Original Title: "Satoshi, companies & whales: Who holds the most Bitcoin?"

Author: EarnBIT

Translation: Plain Blockchain

With nearly 500 million wallet addresses, Bitcoin has become a game-changer that is destined to have a long-lasting impact on the world.

As the king of the cryptocurrency world, Bitcoin has gone through a long and challenging journey since quietly starting trading in 2009, with hundreds of thousands of transactions taking place every day. But do you know who the major Bitcoin holders are?

Who are the top Bitcoin holders?

The largest Bitcoin holders are corporate entities, including some institutions and crypto CEX. CEX stores a large amount of users' crypto assets in cold wallets. Due to the nature of crypto transactions, these addresses are constantly changing.

There are an estimated 106 million Bitcoin holders globally, and although there are 460 million addresses used for transactions, 288 million of them do not hold any Bitcoin.

How to identify Bitcoin holders?

Due to the flow of funds between wallets, the list of major Bitcoin holders is constantly changing. As of May 15, 2024, according to data from the blockchain explorer, the amount of Bitcoin held by the top ten addresses ranges from 69,370 BTC to 248,597 BTC.

The Bitcoin whitepaper suggests creating a new address for each transaction. However, due to the nature of crypto transactions, they are to some extent semi-anonymous: if someone publicly shares their wallet address, all their transactions can be easily traced.

Blockchain analysis also reveals the connection between wallets and real identities. Investigators, regulatory agencies, and compliance teams use on-chain tools to detect and prevent criminal activities.

Bitcoin.org once stated: "The design of Bitcoin is such that once a transaction is made, it is set in stone. It's an open ledger for all to see and verify. The privacy comes in the form of what you do with the currency, not the currency itself."

Satoshi Nakamoto's Bitcoin wallet

The identity of the anonymous creator of Bitcoin, Satoshi Nakamoto, remains a mystery, but he holds 1 million Bitcoins. Since Nakamoto mined the genesis block on January 3, 2009, one of his addresses is easily found: 1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa.

This wallet currently holds approximately 99.84 Bitcoins with no record of outgoing transactions. However, Nakamoto may still have hundreds or even thousands of other independent addresses. These dormant funds add to his mystique.

Top Bitcoin holders and their wallet addresses in 2024

The following are the ten largest individual wallets and their owners determined based on public data and blockchain intelligence.

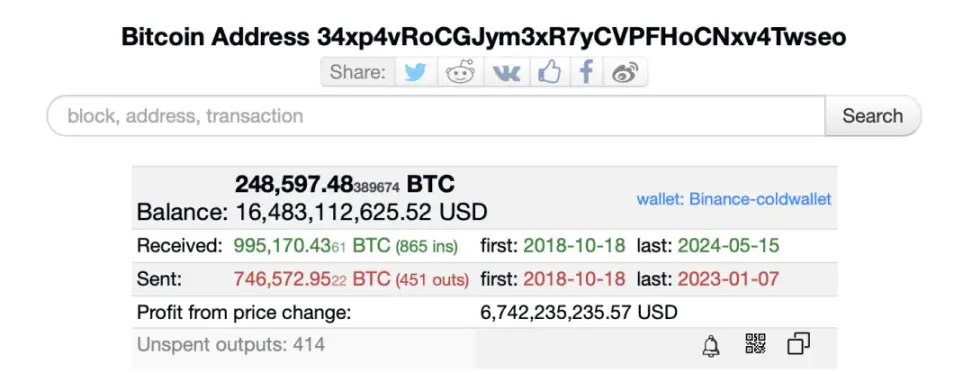

1) BN (Cold Wallet 1) - 248,597.48 BTC

Unsurprisingly, the world's largest crypto CEX manages the largest wallet, holding over 1.2% of all circulating Bitcoins. There has been very little outflow of funds—the most recent outflow occurred in January 2023, involving 2,000 BTC.

