On the afternoon of June 17th, AICoin researchers conducted a live graphic and text sharing session titled "7 Types of 'Main Force Order Language', No Longer Being a 'Bag Holder'!" in the AICoin PC-end Group Chat Live. Here is a summary of the live content.

I. Importance of Main Force Intentions

Identifying the true intentions of operators from complex market signals. The main force's accumulation, shock, and upward stages are all preparations for the final unloading stage. The success of unloading directly determines the success or failure of the main force's operation. Regardless of where the main force pushes the price, if they cannot successfully unload and turn unrealized gains into realized gains, everything will be in vain.

During the unloading stage, the main force will use all kinds of tactics to deceive retail investors into entering the market to receive goods. Their methods are extreme, including collaborating with KOLs to release positive announcements, media hype, and various tactics to attract more buyers. As long as they can convert chips into cash, the main force can do anything.

II. Common Ways of Main Force Unloading

1. Volume-price Divergence, Volume Stagnation

For any trading pair, as long as there is a situation where the volume does not rise despite the circumstances, it can be inferred that the main force is unloading.

Even if there is volume stagnation during the upward trend, even if there is no unloading at that time, unloading is not far off in the future.

2. Failure to Rise When Expected, Reverse Decline

Some coins, regardless of technical, fundamental, or news aspects, may not rise as expected or even experience a reverse decline, which is a common occurrence.

3. Frequent Positive News, KOL Recommendations

Generally, after the main force's upward trend, it is the unloading period. During the main force's upward trend, potential themes related to the coin will appear in the news, known as ambiguous themes. The main force will use these themes to drive the upward trend, which will then transition into the unloading period.

