The world is bustling, all for profit; the world is bustling, all for profit! Hello everyone, I am your friend Lao Cui Shuobi, focusing on the analysis of cryptocurrency market trends, striving to deliver the most valuable market information to the majority of coin friends. Welcome the attention and likes of the majority of coin friends, and reject any market smokescreens!

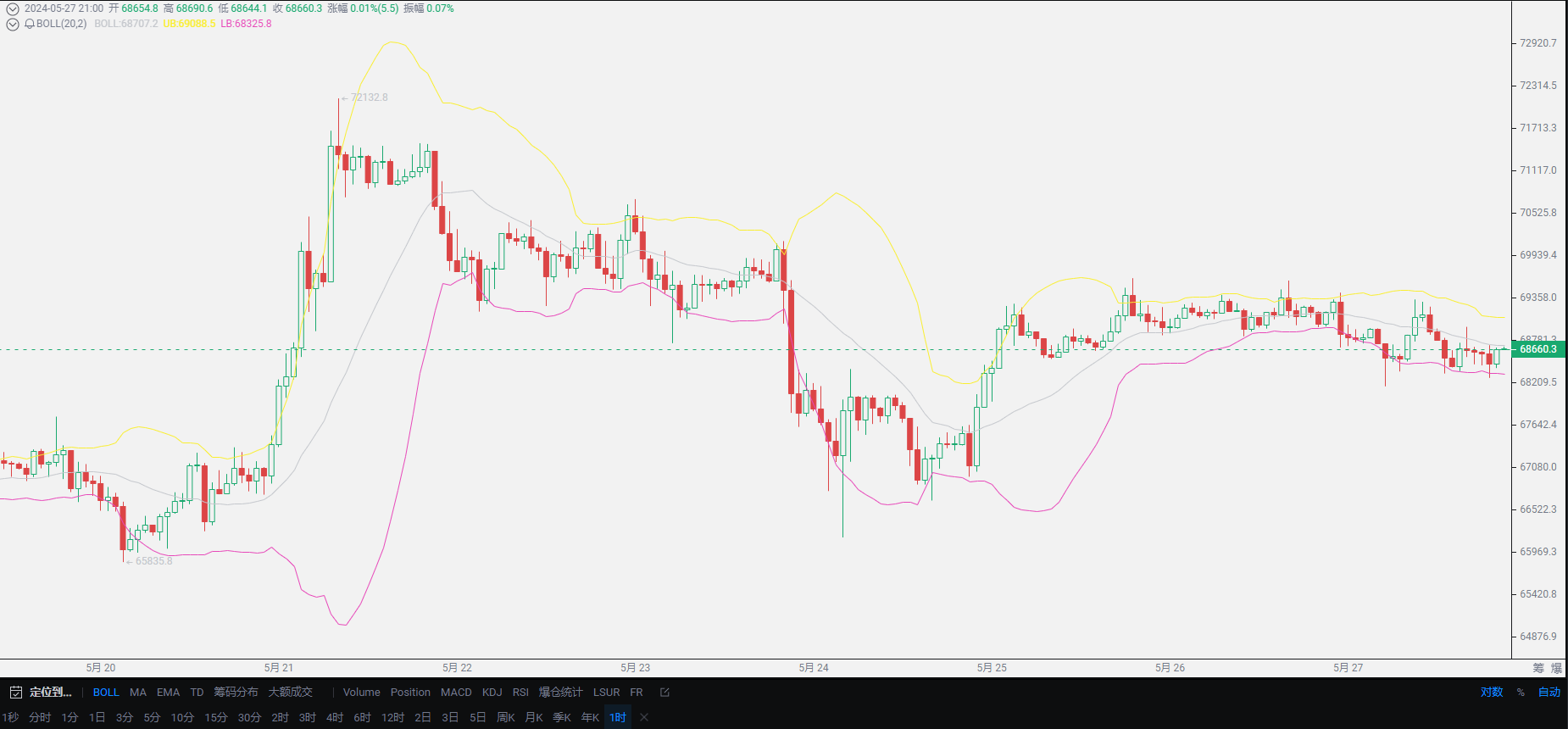

Short-term market trends have once again seen growth, which was somewhat expected. After observing the market for a long time, Lao Cui found that many people still have a relatively unclear understanding of the overall reasons for this growth. After researching a lot of information, I have partially figured out the main reasons. The biggest reason is the sudden news of interest rate cuts in Europe, which has activated the traditional assets of Europe and the United States, gradually leading to an influx into the market. This is good news for us. It is well known that interest rate cuts will reinvigorate the market, and the released funds will definitely choose a more dynamic track to appear in everyone's field of vision. The interest rate cut in Europe is ahead of the United States, indirectly proving that there are differences between Europe and the West in dealing with financial problems, and Europe is gradually awakening.

