Have you fallen into the trap of the KOL round?

Authors: Liu Honglin, founder and director of Shanghai Mankun Law Firm;

Huang Wenyi, Li Jiaqian, lawyers' assistants at Shanghai Mankun Law Firm

SatoshiVM became one of the hot projects in the first half of 24, and one of the reasons was the "farce" caused by KOL.

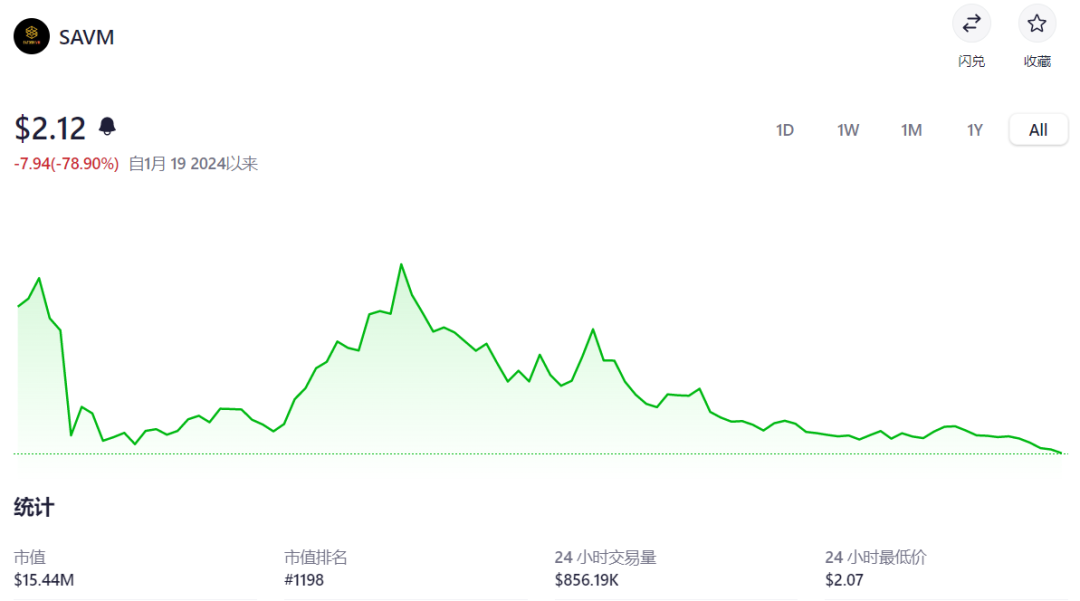

In January 2024, SatoshiVM issued the token SAVM for the first time. Due to the advance promotion by many cooperating KOLs, the token price of SAVM soared from the day of issuance, and shortly after its release, its price had reached $11.66. However, the controversy arose when it was revealed that KOLs received the project's tokens and immediately sold them, causing a huge dispute and leading to a continuous decline in the token price. According to the trading data on June 12, 2024, the lowest trading price of SAVM within 24 hours was $2.07, far from its former glory.

In fact, the cooperation between cryptocurrency projects and KOLs has long been a default marketing method in the industry, leading to the concept of KOL round financing. However, KOLs participating in the KOL round face many legal issues, especially when the projects they are involved in experience significant market fluctuations.

Therefore, today, Mankun Law Firm will discuss the topic of cryptocurrency KOL round with everyone - what is the KOL round? What are its legal risks? And how to avoid these risks?

01 KOL and KOL Round

(I) What is KOL

KOL (Key Opinion Leader) translates to "关键意见领袖" in Chinese, which refers to individuals who possess more accurate product information, are accepted or trusted by relevant groups, and have a significant influence on the purchasing behavior of the group.

In the Web3.0 field, KOLs are essentially a group of coin circle big Vs with rich investment experience or mining awareness and a certain number of followers. They have greater exposure due to the attention they receive, and the information they publish is seen by more people.

As "experts" in the Web3.0 field, they do not necessarily need to accumulate a large number of followers to be called KOLs. Even KOLs with only 5000 followers have the opportunity to receive promotional invitations from project parties and earn certain rewards through project promotion.

