Author: AiYing Compliance

Web3 technology is rapidly developing globally and has attracted widespread attention. Governments, enterprises, and developers around the world are actively exploring and promoting the application of Web3. For example, cryptocurrencies and decentralized finance (DeFi) have become important innovations in the financial field, while NFTs (non-fungible tokens) have shown great potential in the arts and entertainment industries. Web3 has not only brought technological innovation but also profound economic and social impacts, driving the development of the digital economy and the transformation of the global economic structure.

In Southeast Asia, Thailand stands out as a leader in the Web3 market. Thailand has a sound digital asset regulatory system, active market participants, and strong technological and financial infrastructure. This has positioned Thailand at the forefront of Web3 technology adoption and innovation in the region. Particularly in the areas of blockchain applications, cryptocurrency trading, and decentralized finance, Thailand has demonstrated significant potential and competitiveness.

Aiying aims to summarize the current situation, challenges, and opportunities of the Web3 market in Thailand through this Tiger Research report, revealing Thailand's core advantages and development prospects in this emerging field. By studying Thailand's regulatory environment, market participation, and specific measures taken by enterprises and developers, the report aims to help understand how Thailand is rising in the wave of Web3 and explore its future development path. It is hoped that the analysis and interpretation of this report will provide valuable references and insights for policymakers, business decision-makers, and industry participants.

I. Thailand's Web3 Market

Political Background

Despite a complex political environment, the Thai government has shown a positive attitude towards digital assets and blockchain technology. The government's pro-cryptocurrency policies and support for Web3 technology have provided a favorable political environment for the development of Thailand's Web3 market. For example, the Securities and Exchange Commission of Thailand (SEC) and the Bank of Thailand (BOT) respectively introduced a series of regulatory measures in 2018 and 2021 to regulate and promote the development of cryptocurrencies and related businesses. These measures provide legal protection and a clear regulatory framework for the application of Web3 technology in Thailand, helping to attract domestic and foreign enterprises and investors.

Economic Background

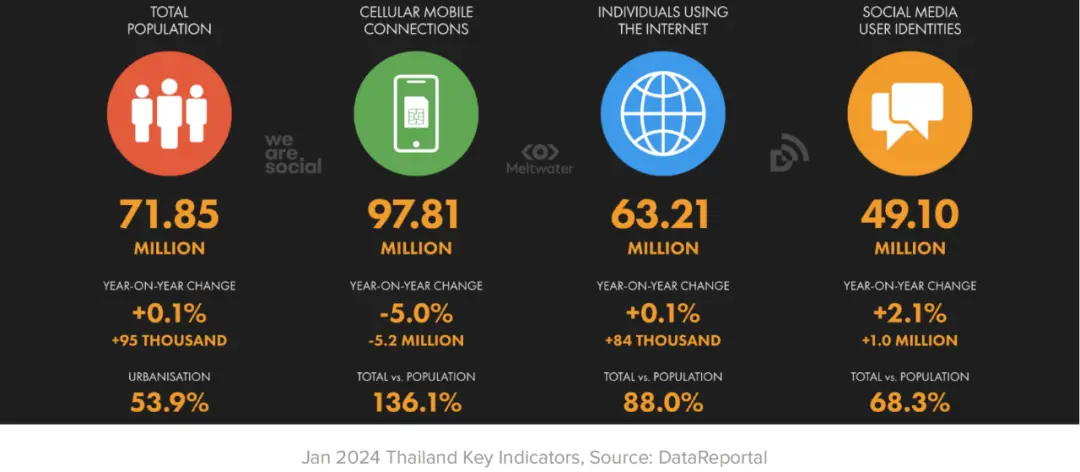

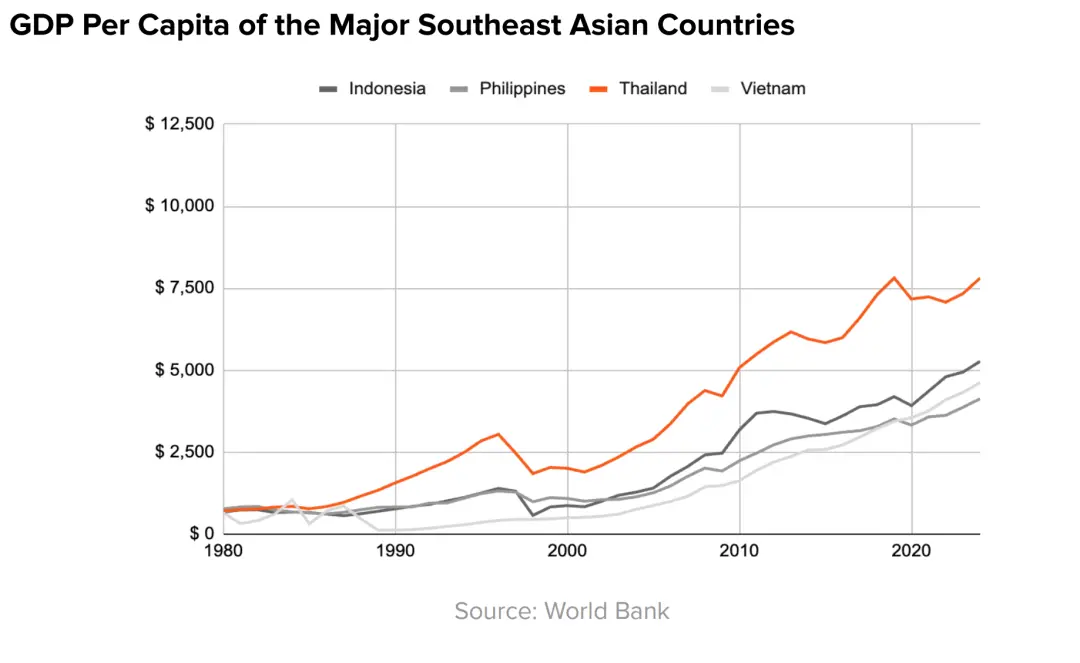

Thailand is one of the important economies in Southeast Asia, known as the "New Tiger of Asia." According to data from 2023, Thailand's GDP reached 512.2 billion US dollars, making it the second-largest economy in Southeast Asia, second only to Indonesia. Thailand ranks second in per capita GDP among Southeast Asian countries, second only to Singapore. However, Thailand also faces some economic challenges, such as political instability, an aging population, and income inequality.

Nevertheless, Thailand has shown tremendous potential in the digital economy field. The Thai government is actively promoting digital transformation, hoping to achieve economic growth through the development of Web3 technology and the digital asset market. Especially during the pandemic, there has been a significant increase in demand for the digital economy and online services, creating new opportunities for the application of Web3 technology.