III. 7 Types of Order Book Language

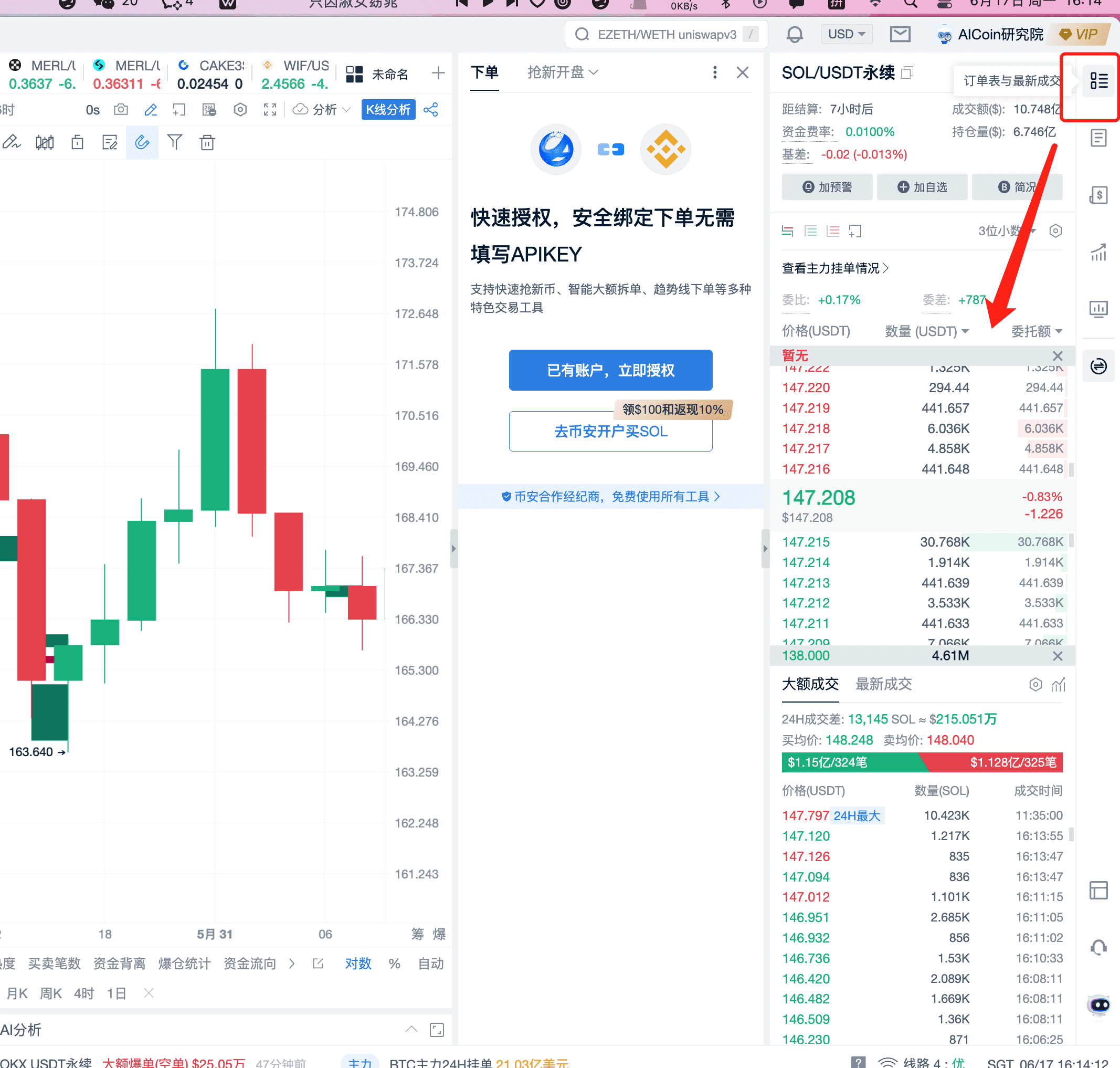

1. Order Book and Buy/Sell Prices

Before understanding the order book, let's first understand what the order book is and what the buy and sell prices are. View the Order Book Information.

Follow me to open the market page.

