Title: AICoin: Macro Interpretation and Data Analysis

Macro Interpretation: Last night, the three major US stock indexes rose together, showing a positive trend in the market. Both the S&P and Nasdaq hit historic highs, and Wall Street has also raised its year-end target for the S&P 500. The competition among the three trillion-dollar clubs, Microsoft, Apple, and Nvidia, has intensified. At the same time, the yield on the 10-year US Treasury bonds rose slightly to 4.285%, but the difference in short-term bond yields indicates some market volatility. The VIX panic index saw a slight increase, Brent crude oil prices rose, while spot gold fell slightly to around $2319. The US dollar index has slightly declined, suggesting a relative weakening of demand for the US dollar in the market.

In international politics, Israeli Prime Minister Netanyahu announced the dissolution of the wartime cabinet, and the military claimed to have controlled most of the Rafah area, indicating a gradual stabilization of the regional situation.

In terms of monetary policy, Federal Reserve official Harker stated that there is a possibility of a rate cut before the end of the year, which the market is keeping an eye on. Powell is about to testify on monetary policy in the Senate, and the market is looking forward to his guidance on future monetary policy. In addition, the size of the UK stock market has surpassed that of France, becoming the largest stock market in Europe.

Tonight, it is important to pay attention to key data such as the US retail sales and industrial output rates, as well as speeches by Federal Reserve officials Barkin, Logan, and Kugler, all of which will provide important guidance for the market.

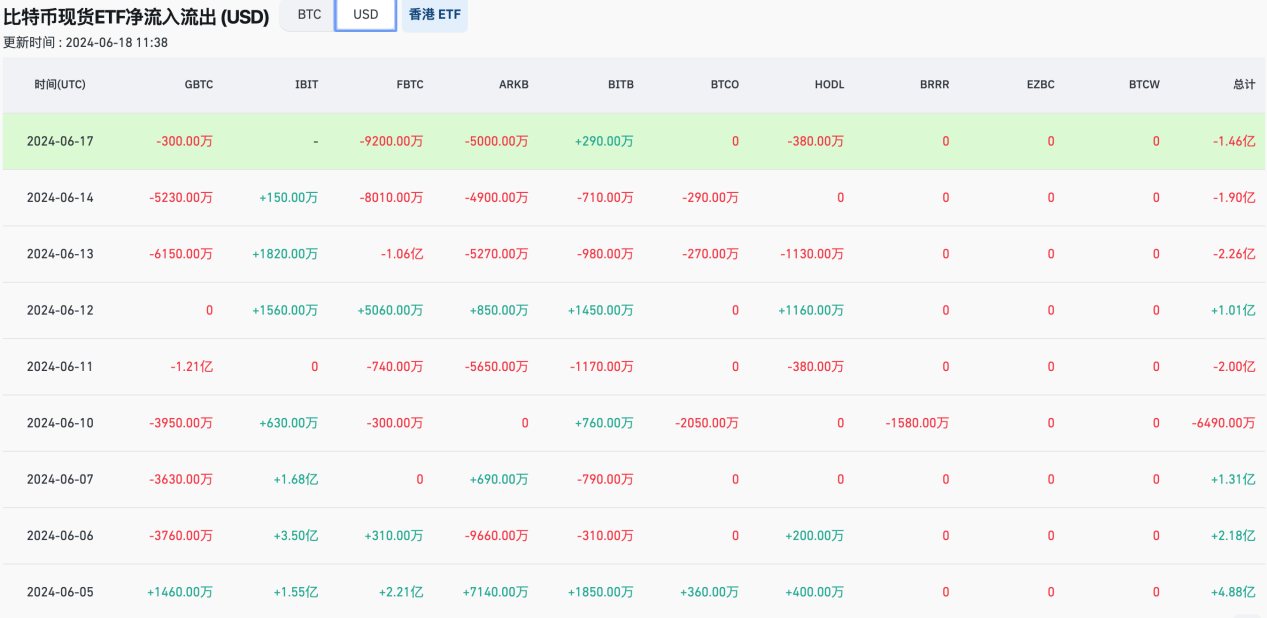

Data Analysis: The net outflow of the US Bitcoin spot ETF was $146 million overnight.

