligibility query page is now online. However, the results of the airdrop have left many users feeling "breached."

As one of the most anticipated potential airdrop projects in the community, LayerZero's airdrop had been highly anticipated, with people expecting a "generous" airdrop. However, as the witch cleansing activities unfolded, a large number of studio and even ordinary user accounts were reported as witch accounts, only to find that after nearly half a year of hard work, they had gained nothing.

As one of the two large-scale airdrop projects that have been equally valued recently, along with Zksync, the controversy sparked by LayerZero has raised questions not only about the "sincerity" of the project, but also about whether a new token distribution paradigm will emerge in the current industry.

Before delving into this, we need to first understand what witch cleansing activities are.

A Month-long Witch Cleansing

LayerZero was founded in November 2021, during a bull market in the blockchain market. With strong capital support and promotion from key industry opinion leaders, LayerZero quickly rose within a year. The announcement of plans to launch a governance token airdrop garnered great attention within the community. The strong capital background, high project valuation, and top-tier status attracted a large number of airdrop hunters. According to Dune's data, since April last year, the on-chain interaction on LayerZero has significantly increased, with daily transaction volume exceeding 200,000 times, peaking at 490,000 times. Such high-frequency interaction not only improved the platform's data performance but also brought in substantial income. For example, the first cross-chain DApp Stargate on LayerZero had a monthly income of over $1 million, which was just one product in its ecosystem.

With such high expectations, the community's anticipation for LayerZero's airdrop has always been high. Despite frequent reports of the airdrop, it was repeatedly delayed. Finally, on May 2nd this year, LayerZero announced that the first snapshot had been completed on the X platform, reaching the peak of market sentiment.

According to WOO X Research's prediction, the value of LayerZero's airdrop could be between $600 million and $1 billion. Conservatively estimated, if the TGE valuation is 4 times, with an initial circulation of 15%, the FDV would be $12 billion, and the airdrop value would be about $600 million, with each user expected to receive $750 to $1,500. In the optimistic estimate, if the circulation is 20% and the TGE valuation is 4.5 times, with an FDV of $13.5 billion, the total airdrop value is expected to reach $1.08 billion, with each user expected to receive $1,350 to $2,700.

However, just as users were eagerly awaiting the airdrop, LayerZero suddenly announced unexpected news. On May 3rd, LayerZero announced that, in order to ensure the fairness of the airdrop, they would conduct a month-long witch review operation.