II. Regulatory Framework

1. Thailand's Digital Asset Regulatory System

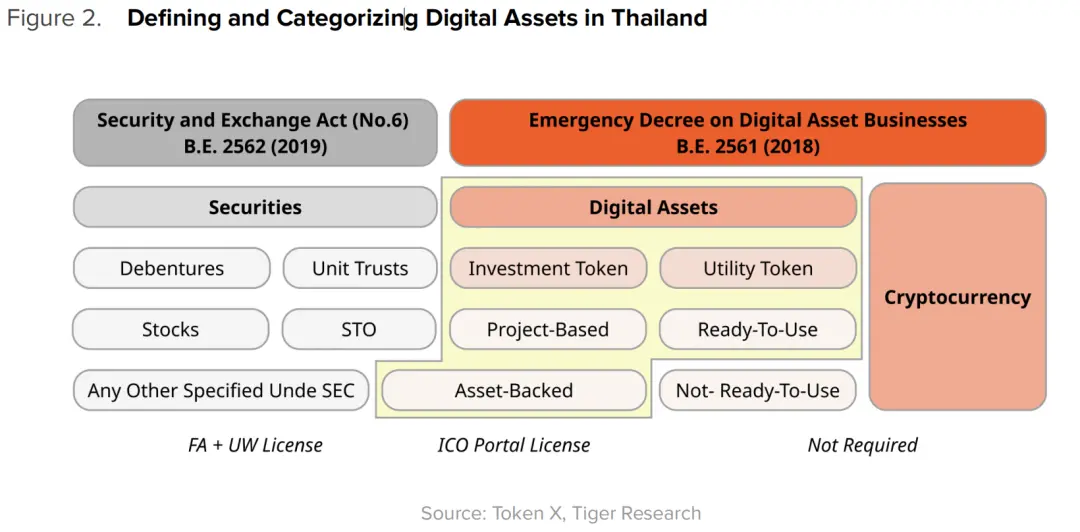

Thailand's digital asset regulatory system is one of the most comprehensive and systematic in Southeast Asia. The establishment of its regulatory framework began in 2018 when the Thai government issued the "Emergency Decree on Digital Asset Businesses B.E. 2561." This decree marked an important step for Thailand in the regulation of digital assets and blockchain technology, making it the first country in Asia to systematically regulate ICOs and other digital asset businesses.

2. Implementation of the 2018 Emergency Decree

In May 2018, the Thai government issued the "Emergency Decree on Digital Asset Businesses B.E. 2561." This decree mainly covers the following aspects:

- Definition and classification of digital assets: Digital assets are divided into two categories: cryptocurrencies and digital tokens. Cryptocurrencies such as Bitcoin and Ethereum are defined as "electronic information units issued based on distributed ledger technology (DLT)." Digital tokens are defined as "virtual assets representing specific blockchain project rights."

- Regulatory authority: The Securities and Exchange Commission of Thailand (SEC) is empowered to regulate the digital asset market, responsible for approving and supervising digital asset exchanges, brokers, dealers, and other related businesses.

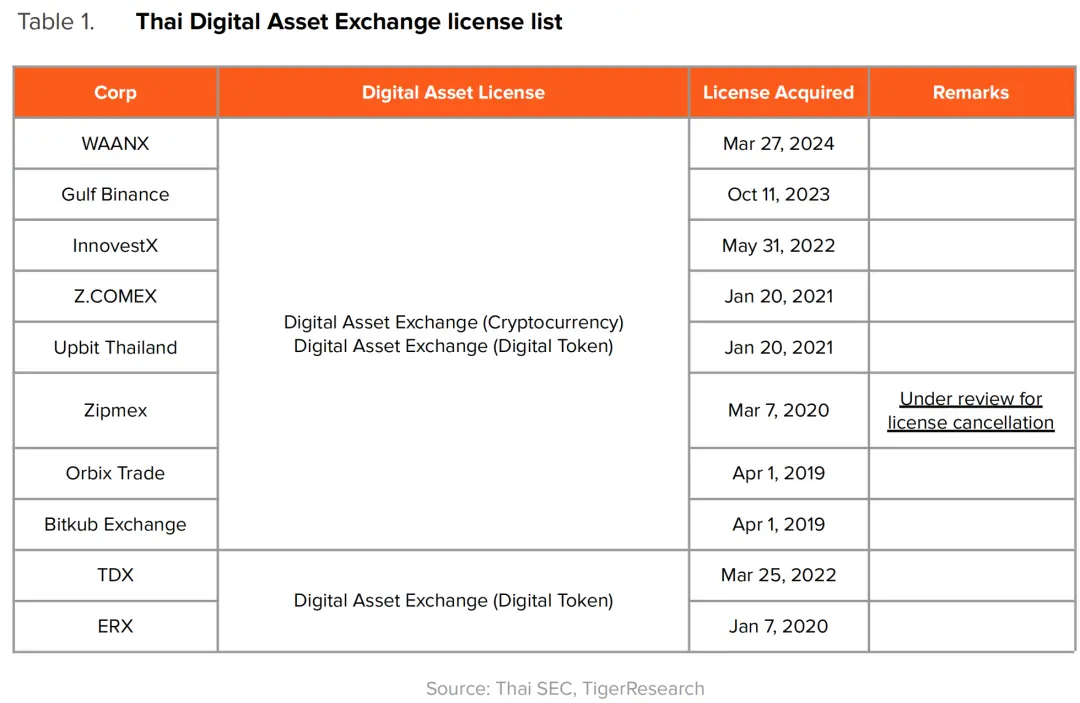

- Licensing system: The decree requires all businesses involving digital assets to obtain a license from the Thai SEC, including digital asset exchanges, brokers, dealers, ICO issuers, and ICO platforms.

3. Licensing Application Requirements and Their Impact

Exchange License:

- Application conditions: Digital asset exchanges must be registered in Thailand, with a minimum capital requirement of 50 million baht (approximately 1.35 million US dollars). In addition, exchanges must ensure the security of client assets, with over 90% of assets stored in cold wallets.

- Operational standards: Exchanges must comply with anti-money laundering (AML) and know your customer (KYC) regulations to ensure transparent and compliant trading.

- Impact: This regulatory measure has increased market transparency and security, attracting more investors and institutions to participate, laying the foundation for the healthy development of Thailand's digital asset market.

Digital Asset Brokers and Dealers:

- Brokers: Must be registered in Thailand, with a minimum capital requirement of 25 million baht (approximately 675,000 US dollars), and cannot aggregate client orders into their own accounts.

- Dealers: Minimum capital requirement of 5 million baht (approximately 135,000 US dollars), mainly targeting professional investors.

- Impact: By clarifying the responsibilities and requirements of brokers and dealers, the Thai SEC has effectively regulated market behavior, preventing market manipulation and other improper activities.