Bitcoin address: 34xp4vRoCGJym3xR7yCVPFHoCNxv4Twseo

Statistics of BN's cold wallet as of May 16, 2024. Source: BitInfoCharts

2) Bitfinex - 180,010.07 BTC

Bitfinex is a well-established CEX founded in 2012. Although it has suffered several major security breaches and its historical record is not perfect, as of May 15, 2024, it ranks 10th in terms of trading volume. The most recent outflow transaction occurred in April 2024, involving 4,000 BTC.

Bitcoin address: b1qgdjqv0av3q56jvd82tkdjpy7gdp9ut8tlqmgrpmv24sq90ecnvqqjwww97

3) Robinhood - 136,295.81 BTC

Robinhood is a US-based zero-commission trading platform that offers trading in stocks, ETFs, cryptocurrencies, and options. It attracts newcomers with user-friendly tools and deposit incentives but has also faced criticism for promoting high-risk activities.

According to BitInfoCharts data, since its establishment in May 2023, there have been no significant outflows from this wallet. As of now, Robinhood has not confirmed ownership of this wallet, but Arkham Intelligence (a blockchain analysis platform) has linked it to the wallet.

Bitcoin address: bc1ql49ydapnjafl5t2cp9zqpjwe6pdgmxy98859v2

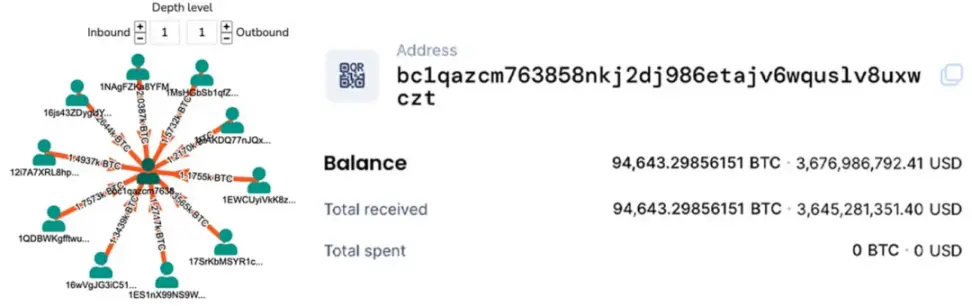

4) FBI (Bitfinex Funds) - 94,643.30 BTC

The funds in this wallet were stolen by a hacker couple from Bitfinex in 2016. US authorities have recovered a portion of the funds (120,000 BTC).

An investigation conducted jointly by the FBI, IRS-CI, and HSI identified the suspects based on gift card purchase records. The wallet is controlled by US federal authorities and was created in February 2022, with only a small amount of funds flowing in after the initial deposit.

After 23 transfers, the Bitfinex funds were consolidated into a single wallet. Source: Bitcoin.com

Bitcoin address: bc1qazcm763858nkj2dj986etajv6wquslv8uxwczt

5) BN (Cold Wallet 2) - 82,833.46 BTC

Relatively speaking, BN's second-largest wallet experiences relatively frequent outflows. The most recent outflow occurred in April 2024, with over 7,910 BTC flowing out.

