Yesterday, the price of Bitcoin repeatedly fell below the $66,000 mark in the intraday session, reaching a low of around $65,139. The author suggested a long strategy in the range of $65,100 to $65,300, and successfully took profit at the $67,000 mark, gaining more than 1800 points. Although the full profit potential was not captured, the focus was on securing gains. The author hopes to achieve more profit in the next opportunity and wishes everyone to profit consistently.

Bitcoin 4-hour chart

Based on the 4-hour chart of Bitcoin, the DIF line and DEA line are below the zero axis, and the DIF line has been on a downward trend recently. The MACD histogram is showing increasing green bars, indicating that the market is currently in a weak position with increasing downward momentum.

Furthermore, looking at the KDJ indicator, the values of K, D, and J lines are relatively low, with the J line crossing below the K and D lines, forming an oversold condition, indicating an overall weak trend.

Lastly, based on the Bollinger Bands indicator, the current price is between the middle and lower bands, closer to the lower band, indicating an oversold condition. The widening of the Bollinger Bands suggests increased market volatility, indicating the possibility of a short-term rebound with significant price fluctuations.

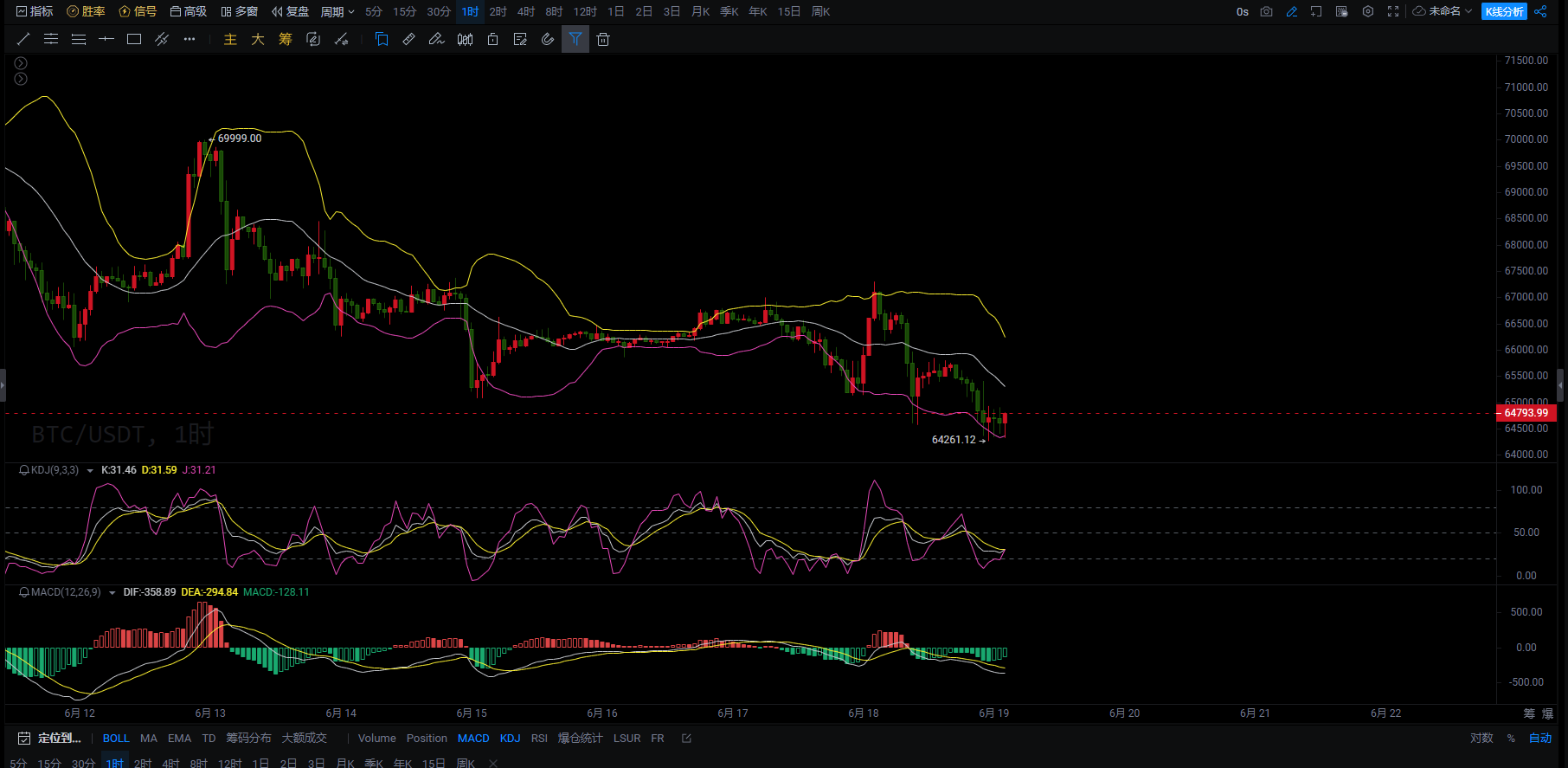

Bitcoin 1-hour chart

Looking at the 1-hour chart of Bitcoin, the DIF line is above the DEA line, but the histogram is still showing green and gradually shrinking, indicating a potential short-term rebound with limited strength.

Additionally, based on the KDJ indicator, the K and D line values are hovering at low levels, and the J line is starting to turn upward, indicating a potential rebound in the short term.

Finally, based on the Bollinger Bands indicator, the current price is running near the lower band, and the Bollinger Bands are starting to contract, indicating a decrease in market volatility, which may lead to a period of oscillation or a small rebound.

Comprehensive analysis: The 4-hour chart shows that the market is still in a downtrend, but signals from the KDJ and Bollinger Bands lower band indicate a potential rebound in the short term. It is recommended to wait for more confirmation signals, such as the MACD histogram turning positive or further upward movement in the KDJ indicator. The 1-hour chart indicates that Bitcoin may experience a brief rebound, but the overall trend remains weak. It is important to monitor the subsequent changes in the MACD and KDJ indicators.

In conclusion, the author provides the following recommendations for reference:

Recommendation 1: Long position at $64,430, with a target of $65,300 to $65,800, and a stop loss at $64,000.

Recommendation 2: Short position at $66,000, with a target of $64,400 to $64,000, and a stop loss at $66,500.

Instead of providing a 100% accurate recommendation, the author emphasizes the importance of guiding the right mindset and trend, as teaching someone to fish is better than giving them a fish. The focus is on developing a mindset that can lead to lifelong profits. The emphasis is on understanding the trend, market positioning, and position planning. The author aims to provide assistance based on practical experience to guide investment decisions and management in the right direction.

Drafting time: (2024-06-19, 01:40)

(By "Coin Master") Disclaimer: The publication on the internet may have a delay, and the above recommendations are for reference only. The author is dedicated to research and analysis in the investment fields of Bitcoin, Ethereum, altcoins, foreign exchange, and stocks, with years of experience in financial markets and real trading operations. Investment involves risks, and caution is advised when entering the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。