Recently, the leading Web3 toolbox PandaTool in the industry announced that it has launched the Raydium V3 market value management tool, which has left many confused: what exactly is V3? As a popular decentralized finance (DeFi) platform, why does Raydium want to introduce V3? What are the features of Raydium V3 compared to V2?

This article will explore the differences between Raydium V2 and V3, and address related issues such as trading in pools on V3.

What is Raydium V3?

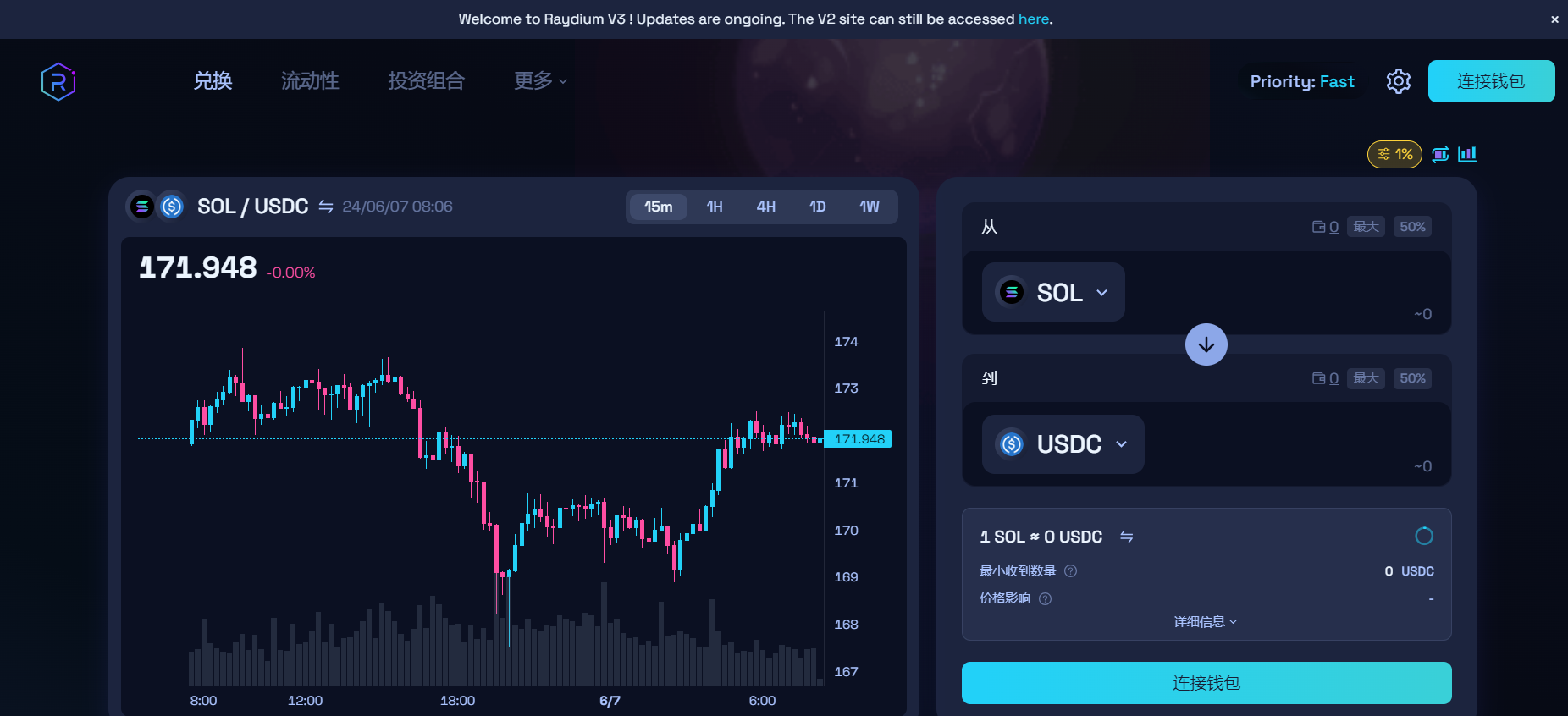

Those who have used Raydium know that its front end is very laggy. When the user volume surges, it is impossible to effectively trade and create liquidity. Based on this, Raydium V3 introduces a new user interface (UI) and a new standard liquidity pool protocol called CPMM. This is an improvement over the old AMM protocol used in V2, aimed at creating a more efficient and cost-effective liquidity provision method.

Advantages of Raydium V3

Improved Protocol: The CPMM protocol in version 3 allows for the creation of cheaper and more efficient liquidity pools.

Lower Costs: Creating V3 liquidity pools is simpler and no longer requires an OpenBook ID, eliminating the expense of an ID fee.

Reduced Expenses: Creating liquidity in Raydium V2 requires a fee of 0.4 SOL. In V3, this cost is only 0.15 to 0.2 SOL, reducing the cost by half.

Convenient Operation: Compared to Raydium V2, V3 is the default liquidity tool recommended by Raydium's official website, making it operable directly from the official website without needing to go through the V2 page.

Disadvantages of Raydium V3

Despite having many promising features, Raydium V3 still faces some challenges that may affect its immediate adoption, which are its disadvantages:

Indexing Issues: Raydium V3 has indexing issues on platforms such as DexScreener and AVE, reducing visibility for traders.

Low Trading Volume: The trading volume of the new protocol is significantly lower than that of Raydium V2, affecting its liquidity and attractiveness.

Trading Delays: Initial trades experience delays, which may hinder early trading activity and volume generation.

Raydium V3 Token Market Value Management

After creating tokens through PandaTool and adding liquidity to V3, we discovered a problem: there is a 40-minute delay in trading, which is not common on other exchanges.

To address this, we need to use the Solana market value management tool developed by PandaTool for trading: https://solana.pandatool.org/swapbot.

In simple terms, the Solana market value management robot is a system that supports automatic and batch trading for Raydium V3, allowing buying and selling based on preset target prices.

Summary of Raydium V3

Raydium V3 has the potential to revolutionize DeFi liquidity provision through its new CPMM protocol and cost-effective features. However, until the indexing and visibility issues are resolved, Raydium V2 remains the safer and more effective choice for token issuance. Leveraging the existing infrastructure of V2 helps ensure higher market capitalization and trading volume, laying a solid foundation for your token issuance.

It is important to note that Raydium V3 is currently only a test version. Once all issues are resolved, V3 may become a true liquidity monster. If you have created a pool on V3 but are unable to trade, the PandaTool market value robot will be your best choice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。