4. Regulatory Measures for ICOs and Their Impact

ICO Issuance:

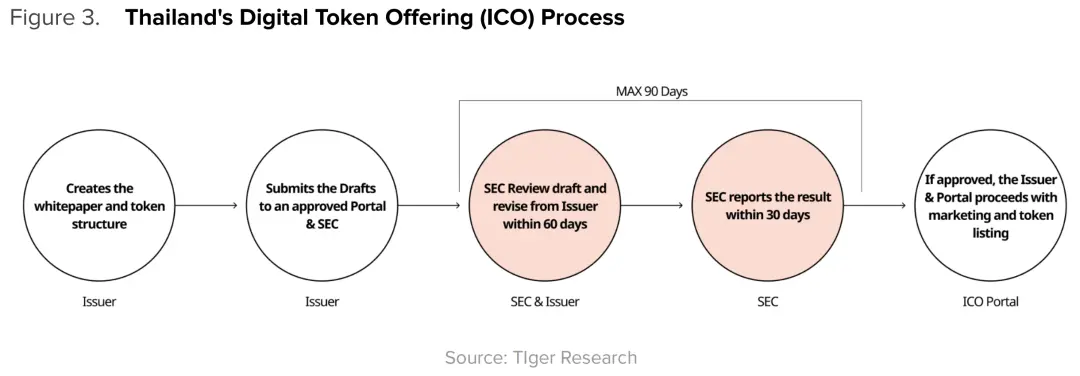

- Approval process: ICO issuance requires preliminary review by ICO platforms and submission of a registration statement to the Thai SEC, including a business plan, white paper, fund usage, and financial statements. The SEC has 60 days to review and decide whether to approve.

- Issuance platform: Issuance is only allowed through ICO platforms approved by the SEC, ensuring the legitimacy of projects and investor protection.

- Investor protection: Retail investors are limited to a maximum investment of 300,000 baht (approximately 8,100 US dollars) per ICO project, and the total ICO quantity is limited to 30% for general subscriptions.

ICO Platforms

- Application conditions: ICO platforms must be registered in Thailand, with a minimum capital requirement of 5 million baht (approximately 135,000 US dollars), and have mechanisms to prevent conflicts of interest.

- Responsibilities: Conduct due diligence on projects, technical audits, anti-money laundering responsibilities, investor suitability assessments, fund management, and supervision of information disclosure.

- Impact: The establishment of ICO platforms and strict approval processes have increased the transparency and legitimacy of ICO projects, enhanced investor confidence, and driven the steady development of Thailand's ICO market.

III. Market Overview

1. CEX Market: Current Status and Trends of Retail Cryptocurrency Trading in Thailand

Thailand has shown high activity in retail cryptocurrency trading. According to data from 2023, the number of users on cryptocurrency exchanges in Thailand reached 2,949,445, while the number of stock market accounts during the same period was only 2,526,530. This phenomenon reflects the strong interest and active participation of the Thai public in cryptocurrencies.

Dominance of Bitkub: Bitkub Exchange is the major player in the Thai market, accounting for approximately 95% of the trading volume. As the first company to obtain a digital asset exchange license, Bitkub not only leads in trading volume but its parent company, Bitkub Capital Group Holdings, has also made extensive investments in the Web3 field through multiple subsidiaries.

Government support: The Thai government actively promotes cryptocurrency trading and, starting from 2024, exempts profits from cryptocurrency and digital token trading from a 7% value-added tax, further stimulating market vitality.

Market drivers: The high participation in the Thai cryptocurrency trading market is mainly driven by high convenience, government incentive policies, and severe income inequality. Thailand's trading system allows transfers from all bank accounts to exchanges, making trading very convenient. Additionally, income inequality has led many Thais to view cryptocurrency investments as an opportunity to change their economic situation.

2. DeFi Market: Participation and Drivers of the DeFi Market in Thailand

The DeFi market in Thailand also shows significant activity, with participants accounting for approximately 20% of CEX participants. This proportion is rare in other countries, reflecting the high speculative tendencies of Thai investors and their expectations of high returns.

Main drivers: According to research by Tiger Research and Kyros Ventures, the average expected return rate of Thai investors in DeFi is as high as 10 times, indicating their willingness to take on higher risks for high returns. This high speculative tendency is the main driver of the high participation in the DeFi market.

Popular DeFi projects: Arbitrum is currently the most popular DeFi project in Thailand, followed by Optimism and other projects. DeFi projects further attract investor participation through airdrops and liquidity mining activities.

3. ICO Market: Thailand's ICO Platforms and Operating Models

The ICO market in Thailand is subject to strict regulation, with seven legally operating ICO platforms, mainly operated by subsidiaries of financial companies. These ICO platforms play a key role in the issuance, consulting, and technical support of ICO projects.

Major ICO Platforms

Token X: A subsidiary of SCBX, providing comprehensive services from token issuance consulting to blockchain technology support. It successfully issued the "BNK48 Governance Token," a practical token applied in the entertainment industry.

Kubix: A subsidiary of Kasikorn Bank, managed the financing project for the movie "Fate of Love" and issued the investment token "Fate Token."

XSpring Digital: A subsidiary of XSpring, issued the investment token "SiriHub Token" and obtained a digital asset broker and dealer license, supporting digital asset trading.

ICO Project Examples:

BNK48 Governance Token: Issued by the Thai entertainment company iAM, through the iAM48 application, fans can participate in voting and enjoy various benefits, enhancing interaction between fans and artists.

Fate Token: Issued by GDH 559, used for fundraising for the movie "Fate of Love," investors can receive returns based on the movie's revenue and have special event participation privileges.

4. OTC Trading: Legitimacy and Growth

Thailand's OTC trading market is legal and growing rapidly, mainly serving institutional investors. Bitazza is a major participant in this field, holding a digital asset broker license and quickly launching services to capture the market.

Market characteristics: OTC trading, due to its simplicity and compliance, is particularly suitable for handling large transactions and is favored by institutional investors. Retail investors can also participate, but due to high thresholds (Bitazza requires a minimum order amount of 30,000 US dollars), retail participation is lower.

Major participants: Bitazza dominates the market, processing trading orders through global exchanges or dealers, providing more flexibility and trading varieties than digital asset exchanges.

Market potential: With the increasing demand for OTC trading by businesses, Thailand's digital asset broker market shows tremendous growth potential. Accurate pricing and efficient trade execution are key factors for market success.

IV. Segment Market Analysis

1. Gaming Market:

Thailand's Web3 gaming market shows tremendous growth potential, especially in the mobile gaming sector. The smartphone penetration rate in Thailand reached 71.47% in 2023 and is expected to rise to 97% by 2028, providing a solid user base for the development of Web3 games.

