On the afternoon of May 23, AICoin researchers conducted a live graphic and text sharing session titled "How to Choose Coins Under Massive Unlocking? (Free Membership)" in the AICoin PC-end-Group Chat-Live. Below is a summary of the live content.

I. New Coin Data

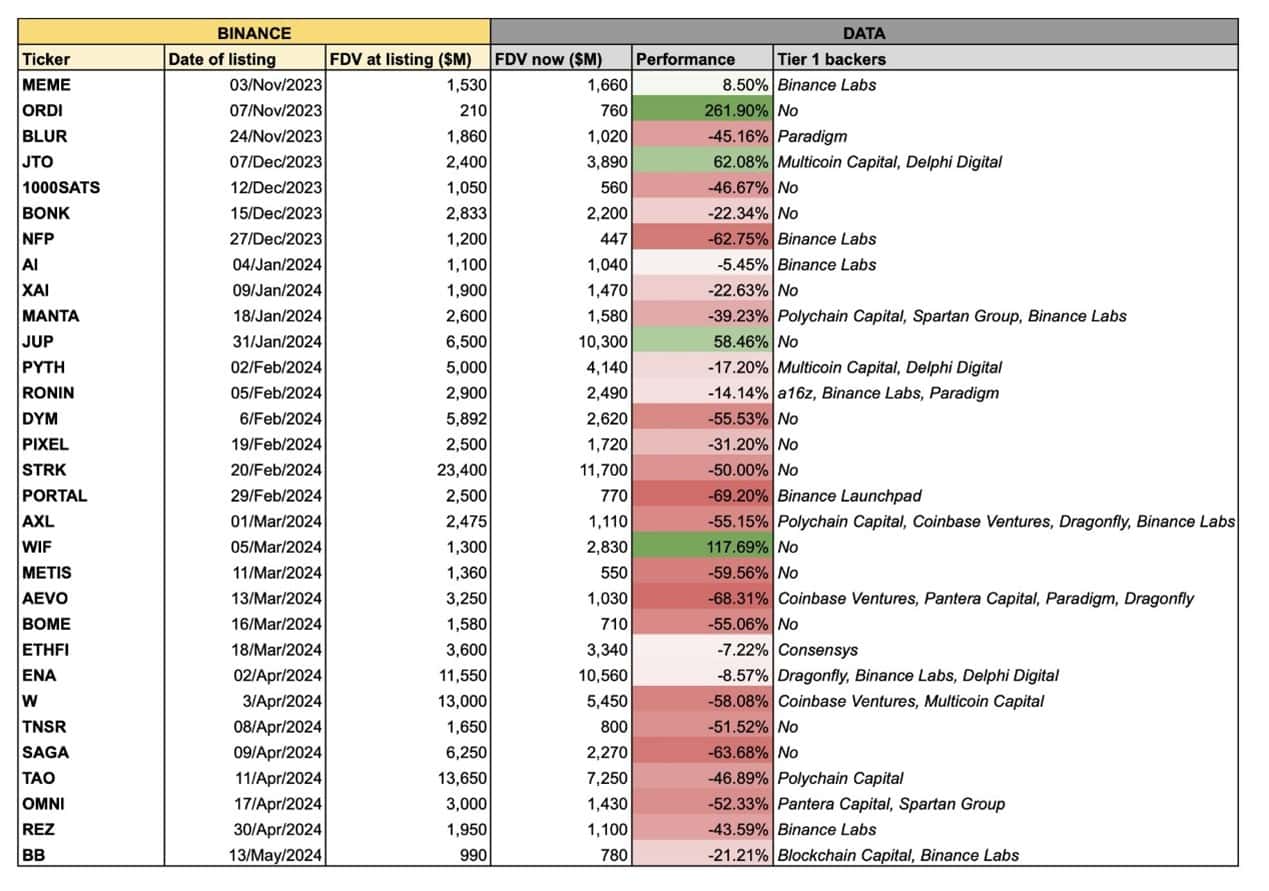

This is the new coin data compiled by @tradetheflow on Binance on May 17, covering the period from November 23 to May 24.

