The world is bustling, all for profit; the world is bustling, all for profit! Hello everyone, I am your friend Lao Cui Shuobi, focusing on the analysis of cryptocurrency market trends, striving to deliver the most valuable market information to the majority of coin friends. Welcome the attention and likes of the majority of coin friends, and refuse any market smokescreens!

The interest rate cut in Europe seems to have not brought much surprise to everyone, and the market remained unchanged, even experiencing a pullback after the announcement. This has led many friends to become increasingly confused about their thoughts on Europe. After looking at everyone's questions, it seems that everyone is becoming more and more disdainful of Europe's economy. Perhaps things are not as bad as everyone thinks. The flow of funds requires a certain time lag to enter the market, especially the non-farm data released in the past few days was not ideal. Although the significance of the data is not significant, it will also affect the mid-term trend. This paragraph is to make everyone pay attention to the interest rate cut strategy in the financial sector, which is related to the trend of the entire financial industry this year. The interest rate cuts in Europe and Canada will be the main theme of this year, prompting the need for the US to consider interest rate cuts. Once the US also joins the interest rate cut camp, it will definitely restart the bull market. (Not only for the currency circle but the entire financial market)

Today happens to be the Dragon Boat Festival, I wish everyone a happy holiday. The recent volatility has indeed caused Lao Cui a lot of headaches. The overall range can be said to be getting larger and larger, causing Lao Cui to be busy with the de-leveraging phase for almost a week. Many friends have the habit of making short-term trades, especially spot users. In fact, for the overall situation, short-term trading is still quite a test of patience. Lao Cui generally does not recommend spot users to do this. The biggest problem with doing this is the fear of losing money. Most spot users with investment experience have a certain grasp of short-term losses. But they cannot withstand the impact of short-term trading. It is best not to try short-term trading. The best choice for spot users is always to follow the trend. Riding a whole trend is always more profitable than occupying short-term fluctuations. Many times, spot users finish the short-term trend and dare not enter the market at the short-term high, always feeling that the short-term is already at a high level, so step by step they watch the beginning and end of the entire bull market, which is a typical case of losing out in the long run for small gains in the short term.

Overall, let's return to our view of the later trend. For the later trend, Lao Cui's target has never changed on the big trend. Including the recent interest rate cut in Europe, it has instead brought a wave of downward trends. Many users feel that the trend of the currency circle is about to reverse, and even think that the subsequent trend will revolve around the short side. Lao Cui does not agree with this. In the previous articles, Lao Cui has always mentioned the time lag with everyone. All funds flowing into the current currency circle market require a certain time lag. After the interest rate cut, it will indeed bring funds into the financial market, but for European companies, the injection of funds will definitely first revitalize their pillar industries. Only after the pillar industries have a benign cycle can they possibly release their funds into investment markets. This principle is very easy to understand. Even if you know that the investment return rate in the currency circle market is relatively high, it is impossible to abandon your core industries to engage in venture capital.

This is only the strategy for Europe, not the interest rate cut in the US; everyone should be clear that the currency circle market is mostly driven by public opinion. So everyone will find that the interest rate cut in Europe will only lead to a wave of growth, and when the official interest rate cut comes, it will instead withdraw a portion of the funds. This is the usual means of the big players, and it is also a harvest for retail investors. There has been no inflow of funds into Europe throughout the entire fluctuation, everything is just a show put on by the big players. This is what we mentioned about the time lag. However, the purpose of this round of market manipulation is to point the direction for everyone. The decline is the normal behavior of the market. The inflow of European funds will not only have a short-term trend of a few hundred points.