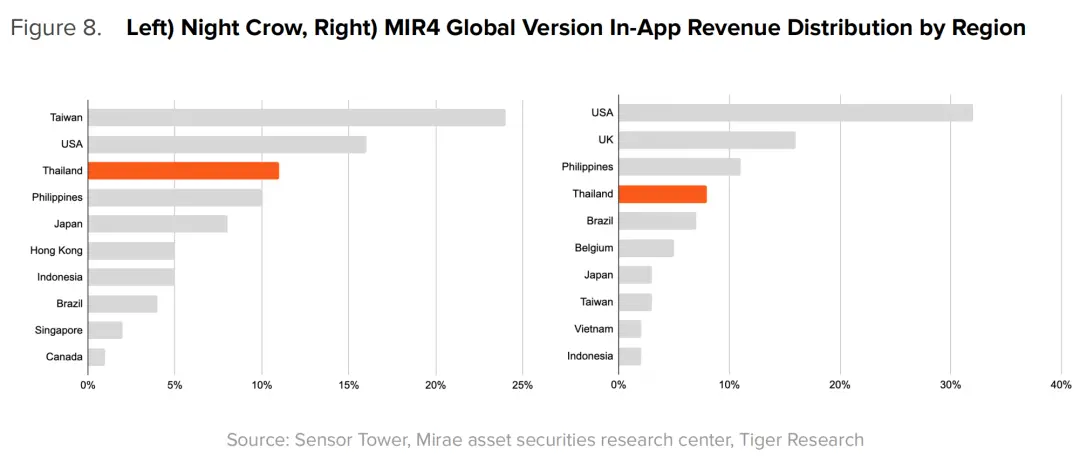

Main games: Globally renowned Web3 games such as "Nightcrow," "Mir4," and "Axie Infinity" are very popular in Thailand. However, local game developers have relatively less experience in developing original games, resulting in lower game quality.

Shift in Model: With the decline in the popularity of Play-to-Earn (P2E) model, user behavior has changed. Players are more inclined to cash out their earnings from games immediately. In response to this change, hybrid mode games, such as "Nightcrow" that combine Web2 and Web3 elements, are emerging as a new development trend.

2. NFT Market:

The NFT market in Thailand has experienced a decline in trading volume amid a sluggish global market, but individual artist works and a few blue-chip projects still maintain active communities.

Individual Artists: The art NFTs of young Thai artist Gongkan have gained widespread attention for their unique style and creativity, even receiving appreciation from Apple CEO Tim Cook, further increasing the popularity of his work.

Blue-Chip Projects: Projects like Pudgy Penguins and Azuki have established strong local communities in Thailand. Despite the overall market downturn, these projects maintain high participation through regular events.

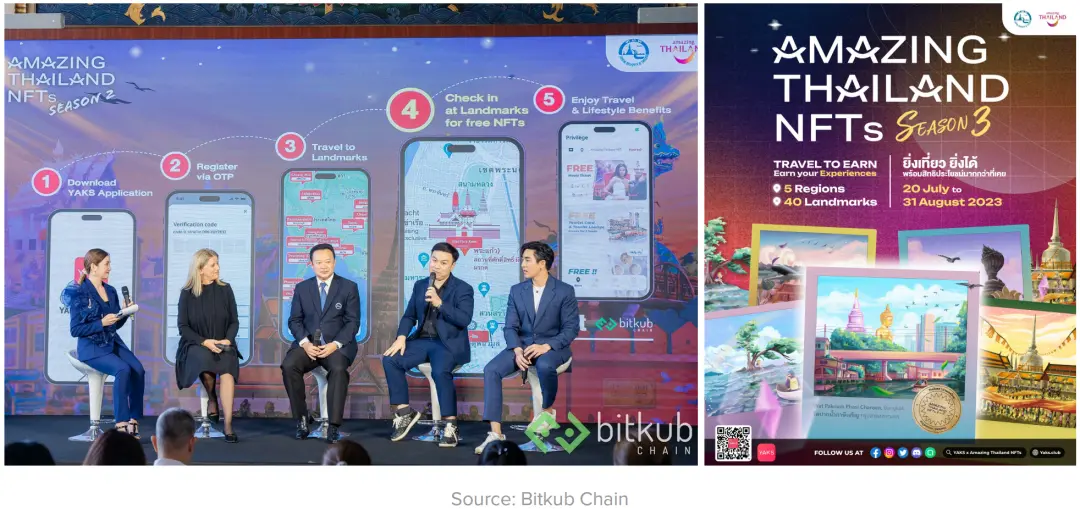

Government Involvement: The Tourism Authority of Thailand (TAT) launched the "Wonderful Thailand NFT" project, combining the Travel to Earn (T2E) model. Visitors can collect art NFTs by visiting specific locations and use them to enjoy travel-related benefits. This innovative project demonstrates the integration of blockchain technology with the tourism industry.

3. Infrastructure:

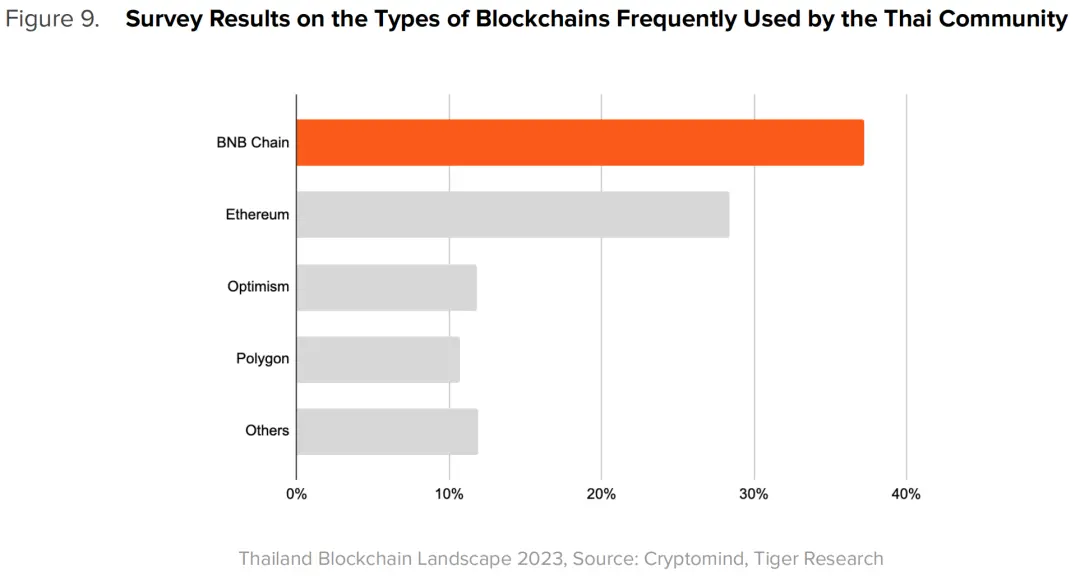

Thailand's Web3 infrastructure is continuously developing, with BNB Chain currently dominating the market. However, emerging chains such as Arbitrum, Optimism, and Ronin are gradually gaining prominence.