The second column shows the listing time, and the third column shows the FDV (Fully Diluted Valuation) at the time of listing. It can be seen that the FDV of most projects currently ranges from $450 million to $10.5 billion. Projects with red bars indicate the performance of tokens since listing, and many have fallen below the listing price.

The last column shows the project investors, commonly known as VCs. Among them, the best-performing categories are: ORDI (Inscription), JTO (LSD&MEV), JUP (DEX), WIF (MEME). Historically, Inscription ORDI belongs to the BTC ecosystem, while the other three categories belong to the Solana ecosystem.

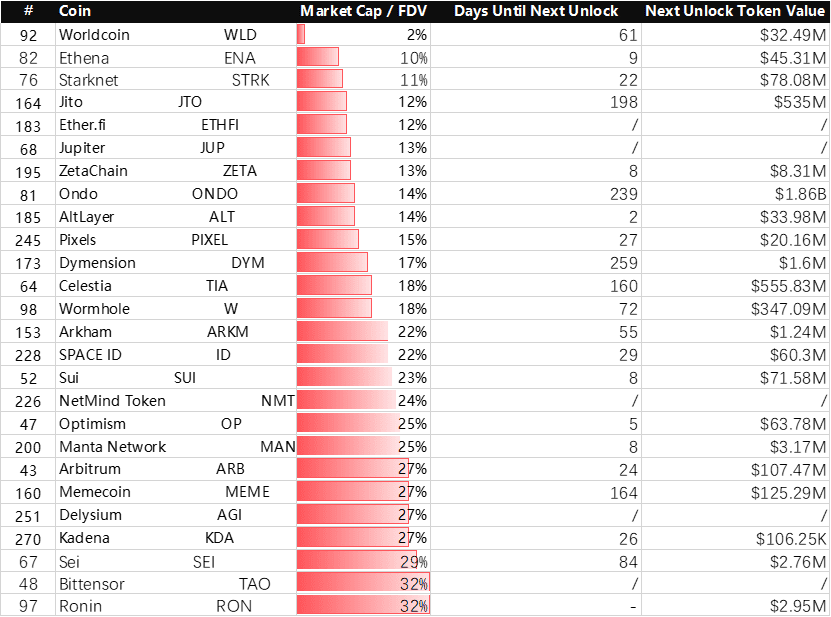

One current measure of token circulation is the market cap/FDV. MarketCap = price * current circulating token quantity. FDV (Fully Diluted Valuation) = price * total token quantity. Currently, the market cap/FDV can measure the current circulation rate.

A few days ago, Binance Research released a report: It is estimated that approximately $155 billion worth of tokens will be unlocked from 2024 to 2030. Currently, the unlocking of tokens in the market still brings significant selling pressure. A current trend is: low circulation + high FDV, indicating relatively limited chips in the market and excessively high FDV.

Recently, VC coins and Meme coins have been described as not picking up each other's orders, depicting a struggle between institutions and community users. Essentially, large institutions acquire a large number of chips at extremely low costs in the primary market and need to find someone to take over for cashing out. Currently, the most common approach is to list, not only to list but also to list on major exchanges, with the most typical being listed on Binance.

II. Tokens with High FDV, Low Circulation Rate, and Large Unlocking Soon

In the current market, it is important to pay special attention to tokens with high FDV, low circulation rate, and large unlocking soon.

The second column shows the circulation rate, with many new coins included. The third and fourth columns represent the next unlocking time and the estimated value of the unlocking tokens. If a token is to be unlocked soon and has a low circulation rate, continuous selling pressure will likely occur in the future. The details of token unlocking can be found on TokenUnlock and in the project's community forums.

Because the data updated on the website may not keep up with the temporary changes made by the project team, it is necessary to check the proposals. The market is currently approaching the level of the bull market in 2021.

The total market value of the crypto market is currently close to $2.6 trillion, having recovered from the FTX explosion in November 2022.