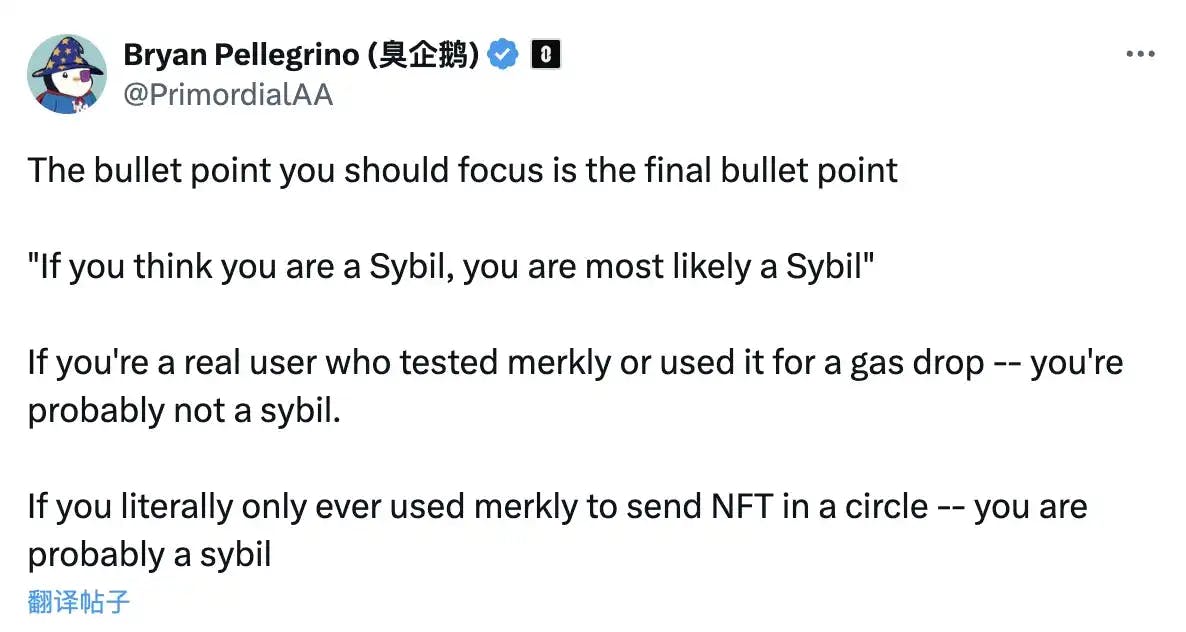

It is not uncommon to conduct witch reviews during airdrops. Witches typically refer to the behavior of using a large number of accounts to conduct meaningless or small transactions in order to obtain the airdrop. However, this review introduced a new "bounty reporting mechanism." According to the official announcement, the review will be divided into three stages. The first stage is a 14-day self-exposure stage, during which users can self-disclose their witch behavior, and the official will retain 15% of the airdrop allocation for such accounts. The second stage is the official review stage, during which LayerZero will screen based on specific rules, and any witch accounts found will not retain any airdrop allocation. The most controversial is the third stage—the bounty reporting stage. From May 18th to May 31st, anyone can submit a report on GitHub, and successful reporters will receive 10% of the airdrop allocation from the reported account, with the remaining 90% returning to the airdrop pool, and the reported account will no longer receive any airdrop.

Finally, today, Bryan Pellegrino, CEO of LayerZero Labs, announced on X that there are a total of 1.28 million eligible addresses, and approximately 10 million tokens will be returned to genuine users. The witch review has come to an end. There were 803,000 addresses identified as potential witches, with over 338,000 addresses self-exposing as witches.

"Insider Trading" Controversy and Off-exchange Prices of 3U

As the witch review came to an end and users eagerly anticipated the arrival of the airdrop, LayerZero found itself embroiled in an insider trading controversy. While most users were dissatisfied and mocking the airdrop results, some users claimed to have received a large number of ZRO tokens. These lucky individuals mostly held Kanpai Pandas NFTs. For example, an address with 50 Kanpai Pandas NFTs received 5,335.55 ZRO tokens, while another address starting with 0x816 received 10,000 ZRO tokens for holding 152 NFTs. On average, each NFT received approximately 100 ZRO tokens, adjusted according to the rarity of the NFT.

As the Kanpai Pandas project is not widely known, this has led to suspicions of "insider trading" among users. However, according to nftgo's data, the peak trading volume of Kanpai Pandas did not show any obvious correlation with the LayerZero airdrop snapshot time, and the official Twitter account has been operating normally. Therefore, the allegations of "insider trading" regarding Kanpai Pandas have not been confirmed.

At the same time, many users have expressed that they have invested a lot of time and effort, incurring costs of hundreds of dollars, but may only receive 25 ZRO tokens. Based on the off-exchange price of $3 per token, this is far from enough to cover the costs. These users believe that LayerZero's airdrop this time was "lacking in sincerity."

One user, Axel Bitblaze, who holds 36 Kanpai Pandas NFTs (approximately 36E), received 10,000 LayerZero (ZRO) tokens. He expressed disappointment with the airdrop allocation given to on-chain users: "Wallets in the top 1% only received 200-500 tokens, which is just crazy… My family and I also made efforts to interact to receive the airdrop allocation. Although we ranked in the top 1%, these interactions only resulted in a small airdrop."

Some users even believe that the end of the Zksync and LayerZero airdrops will mark the end of airdrops.

Not only the ZRO airdrop, but the recent ZK airdrop has also sparked similar controversies. The number of eligible addresses was much lower than expected, the decision-making process was not transparent, Nansen distanced itself, and suspicious addresses frequently appeared, yet the official did not make a direct response. This series of operations has plunged the ZK airdrop into an "insider trading" controversy. Previously, AltLayer was also questioned by the community for "insider trading" due to OG NFTs.

The fundamental issue lies in the community's dissatisfaction with the airdrop distribution. Retail investors cannot determine how to meet the official airdrop criteria, and the official "final interpretation" will only increase suspicions of opaque operations, leading to airdrop tokens being allocated to "insiders," who then sell the tokens, with retail investors picking them up, and the remaining token supply continues to be unlocked, further suppressing the market.