BNB Chain: Due to its EVM compatibility, strong developer community, and support from the Binance ecosystem, BNB Chain has wide applications in Thailand.

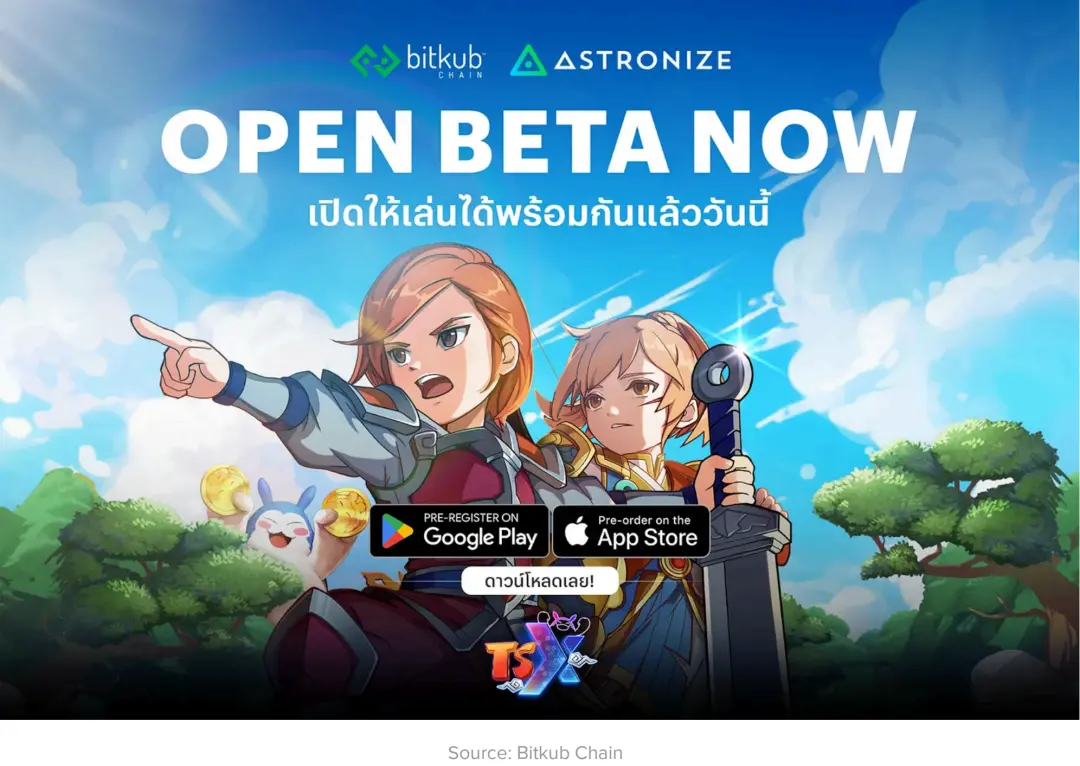

Emerging Chains: Arbitrum performs strongly in the DeFi sector, while Ronin and Optimism are rising in the GameFi sector. Thailand's Bitkub Chain also supports Web3 games and has launched games like "Dawn Village," indicating a trend towards diversification.

Local Chains: Most local chains in Thailand are private chains for regulated businesses. Bitkub Chain is the only public chain, operating as the Ethereum hard fork mainnet and planning global expansion in Southeast Asia.

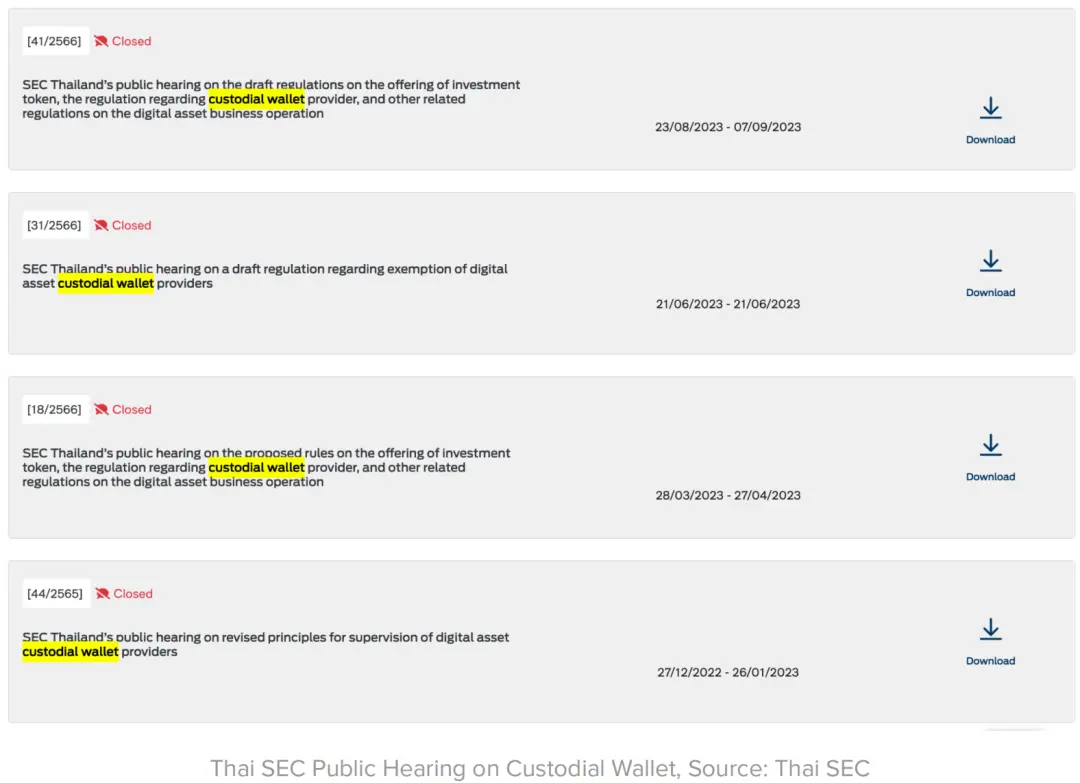

4. Custody and Wallet Services:

Thailand's digital asset custody service market is gradually taking shape, with projects applying for custody service licenses as the market warms up.

Major Participants: Companies like RakkaR Digital and Orbix Custodian have started applying for custody service licenses as the market warms up. These companies provide secure digital asset custody services and meet strict regulatory requirements.