You can also see that the euro exchange rate, after reaching a high, has shown a trend of decline, and the speed of the decline is higher than that of the US dollar. The fundamental reason is the impact of the war. As long as the interest rate cut strategy is passed next week, it will definitely open the floodgates for the entire financial market, especially for investments in Germany, which is favorable for us. Stimulating economic growth is also good for the coin circle. At least there will be a large influx of funds. The area that short sellers need to pay attention to is the 3900-4000 position, where there are a large number of pending orders, which also proves that the giants do not have high expectations for Ethereum to reach historical highs before the interest rate cut in the United States.

Lao Cui's views are definitely consistent with those of major funds. Yesterday's article also pointed out that the mid-term trend will definitely be dominated by the bulls, but the bears are not as helpless as they are in a bull market, only accepting losses. The mid-term trend will not persist for too long. Even if the interest rate cut in Europe will bring about growth, it may only be temporary. The transmission of funds takes time, which means that it will take some time for funds to flow into the coin circle. In the short term, there is no problem with being bullish. As long as you are not greedy, you can basically make a profit. Looking at the situation on a monthly basis, we still need the assistance of the United States. As for the funds from Asia, you don't need to worry about the entry of giants. Basically, it's like a clay Buddha crossing the river. Especially the representative financial giant, Japan's assets have basically shrunk by thirty percent, and being able to smoothly pass through this crisis is already considered a good performance.

I never expected that last week, the trend of Ethereum was so unbearable, but this week there was a complete turnaround. In the future, the trend of Ethereum will definitely be better than that of Bitcoin. This issue is also very prominent. The inflow of funds into Bitcoin has basically reached its peak, while the upper limit of Ethereum is still not visible. If you want to choose a cryptocurrency to invest in, the first choice must be the Ethereum series, and the same goes for small cryptocurrencies. For those who are stable and have a small volume, you can consider BNB. I won't go into the specific reasons, as I have talked about it too much before. For users holding spot positions, there is no need to be too anxious. The longer you hold, the higher the returns will be.

The remaining content will focus on contract users. Recently, almost all the users who contacted Lao Cui were losing money. In such a volatile market, it is very easy for contracts to be liquidated. Regardless of the position allocation, for a market with frequent long and short bursts, it is powerless. Lao Cui is also not good at comforting everyone, which is an inherent characteristic. The ultimate goal of contract users must be spot positions. Contracts belong to the speculative market. Once everyone's original capital accumulation is sufficient, which is the 50,000 U mentioned by Lao Cui earlier, reaching this standard definitely requires development in the spot market, and not too much investment in contracts. The end point of contracts is definitely liquidation. Over-investment is not a good thing for everyone. At the human level, ordinary people are ultimately no match for capitalists. With a small amount of capital, the big players can make you profitable countless times, but as soon as a market trend comes, they can make you hand over all your capital.