At present, many people may not pay much attention to ETF data, or may be immune to the daily changes in data. However, the current decline in BTC price can be verified from a data perspective. Excluding weekends, since June 13, ETF funds have seen net outflows for three consecutive trading days, even with the GrayScale selling only $3 million. Both Fidelity's FBTC and ARK's ARKB have seen large-scale net outflows.

This indicates that the ETF funds that were bought in the range of roughly $56,500 to $73,000 lack confidence in the future market. In the short term, they have sold ETF shares when the market fell, and the continued selling and outflow of funds have also led to a continued downward trend in the market. As for the possibility of the price stabilizing in the future, the net outflow of ETFs may ease when the price stops falling, or the price may stabilize and rebound when ETF funds turn into net inflows. However, overall, the daily outflow of funds has decreased, which may be a sign of a slowdown in the downward momentum in the future.

Coincidentally, in the afternoon, I also saw some opinions that were consistent with the logic of the ETF fund outflow that I shared in the community at noon. For example, the CEO of Apollo Crypto mentioned that the decline in the crypto market is not clearly related to any catalyst, but may be related to the outflow of funds from the Bitcoin spot ETF.

Regarding the doubts about the media constantly saying that the exchange has reached its lowest historical balance, I explained it today. The exchange balance data currently has some distortion. For example, data such as spot ETFs in various countries will not be included in the exchange balance, but essentially, they are also traded on the secondary market. Just roughly calculated, the current scale of BTC held by spot ETFs exceeds 1 million coins, which is just moving from one pool to another. The exchange BTC balance has been fluctuating around 2 million coins in the past two years, sometimes counting more exchanges, sometimes fewer, with some changes in criteria. With a volume of 1 million BTC in ETFs in the exchange, it already accounts for nearly half of the total volume. Therefore, comprehensive consideration is needed.

I also want to share a research report's viewpoint. 10x Research mentioned that the unlocking of large amounts of altcoins is dragging down Bitcoin. In its market analysis report, 10x stated that last week was one of the most critical weeks for the cryptocurrency market in 2024. In particular, altcoins have seen a significant decline. The market is struggling to absorb a large amount of tokens unlocking, totaling $483 million, including Aptos ($97 million), IMX ($51 million), STRK ($75 million), SEI ($62 million), ARB ($90 million), APE ($18 million), and UNI ($90 million). Early investors and venture capitalists seem to be facing pressure to cash out, and these token flows are dragging down Bitcoin. Bitcoin miners have started selling their Bitcoin inventory, and the ETH balance on exchanges has increased by a significant $2.5 billion, which is related to potential selling pressure. Despite some improvement in inflation data, there has been a large outflow from Bitcoin ETFs (an average of $660 million outflow over 5 days), as the overall net outflow across various areas (stablecoins, futures leverage, ETFs, etc.) amounted to $2.4 billion, marking the third consecutive week of net outflow since the launch of ETFs in January 2024. In addition, as SOL-USDT broke through key trend levels and support lines, SOL may face more downward pressure, with some analysis suggesting it may fall to $100.

In terms of the market, last week and yesterday, I actually wrote a lot of analysis on the weekly, daily, and four-hour charts. The intraday low dropped to the short-term support level near $64,275-$64,600 that I mentioned earlier. This is the initial point of the previous head and shoulders bottom formation and the Fibonacci 50% retracement resonance support level we mentioned last week. Some buying interest appeared at this level in the short term, leaving behind a small to medium-sized lower shadow. However, considering the daily chart pattern and the temporary lack of strong support in the four-hour downtrend channel, as well as the stabilization and reversal signals have not appeared.

Spot Market: Strong currencies to watch intraday include ELF, ORN, and VLX.

Disclaimer: The strategy represents only personal subjective opinions, is for reference only, and does not constitute a basis for trading. Operating based on this information is at your own risk.

Follow us: AICoin

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。