Market Dynamics: While global custody service providers like Fireblocks have a certain market share in Thailand, market competition is expected to intensify with the introduction of licensed local custody services.

Non-Custodial Wallets: MetaMask is the most widely used non-custodial wallet in Thailand, similar to the situation in other countries.

5. Developer Ecosystem:

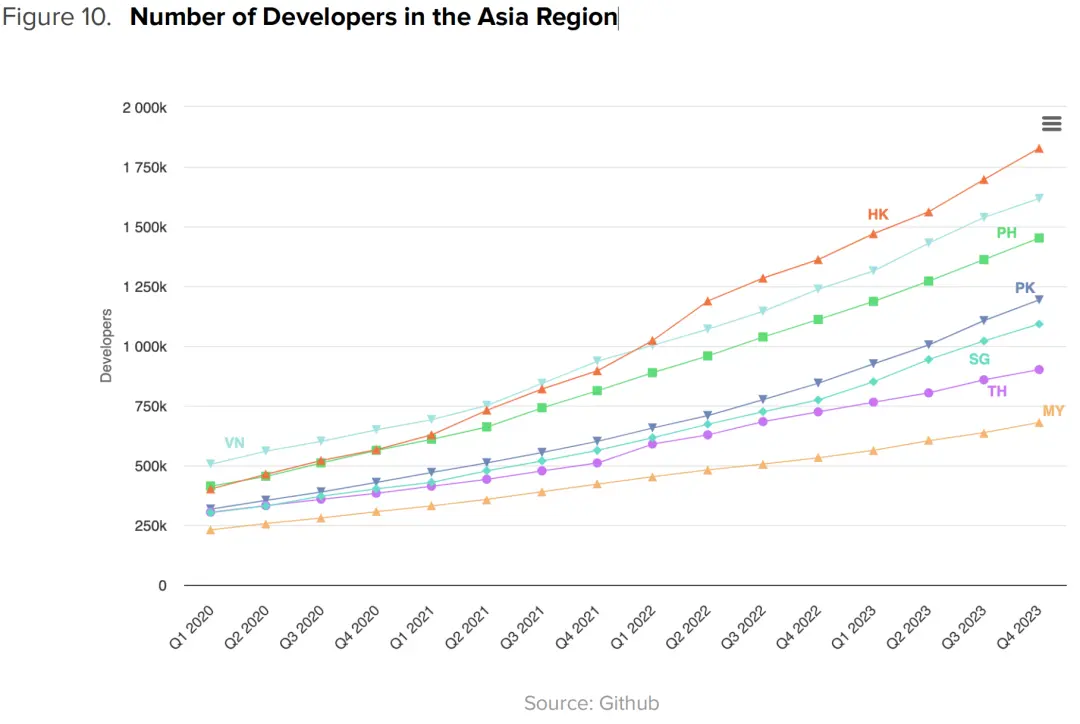

Thailand's developer community, although not as large as neighboring countries, is rapidly growing with support from companies and universities.

Support Projects: For example, Bitkub Chain holds monthly "BKC Developer Showcases" to provide funding for promising projects and support developers through "BKC Developer Tools." This developer-friendly strategy demonstrates its commitment to driving the local blockchain ecosystem.

University Role: Major universities like Chulalongkorn University, Chiang Mai University, and Thammasat University actively participate in blockchain talent development and operate their own blockchain communities, showing a strong interest in the Web3 industry.

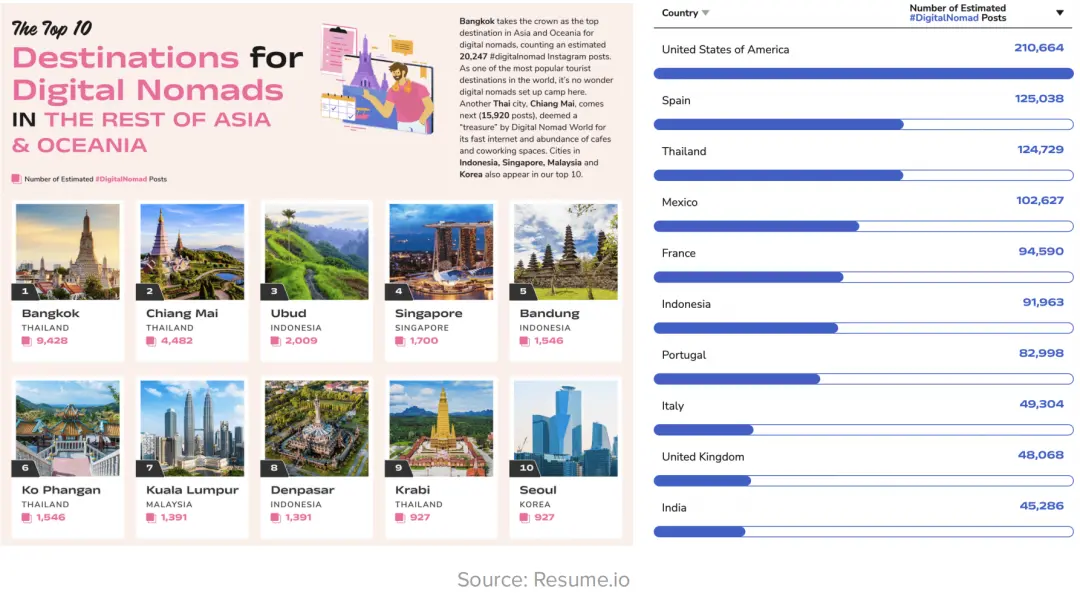

Digital Nomads: Thailand's provision of long-term visas and lower cost of living has attracted a large number of digital nomads, directly and indirectly driving the development of the IT industry.

6. Corporate Initiatives:

Thailand's Web3 industry is primarily driven by traditional financial and energy companies, which, with government support, actively invest in Web3 projects.

