Hello everyone, I am your friend Lao Cui Shuo Bi, focusing on the analysis of digital currency market trends, striving to deliver the most valuable market information to the majority of coin friends. Welcome the attention and likes of the majority of coin friends, and refuse any market smokescreen!

The recent decline has left many users at a loss. Lao Cui took some time yesterday to look at the overall data and also reviewed the opinions of various analysts. The overall market behavior has left not only coin friends at a loss, but even institutions and platforms are unable to understand. In terms of the amount of funds, there has been almost no significant action. Why has this led to a relatively large decline in this round of the market? Everyone has overlooked the overall financial market. Since June, the most heated signal in the financial market has been the interest rate cuts in Europe, and the US has also shown signs of interest rate cuts, causing everyone to forget about several other important matters in the coin circle.

The first and foremost is the opening of the European Cup, which can be said to have attracted a large number of gamblers from the coin circle to try their luck, and the largest component of the coin circle is gamblers. Rational and clear-headed users are still in the minority. Especially the old capital in Europe and the United States, they prefer traditional methods, which are easier to profit from (compared to the coin circle) and the results are mostly within a controllable range. There will inevitably be a competitive relationship between markets, and this round of competition has temporarily been unable to boost the coin circle. Secondly, everyone can pay attention to the US stock market. The performance of tech giants in the recent period has been extremely eye-catching, and behind this intense growth is actually the interest rate cuts in Europe. The interest rate cuts in Europe have unexpectedly led to a two-point drop in their own economy, although there has been some recovery. But the overall result is indeed unexpected, with a decline instead of an increase. This is almost identical to the interest rate cuts in Japan. In such a difficult situation, effective measures have not been taken to prevent it. The reasons for this can be pondered by everyone.