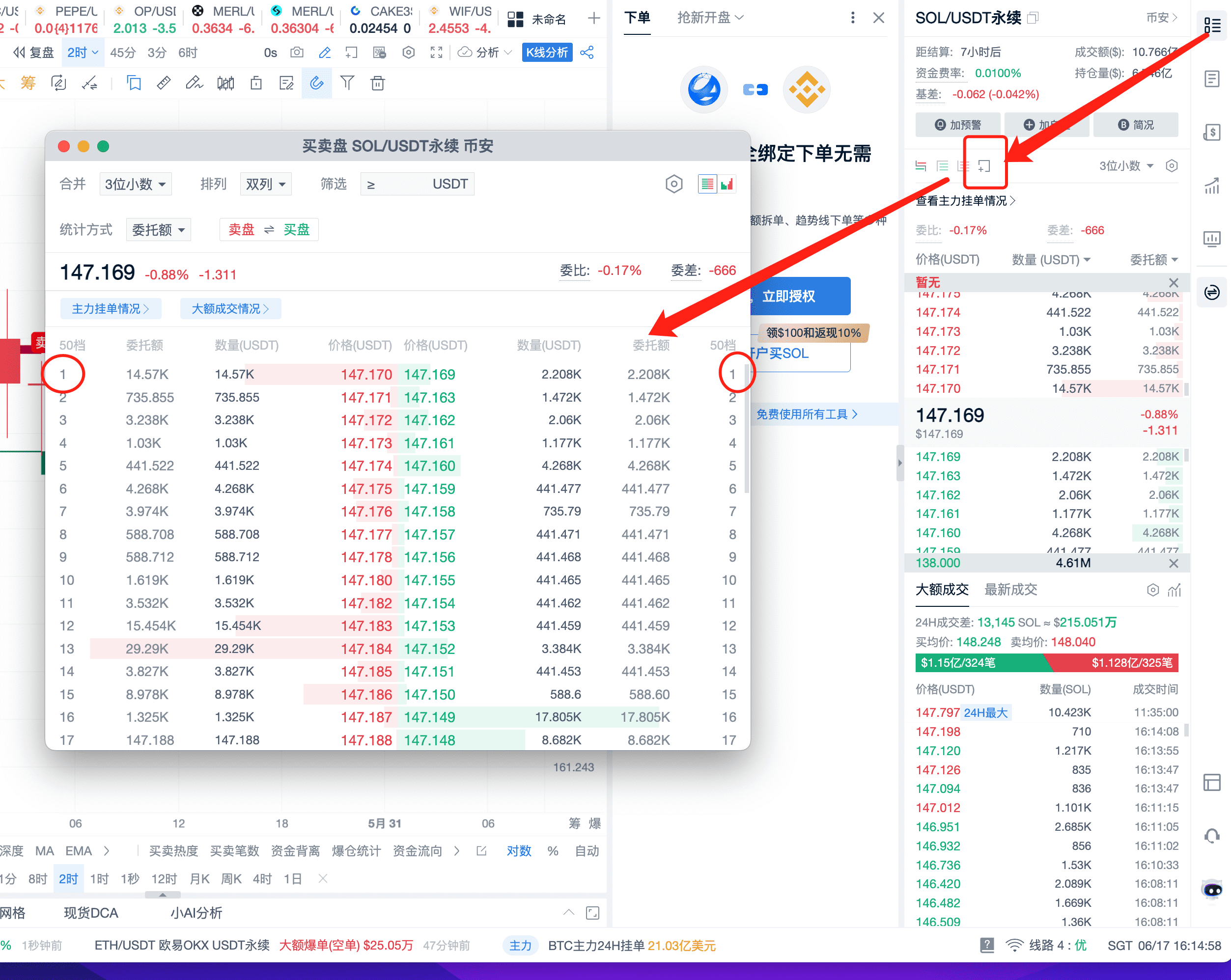

The red top row is the sell order. The green top row is the buy order. In a new window, open the buy and sell orders, and you can see the order book. The first order, represented by the circle 1, refers to the buy and sell orders.

2. Deciphering the Seven Types of Order Book Language

(1) Order Book Language 1: Large Orders Suppressing Absorption

Order Characteristics: There are relatively large sell orders above the first sell order, while the buy orders below are relatively normal, and the price does not drop.

Principle: This is a typical method of suppressing orders and absorbing chips. The main force intentionally places many large sell orders above, creating the impression of heavy selling pressure at the top, which may lead to a price drop, causing ordinary investors to sell out of fear.

"Large Orders Suppressing Absorption" is a common method used by the main force to manipulate the market and secretly absorb chips. Its purpose is to create the illusion of selling pressure and lure retail investors into panic selling, while the main force collects chips at lower prices.

A. Order Characteristics:

Observe the sell order situation, especially above the first sell order. If there are abnormally large sell orders above the first sell order, and the total volume of these orders is significantly higher than normal, caution is needed. At the same time, the buy orders are relatively normal, with stable buying intentions.

B. Price Change Analysis:

Despite the heavy sell orders, theoretically putting pressure on the price to drop, the price does not significantly drop, and may even show stability or a slight upward trend. Upon closer observation of the intraday chart, if the price remains stable or slightly rises, this may indicate the main force's control over the market.

C. Analysis of Buy Order Behavior:

Pay attention to changes in the first buy order. If, in a stable price situation, there are frequent small buy orders at the first buy order, this usually indicates a force actively absorbing the sell orders.

D. Hidden Purpose of the Main Force's Behavior:

The large sell orders may be a feint, not intended to actually sell chips, but to create the illusion of selling pressure, leading to panic selling by retail investors, allowing the main force to collect chips at lower prices. This strategy generally appears during periods of relatively low trading activity, which the main force uses to absorb chips at lower prices.

E. Response to Large Orders Suppressing Absorption

Observe the order book and trading volume: Continuously monitor the situation of large orders and combine it with the trading volume. A large volume of orders with low trading volume may be a sign of suppressing orders and absorbing chips. It may be advisable to hold or even buy, as the main force is also buying. Reference can be made by following the main force.

F. Combined View of Order Book and Trading Volume

At the position just now, let's take a look at the order book and trading volume.

Continuously monitor the situation of large orders and combine it with the trading volume! Following the main force, our PRO members have a very powerful feature, monitoring large orders by the main force. Monitoring of large orders and rapid order cancellations, all visualized indicators on the candlestick chart. Click the link to experience: https://www.aicoin.com/zh-Hans/vip

(2) Order Book Language 2: Large Orders Pushing Out Unloading

"Large Orders Pushing Out Unloading" is a typical strategy used to release inventory at high prices and gain profits. This method is particularly suitable for coins with high liquidity and market capitalization.

A. Order Characteristics:

Buy Orders: Below the first buy order, there are only large buy orders, indicating a large demand and willingness to buy in the market.