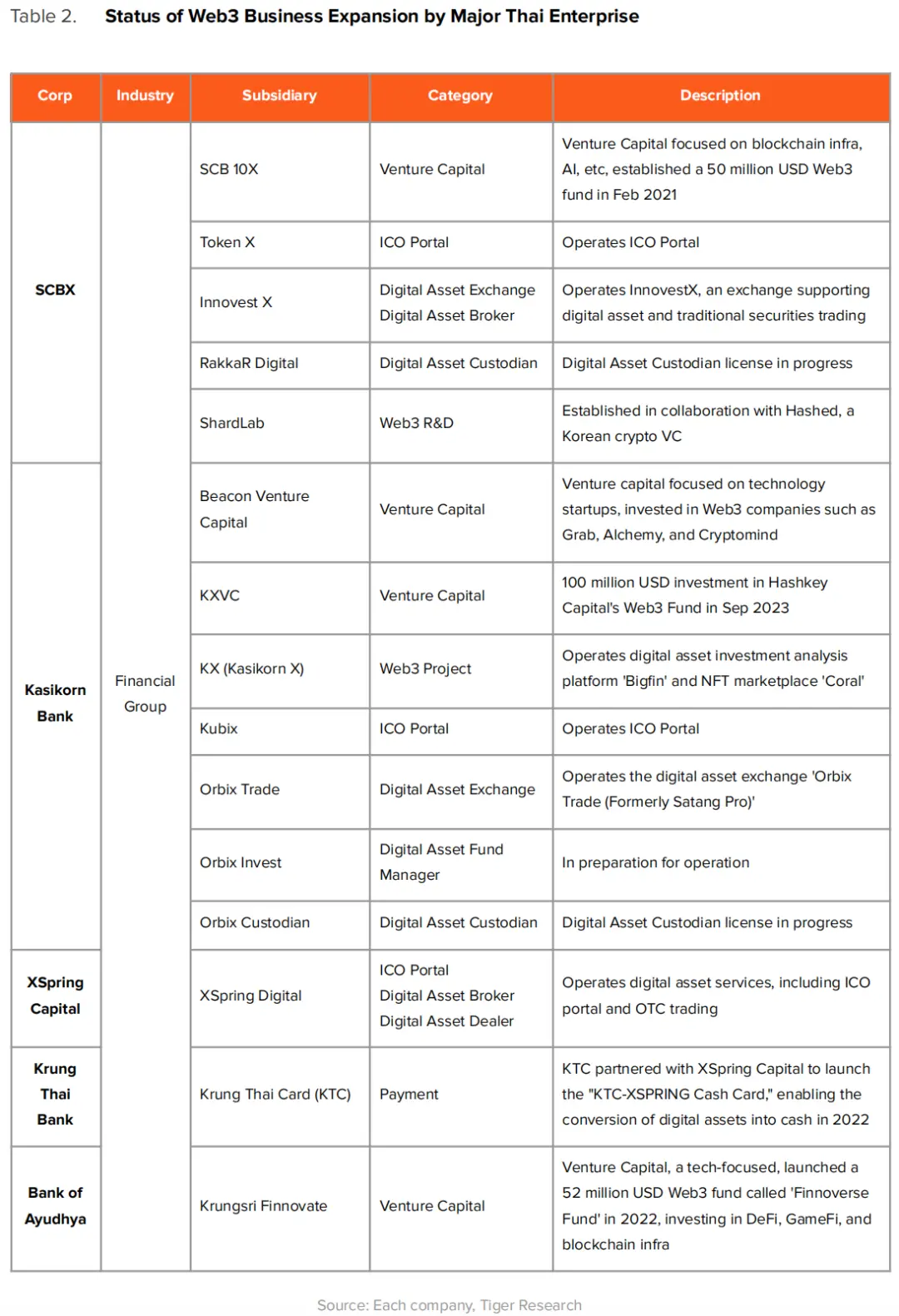

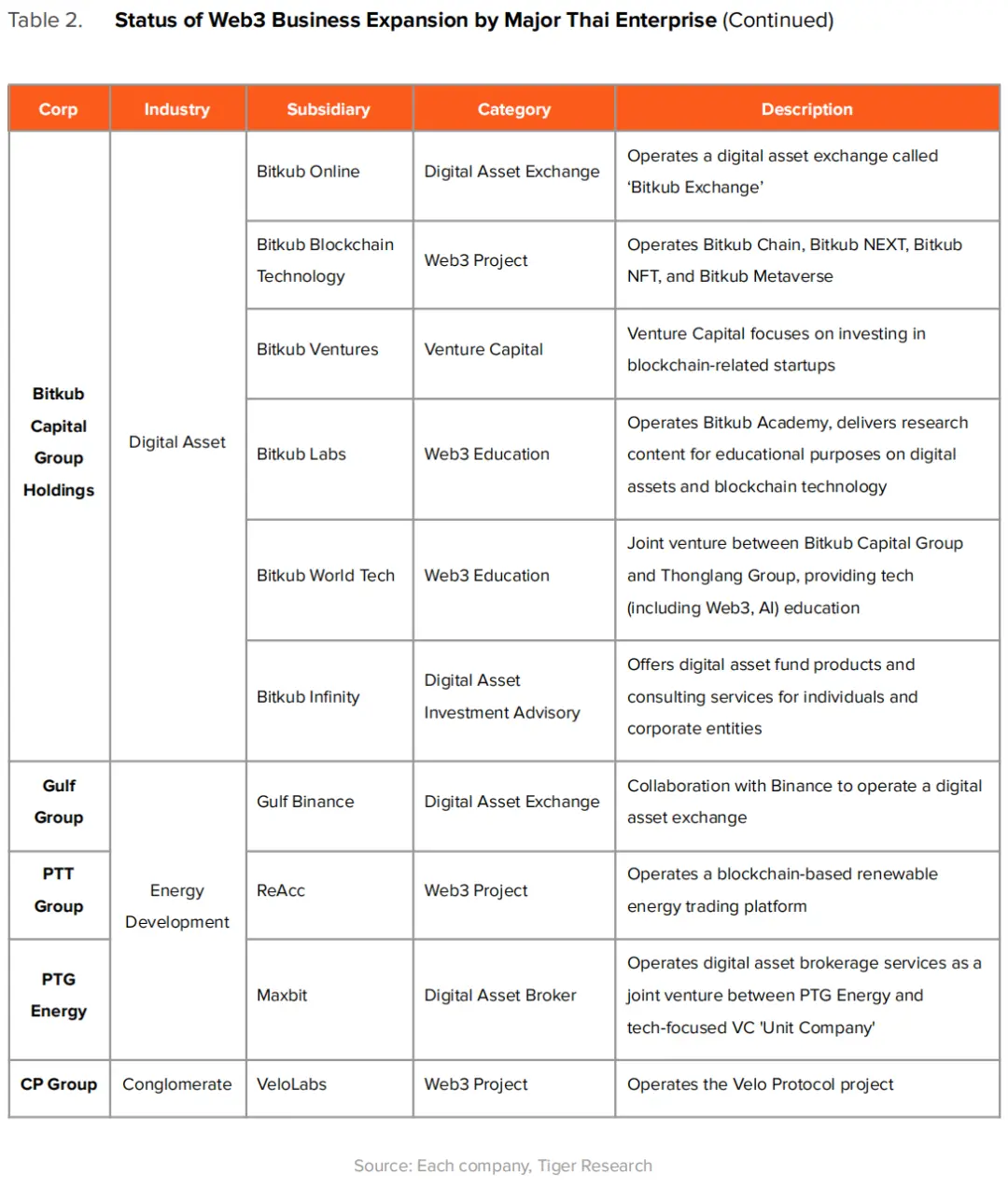

Major Companies:

- SCBX: Through its subsidiaries SCB 10X, Token X, and InnovestX, SCBX has made extensive investments in the Web3 field, including ICO platforms, digital asset trading, and custody services.

