Immortals fight, mortals suffer. The financial market is facing geopolitical risks, and the currency war continues. The largest bank in the United States, JPMorgan Chase, is shorting gold in an attempt to boost the US dollar to maintain its financial hegemony. It is reported that JPMorgan Chase, with a triple leverage, has opened a trillion-dollar gold futures short position, a scale that is even twice the current gold reserves of the United States. Global buyers, including China, have not stopped buying gold. This puts JPMorgan Chase in a dilemma. If gold continues to rise, it will create unprecedented pressure on JPMorgan Chase. When they are unable to fulfill all the short contracts, the largest bank in the United States will be on the verge of bankruptcy…

The US dollar index fell below the half-year rising channel three days later and then rebounded with great force. Stocks, gold, and cryptocurrencies all fell. At the same time, Bitcoin surged to 72000 and then failed, falling back. It also fell below the daily rising trend line and MA20 in the morning, and the reminder last night was to reduce positions if the rebound failed to break through 70300, with the lowest point at 67600, and Ethereum at 3533.

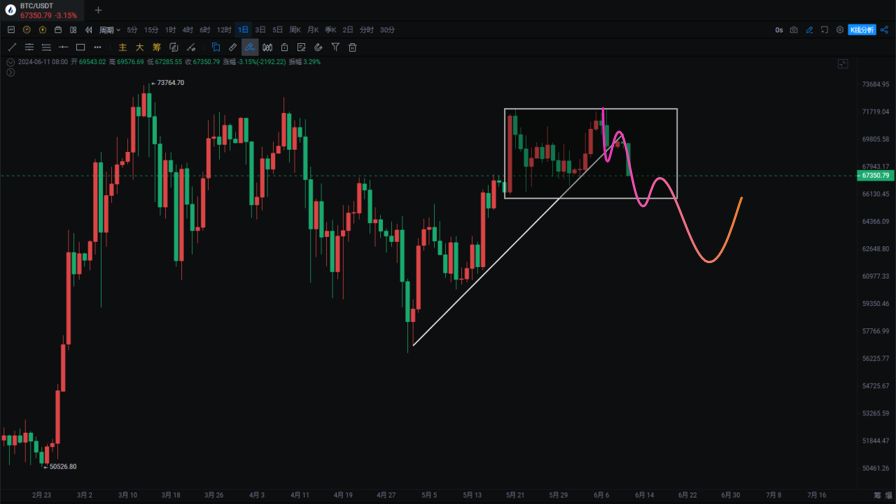

Bitcoin The daily descending flag pattern is firmly suppressed, failing to break through the upper line after three attempts, and the morning rising trend line and MA20 have been broken. Currently, the bulls can only hope for support at the bottom of the large bullish candle on May 20th, as well as the support of MA60 and MA120. Caution is advised, and those who operate cautiously should wait for a breakthrough and stabilization above 74000 before re-entering. If it continues to fall below, there is a risk of a sharp decline. (Internal reminder: reduce positions if the rebound fails to break through 70300)

Two possibilities: According to the continuation of the descending flag pattern, the future is very pessimistic.

We also previously predicted two perfect bullish bat patterns, with the bat falling to 53000-56000, hitting a low of 56552 and rebounding, and then warned of a bearish bat pattern hitting 71000-72000, which also came true. If all the bullish supports I mentioned earlier fail, the perfect bullish bat pattern will be at 42000-44000 (black swan event).

Support: Resistance:

Ethereum Ethereum has broken through the rising flag pattern and also broken through the support at 3678, falling to 3533 near the previous bottom support. The next support is at 3365-3400. Three Ethereum fund-related addresses have sold a large amount of ETH in the past week, and Bitcoin ETF has seen outflows for the first time after 19 days of net inflows. In any case, the bottom of the explosive rally on May 20th must not be broken, otherwise the possibility of a bull market ending. A bunch of altcoins are at the bottom, and once they break, it is unknown whether there will be a bull market in the second half of the year or if it will be postponed to next year. This wave of Bitcoin and Ethereum pulling back near the previous high has only been followed by a few strong altcoins, and most of those who are trapped have not recovered their losses.

Support: Resistance:

If you like my views, please like, comment, and share. Let's go through the bull and bear markets together!!!

The article is time-sensitive and is for reference only, with real-time updates.

Focus on candlestick technical research, win-win global investment opportunities. WeChat public account: 交易公子扶苏

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。