Last week, the European Central Bank announced a 25 basis point rate cut. Essentially, the tightening cycle of European monetary policy has ended, and an easing cycle has begun.

➤ Impact on the US Dollar Index

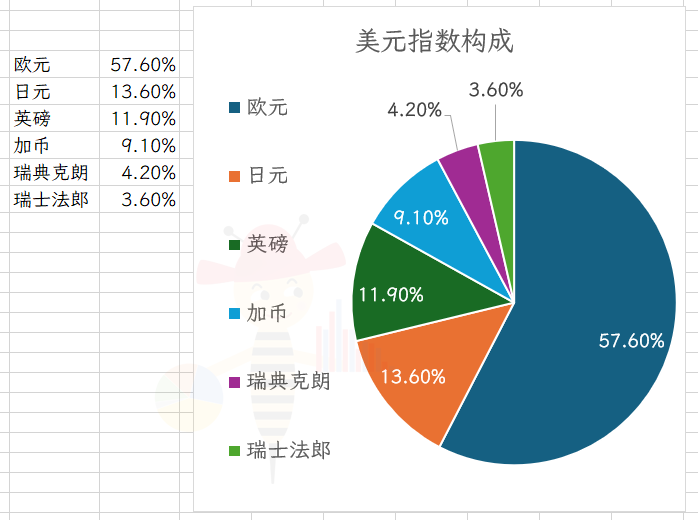

In the calculation of the US Dollar Index, the euro accounts for 57.6%, followed by the yen at 13.6% and the pound at 11.9%.

The yen is in a serious devaluation state. The Bank of England is expected to announce a rate cut this month as well.

This means that there is a high probability of a temporary rise in the US Dollar Index before the Fed cuts interest rates.

During most of the time, BTC has exhibited inverse fluctuations with the US Dollar Index.

Brother Feng created a line chart using the logarithm of the prices of the US Dollar Index, BTC, and ETH. The coordinates for the US Dollar Index are on the right, while those for BTC and ETH are on the left.

It can be seen that, firstly, BTC and ETH mostly exhibit inverse fluctuations with the US Dollar Index. Secondly, during the rise of the US Dollar Index, the retracement of ETH was more pronounced in the first two instances. However, in the last instance, which is this year, when the US Dollar Index rose, the retracement of ETH and BTC was not significantly different. After all, the market has already priced in the ETF for ETH.

Summary: From the perspective of the US Dollar Index, an increase in the US Dollar Index is bearish for cryptocurrencies. However, due to the influence of ETFs, the retracement space for BTC and ETH is limited, but other altcoins may experience relatively significant declines.

➤ Impact on US Stocks

The US has maintained its interest rates, and the balance sheet reduction is still ongoing. With the rate cut in Europe, hot money may flow into the US investment market, leading to a potential rise in US stocks.

BTC has exhibited a certain degree of synchronous fluctuations with US stocks. However, with hot money chasing after US assets, there may be more interest in BTC ETFs on US stock exchanges.

Summary: From the perspective of US stocks, the rate cut in Europe may be beneficial for BTC.

➤ Impact on the Fed's Interest Rate Cut Decision

The appreciation of the US dollar and the depreciation of the euro are favorable for US imports but unfavorable for exports.

In the short term, a depreciation of the US dollar is beneficial for imports, and the total amount of US imports from Europe is not low (approximately around 10%), leading to a decrease in import prices, which is favorable for reducing the US inflation rate.

However, if the exchange rate of the US dollar against the euro continues to rise, it will have a significant impact on export enterprises, which will affect the US economy and employment. (In fact, from the second half of 2023 to the present day, the US Dollar Index has shown an overall upward trend, and the unemployment rate has also increased to some extent.)

Therefore, the rate cut in Europe also puts some pressure on the Federal Reserve.

Brother Feng overlaid two charts of the Federal Funds Rate of the Federal Reserve and the European interest rates adjusted by time and rate.

The US started raising interest rates in March 2022, while Europe began raising interest rates in July 2022.

In June 2024, Europe began cutting interest rates, so optimistically, there is a high probability that the Federal Reserve will announce a rate cut in September.

Looking back at the dot plot from December 2023, there is a relatively high probability (albeit not very obvious) of three rate cuts in 2024, starting in September 2024. By March 2024, the dot plot of the Federal Reserve officials shows a high probability of three rate cuts in 2024 (with a cut in September).

Summary: The time for the Federal Reserve to maintain high interest rates is probably limited. It is optimistic to expect an announcement of a rate cut in September. Pessimistically, it is also possible for a rate cut to be announced on November 8, the day of the FOMC meeting after the November 5 election, and the probability of a rate cut in December may be relatively low.

➤ Conclusion

Against the backdrop of the rate cut in Europe, the US Dollar Index may have a bearish impact on BTC, while US stocks may have a bullish impact on BTC. When these two factors are combined, BTC may not exhibit a very clear trend. (Note: The probability of a bearish impact is greater. Since January 21, 2018, based on weekly opening prices, BTC has a 58% probability of exhibiting inverse fluctuations with the US Dollar Index and a 51% probability of exhibiting synchronous fluctuations with the Nasdaq.)

ETH may be slightly weaker than BTC, but the probability of a downturn in altcoins may be higher.

In addition, on June 13, the Federal Reserve will release a new dot plot, and whether the Federal Reserve will adopt a dovish or hawkish stance will affect market sentiment.

It can be confirmed that the balance sheet reduction will be announced in June.

What is uncertain is the prediction for the rate cut.

The focus is on when the balance sheet reduction will stop. It is possible that the reduction will stop at the same time as the rate cut, or the reduction will stop first before the rate cut. However, the rate cut is unlikely to happen before the reduction stops.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。