Bitcoin address: 3M219KR5vEneNb47ewrPfWyb5jQ2DjxRP6

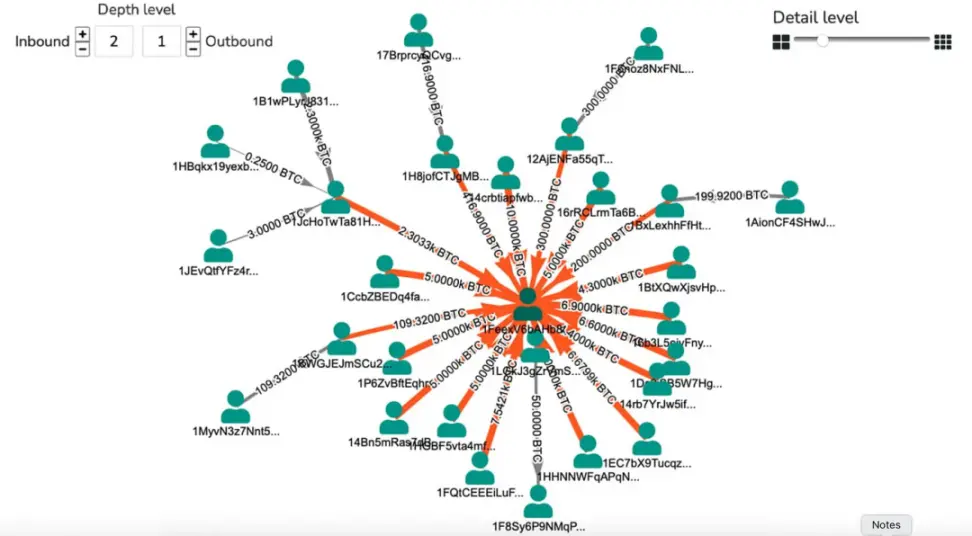

6) Anonymous Mt. Gox Hacker - 79,957.26 BTC

In 2011, approximately 80,000 BTC was stolen from Japan's Mt. Gox. Three years later, this CEX ceased operations after exposing theft, fraud, and poor fund management, having handled over 70% of Bitcoin trading before that.

The wallet's history shows unauthorized funds transferred from the former Bitfinex CEO. Since 2011, there have been no outflows, only a few small deposits.

Bitcoin address: 1FeexV6bAHb8ybZjqQMjJrcCrHGW9sb6uF

Transaction distribution traced back to the hacker's address. Source: Bitcoin.com

7) Anonymous Holder - 78,317.03 BTC

The address was activated on March 23, 2024, and there have been no outgoing transactions. The activity since the initial deposit has been very limited, and the owner is still unknown.

Bitcoin address: bc1q8yj0herd4r4yxszw3nkfvt53433thk0f5qst4g

8) Tether (Cold Wallet) - 75,354.08 BTC

Arkham Intelligence confirmed that this leading stablecoin issuer received thousands of Bitcoins from Bitfinex's hot wallet. The Tether wallet began operating in September 2022 and has only sent 0.0576 BTC in 50 transactions.

Bitcoin address: bc1qjasf9z3h7w3jspkhtgatgpyvvzgpa2wwd2lr0eh5tx44reyn2k7sfc27a4

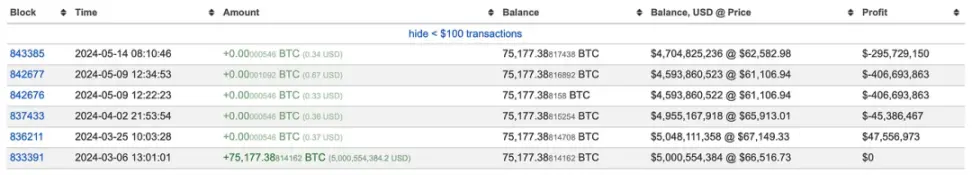

9) BN (Cold Wallet 3) - 75,177.38 BTC

This third-largest address related to BN has been dormant since March 2024 and received nearly $5 billion worth of Bitcoin before that.

Bitcoin address: 3E97AjYaCq9QYnfFMtBCYiCEsN956Rvpj2

Transaction history of BN's wallet as of May 16, 2024. Source: BitInfoCharts

10) FBI (Silk Road Funds) - 69,370.17 BTC

Silk Road was the first modern darknet market, which closed in 2013, used for drug trading, money laundering, and other illegal activities involving Bitcoin. It operated as an underground service on the web, allowing users to operate anonymously.

The Bitcoins in this wallet did not come directly from Silk Road. A hacker infiltrated the market and stole the Bitcoins between 2012 and 2013. In 2020, the hacker returned these Bitcoins to US authorities.