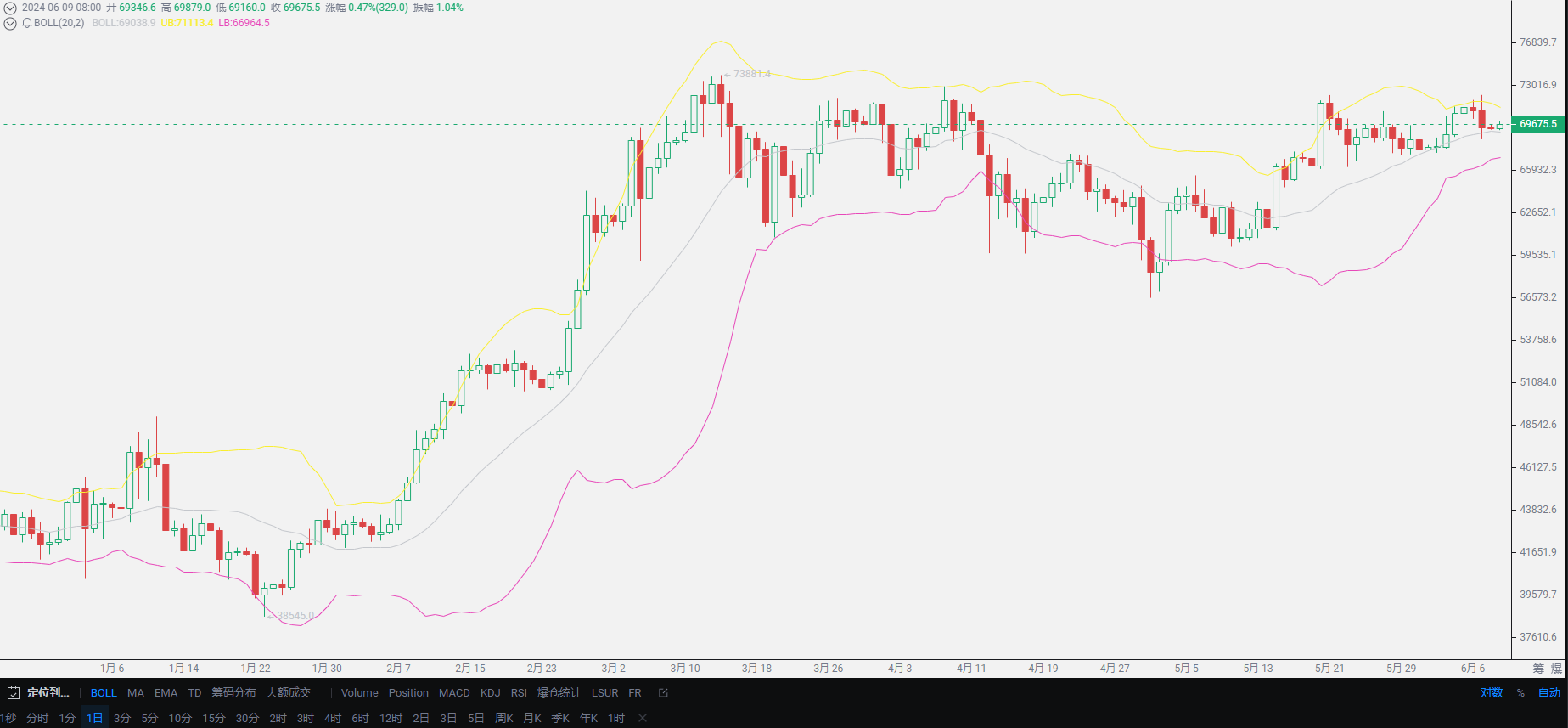

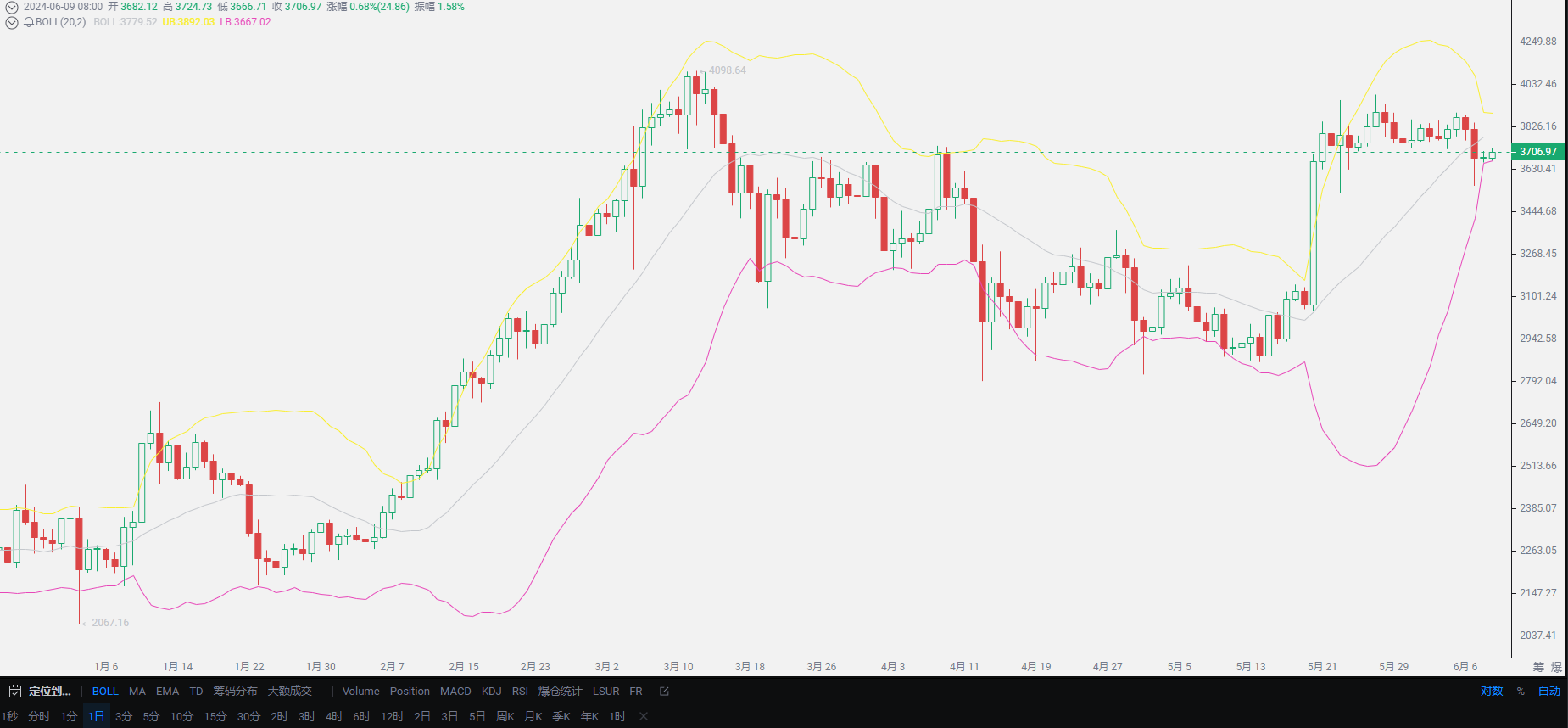

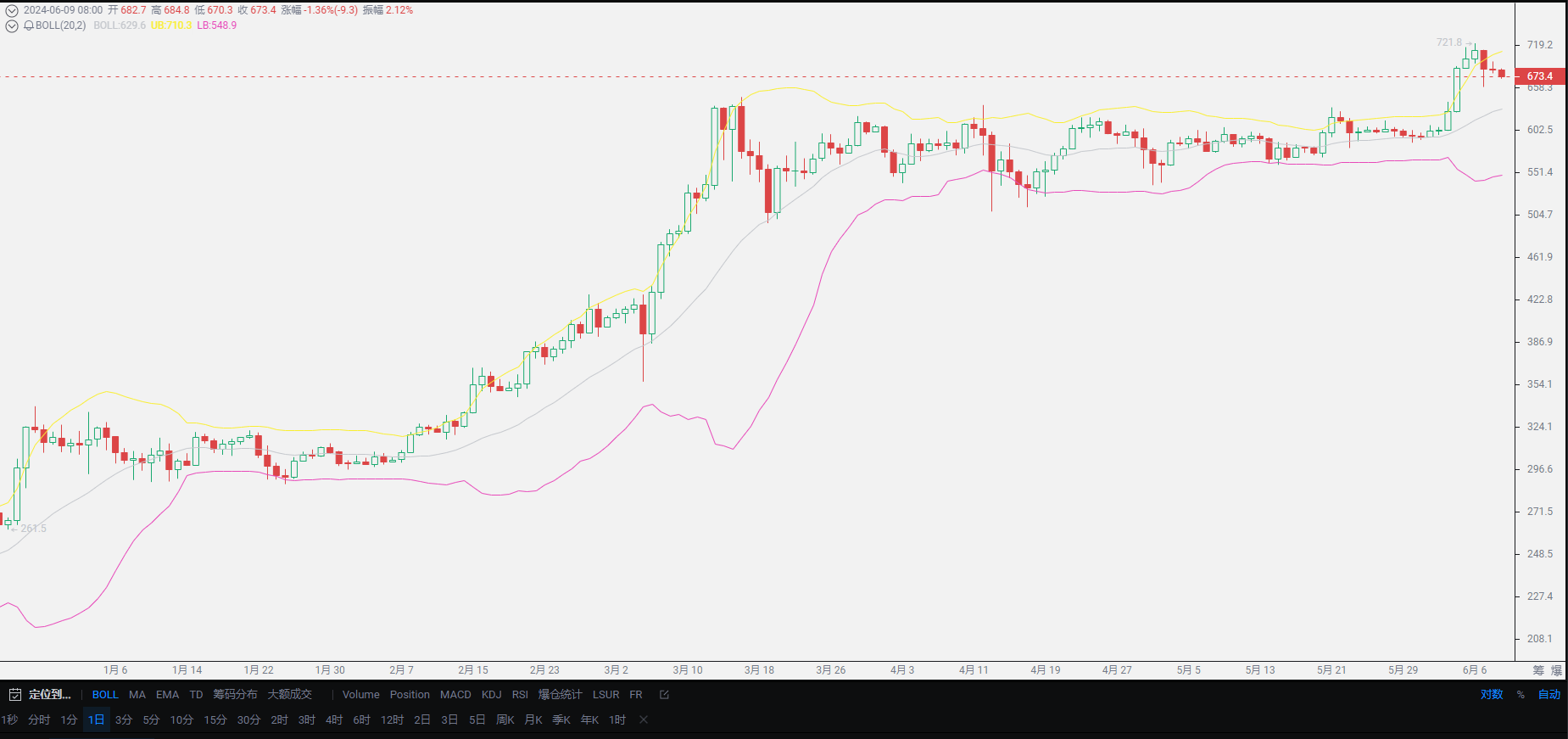

Lao Cui's conclusion: In summary, since Bitcoin and Ethereum reached their highs, Lao Cui has always judged the overall trend based on the overall amount of funds. Under the current strategy, it is certain that we cannot judge the overall trend with the previous perspective. So the strategy that Lao Cui has always pursued is that it is difficult to reach a new historical high, but it is not wise to be bearish blindly. Under the current situation, the market will not break through a new historical high or break the recent low. The overall range of operation has always been like this. Regardless of how the market changes, it cannot escape the overall wide-range operation. For the later period, the trend will still continue in this way, but the interest rate cut in Europe will sooner or later guide the trend of the currency circle to rise. Coupled with the impact of the US and Ethereum's listing news, spot users must continue to be bullish. Users who entered at all levels do not need to worry too much. For contract users, if they want to follow the trend, they must also be consistent with spot users. Long positions can expand profits, and short positions must reduce risks. (Friendly reminder: Pay attention to Lao Cui's last trend chart, it is worth having)

Original article created by the public account: Lao Cui Shuobi. Contact directly for assistance.

Lao Cui's message: Investment is like playing chess. Masters can see five steps, seven steps, or even a dozen steps ahead, while those with lower skills can only see two or three steps. The master considers the overall situation, plans for the general trend, and does not focus on every move, but aims to win the game in the end. The lower skilled players fight for every inch, frequently switching between long and short positions, only fighting for short-term gains, and frequently end up in trouble.

This material is for study and reference only and does not constitute investment advice. Buying and selling based on this material is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。