The world is bustling, all for profit; the world is often moving, all for profit! Hello everyone, I am your friend Lao Cui Shuobi, focusing on the analysis of digital currency market trends, striving to convey the most valuable market information to the majority of coin friends, welcome the attention and likes of the majority of coin friends, and refuse any market smoke bombs!

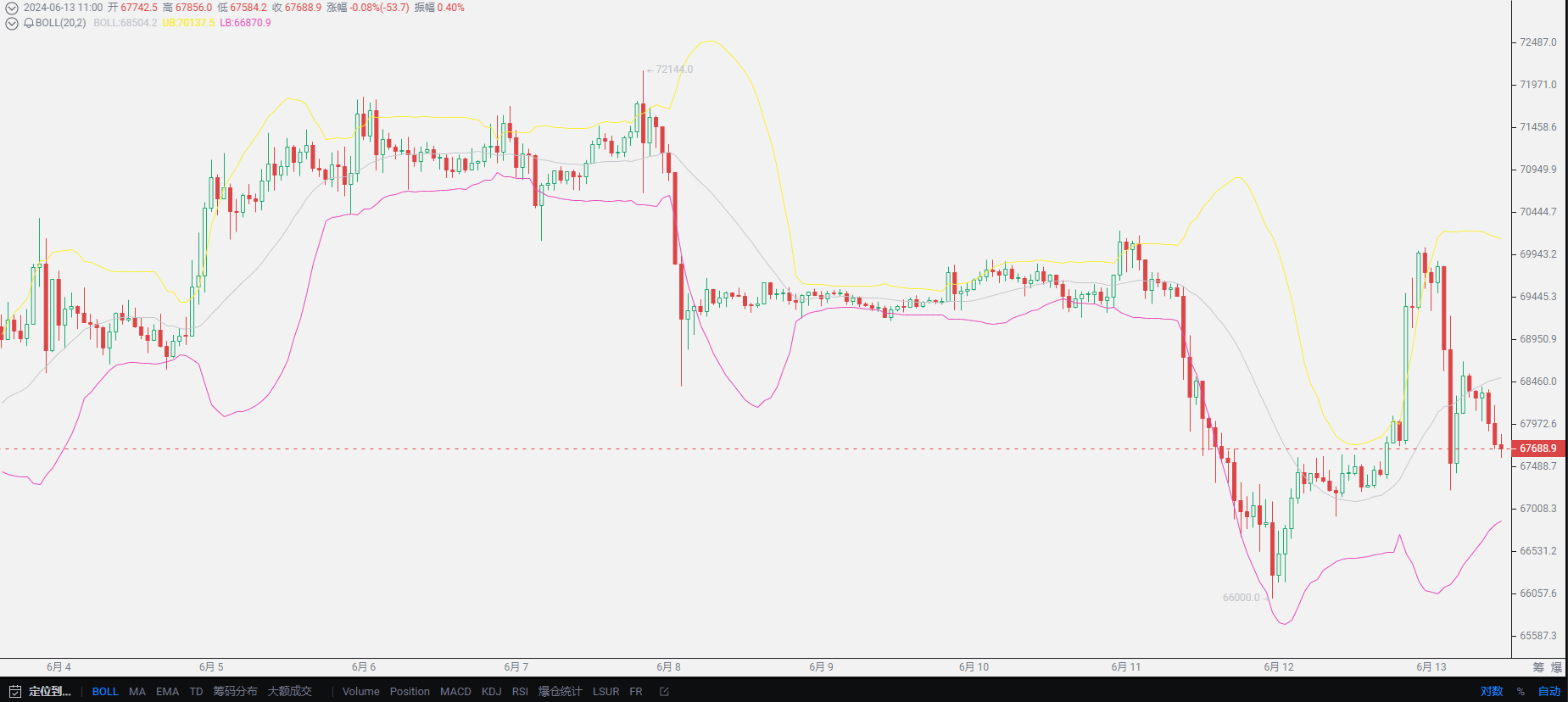

The market continues to decline, and everyone is gradually becoming restless. Today, let me explain the recent trends in detail to avoid any disturbances. First of all, as usual, let's start with the exchange rate. Currently, the US dollar price has risen from 7.18 to around 7.25, followed by a short-term reversal of the market. In Lao Cui's eyes, this is not really a reversal, but more of a pullback. Everyone's expectations for the coin circle are somewhat high, whether it's Ethereum or Bitcoin, it can be said that there have been behaviors reaching high points in the short term. Overall, the performance in all financial markets is still outstanding. Previous articles have mentioned the rise in exchange rates, for those who do not understand, you can take a look at Lao Cui's previous detailed explanations. The rise in exchange rates and the overall decline in the financial market are inevitable results.

