Authors: LD Capital, Duoduo

Basic Information

pSTAKE Finance is a multi-chain liquidity staking project. The token was launched in early 2022 and originally provided liquidity token staking services for the BSC chain and the Cosmos ecosystem, with a TVL of approximately $7 million. Recently, it has partnered with the BTC collateral project Babylon to launch BTC collateral services. Over 90% of the project's tokens have entered circulation, with a market value of $57 million.

Team and Financing: Strategic Investment by Binance Labs in 2022

The founder has a background in Singapore and graduated from Nanyang Technological University. The project received a $10 million angel round investment in November 2021, with investment institutions including Galaxy Digital, Coinbase Venture, and others. The token price in this round was $0.1, with institutions receiving 100 million tokens, accounting for 20% of the total token supply. In December 2021, the project conducted a public offering through coinlist, raising a total of $10 million at a token price of $0.4, selling 2500 tokens, which accounted for 5% of the total token supply. In May 2022, the strategic round of financing received a single investment from Binance Labs, with the specific investment amount and valuation undisclosed. It can be seen that the current secondary market price is close to the seed round financing price and lower than the public offering price.

Due to the investment dilemma caused by the low market value and high FDV token issuance model, Binance released the Binance Coin Listing Project Open Recruitment Plan in May 2024, hoping to strengthen support for small and medium-sized cryptocurrency projects with good fundamentals, organic community bases, sustainable business models, and industry responsibility to promote the development of the blockchain ecosystem. As a low market value, high circulation token that has participated in investment during the bear market and has not yet been listed on Binance, pSTAKE has the opportunity to be selected for this plan.

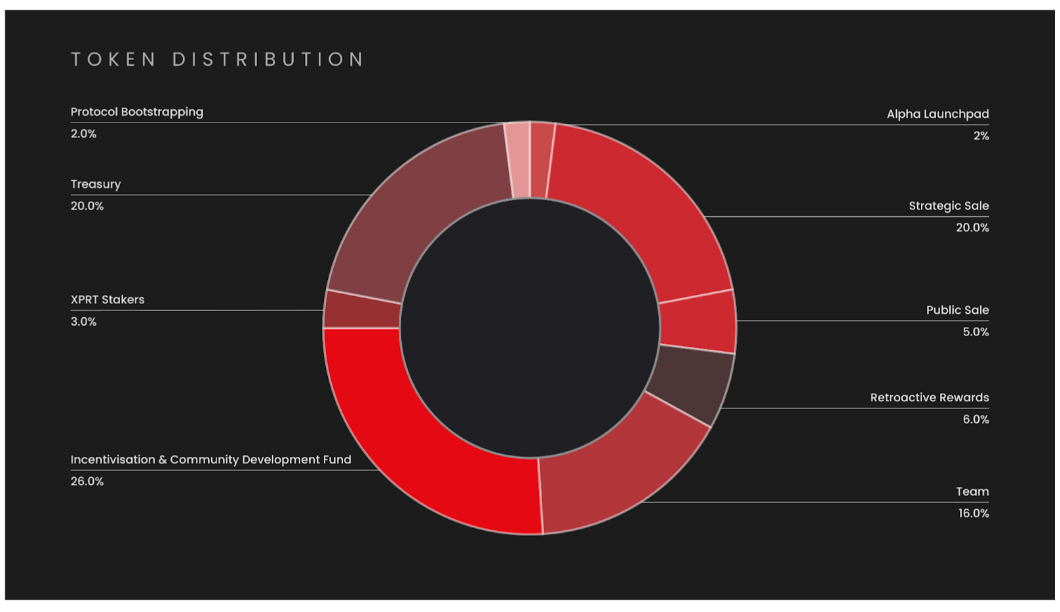

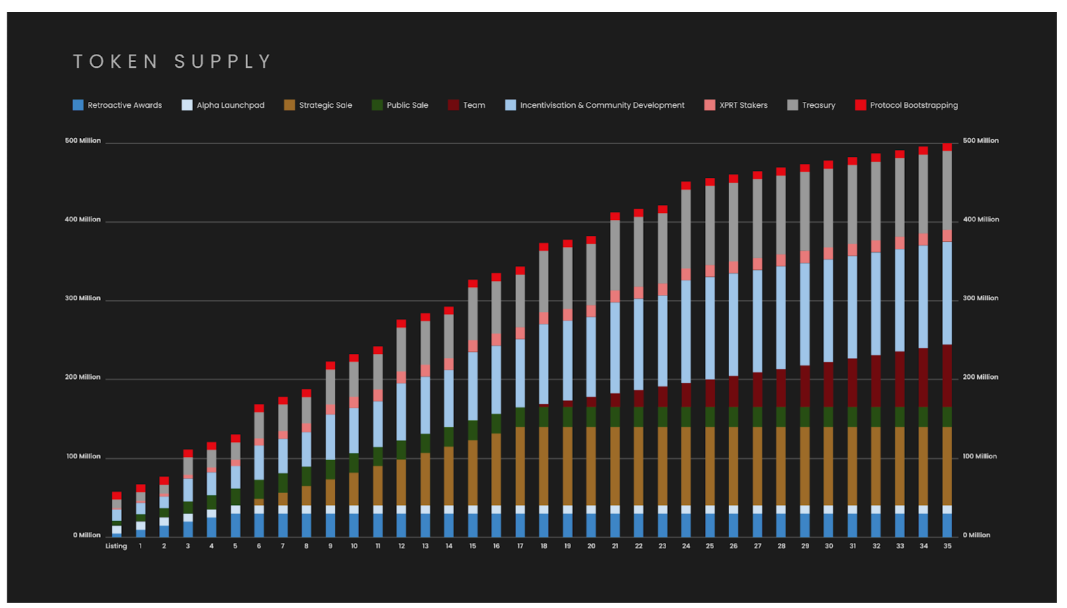

Token Economics: 93.6% of Tokens in Circulation

The total supply is 500 million tokens, launched in February 2022, and over 93.6% of the tokens have already entered circulation. A portion of the tokens belonging to the team has not been released yet. According to the plan, the team's tokens will be locked for 18 months, and then released linearly over the next 18 months, with a total release period of 36 months, meaning that all tokens will be released by February 2025.