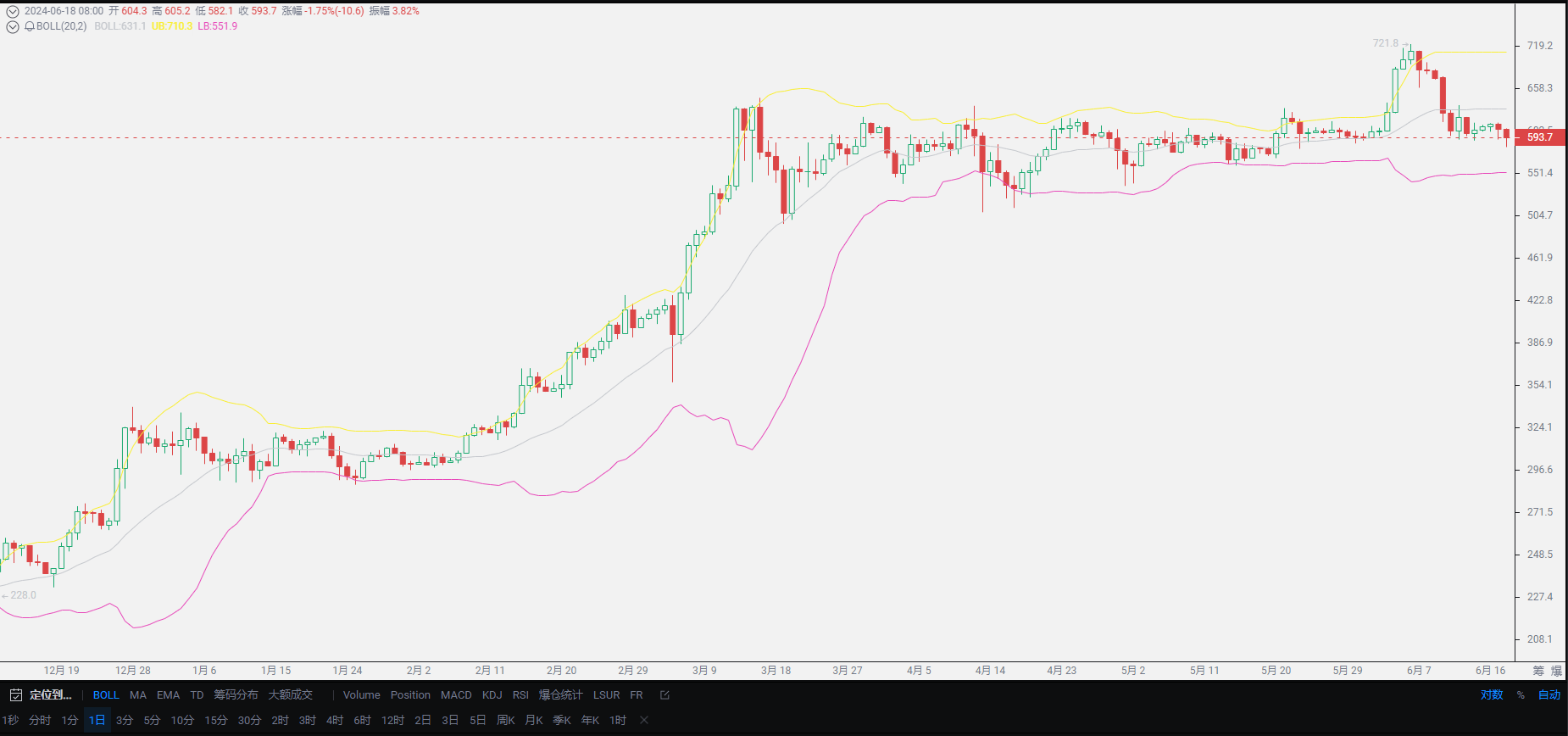

The factors that can affect the entire coin circle economy are nothing more than the US stock market, the US dollar exchange rate, and the trend of gold, and finally the performance of other markets. Among them, the performance of the US stock market is almost completely contrary to that of other markets. The tech industry in the US stock market is booming, while the performance of other markets is basically downward. Only the trend of the US dollar exchange rate and gold remains. Everyone can take a look at the overall performance of gold. Since the beginning of this year, the performance of gold has basically been like a cliff in the financial market. It is not an exaggeration to call it the leader. The end of the war's impact is also the silence of the gold market. There has been no decline, but it is very difficult to maintain the overall operation at the moment. In the second half of the year, without an escalation of the war, it is difficult to break through the existing balance. Retail investors will not sell, and capital will not tolerate a decline. The gold market can basically be ignored.