Sell Orders: On the sell side, there is only a large sell order at the first sell order. Once this sell order is filled by buyers, new large sell orders will quickly appear, indicating sustained selling pressure.

B. Operating Principle:

The main force continuously places large orders at the first sell order to entice or force buyers to purchase at higher prices. The purpose is to continue unloading at high prices and sell off their chips. This strategy is particularly evident when the coin's value is high, as the main force takes advantage of the market's high valuation of the current asset to achieve high-priced sales.

C. Market Impact:

This operation usually leads to increased price fluctuations, as the main force's continuous unloading may to some extent depress prices, and then the existence of large buy orders may push prices higher, resulting in rapid price fluctuations. This operation can quickly influence market sentiment and price trends.

D. Response Strategy:

We should continuously monitor changes in the buy and sell orders and related trading volume data. Once there are repeatedly appearing large sell orders, caution should be exercised. By understanding the main force's movements, blind operations can be reduced, significantly increasing the success rate of trades. Obtain real-time market data analysis to accurately understand the main force's dynamics. Monitoring of large orders by the main force, rapid order cancellations, and other tools comprehensively enhance your trading capabilities.

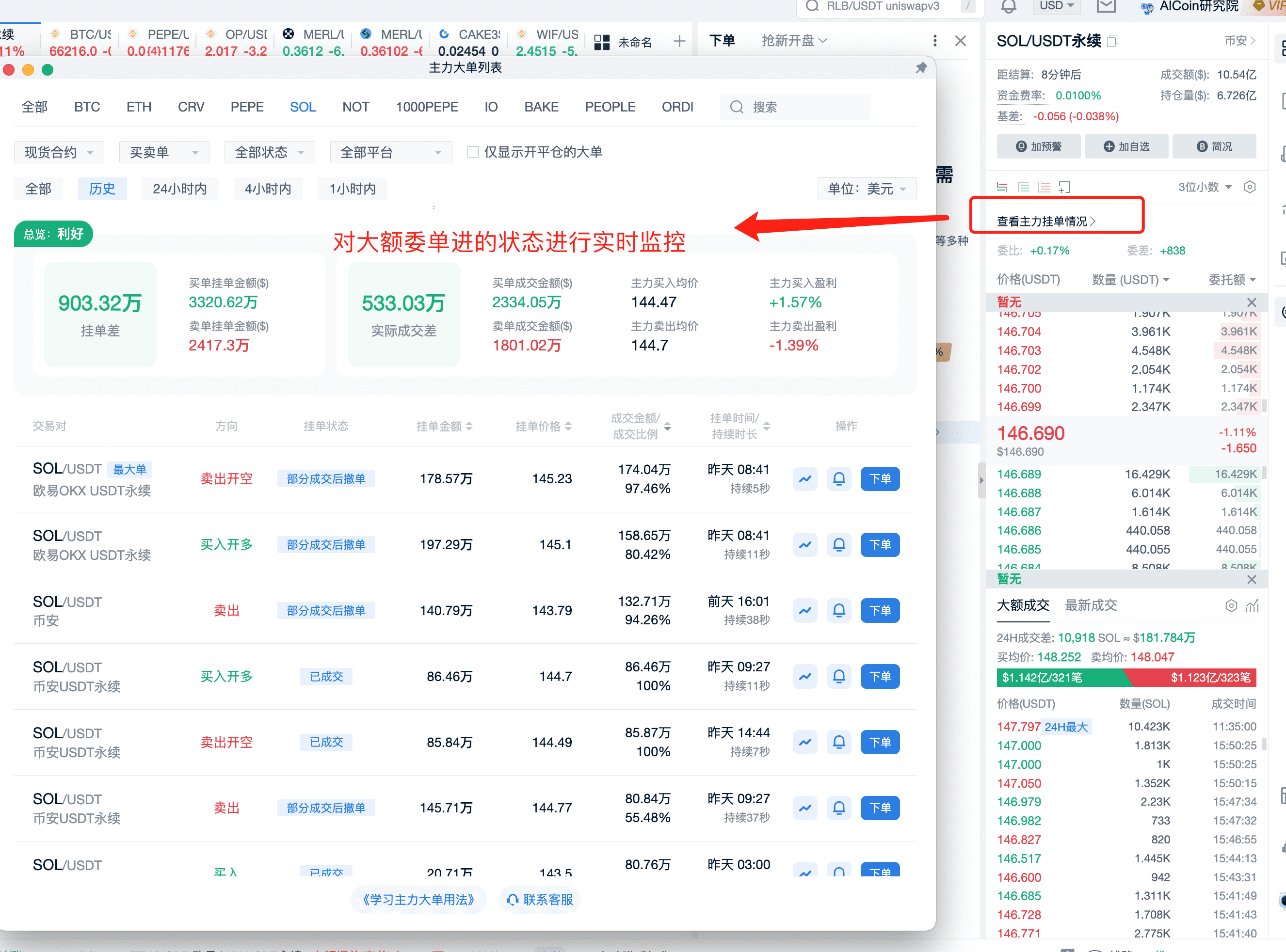

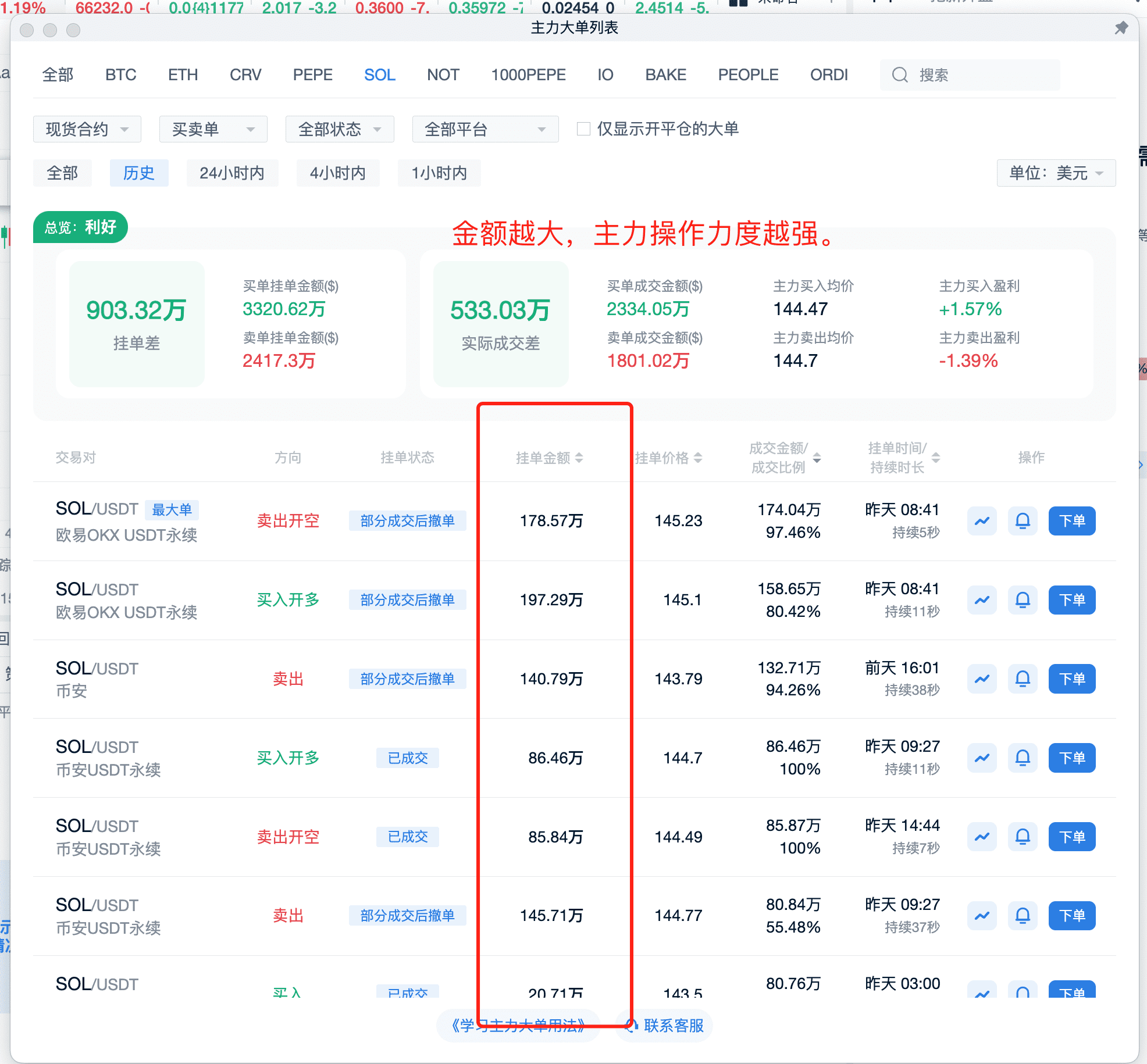

At the same time, set reasonable stop-loss positions to avoid chasing price increases at high levels and prevent losses caused by rapid price drops after the main force unloads. The monitoring of large orders by the main force is independently developed by the AiCoin team, based on market order book data, providing real-time monitoring of the status of large orders.

Achieve precise tracking of the main force's order book situation, helping investors prepare to seize entry opportunities.