Recent Partnerships: New Narrative of BTC Recollateralization

Recently, pSTAKE has expanded its business focus on BTC recollateralization and reached a cooperation agreement with the BTC collateral protocol Babylon. This partnership is an entry point for the current new narrative and may bring significant and long-term TVL growth to the project.

Babylon is a Bitcoin collateral protocol founded by Stanford University professor David Tse, with a total investment of $96 million from top-tier crypto investment institutions, including Paradigm, Hashkey, Binance Labs, Polychain, IDG, and others. Babylon is similar to the Eigenlayer position in Ethereum and is currently in the testnet phase. After the mainnet launch, TVL is expected to grow rapidly.

A series of cooperation agreements will emerge around Babylon, and the business scale of these agreements will grow. At the same time, there will be competition between the protocols. Currently, multiple protocols have announced cooperation with Babylon in the BTC collateralization field, including the BTC layer 2 B²Network, Merlin, the ZK-driven BTC execution layer Chakra, and the AI recollateralization protocol Mind Network, among others.

pSTAKE's liquidity staking plan will provide returns for Bitcoin. Users can deposit BTC into pSTAKE to receive corresponding liquidity staking tokens, participate in other DeFi projects on-chain, and earn returns. After the Babylon mainnet launch, the BTC deposited in PSTAKE will also be collateralized in the Babylon protocol, earning corresponding returns.

Binance Research also provided feedback on the latest business development direction of pSTAKE in its weekly market highlights summary on May 19th.

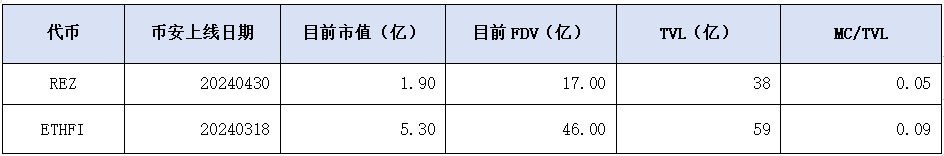

Valuation Comparison

The following is the valuation situation of the Ethereum recollateralization protocol listed on Binance. The dimensions affecting the valuation consideration include: narrative popularity, business data, liquidity premium (whether listed on Binance), financing valuation, competitive advantage position in the race, and others. pSTAKE's valuation is not much different from the previous institutional financing valuation and is generally undervalued. A brief comparison of the valuation of Ethereum collateralized tokens is provided for reference. It should be noted that the actual TVL of pSTAKE is currently very small, with a significant gap compared to Ethereum recollateralization projects.

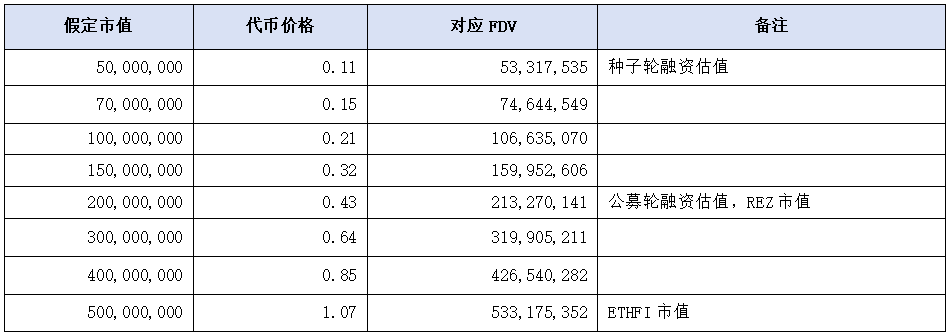

Under different market value assumptions, the price changes and FDV changes of pSTAKE:

Conclusion

pSTAKE currently has a low market value, and the tokens are almost entirely in circulation. The tokens were launched in February 2022, experienced a full bear market decline, and thorough washing out. The current market price is close to the seed round private placement price, far below the public offering price. It received investment from Binance in 2022.

The business has added a hot new narrative. The previous business of pSTAKE was liquidity staking in the BSC and Cosmos ecosystems, which were not hot topics. In May 2024, it added BTC recollateralization business and partnered with the BTC collateral protocol Babylon. This partnership may bring rapid and sustained growth in business scale.

pSTAKE received strategic investment from Binance in 2022, with low market value, high circulation, and a new narrative: heavyweight collaboration with the BTC collateralization protocol Babylon and strategic investment from Binance. It has the opportunity to be selected for the Binance Coin Listing Project Open Recruitment Plan.

The main risk is that pSTAKE currently has a very small TVL and will mainly depend on the development of Babylon. Babylon is still in the testnet phase and will require some waiting time. At the same time, there are multiple protocols collaborating with Babylon, and pSTAKE may not necessarily have a competitive advantage in the BTC recollateralization race, and the business growth data may not meet expectations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。