KOLs generally earn income in two ways: the first is to receive immediate rewards, similar to the common promotion methods on platforms like X, such as Giveaway KOL or NBA star endorsements; the other is to act as project investors, using their influence as "technical shareholders" or directly participating in investments. After the project's token is launched, they receive or purchase project tokens at a discount as investors or early contributors.

(II) How to understand the KOL Round?

The KOL round is actually the second form mentioned above. The reason for the different terminology is due to different perspectives.

From the perspective of project financing, some cryptocurrency startups raise venture capital through equity, while others raise funds by selling their own issued tokens or subsidiary tokens. Of course, some companies adopt a mixed financing round method of tokens and equity to raise funds.

The KOL round refers to the project party inviting KOLs for promotion while also treating them as financing targets. Unlike other financing targets, KOLs, as early contributors to the project, usually can obtain a certain discount when purchasing the project's tokens, and even receive token allocations for free.

In April 2024, RootData, a Web3.0 asset data platform, released statistics on KOLs' participation in project financing over the past six months, with dingaling ranking first for participating in 21 project financings.

It is worth noting that from this list, NFT players account for a relatively high proportion. One possible reason is that the NFT market has been underperforming in recent years. Therefore, NFT project parties and KOLs also need to seek new growth points and breakthroughs to further stimulate market operations. The linkage between project parties and KOLs may be one of the reasons for the large influx of NFT players into the primary and secondary markets.

02 Legal Issues to Pay Attention to in the KOL Round

(I) Regulatory Dynamics Related to the KOL Round

In China, based on regulations such as the "Advertising Law," "Regulations on the Conduct of Internet Anchors," and the "Guiding Opinions of the State Administration for Market Regulation on Strengthening the Management of Internet Live Broadcasting," traditional KOLs need to clearly disclose their commissioned promotion relationship with the brand in written or video promotions and are subject to related regulations. For example, if a KOL inserts product promotion in a video, they need to label it as an advertisement when releasing the video. However, there is currently no specific legal support for the cryptocurrency industry in China.

In the United States, according to a KOL financing contract revealed by Bloomberg, KOLs who invest at a discounted price must promote the project through long podcasts and TikTok videos, and when promoting the project, they must disclose their relationship with the project.

At the same time, the cryptocurrency promotion by KOLs will also be subject to scrutiny by the U.S. Securities and Exchange Commission. For example, in October 2022, Kim Kardashian was found to have violated relevant regulations in the United States for not disclosing her commission relationship with the project party when promoting a project token, and was subject to scrutiny and charges by the U.S. Securities and Exchange Commission.

However, in practice, it is usually difficult for outsiders to know the relationship between the project party and KOLs and the internal trading patterns. Not all project parties or KOLs will disclose their internal relationships to each other. Therefore, unless there are "informants," relevant departments find it difficult to obtain information about the KOL round and often find it difficult to regulate the KOL round.