From the trend of BTC, it roughly aligns with this data. The yellow represents the trend of BTC. However, there is a question: this round of bull market is basically driven by BTC. News from the SEC can be found on Twitter or the SEC official website: https://www.sec.gov/newsroom. The TVL data on the chain is still far from the bull market of 2021. The current TVL has reached $115.64 billion, still some distance from the peak TVL of over $210 billion in 2021. After many projects are listed, the project data will drop significantly. Therefore, the pressure of token unlocking can be viewed together with the project data to see if the project is sustainable, or if the project team simply wants to sell tokens. However, it is still necessary to pay more attention to the DeFi ecosystem, as there have been some good projects in 2021 such as Yield, LSD, and DEX.

The total market value of crypto can be found in the index.

III. How to Diversify the Evaluation of Project Ecosystem Data?

You can refer to: user daily activity, TX quantity, number of ecosystem protocols, fees, returns, and project sustainability. Project sustainability can be analyzed from the perspective of regulatory policies, hacking incidents, and project teams. Before a project is listed, there is often a broad narrative aimed at the market. However, whether the project can continue to empower its token holders is a major issue.

BNB is often referred to as a golden shovel. This type of platform token can bring decent returns to its holders through mining activities and can be seen as the conversion of bargaining power between major exchanges and project teams.

IV. How to Select Tokens and Projects from Massive Unlocking?

1. PMF (Product Market Fit)

In the crypto market, liquidity is always the core, and projects that can create or increase liquidity are worth paying attention to. This is reflected on the chain in terms of TX quantity and fees, and another focus is user demand.

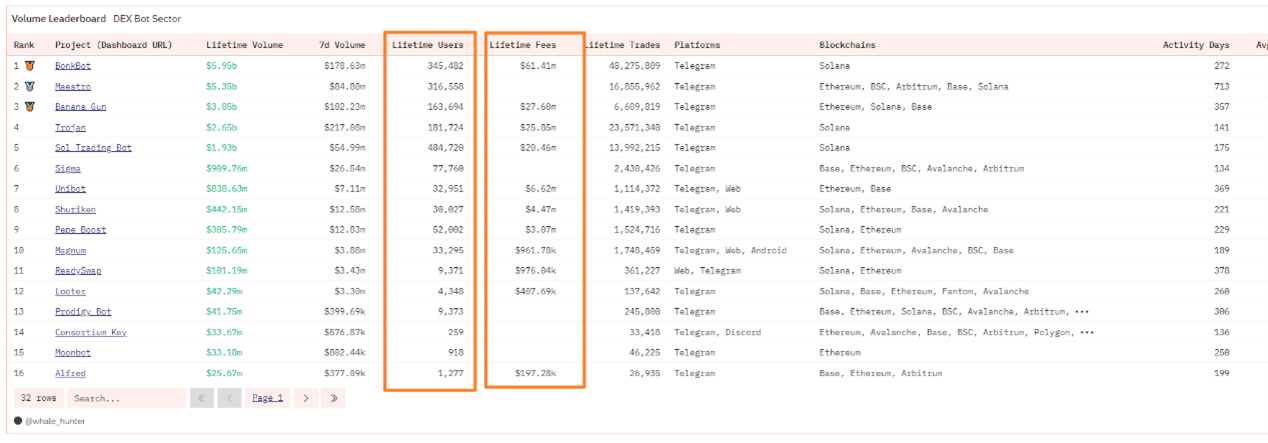

This is data from the robots. Many robot projects generate trading fees of over tens of millions of dollars, and searching for "Bot" on Dune can be seen at: https://dune.com/whale_hunter/dex-trading-bot-wars. The reason these projects are all less than a year old is that trading robots meet the needs of retail investors: speed. Increasing the speed of trading can create profits. For the project team, the increased trading frequency by users generates more trading volume, which can lead to profits.

2. Tokens with Full Circulation and Openness and Community Support

Meme coins are the most typical in this category. New retail investors: take a look at Birdeye, ave.ai, DexScreener. Currently, these three are widely used. Although cats, dogs, frogs, and monkeys have become rampant, the potential of these types of tokens representing the Solana ecosystem and the Base ecosystem is increasingly evident.

