On the afternoon of May 27th, AICoin researchers conducted a live graphic and text sharing session titled "ETF, a new way for old leeks to profit (with membership giveaway)" in the AICoin PC-end group chat live. Here is a summary of the live content.

I. The Rise and Expansion of ETFs

There is an increasing variety of ETFs available in the market, and the market capitalization is growing. It has gained recognition from traditional financial institutions, including large asset management companies such as Fidelity, BlackRock, and Invesco, which are all laying out plans for cryptocurrency ETFs, enhancing the market's credibility. More and more countries are gradually introducing policies to regulate and allow the issuance and trading of cryptocurrency ETFs. For example, the U.S. Securities and Exchange Commission (SEC) has gradually relaxed its stance, and countries such as Canada and Switzerland have approved various types of cryptocurrency ETFs.

ETFs have gone through a decade from application rejection to approval. The approval of ETFs has brought unlimited imagination and new ways of profit. According to reports from relevant media, the total scale of all open-end funds in the United States is over 6 trillion, with a potential allocation scale of 9.7 trillion US dollars. If these funds are allocated 1%, there will be a flow of 970 billion US dollars, and 9700 billion if allocated 10%. Currently, the scale of ETFs is only over 500 billion, which is only the scale of mutual funds in North America and Europe, excluding unlisted asset management, which has a larger scale but is difficult to estimate.

By 2024, the Bitcoin spot ETF will be approved. In the early morning of May 24th, with the approval of the 19B-4 form for 8 Ethereum spot ETFs by the U.S. SEC, the listing is only a matter of time.

In addition to Bitcoin and Ethereum, there may be more ETFs for other cryptocurrencies, such as Solana and Cardano. ETFs are bringing more and more funds to the cryptocurrency market. Moreover, the U.S. has implicitly recognized cryptocurrency as a legal reservoir of U.S. dollars, and more funds will flow in the future. The inflow of funds brings long-term benefits to the industry. Of course, short-term fluctuations are inevitable.

The method of making money through cryptocurrency ETFs is similar to other types of ETFs, mainly relying on market trends, investment strategies, market insights, and effective risk management.

II. Method and Strategy Sharing

1. Hold and Long-term Holding

Choose promising cryptocurrencies, purchase and hold them for the long term. If unable to hold for the long term, some short-term trading can be done. However, at present, for short-term trading, one needs to consider transaction fees and mindset. With the ETF just launched, if the future market outlook is good, it is easy to end up with lower profits from short-term trading compared to holding. Therefore, long-term holding is important.

2. DCA Strategy

The DCA (Dollar-Cost Averaging) strategy does have its unique advantages and effectiveness in cryptocurrency ETF (exchange-traded fund) investments. By investing in batches, the DCA strategy can effectively reduce the risk of market fluctuations, especially suitable for the highly volatile cryptocurrency market. The DCA strategy has good adaptability in bear markets, bull markets, and volatile markets. In bear markets, it lowers the average cost by accumulating more shares at lower prices; in bull markets, it capitalizes on the overall market appreciation even as the purchase price increases each time; and in volatile markets, it achieves steady growth through low buying and high selling to average costs.

Although the DCA strategy can reduce risks in most cases, potential risks still need to be considered. In times of extreme market volatility, the DCA strategy may not always significantly reduce risks and may still be affected by extreme market fluctuations. However, with the approval of ETFs, the returns from DCA outweigh the risks. Of course, apart from using the DCA strategy after the approval of ETFs, there are many other investment portfolios that can be considered.

3. Use Options to Amplify Investment Returns

With the approval of ETFs, attention can be given to options, which contain new opportunities. Use options (such as call options or put options) to amplify investment returns. However, the threshold for options is indeed high, so it depends on individual circumstances. Currently, for many people, there is resistance or a threshold for long-term holding of coins, and options are not suitable. Therefore, the DCA strategy is suitable for many people, and it is a relatively good profit strategy for cryptocurrencies after the approval of ETFs. Options and contracts are different, so do not confuse them.

Of course, based on the market situation, arbitrage can continue. Currently, the returns from arbitrage are not as good as those from DCA. For those with U.S. stock accounts, consider a combination of ETFs and U.S. stocks, which is a new way of playing and offers many profit opportunities after the approval of ETFs. However, options, U.S. stocks, and these are a bit high for most people, so it is still recommended to use the DCA strategy.