(II) Suspected Fraud in False Advertising

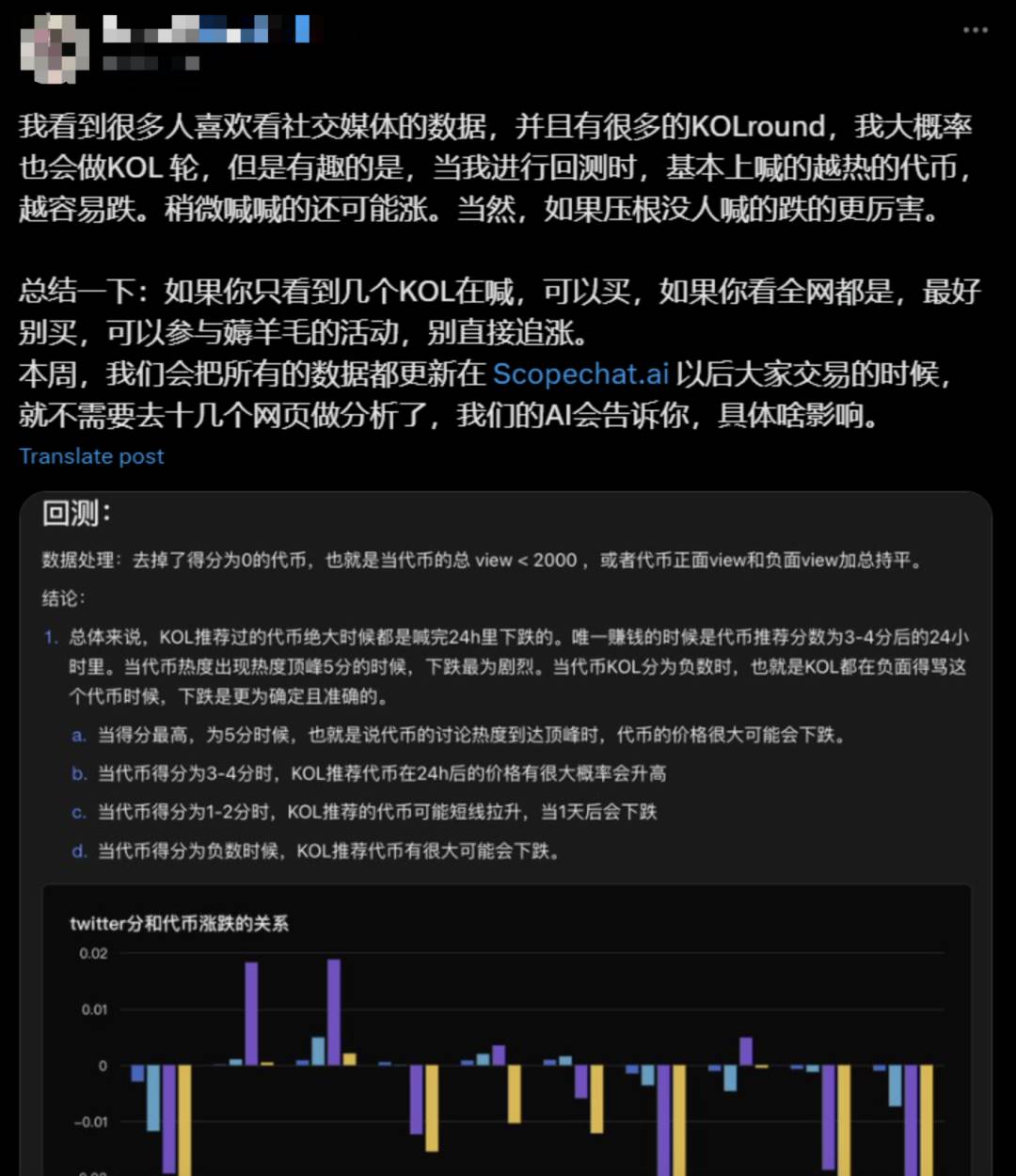

As surfers in Web3.0, many investors are aware that even if KOLs are only paid to advertise and do not participate in project financing, their exaggerated promotion of a project should not be fully trusted. Following this line of thought, once KOLs purchase or intend to purchase project tokens and invest in the project, the truthfulness of the project information they provide becomes even more questionable.

According to some industry insiders, few KOLs can truthfully state their promotions, and their statements often contain vague, ambiguous, or completely false content, intending to induce investors to buy project tokens.

In fact, this half-truth, exaggerated promotion by KOLs poses legal risks of civil fraud or even criminal fraud. According to Article 148 of the "Civil Code," if KOLs' false statements lead investors to have a mistaken understanding and purchase tokens or participate in the project, causing financial losses, then the KOLs' behavior constitutes civil fraud, and investors have the right to claim compensation.

More seriously, if KOLs intentionally misappropriate investors' property illegally and enable the project party to obtain investors' funds through deception, ultimately causing investors to suffer financial losses, then the KOLs' behavior is likely to constitute the crime of fraud as stipulated in Article 266 of the "Criminal Law," and they will bear criminal responsibility.