In comparison, the early representative airdrop of Uniswap appears to be more transparent and fair. Uniswap's official statement was that anyone who had used Uniswap, regardless of whether the exchange was successful, could receive 400 UNI tokens. At the same time, holding UNI tokens could also receive a series of benefits such as SOCKS tokens.

Although this no-threshold airdrop has also been criticized, in today's era of airdrop projects being criticized for "insider trading" and picking up, UNI appears to be a successful airdrop case.

Some believe that the real reason for the strong dissatisfaction with the ZRO airdrop is that these airdrop projects have disrupted the balance between VCs, project parties, and "picking up" users.

"Picking up" users or studios are the weakest party in the game of VCs pushing up valuations and lavishly spending money. Project parties need user interaction data to attract VC investment, and VCs need project parties to issue tokens to cash out and exit. Project parties use promises of tokens that may become valuable in the future to attract "picking up" users to work for free to grow their data. However, there is also a view that whales should not receive all the tokens just because they have invested a large amount of capital, but the smallest users should receive some basic amount of tokens in any case.

This is also the origin of the widespread anti-institution sentiment in the current Web3 field, because due to the greed of VCs or investment misjudgments, these projects have obtained extremely high valuations, but cannot form a reliable, stable business model, and can only rely on issuing tokens to make retail investors bear the burden of their indigestible assets.

However, despite the eye-opening ZK and LayerZero airdrops, picking up is still a way for ordinary users to profit, although the returns are continuing to decline.

Airdrops Worth Paying Attention to After LayerZero

Manta Network: The Manta token is an OFT token, and the team deploys the OFT Manta Token on different chains to support cross-chain Manta token transactions.

Allocation plan: 10% allocated to developers; 30% allocated to early adopters; 20% allocated to ecosystem partners; 40% allocated to LP providers.

Project link: https://app.trendx.tech/project/Manta%20Network/1d507e4c

Canto: Canto is a Layer 1 blockchain built using the Cosmos SDK, and through LayerZero's OFT standard, CANTO's cross-chain representation is deployed to Ethereum, allowing users to provide liquidity and trade CANTO on the mainnet, providing additional bridging paths for Canto.

Allocation plan: 70% allocated to CANTO OFT cross-chain users, with a total of at least 50 CANTO cross-chain to/from Ethereum, with 20% evenly distributed and 80% distributed proportionally to the cross-chain volume; 20% allocated to PancakeSwap (Ethereum) CANTO/WETH LP, distributed according to the ownership percentage of the liquidity pool at the time of the snapshot; 10% allocated to Canto developers.

Project link: https://app.trendx.tech/project/Canto/57fcc700

DappRadar: DappRadar is a DApp data analysis platform.

Allocation plan: 10% allocated to developers; 90% allocated to RADAR stakers.

Project link: https://app.trendx.tech/project/DappRadar/a09d08a0

KelpDAO: KelpDAO is a liquidity restaking protocol, and its rsETH can be cross-chained to other L2s using OFT.

Allocation plan: 40% allocated to users cross-chaining to various L2s; 20% allocated to users natively minting rsETH on L2; 20% allocated to the top 500 liquidity providers on the mainnet and L2; 10% allocated to rsETH holders on the mainnet; 10% allocated to Kelp's core team to pay for developer fees and audits.

Project link: https://app.trendx.tech/project/KelpDAO/73360fcf

Pendle: Pendle is a yield trading protocol.

Allocation plan: 10% allocated to developers; 90% allocated to vependle holders.

Project link: https://app.trendx.tech/project/Pendle/3d1e2ed8

Follow Us at TrendX

TrendX is a leading AI-driven Web3 trend tracking and intelligent trading platform globally, aiming to be the preferred platform for the next billion users entering the Web3 space. By combining multidimensional trend tracking and intelligent trading, TrendX provides a comprehensive project discovery, trend analysis, primary investment, and secondary trading experience.

Website: https://app.trendx.tech/

Twitter: https://twitter.com/TrendX_tech

Investment carries risks, and projects are for reference only. Please bear the risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。