The world is bustling, all for profit; the world is often moving, all for profit! Hello everyone, I am your friend Lao Cui Shuibi, focusing on the analysis of digital currency market trends, striving to convey the most valuable market information to the majority of coin friends. Welcome the attention and likes of the majority of coin friends, and refuse any market smokescreens!

After the baptism of the previous day, the users of the contract have experienced another big wave. Although the announcement has temporarily appeared to be approved, the market has not moved. It seems that only when happiness is close, people will feel happy, but when happiness comes, there is not much feeling. Many friends have asked Lao Cui about the judgment of the overall trend. This point still refers to the global economic trends. The overall trend is more of a test of everyone's judgment on the global situation. I believe that everyone has a certain understanding of financial crises, but only this round of financial crisis has deeply affected the general public. Why did this situation occur? It's simple. This round of financial crisis is different from the past. Previous crises could be said to have been basically digested at the national level, but only this time, it can affect our lives.

This needs to be explained from the beginning. The crisis in 2007, everyone is very clear that it originated from the bursting of the 2002 Internet bubble in the United States, which led to the subsequent subprime mortgage crisis, and the most significant company, Lehman Brothers, went bankrupt. Learning from history, this round of crisis can be said to be the biggest crisis faced by human history. It started from the biological crisis and has now evolved into a financial crisis, so the feelings of everyone this time are quite deep. For three years, most of the public did not have high incomes, which led to insufficient preparation for the upcoming financial crisis, and it can be said that the unemployment rate this time has become an insurmountable problem. Coupled with the collapse of the housing market, the assets in the hands of most users have almost halved.

Because this financial crisis is not caused by economic factors, so basically all financial policies are ineffective against it. This directly addresses all the questions from coin friends about when the financial crisis will be over. Lao Cui actually finds it difficult to predict this aspect, which is beyond Lao Cui's ability to anticipate. Not to mention learning from history, because this crisis has no historical reference, and there is no direct strategy to follow. Most countries are taking it step by step. From the perspective of the housing market, everyone can see that they want to burst the bubble, but they also do not want to bear the losses. It's a bit of a fantasy, so everyone does not need to worry too much about these aspects. At present, it seems that the strategies we are implementing are still effective, at least better than the way the United States is handling it. If this crisis cannot be properly resolved, it is highly likely to trigger a certain scale of war.