III. DCA View

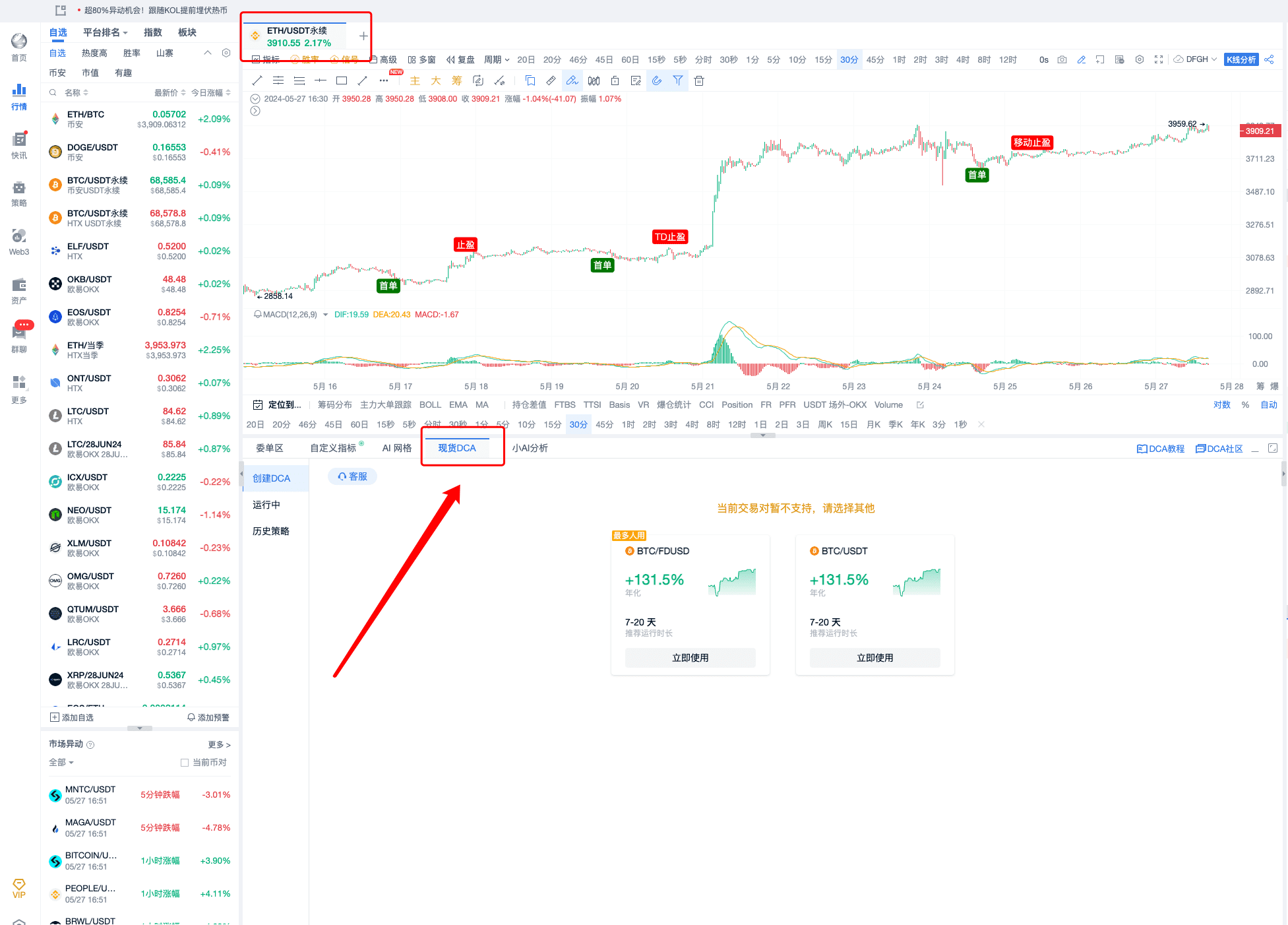

This is the spot DCA.

