Hello everyone, I am your friend Lao Cui Shuobi, focusing on the analysis of digital currency market trends, striving to deliver the most valuable market information to the majority of currency friends. Welcome the attention and likes of the majority of currency friends, and refuse any market smoke bombs!

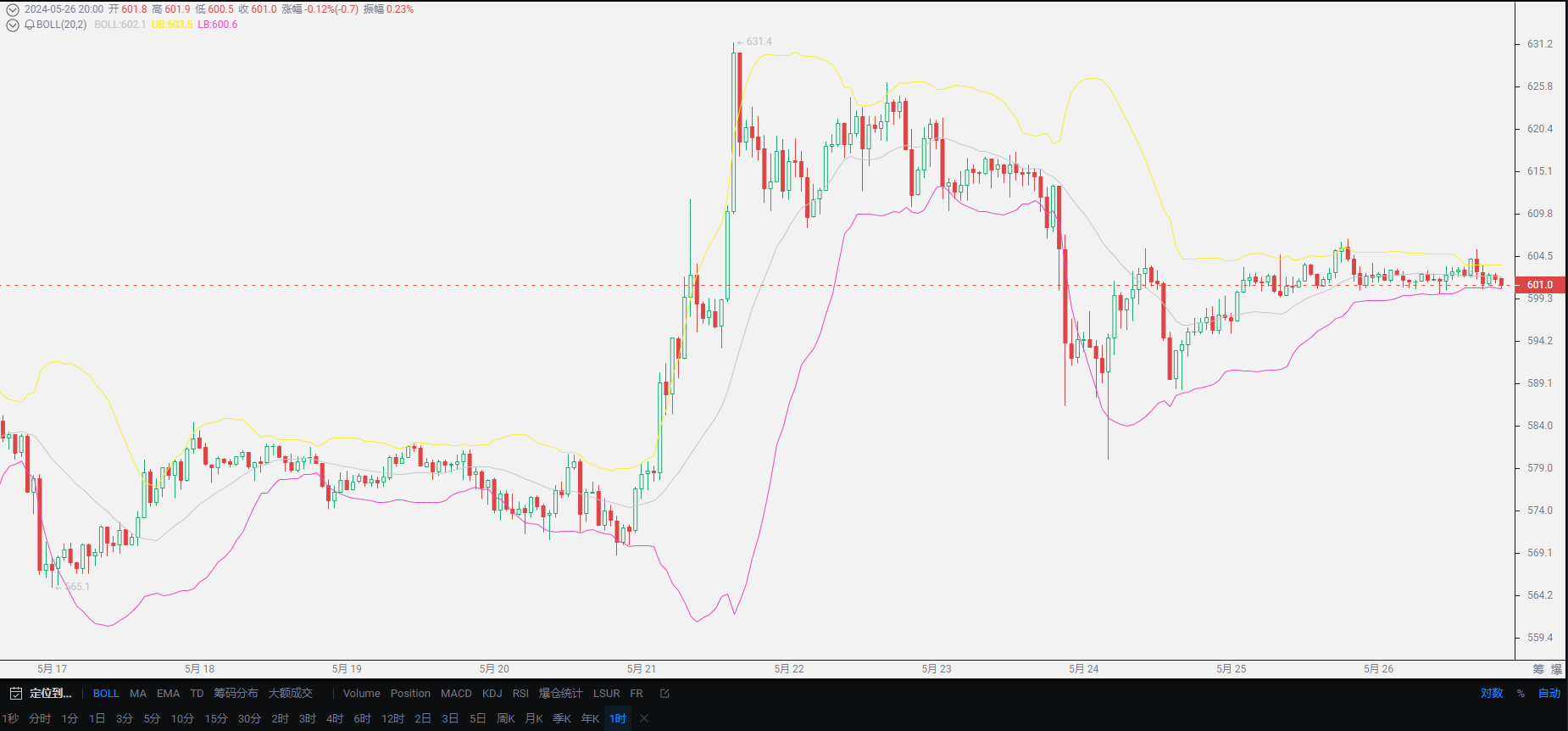

The trend was very flat yesterday, but it made Lao Cui even more worried. The point of concern is very simple: Bitcoin's daily trading volume was only 150 million, and Ethereum was only 8000. The extreme shrinkage kept Lao Cui awake all night. This is very much like the calm before the storm, especially like the eve of an impending storm. Although the overall market trend is still tending to be stable, the increase in risk is growing at an exponential rate. The current round of pullback trend, as you can clearly see, the rebound of the bulls is becoming increasingly weak. The rebound strength from the high point is relatively weak, and the speed of the bearish decline is also powerless. The entire wide-ranging oscillation can be said to have reached a new level.

In such a sluggish market situation, the lack of a short-term decline and even the appearance of a small cycle rebound may not be a good sign for the currency circle. The previous rise is believed to have led to the liquidation of many currency friends, and it is certain that the funds of retail investors are unable to re-enter. The current situation of the giants is also in a state of agony. They want to boost the market but lack the funds, and they want to exit but are afraid of not being able to completely withdraw. Many friends still do not understand the global nature of the crisis. Although you have heard Lao Cui talk about the crisis enough, it seems very disdainful of the formation of this crisis. In the remaining content, Lao Cui will explain why this crisis has formed.

Those interested can take a look at the current debt of the United States and the West, which has reached historically high levels. Drawing from history, the previous solution was the birth of World War I and World War II. The current debt is obviously higher than the previous two situations, which has caused concern for many capitals in the current situation. If the United States and the West had absolute strength, they would definitely want to solve the crisis in this way, but the current situation does not have a great chance of success, so local wars have also emerged. This crisis is caused by the high debt of the West. As for the solution, there is currently no precedent (except for war) that can perfectly solve it. In the financial sector, it means that there is no practical experience to refer to, so all we can do is speculate. Even if we maintain a relatively objective perspective on the entire situation, there is still no correct answer.