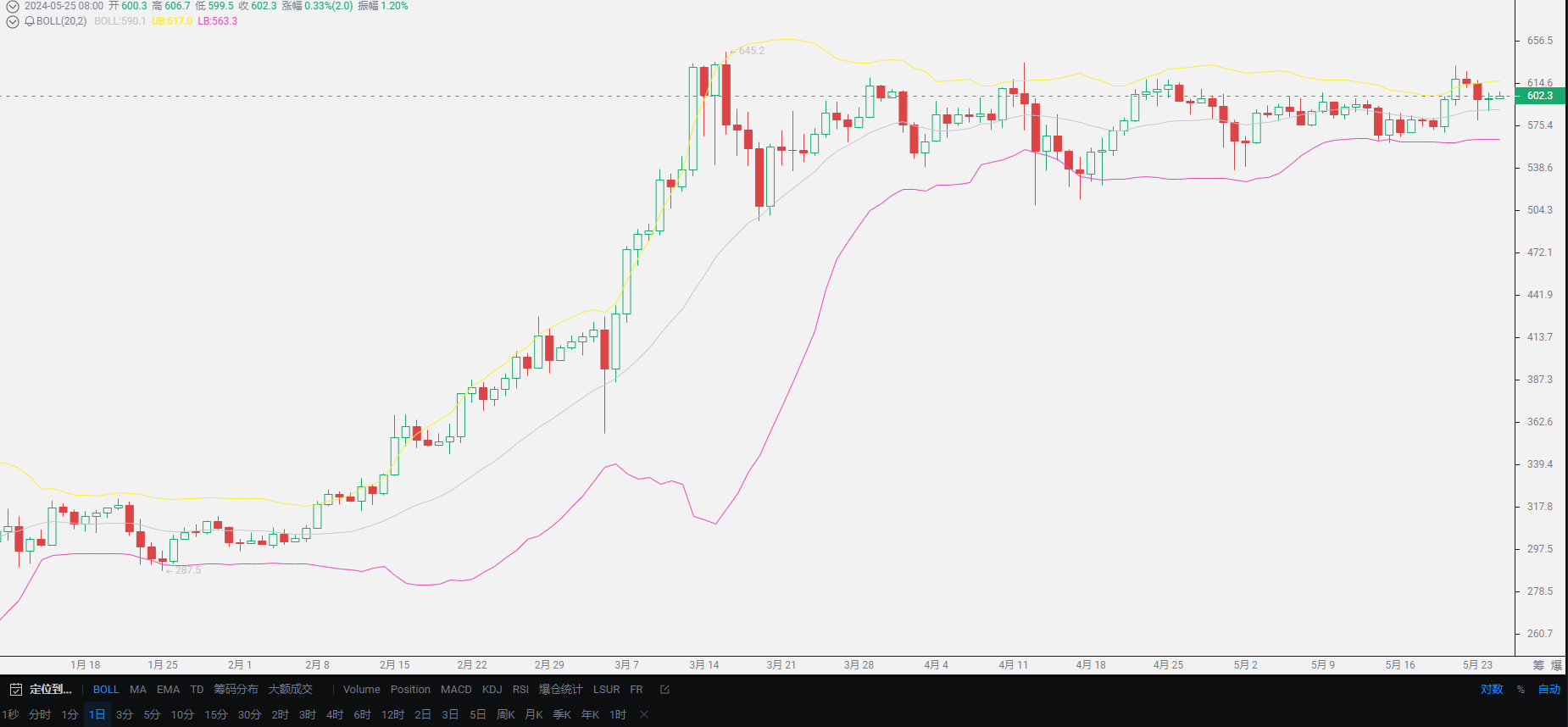

These are definitely within a controllable range and are already happening continuously. So, when it comes to the coin circle, the essence of the market is the trading between buyers and sellers, and only with trading can a market be formed. Globally, major players with a certain scale are basically involved in the financial crisis and have also invested in the suppression of Asian assets. Then there is the amount of funds at the national level, which are also involved in the financial war. In such a chaotic situation, where does the coin circle's capital growth come from? When it comes to this round of growth, many friends think that Lao Cui's analysis is a misjudgment. Regarding the aspect of growth, Lao Cui has always mentioned that it must wait for the news of Ethereum's listing and the guidance of interest rate cuts to lead to the recovery of the global financial market. Therefore, most friends are focused on Lao Cui's statement that there will be no growth in the near future. Completely ignoring the announcement of Ethereum's listing. It is hoped that everyone can take a broader view of the entire financial investment market, rather than being fixated on the current trend.

We are still in the mud, not just in the coin circle, but in all markets. The depth above is still limited, as mentioned in the previous article, being bearish is better than being bullish. This round of rise is more of a follow-the-leader form, including the announcement being approved, these messages are basically hints released by the United States. After the market rises, everyone rushes in, and the remaining time is waiting for the sickle to harvest. Therefore, looking at the future trend of the coin circle market, Lao Cui still tends to be more inclined to a bear market. Short-term rebounds are not enough to convince Lao Cui's thinking, and Lao Cui still stands on the idea of harvesting leeks to guide the market's upward trend.

The coin circle market still competes with other markets, including gold, silver, and the stock market, all of which can only be considered competitors of the coin circle. With the gimmick of listing, it can attract a wave of pulling and can attract more investors, while also harvesting a wave of leeks. The demands on Lao Cui are a bit too harsh, wanting Lao Cui to perfectly predict the listing route of Ethereum, which is a bit difficult for Lao Cui. Lao Cui is completely unaware of the news of Ethereum's listing, so can only remind everyone that the news of Ethereum's listing and the interest rate cut by the United States will lead to growth in the coin circle, but Lao Cui cannot predict the specific timing. Currently, aside from these two pieces of news that can change the short-term trend, the rest of the time will mostly maintain a wide-ranging oscillation, continuing the previous trend.

Lao Cui's message: Investment is like playing chess. A master can see five steps, seven steps, or even a dozen steps ahead, while a low-level player can only see two or three steps. The high-level player considers the overall situation, plans for the general trend, does not focus on each move, and aims to win the game in the end, while the low-level player fights for every inch, frequently switching between long and short positions, only fighting for short-term gains, and frequently ends up in trouble.

This material is for learning reference only and does not constitute buying or selling advice. Buying or selling based on this material is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。