Bitcoin address: bc1qa5wkgaew2dkv56kfvj49j0av5nml45x9ek9hz6

Top Five Institutional Bitcoin Holders

1) MicroStrategy Incorporated - 214,400 BTC

Led by cryptocurrency advocate Michael Saylor, this business intelligence provider is the top corporate holder of BTC. According to its Q1 2024 financial report, after the latest acquisition in April, its Bitcoin holdings reached 214,400.

At current prices, these holdings are worth approximately $13.5 billion, and reportedly, the company has realized paper profits of around $6 billion from Bitcoin. As a former internet entrepreneur, Saylor once lost $6 billion in a day but then made billions in Bitcoin's rise, causing the company's stock price to soar.

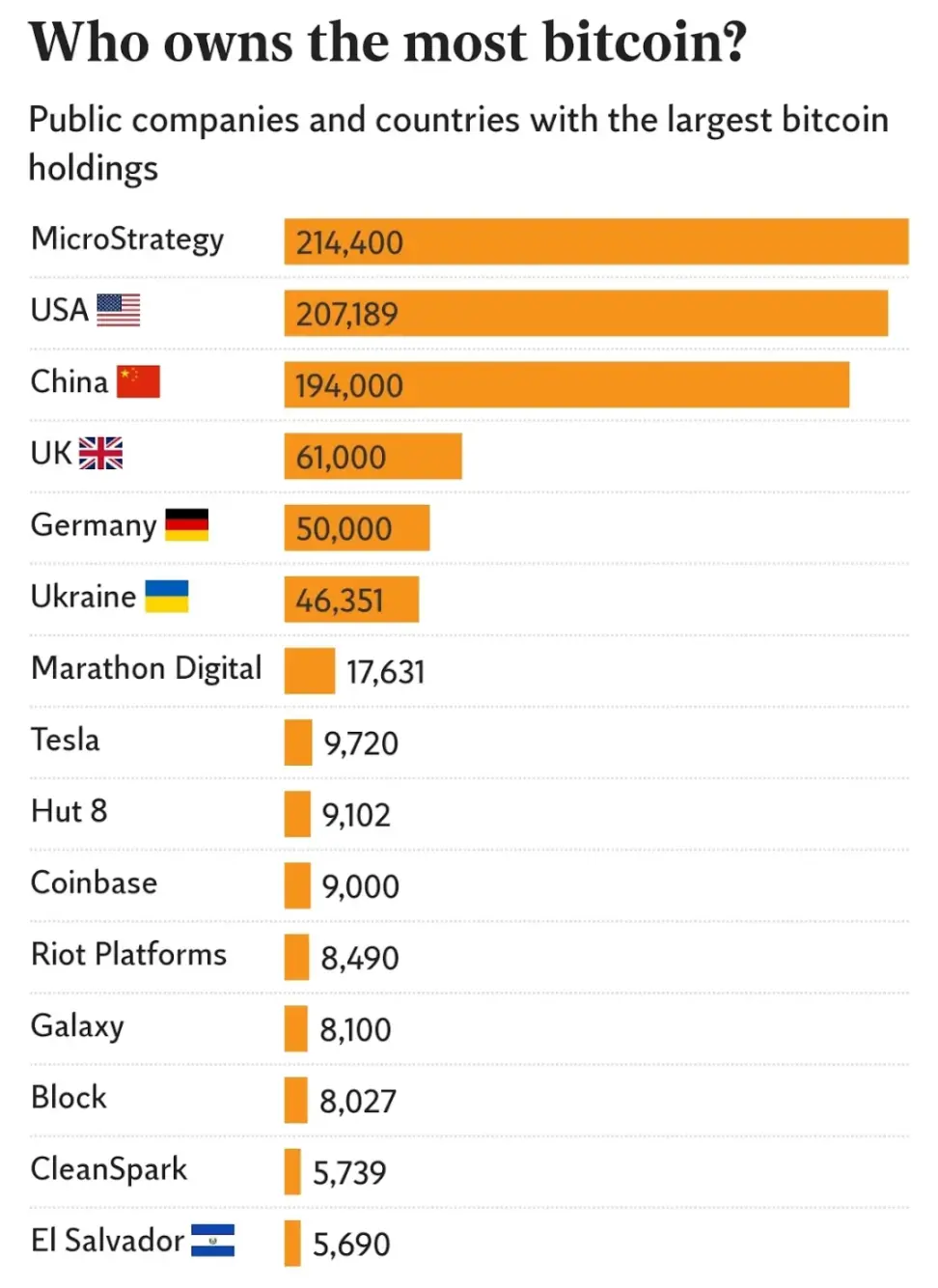

Enterprise and national Bitcoin holdings rankings as of May 6, 2024. Source: Independent