In case a figure like Hitler really appears now, the appearance of such a figure will change the entire global situation. The current general thinking is that World War III will not happen. For capital, these are only present in analysis, and what capital needs to do is to plunder assets. The ongoing Asian financial plunder war is a series of chain reactions. So, as Lao Cui emphasized in yesterday's article, it is impossible to determine the specific trend in the future market. From the perspective of future predictions, we can only judge from the entry funds. The USDT exchange rate has shown signs of recovery. I would like to remind everyone again to pay attention to this special issue. It will be difficult for the market to continue its upward trend if it exceeds 7.3.

Lao Cui's conclusion: Looking at the overall trend, Bitcoin's upward trend is slightly tired, but the future trend will definitely revolve around Ethereum. This also confirms our previous speculation. At the logical level of the overall operation, the upper limit of Ethereum is higher than that of Bitcoin. A slight announcement of listing can lead the entire currency circle to rise. From a technical perspective, starting from the high point of 3952 set by Ethereum, it did not touch the 4000 mark and went straight down to 3524. It is currently in the market repair stage and will still maintain a period of oscillation in the short term. However, the volume of funds entering the market at the 3900-4000 mark is not optimistic, and the bears are relatively weak. It is feared that if it cannot return to below the 3750 mark in the short term, the market will still see a wave of growth, but the upward space is not too large. The overall space below is still greater than above, and it is difficult to reach a new historical high. Currently, the bears are in a dominant position in the big trend. The observation point for the bulls is whether they can stabilize at the 3800 mark today. For spot users, they can find a position to enter the market, while contract users should try to go short around the high point. It is highly likely that there will be a pinning market in the future!

Lao Cui's message: Investment is like playing chess. Masters can see five steps, seven steps, or even a dozen steps ahead, while those with lower skills can only see two or three steps. The masters consider the overall situation and plan for the general trend, not focusing on individual moves or territories, but aiming to win the game in the end. On the other hand, those with lower skills fight for every inch, frequently switching between long and short positions, only fighting for short-term gains, and frequently getting trapped in the results.

This material is for learning and reference only and does not constitute investment advice. Buying and selling based on this material is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。