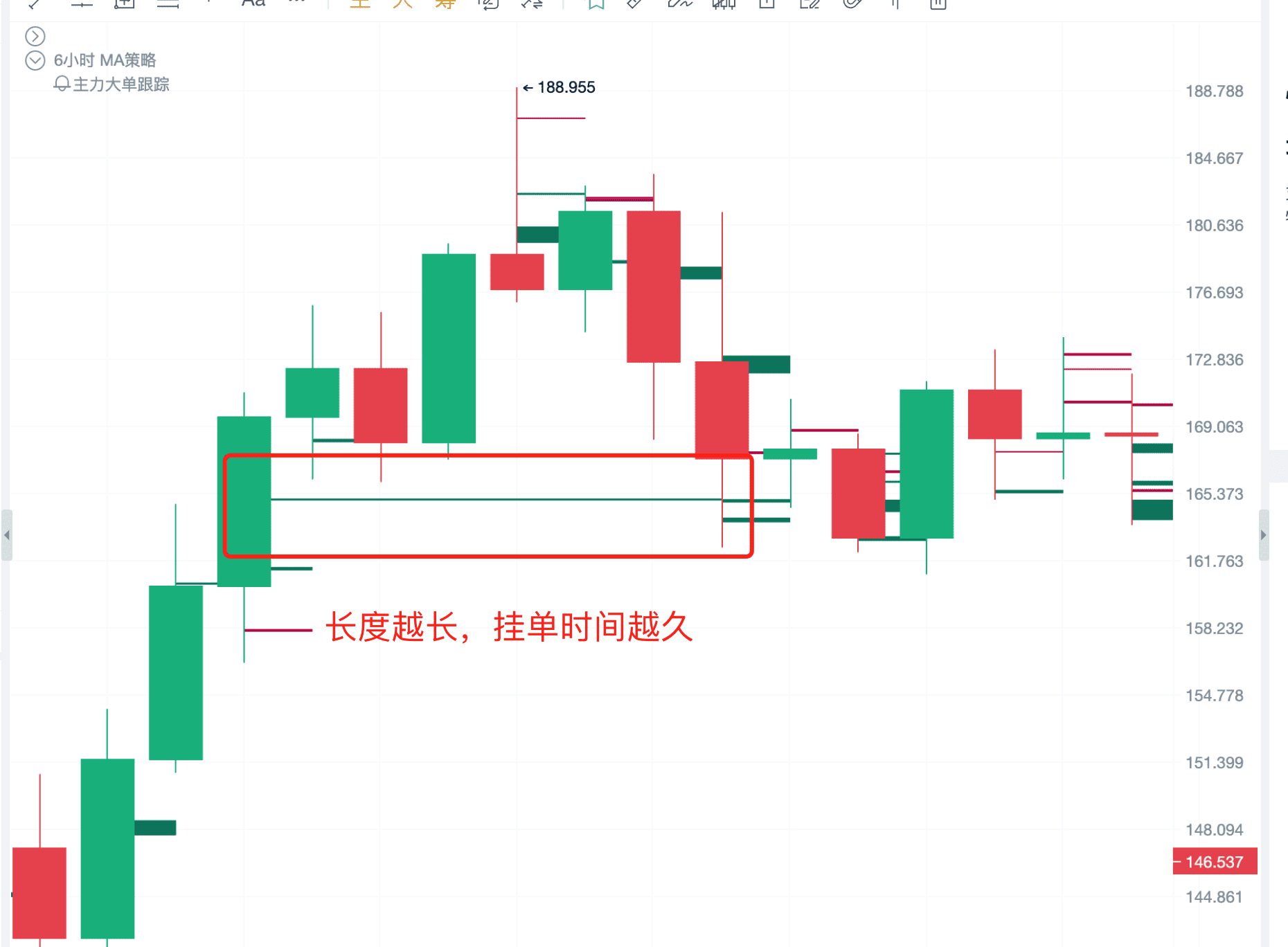

E. Some Uses of Large Orders by the Main Force

Main Force Large Order Characteristics—Length: Order placement time; Thickness: Order amount; Depth: Executed/Partially executed.

(3) Order Book Language Three: Large Buy Order Supporting Alone

"Large Buy Order Supporting Alone" refers to a single large buy order continuously supporting market prices in an environment with large sell orders, typically a phenomenon manipulated by the main force. This operation may be for wash trading or accumulating more chips.

A. Order Characteristics:

Sell Orders: There are several large sell orders, creating the impression of significant selling pressure and an impending price drop for market participants.

Buy Orders: Only a significant large buy order supports market prices, preventing them from dropping.

B. Operating Principle:

Price Control: By placing large sell orders at the second sell order and large buy orders at the second buy order, the main force effectively controls the market's top and bottom, limiting the price fluctuation range. In this narrow range, the price is easily manipulated.

Wash Trading Purpose: The purpose of wash trading is to entice impatient or uninformed investors to sell or trade within this range, while the main force uses this opportunity to turn over, collect more chips, or cut off unstable chips.

C. Market Impact:

Narrow trading may reduce market volatility but also increase uncertainty, as new market participants and a few retail investors find it difficult to judge future trends. Identifying the technique of wash trading can help avoid making hasty trading decisions in a market with no clear direction.

(4) Order Book Language Four: Sandwich Wash Trading

"Sandwich Wash Trading" is a relatively complex trading technique in the market, achieved by carefully setting buy and sell orders to control price fluctuations within a narrow range for the purpose of wash trading. This technique is quite common, especially in projects with large market capitalization and good liquidity.

A. Order Characteristics:

Both above the second sell order and below the second buy order are large orders: This order setting creates the illusion of significant buy and sell pressure, but these large orders are relatively difficult to reach as they are set at prices deviating from the current market.