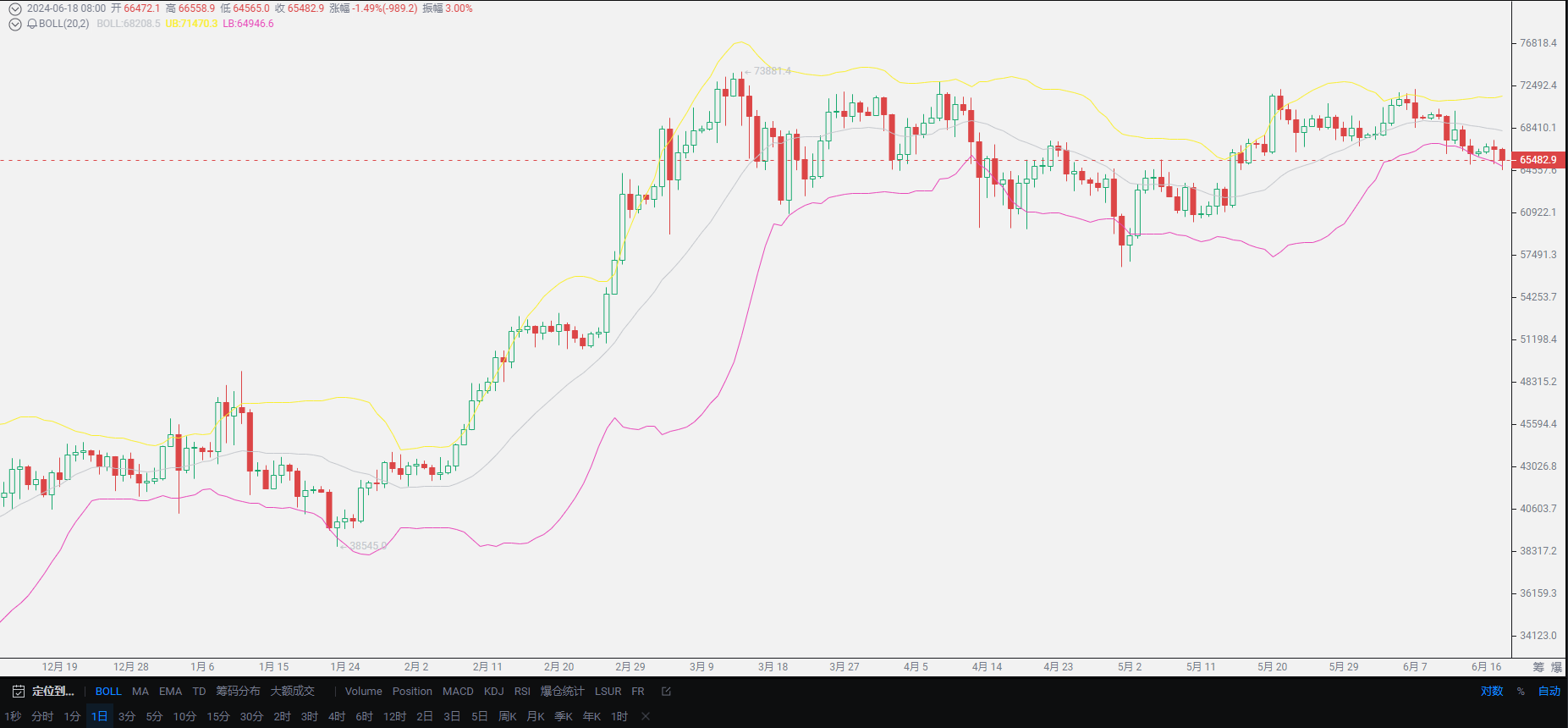

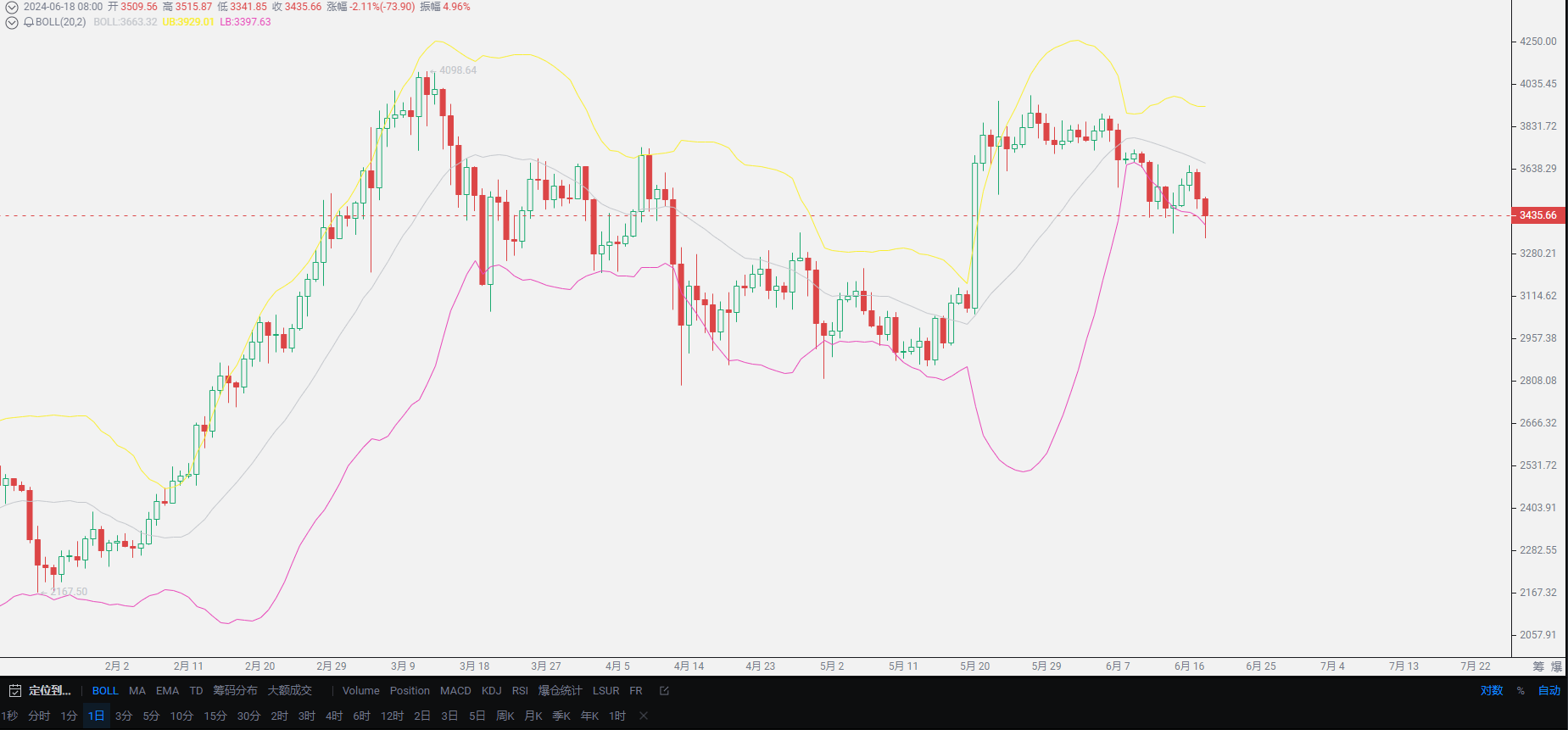

Finally, there is the issue of the US dollar exchange rate. The interest rate cuts in Europe have indeed given the US a breather. This is very easy to understand. The question raised earlier is why the US tech industry has shown signs of ignition after the interest rate cuts. This is also beyond doubt. It is definitely the flow of funds from Europe, most of which have converged on the US side. There is a possibility of a delay in the interest rate cuts, but it does not mean that there will be no interest rate cuts this year. This situation will definitely occur this year, and there is no need to discuss this further. The influx of funds will inevitably lead to a revaluation of the US dollar, and the price of USDT will follow suit. Lao Cui has seen it return to around 7.28 at its highest point. As long as the exchange rate touches around 7.3, it is probably still necessary for Ethereum and Bitcoin to recover to their previous highs. So for users who want to be bullish in the coin circle, there is still a chance for a rebound of one or two hundred. With the support of traditional capital, there will not be a one-sided market. There will definitely be downward trends.

Lao Cui's conclusion: Considering the above, the current trend in the coin circle is very unfavorable, and it is basically dominated by a bearish trend. Users who are trapped in long positions should try to seize the trend of rebounds to get out of the trap. If there is profit, be sure to exit in a timely manner. Don't think that one trade can solve all your troubles. Try to be as rational as possible. The same goes for those in short positions. Try to take profits and be safe. For the later period, there will not be too much room for downward movement. Due to the impact of interest rate cuts and listings, the market will definitely rise again. For spot users, there is no need to explain too much. At the current stage, it is possible to enter and wait at the macro level. As long as there is a decline, enter the market directly at the moment, and wait for the right time. Ethereum's 4000 and Bitcoin's 70,000 will definitely come. At the current stage, you can enter in batches. For contract users, they are currently in a short position and can set up an ambush for the trend (just follow the trend).

Original article created by public account: Lao Cui Shuo Bi. For assistance, you can contact directly.

Lao Cui's message: Investment is like playing chess. Masters can see five steps, seven steps, or even a dozen steps ahead, while those with lower skills can only see two or three steps. The high-level players consider the overall situation and plan for the general trend, not focusing on every single move, but aiming for the ultimate victory. The lower-level players fight for every inch, frequently switching between long and short positions, only fighting for short-term gains, and as a result, they frequently get trapped.

This material is for learning and reference only and does not constitute investment advice. If you buy or sell based on this, you do so at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。