With holdings exceeding 1% of all existing Bitcoins, MicroStrategy holds more cryptocurrency than any single country. Its holdings are over ten times that of Marathon Digital Holdings.

MicroStrategy's stock is widely seen as a proxy for traditional investors' exposure to Bitcoin. It has risen by 138.03% year-to-date, supporting its inclusion in the MSCI Global Index, effective May 31.

2) Marathon Digital Holdings, Inc.

As the second-largest publicly traded corporate holder, this US mining company holds over 17,631 Bitcoins, worth over $1.5 billion, including the holdings after selling approximately 600 Bitcoins earlier.

Unlike MicroStrategy, Marathon Digital failed to meet its revenue expectations for Q1, with a 34% decrease in mined Bitcoins due to equipment malfunctions, maintenance, and weather-related obstacles. This decline has caused its stock price to fall by 14.01% year-to-date.

The company plans to sell more of its Bitcoin holdings "to support monthly operations, manage cash reserves, and for general corporate purposes."

3) Tesla, Inc.

The automotive giant founded by Elon Musk entered the Bitcoin market in February 2021, acquiring $1.5 billion worth of Bitcoin to seek diversified investment channels and optimal profit value. Within a year, the company sold 75% of it, citing concerns about low liquidity due to the China COVID-19 lockdown.

According to Arkham's estimates, as of April 2024, this electric car manufacturer holds approximately 11,509 Bitcoins. The Q1 balance sheet shows that net digital assets have remained unchanged since Q4 2022. Bitcoin accounts for the vast majority of the funds.

Despite accepting DOGE as a payment method for merchandise, Tesla holds very little of this Memecoin. Its stock performance has recently declined, with a 29.64% year-to-date decrease.

4) Coinbase Global, Inc.

This US-based company is the world's largest publicly traded CEX, holding over 9,100 Bitcoins. It plays a significant role in the cryptocurrency space, serving retail users and institutions and custoding tens of thousands of Bitcoins.

Similar to MicroStrategy, Coinbase's stock has risen since the beginning of 2024. Despite regulatory crackdowns by the SEC, its stock has risen by 26.44% year-to-date, benefiting from the surge in Bitcoin prices.

5) Hut 8 Corp.

This Canadian mining company is the only non-US company among the top five publicly traded holders and the second-largest publicly traded mining company, holding approximately 9,100 Bitcoins.

According to Benchmark's report, these holdings provide "significant liquidity and the ability to capture gains during Bitcoin price increases." Its value is approximately $592 million, representing around 82% of Hut 8's market capitalization.

Similar to Marathon Digital, the company has faced financial difficulties this year, with its stock price falling by 33.81% year-to-date.

Conclusion

Buying and holding Bitcoin for the long term and waiting for its appreciation is one way to make money. However, the continuous development of various assets and financial products also provides opportunities for indirect participation, including Bitcoin ETFs (spot and futures), stocks of entities with large Bitcoin holdings, and funds investing in Bitcoin or blockchain-related companies.

It can be seen that, driven by institutions, CEX, and service providers, Bitcoin has a complex and diverse user base, and understanding the user profile can help us understand the current level of participation and adoption of Bitcoin.

The total number of Bitcoin users does not equal the number of addresses. However, the five billion transactions conducted daily and the 67 million wallets with at least $1 balance indicate the market's active participation and increasing acceptance of Bitcoin.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。