Returning to the traditional economic level, the overall traditional economy is still in a downward phase, and the recovery effect also requires the injection of liquidity by the United States to gradually show. Last night was another thrilling night, coinciding with the CPI and the Federal Reserve's interest rate decision, both of which control the short-term trend and long-term trend, respectively. Looking at the overall trend of the past two days, what the coin circle is showing seems to indicate that the later results may not be as expected. We won't speculate too much on this point, everything is waiting for the presentation of the later trend results. The Fed's forecast brings the rate cut back to September, and the second half of the year will inevitably create historical highs in the coin circle. Due to Lao Cui's excessive talk, everyone has overlooked the most important point at present, that is, the global economy is still in a downward state, not the so-called bull market stage that everyone thinks, although it is indeed a small bull market in the coin circle this year. But looking at the global economic market, it is still in a phase of downward recovery, which is also a problem caused by multifaceted influences.

Today, Lao Cui will focus on how to deal with the situation under the economic downturn. An economic downturn does not mean that everyone cannot make money. It also creates a group of epoch-making figures and represents the emergence of opportunities. The end of the housing bubble era in the United States has led to the brilliance of the Internet, and also the emergence of a series of high-tech companies such as Apple, Google, and Facebook. The era will not stop progressing because of the decline of a certain industry, and the coin circle has shown its potential in this regard. In the state of economic downturn, the performance of the coin circle this year is completely contrary to the overall economic trend. The coin circle may become the next trend. You will find that blockchain is present in all current high-tech products, and the coin circle will almost appear in the strategic aspects of artificial intelligence and various countries. From this trend, the existence of the coin circle is still crucial.

Regarding the current economic trend, why has this situation arisen? Lao Cui summed it up overall. First of all, it is the interest rate hike in the United States, severe capital outflows, RMB depreciation, stock market volatility, negative export growth leading to weak investment, overcapacity, weak real economy, and a sharp drop in bulk commodities (only referring to the domestic market), causing entrepreneurs to lack confidence, slowing down the economies of emerging countries, and the environmental capacity has also reached its limit, with increasingly severe smog. In summary, no industry feels that it is doing well. Combining the above, the first problem to be solved is the interest rate hike in the United States, which has already shown a trend of rate cuts this year. However, other aspects have not been effectively resolved, and even alleviated strategies have not been implemented. On the financial crisis front, it is also the first time in human history to face such a great impact, so there is no need to ask Lao Cui when things will return to normal, as Lao Cui currently does not have the ability to predict this.

Why does Bitcoin's performance this year show a trend of progress instead? Most users may attribute the reason to the impact at the listing level. Although Lao Cui agrees with this view, he does not blindly follow it. In Lao Cui's view, it is the impact at the war level that has affected the economic level. For example, the United States freezing Russia's overseas assets has caused Russia to use the coin circle channel to transfer assets back to the country. This also applies to some capital operation methods in our country. It can be said that under the influence of all current war situations, the coin circle has a presence, without discussing the political impact, only discussing the strengths of the coin circle at this time, which are unique attributes that all financial markets cannot possess, and this is the value of the coin circle's existence. Through this operation in our country, it can be said that it has helped many capital to escape from domestic supervision in the short term, although it has made the coin circle brilliant, it is not a good thing in the long run.

Lao Cui's conclusion: Ultimately, we return to the current trend. Last night's decision was very favorable for the financial level. With the recent micro-manipulations by the United States, Lao Cui is no longer concerned about the interest rate reduction at the meeting level. The recent remarks by the United States seem to have a deep meaning of being guided by experts. In the past, interest rate cuts were basically in line with the European level, and one meeting solved all the troubles. However, this round of interest rate cuts is a process that everyone cannot predict, and the internal struggle over whether to cut interest rates and when to cut interest rates is also very intense. It can be said that they have not formed a unified view internally, giving us the feeling that it is uncertain, and even slightly favorable news may delay their decision to cut interest rates. The only certainty is that there will definitely be an interest rate cut this year, so unless the United States determines when to cut interest rates, we can only obtain long-term benefits at the meeting level. In summary, the timing of interest rate cuts still affects whether the bull market can truly arrive, and these two are definitely linked. Only an interest rate cut will make the US dollar exchange rate decline, at least breaking through the 7 mark is achievable. I remind everyone, as good as shorting may seem, do not be greedy!

Original article created by public account: Lao Cui Shuobi. For assistance, you can contact directly.

Lao Cui's message: Investment is like playing chess. Masters can see five steps, seven steps, or even a dozen steps ahead, while those with lower skills can only see two or three steps. The high-level players consider the overall situation, plan for the general trend, and do not focus on individual moves and territories, but aim for the ultimate victory. The lower-level players fight for every inch, frequently switching between long and short positions, only fighting for short-term gains, and frequently end up in trouble.

This material is for study and reference only and does not constitute investment advice. Buying and selling based on this material is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。