(III) Risks of Illegal Pyramid Schemes

Based on the previous statement, the cooperation model between KOLs and project parties usually lacks transparency, and the outside world also finds it difficult to know the specific way KOLs obtain project tokens. However, if the token allocation quota of KOLs is linked to the number of successful investors they bring in, and the KOLs promote the project within their paid community, then this practice may be suspected of illegal pyramid selling activities.

From the definition of the crime of organizing and leading pyramid selling activities in Article 224 of China's "Criminal Law," the main elements of pyramid selling in criminal law are: collecting "entry fees" + rewarding based on "headcount" + enticing or coercing participants to continue developing others, forming a hierarchical structure of three levels or more.

Therefore, if KOLs meet these criteria when promoting the project, namely collecting community membership fees, obtaining token rewards based on the number of investors they bring in, and enticing investors to continue developing downlines, forming a hierarchical structure of three levels or more, then the behavior of KOLs may constitute the crime of organizing and leading pyramid selling activities and they will bear criminal responsibility.

(IV) Risk of Being Identified as an Accomplice to a Criminal Offense

Recently, the ZKasino project has sparked widespread attention to the risks of KOL project promotion. In March 2024, the project party released a funding pledge activity.

Multiple KOLs participated in the KOL round financing of ZKasino and promoted the project through channels such as Twitter, cryptocurrency community forums, and offline events, receiving corresponding token rebates and investment discounts.

However, after over a million users participated in bridging over ten thousand ETH, the ZKasino project party unilaterally changed and deleted the official website's activity description, not only failing to return the users' pledged ETH as agreed, but also forcibly converting all of the users' ETH into platform tokens.

This behavior has caused a huge controversy, and some KOLs who participated in financing and promotion of the project were accused of "soft rug" (exit scam) after the project, and faced strong questioning and condemnation from their fans, accusing them of engaging in interest transfer and should bear corresponding criminal responsibility as "accomplices."

Like the KOLs in this incident, many KOLs often consider their promotion of projects and high-selling of project tokens as normal business investment behavior, unrelated to the project party and not responsible to users.

However, what goes up must come down. KOLs can seek benefits from the skyrocketing of project tokens, but there is also a high possibility of being implicated due to problems with the project, facing serious legal risks.

If the project party is deeply involved in criminal activities due to fundraising methods, project content, etc., and KOLs play a significant role in promoting and publicizing the project in question, then according to Article 25 of the "Criminal Law of the People's Republic of China," KOLs are likely to be identified as knowing or should have known the insider information of the project party and face charges from judicial authorities, and bear related responsibilities.

Some experienced KOLs have realized this risk and started taking self-protection measures. For example, KOL 0xKillTheWolf shared on Twitter the reasons for refusing to participate in the ZKasino KOL round, including doubts about the project's valuation, revenue data, and distrust of the founder's character. This cautious attitude is worth emulating by other KOLs.

03 The KOL Round is Not Always Rosy

From the analysis of the legal risks mentioned above, it can be seen that when KOLs participate in the KOL round financing of Web3.0 projects and engage in promotional activities, they should pay attention to the following points to avoid misleading investors and prevent involvement in criminal cases:

Conduct comprehensive due diligence and risk assessment of the project, understand key information such as the operation mode, profit model, development prospects, and potential risks of the project;

When promoting the project, fully disclose their vested interest in the project tokens;

Avoid false promotion of the project and refrain from abusing influence to manipulate the market.

Some KOLs may think that by promoting overseas projects or being involved in overseas projects, they will not be subject to judicial supervision in China. This idea is a bit presumptuous. According to relevant provisions of China's "Criminal Law," as long as the criminal act or result occurs within China's jurisdiction, or the KOL holds Chinese nationality, China has jurisdiction.

Finally, Mankun Law Firm suggests that KOLs in the Web3.0 field should be cautious when conducting any promotion, with a sense of responsibility to investors, in order to exert their professional value as "Key Opinion Leaders" and contribute to the healthy development of the Web3.0 ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。