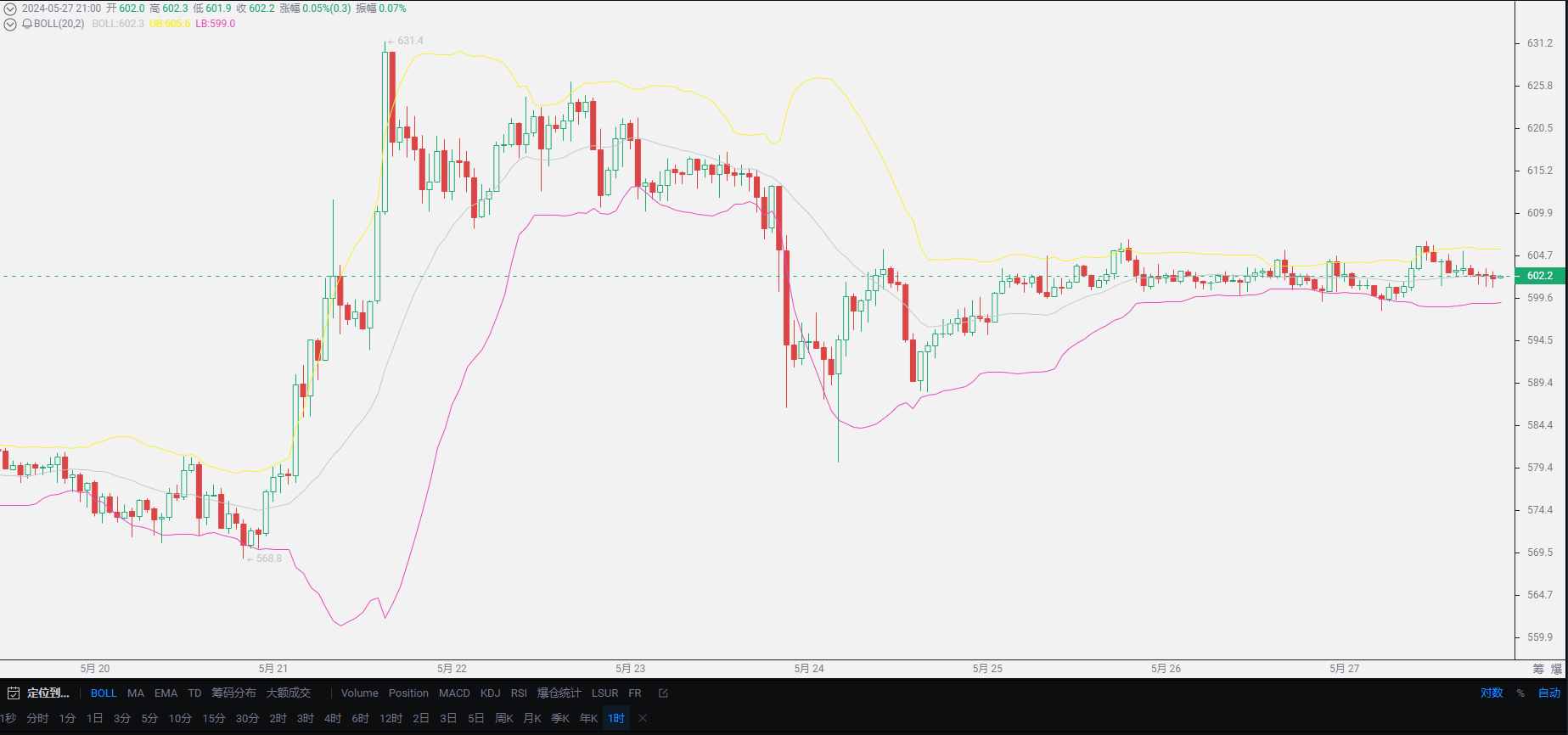

Lao Cui's conclusion: Yesterday's article mentioned that as long as the 3800 level is held, the market will definitely continue its upward trend, and the bearish side is completely at a disadvantage. For the future market, the bullish side still dominates. Whether it is the implementation of the interest rate cut strategy in Europe next week or the influx of large funds, it does not have much impact on our overall major trend. Ultimately, it is the same as our analysis yesterday. The upward space is getting lower, especially before the interest rate cut in Europe, there may be a wave of downward space. Of course, the downward space will definitely not be too deep, but overall, it is higher than the upper position. Contract users should observe the 3900 position. If it can stabilize, after stabilizing, there will be an attack on the 4000 level. Currently, more funds will flow into Ethereum, and the upward space for Bitcoin is lower than that of Ethereum. Whether Ethereum can rise with Bitcoin is uncertain. Once it falls below the 3850 level, everyone can act accordingly, and the space for short positions will be quite intense. The position of the previous spike will be realized. Spot users should exit for profit as soon as possible.

Original article created by public account: Lao Cui Shuobi. For assistance, you can contact directly.

Lao Cui's message: Investment is like playing chess. Masters can see five steps, seven steps, or even a dozen steps ahead, while those with lower skills can only see two or three steps. The high-level players consider the overall situation, plan for the general trend, and do not focus on individual moves or territories, with the ultimate goal of winning the game. The lower-level players fight for every inch, frequently switching between long and short positions, only focusing on short-term gains, and frequently end up in trouble.

This material is for learning and reference only and does not constitute investment advice. Buying and selling based on this material is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。