Almost empty at the first buy and sell orders: This indicates weak buying and selling power near the current price, making it easy to control.

B. Operating Principle:

Price Control: By placing large orders at the second buy and sell orders, the main force effectively controls the market's top and bottom, limiting the price fluctuation range. In this narrow range, the price is easily manipulated.

Wash Trading Purpose: The purpose of sandwich wash trading is to get impatient or uninformed investors to sell or trade within this range, while the main force uses this opportunity to turn over, collect more chips, or cut off unstable chips.

C. Market Impact:

Narrow trading may reduce market volatility but also increase uncertainty, as new market participants and a few retail investors find it difficult to judge future trends. Identifying the technique of sandwich wash trading can help avoid making hasty trading decisions in a market with no clear direction.

(5) Order Book Language Five: Top Unloading

A. Market Behavior:

After a rapid rise, the market sees a large number of sell orders, and the price starts to fluctuate at high levels.

Large holders or institutions may start gradually selling off a large amount of cryptocurrency they hold to realize profits.

B. Order Book Characteristics:

A large number of buy orders may gather in a specific price range, forming strong support. However, despite this, sell orders continue to appear, and the price often cannot break through a certain resistance level.

C. Motivation and Impact:

The purpose is to gradually reduce holdings while strong buy support still exists in the market, avoiding a massive sell-off that could directly break through the support level and cause a price collapse. For us, the key is to identify this potential unloading signal and avoid entering at high prices.

D. How to Respond:

Observe market sentiment and technical indicators: Use technical analysis tools such as RSI, MACD, etc., to identify potential top signals.

Analyze trading volume: A sudden increase in trading volume may indicate the appearance of large trades, an important signal.