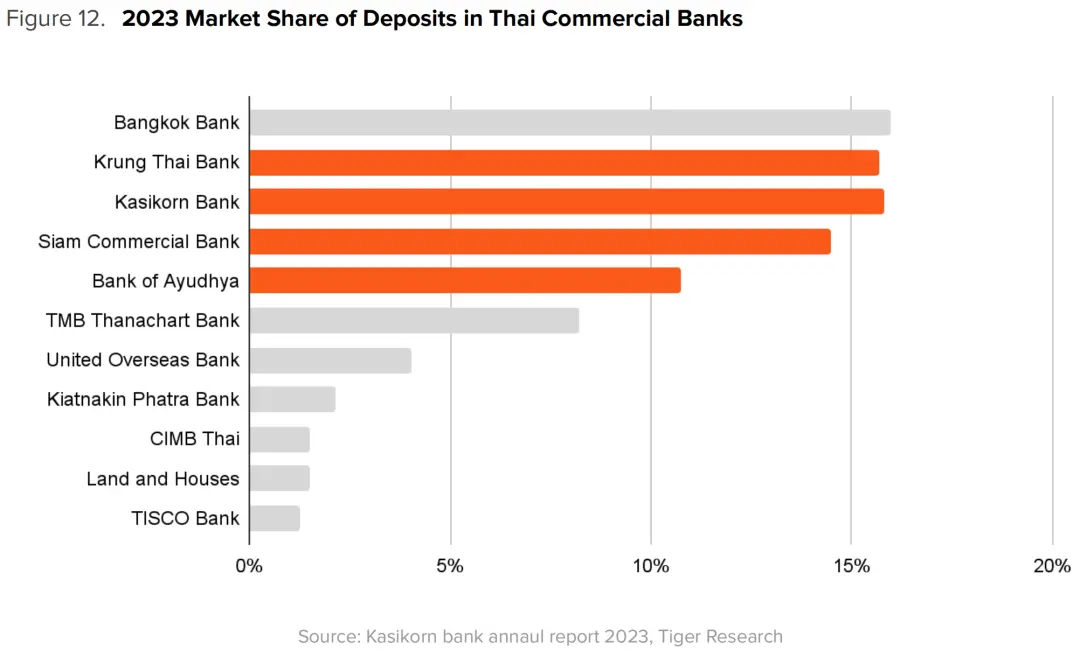

- Kasikorn Bank: Through its subsidiaries KX (Kasikorn X), Kubix, and Orbix Trade, actively participates in digital asset investment analysis, NFT market, and digital asset trading.

- Gulf Energy Development: Operates the Gulf Binance digital asset exchange in cooperation with Binance.

- PTT Group: Operates the blockchain-based renewable energy trading platform ReAcc.

- Bitkub: A leading blockchain technology and digital asset company in Thailand, has made extensive investments in the Web3 field through multiple subsidiaries, including Bitkub Chain and Bitkub Exchange.

Challenges and Opportunities

Challenges

1. Political Instability

Background: Since becoming a constitutional monarchy in 1932, Thailand has experienced 19 military coups. The most recent coup occurred in 2014, and despite a pro-cryptocurrency government coming to power in 2023, political uncertainty still exists in Thailand.

Impact: Political turmoil may lead to policy discontinuity and changes in the regulatory environment, affecting market confidence and long-term investor planning.

2. Aging Population

Background: Thailand's aging population issue is becoming increasingly severe, with the median age in Thailand reaching 40.5 years in 2023, much higher than neighboring countries like Vietnam (32.8 years) and Laos (24.4 years).

Impact: An aging society may lead to labor shortages, reduced innovation capabilities, and slower economic growth, affecting talent supply and technological innovation in the Web3 market.

3. Income Inequality

Background: Thailand faces serious income inequality issues, with extreme wealth disparity. High income inequality may lead to social instability and insufficient consumer purchasing power.

Impact: While income inequality may drive some individuals to actively engage in cryptocurrency investments, overall insufficient consumer purchasing power may limit further market expansion and adoption.

Opportunities

1. Young Leadership

Background: Despite Thailand's aging population issue, the development of the Web3 market is primarily driven by young leaders in their 30s, such as the leadership teams of Bitkub and Cryptomind.

Impact: These young leaders have high acceptance of new technologies, strong innovation capabilities, and the ability to quickly adapt to market changes, driving the development and adoption of Web3 technologies.

2. Government Support Policies

Background: The Thai government actively promotes the development of the digital economy and Web3 technologies. Pro-cryptocurrency policies, exemption of value-added tax on profits from digital asset trading, and support for blockchain technology are important measures to promote market development.

Impact: Government support policies provide a favorable market environment, attracting a large number of domestic and foreign investors and companies, helping to boost market confidence and accelerate technological innovation.

3. Participation of Traditional Financial Institutions

Background: Traditional financial institutions in Thailand, such as SCBX, Kasikorn Bank, and Gulf Energy Development, actively participate in and invest in Web3 projects, establishing digital asset subsidiaries and funds.

Impact: The participation of traditional financial institutions not only brings abundant resources and financial support but also accelerates the adoption of Web3 technologies and applications through their extensive customer base and market influence.

Conclusion

In the rapid development of the Thai Web3 market, despite facing challenges such as political instability, an aging population, and income inequality, the significant opportunities and development momentum are evident through the young leadership, government support policies, and active participation of traditional financial institutions. Thailand has established a comprehensive and strict digital asset regulatory system through the "Emergency Decree on Digital Asset Businesses 2018," regulating market behavior, enhancing market transparency and security, attracting a large amount of investment and corporate participation. Cryptocurrencies, ICOs, DeFi, retail cryptocurrency trading, NFT markets, and the continuously developing infrastructure and custody services all demonstrate significant potential and activity, positioning Thailand as a leader in the Web3 industry in Southeast Asia and globally.

Additionally, according to Aiying's understanding, the Thai government announced on May 29th the launch of a new visa category for digital nomads and freelancers. The Thai government introduced a new Thailand Digital Nomad Visa (DTV) for foreigners who want to work remotely. The cost of the DTV is $270 (10,000 Thai Baht) and is valid for five years. The stay period for the DTV is 180 days, with an option to extend for another 180 days for the same fee, allowing the visa holder to work in Thailand for nearly 12 months at a time. The visa requirement stipulates that for those working remotely in Thailand, they need to provide at least approximately $13,650 (500,000 Thai Baht) as a support guarantee for spouses and children.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。