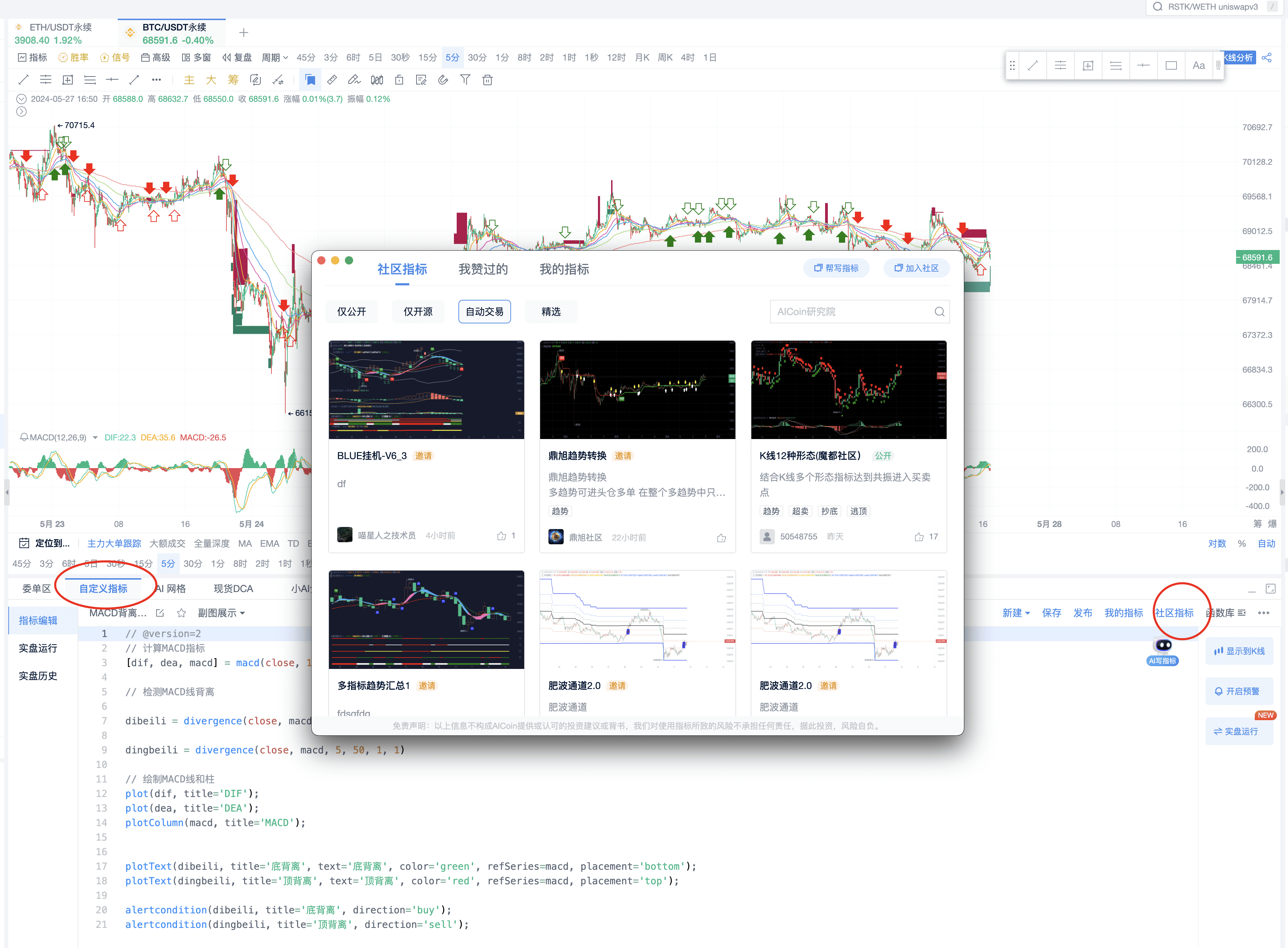

You can also check if there is a community to do the DCA strategy in the custom indicator community.

For PRO members and signal alert members, exclusive high-quality tools tailored for lazy friends, custom indicators can help any AICoin user to plan their trades and trade their plans. If you want to see more custom indicator strategies and multiple alert reminders, feel free to experience the custom indicator membership for a limited time by clicking the link below: https://aicoin.com/zh-CN/vip/chartpro

Recommended Reading

- How to choose coins under massive unlocking?

- EMA Long Positioning Strategy

- Small wins all, a high-winning MACD strategy

For more live content, please follow AICoin's "News/Information-Live Review" section, and feel free to download the AICoin PC-end.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。