- [Review] -

Yesterday's strategy was perfect. Hehe.

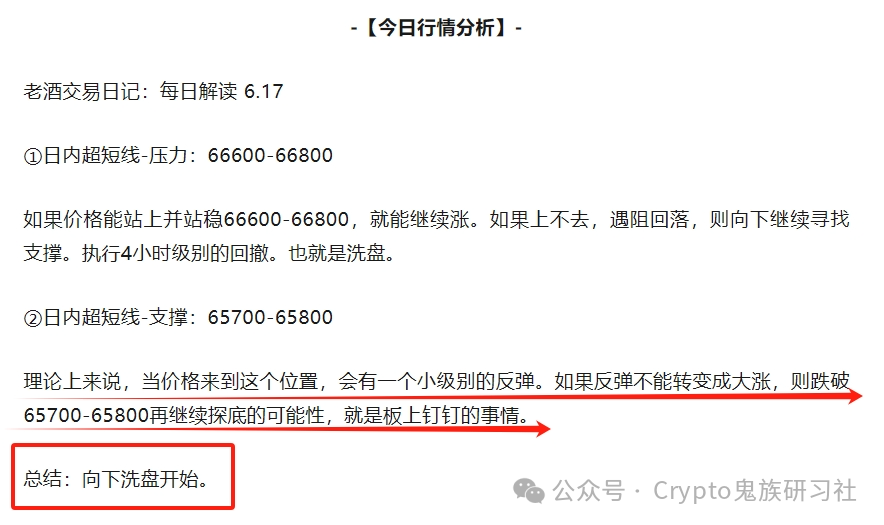

- [Today's Market Analysis] -

Old Liquor Trading Diary: Daily Interpretation 6.18

① Intraday ultra-short-term - Resistance: 65800

Breaking through 65800, look at 66300. As long as this is done, it will be a trend of oscillation and upward movement.

② Intraday ultra-short-term - Support: 64800

If it falls below 64800, look for a new low near 64300, fluctuating up and down by 200 units. The final drop.

Summary: The mindset has shifted from short to long.

- [Cryptocurrency News] -

Why did the cryptocurrency market fall today?

The cryptocurrency market suffered a heavy blow today, with the total market value falling by more than 4.30% to around 2.50 trillion US dollars on June 18. This sudden drop has left many investors puzzled, trying to understand the core catalyst behind this decline and whether a recovery is imminent.

The Fed officials' interest rate cut forecast has damaged the cryptocurrency market.

Today's cryptocurrency market decline is part of the adjustment that began over the weekend, when Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, made a "reasonable prediction" that interest rates would only be cut once in 2024. Kashkari stated on the "Face the Nation" program on CBS on June 16 that "we need to see more evidence to convince us that the inflation rate is falling to 2%."

His remarks sharply contrast with the expectations of bond traders in September and November for at least two interest rate cuts in 2024. For example, the target interest rate probability for a rate cut in September has dropped from 66% over the weekend to 55% on June 18.

The reduced expectations for an interest rate cut coincided with a rebound in US Treasury yields, with the annualized yield on the benchmark 10-year bond (US10Y) rising by 14 basis points since the weekly opening on June 17. Higher bond yields reduce the opportunity cost of holding riskier assets such as cryptocurrencies, which is also why the cryptocurrency market has experienced a significant decline this week (including today's losses).

Bitcoin ETF outflows continue.

Today's cryptocurrency market decline has been further influenced by risk-averse strategies adopted by Bitcoin exchange-traded fund (ETF) traders and investors.

It is worth noting that as of the week ending June 14, the holdings of the US spot Bitcoin ETF fell by about 3.65% to around 15.1 billion US dollars. The outflow trend continues this week, with the net reserves of this investment tool on June 17 at 1.459 billion US dollars, bringing the ETF's net reserves to 149.56 billion US dollars.

The cumulative inflow of spot Bitcoin ETFs

These outflows are consistent with the strengthening of the US dollar against a basket of major foreign currencies. A stronger US dollar typically indicates a reduced risk appetite among investors, which helps explain the accelerated outflow of Bitcoin ETF funds and the resulting anxiety in the cryptocurrency market.

Long liquidation has damaged the interests of cryptocurrency market bulls.

As the long liquidation force has exceeded the short liquidation force in the past 24 hours, the downward trend in the cryptocurrency market has further accelerated.

Long traders (those betting on the rise of the cryptocurrency market) experienced liquidations worth about 403 million US dollars in the past 24 hours. In contrast, short traders suffered liquidations of over 61 million US dollars during the same period.

When long positions are liquidated, traders betting on price increases are forced to sell their positions, usually resulting in losses. This increased selling pressure has led to a lower valuation of the cryptocurrency market today.

In conclusion, there is heavy pressure above, but below, there is not much room for further decline.

Personal opinion, for reference only

Official account ↓↓↓

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。