3. Confirmation of Data and Narrative

Many narrative concepts, such as open ecosystems, Trad-Fi, privacy, re-staking, AI, are actually quite speculative.

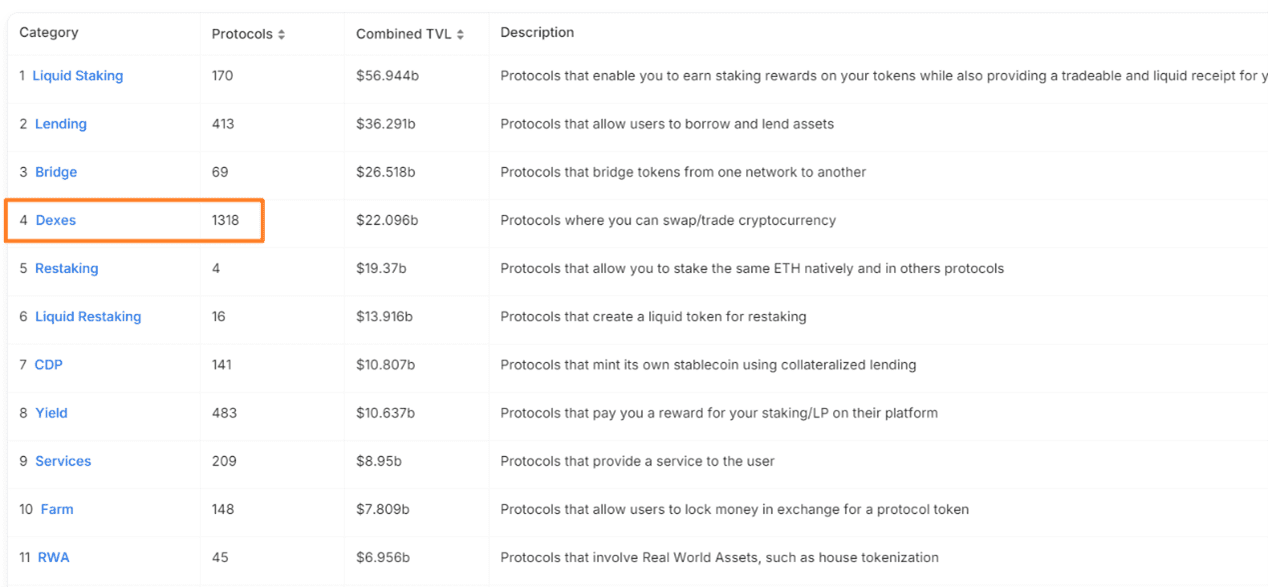

Like DEX protocols, there are over 1,000 of them, but do we really need so many swaps? In fact, looking at the data, we can see that the common DEX on-chain are Uniswap and Raydium. However, personally, many users prefer to use DEX aggregators such as 1inch, CowSwap, Paraswap, and 0xExchange.

A lot of data can help us see the potential of these tokens and projects. The simplest of these is trading volume and fees. Regardless of whether there is profit, trading fees are a cost for users. These are the most commonly used on-chain transactions. It's worth paying more attention to buying tokens of new projects, as they are usually listed on centralized exchanges like Binance after DEX. If it's ETH, it's good to check Twitter and the SEC official website. Binance is a centralized exchange, and there is more information on on-chain trading volume and fees on L2 Beat and Defillama.

The PRO membership and signal alert membership are high-quality tools tailored for lazy friends, and custom indicators can help any AICoin user plan their trades and trade their plans. If you want to see more custom indicator strategy displays and multiple alert reminders, feel free to activate the signal alert/PRO version candlestick chart, both of which offer a limited-time free trial of the custom indicator membership. Click the link below to activate the trial: https://aicoin.com/en/vip/chartpro

Recommended Reading

- EMA Bullish Alignment Strategy

- A MACD High Win Rate Strategy

- Insight into Coinbase Premium for Large Orders, Is BTC Rebound Imminent?

For more live content, please follow the AICoin "News/Information-Live Review" section, and feel free to download AICoin PC-end.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。