Exercise caution: Maintain cautious investment in uncertain market trends, set stop-loss orders to avoid being trapped at high levels.

(6) Order Book Language Six: Reverse Limit Price Unloading

This mainly occurs in short-term popular projects, especially after a significant price increase.

A. Order Characteristics:

a. Sudden suppression after a significant rise: After a significant rise, there is a sudden large sell order suppressing the price to a relatively low level. This suppression is usually rapid and deep, aiming to quickly change market sentiment.

b. Large buy orders support but no price increase: Below the suppressed lower price, there are continuous large buy orders that seem to support the market, preventing further price drops. Despite the large buy orders, the price strangely does not rise, while the trading volume increases.

c. Continuous sell orders but new sell orders appear immediately after being filled: At a certain price level, although large sell orders are gradually absorbed, new sell orders continue to appear, quickly replacing the original sell orders.

d. Stagnant stock price but increasing trading volume on the intraday chart: Although the price appears stable, the trading volume is continuously increasing, indicating intense trading between buyers and sellers.

B. Operating Principle:

The main force creates market panic by suddenly suppressing prices, attracting bargain-hunting buyers. This sudden price drop attracts a large amount of speculative funds.

The main force uses the reverse trading method to continuously sell at lower prices and buy in small amounts, creating a situation where the market's buy support seems strong but the price does not rise. This strategy can continue to release holdings without causing a rapid further price drop.

C. Investor Response:

Be especially cautious about sudden significant price drops (watch for anomalies), as this may be a signal of main force operations.

If the price does not rise but the trading volume continues to increase, this may indicate the unloading phase. Avoid blindly buying in this situation.

Enhance the ability to analyze the market, especially observing and analyzing the order book, to avoid being inadvertently affected by market manipulation.

(7) Order Book Language Seven: Reverse Limit Price Unloading

This is typically used by large holders or operators who use specific and easily recognizable numbers (such as 888, 555, 666, 999, etc.) in buy and sell orders. These numbers are often not randomly chosen and may have specific intentions or signals.

A. Order Characteristics:

Use of easily remembered repeating numbers: Buy and sell orders with repeating numbers such as 888, 999, etc., are visually easy to recognize and remember.

Prominence in quantity and position: These orders are often not just occasional occurrences, and these special numbers may frequently appear in the trading order book, often at critical buy or sell price points.

B. Signal Transmission:

Signal to compartmentalized institutions: In organized market operations, operators may need to communicate trading intentions or strategies with external partners (such as other institutions or compartments).

Using specific numbers in order placement as pre-arranged signals can inform partners of the beginning or end of a certain strategy without disclosing specific trading plans.

Example: Classic TRB

These signals may mark the beginning of buying, accelerating unloading, or a change in market operation strategy.

Psychological Manipulation

Deception and unloading: Special number order placements may also be used to influence the psychology of other ordinary investors, creating an illusion that there are large players operating in the market. For example, a large number of orders may give market participants a signal that the price will rise or fall, prompting them to follow suit.

This method may be used to attract more buyers into the market, making it easier for the main force to unload at higher prices, or conversely, attract sellers to suppress prices for easier accumulation at lower prices. This is definitely intentional manipulation.

- Summary of the Seven Order Book Languages

Large orders pressure and absorb chips, large orders unload, large buy order supports alone, sandwich wash trading, top unloading, reverse limit price unloading, special number order placements

- Suggestions for Dealing with Main Force Unloading Operations

Rely on a single technical indicator, and if things don't look good, immediately exit. Success is simply repeating simple tasks.

When trading short-term, always set stop-loss orders, for example, if it drops by 5%, sell regardless of the reason, aiming for big gains and small losses. For medium-term trading, don't worry about short-term fluctuations. Buy when the time is right, sell when the time is right, then stay out of the market and wait for the next opportunity.

Note: Absolutely do not touch "air coins," which are coins with no narrative, not a hot topic, and where the majority of the circulating market value is controlled by the manipulators. Otherwise, the previous profits will be in vain.

Join PRO membership and let us overcome the market's tricks with the power of technology to protect your investments. Don't wait to be played by the market, take a step towards smarter and more professional investing now. Click the link below to learn more and start your PRO membership journey: https://www.aicoin.com/zh-Hans/vip

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。