For these smart money addresses, in addition to being able to learn and imitate through copy trading, perhaps we should explore the scientific methods of MEME coin trading through the analysis of their trading logic and behavior.

By Frank, PANews

MEME coins are like a dark forest, with extremely fierce competition. Countless speculators are competing in it, but it seems difficult for anyone to become a consistent winner. In this situation, the instances of those who have made a name for themselves seem to be more instructive. For these smart money addresses, in addition to being able to learn and imitate through copy trading, perhaps we should explore the scientific methods of MEME coin trading through the analysis of their trading logic and behavior. PANews has compiled a list of 5 recent typical smart money addresses, attempting to uncover the secrets behind their trades and what kind of formula has led to their success.

Case One: Single-handedly turning trash into treasure

Smart money address: AcLHpBGUgsRApF2eF3tPPxMsgsnyBAr53mdBvLM8ST8z

On May 16 at 10:42:30, the 1DOL token was created on pump.fun, with only the founder buying 5 SOL in the early stage. This token had only 10 comments on PUMP and almost no trading activity in the 3 days after its creation. The Twitter account associated with the project was suspended. Originally, this was another case of a failed launch. On May 19 at 4:28:18, the founder started selling 1.5 SOL.

On May 19 at 5:39:58, the address 4gQYeDooUUHXG6wXDaUR3sL68ZHr2niim2aiZiQNgvGv started buying 13 SOL of 1DOL. After the purchase by the address 4gQYe, it quickly sparked a buying frenzy in the market. The project's funding within an hour met the price curve progress on Pump and was listed on Raydium.

Subsequently, the market value of 1DOL surged to $20 million, and the holdings of the address 4gQYe reached nearly $2.26 million, with a profit of 993 times. According to PANews analysis, this address belongs to a Twitter user named Sunday Funday, who is a seasoned MEME coin player. He had spent 421 SOL participating in the fundraising for BOME, and as a result, made a profit of about $18 million.

According to PANews analysis, Sunday Funday's main approach is to focus on crypto artists. He once stated on Twitter that the success of BOME was due to his understanding of the artists, which is why he heavily invested and made big money. Of course, after the success of BOME, Sunday Funday became a target for many players to track. Therefore, every time he buys, it attracts many followers. Although it is not known whether 1DOL was intentionally pushed to the top or not, the results have created a new wealth code. However, with the current pool size of only $230,000, Sunday Funday's millions in profit are just paper wealth and difficult to cash out.

On social media, many players questioned whether Sunday Funday was an insider trader, obtaining high returns by attracting other addresses to buy. In response to these questions, Sunday Funday stated, "Did I buy because I believe in the artists? 100%. Did others buy because I bought? Maybe." As of May 21, Sunday Funday has not sold the tokens.

Case Two: Short-term hunters and long-term lurkers on GME

Address: 3zdzNQPcJ4NdEsK2EEHbRMvupVqJPmk94YQyJpMSjPf1 is a short-term hunter who made a profit of $200,000 through GME.

First purchase: From 2024-05-13 00:05:41 to 2024-05-13 03:13:54, spent approximately $16,000 to buy 18,640,537 GME tokens.

Started selling after holding for about 9 hours, at which point the GME price had risen by more than double its cost. The first sale was about $61,000, recovering the cost and making a profit of 4 times.

During the purchase process, the GME trend had just started to ferment, with a rise of over 30% in the time period of the initial purchase. However, this player remained steadfast in buying and completed most of the position building within 5 minutes (about 87% of the initial total position).

Address: 2nU4GehM5FLtdZcx8BiAHgMFW6ziDJbtFmXsKiwkzUdP is a long-term player who started accumulating GME 2 months in advance. This player started accumulating GME from March 5 and continued until May 1, accumulating a total of 69,400,000 GME tokens, with a total investment of $19,000. Until May 13, when Roaring Kitty returned to start selling, the profit was $468,000.

Both of these players obtained high returns through the GME token, but their styles of operation are clearly different. From the results, it seems that the long-term player has the upper hand. However, the short-term hunter 3zdzN also had a similar long-term layout for tokens, but the price trend was consistently downward. Clearly, short-term trading may be more suitable for the player at address 3zdzN.

Case Three: Winning a $100,000 jackpot like a lottery player

Address: 7BBgSsxsjtS8NSZqKZp7qmsoDenupqBaCNZPj8Tvh7g8 (alienbot.sol)

This address's user is like a lottery player, liking to invest 0.2-0.3 SOL in newly launched tokens. Of course, most of the tokens end up being worthless. From May 6 to May 8, this player completed a total of 450 such transactions, spending a total of 57.3 SOL (about $8,700). 99% of the projects did not yield any returns. Only one PumpnDump successfully took off, yielding a profit of $106,000. Although the media may mention that the user won $100,000 with 0.3 SOL, the cost behind this $100,000 is not low (alienbot.sol and other associated addresses also have the same investment strategy, with a total cost far exceeding 57.3 SOL).

Many players on social media questioned whether this address was an insider trading address, but after PANews analysis, it seems that this player's success may purely be the result of winning the lottery. However, this strategy is not suitable as an investment plan, especially since there are over 16,000 tokens issued on the Solana chain every day. The ultimate result of such trading methods may still be not worth the effort.

Case Four: Suspected potential profits of nearly tens of millions from insider trading

Address: 5YYaPTFHuW3cgFvgd6oHZy1HgPWGKa59NJKhHVKoMCAX was suspected of being an insider trader for MANEKI, as this address invested over $100,000 in MANEKI just 1 minute after its launch.

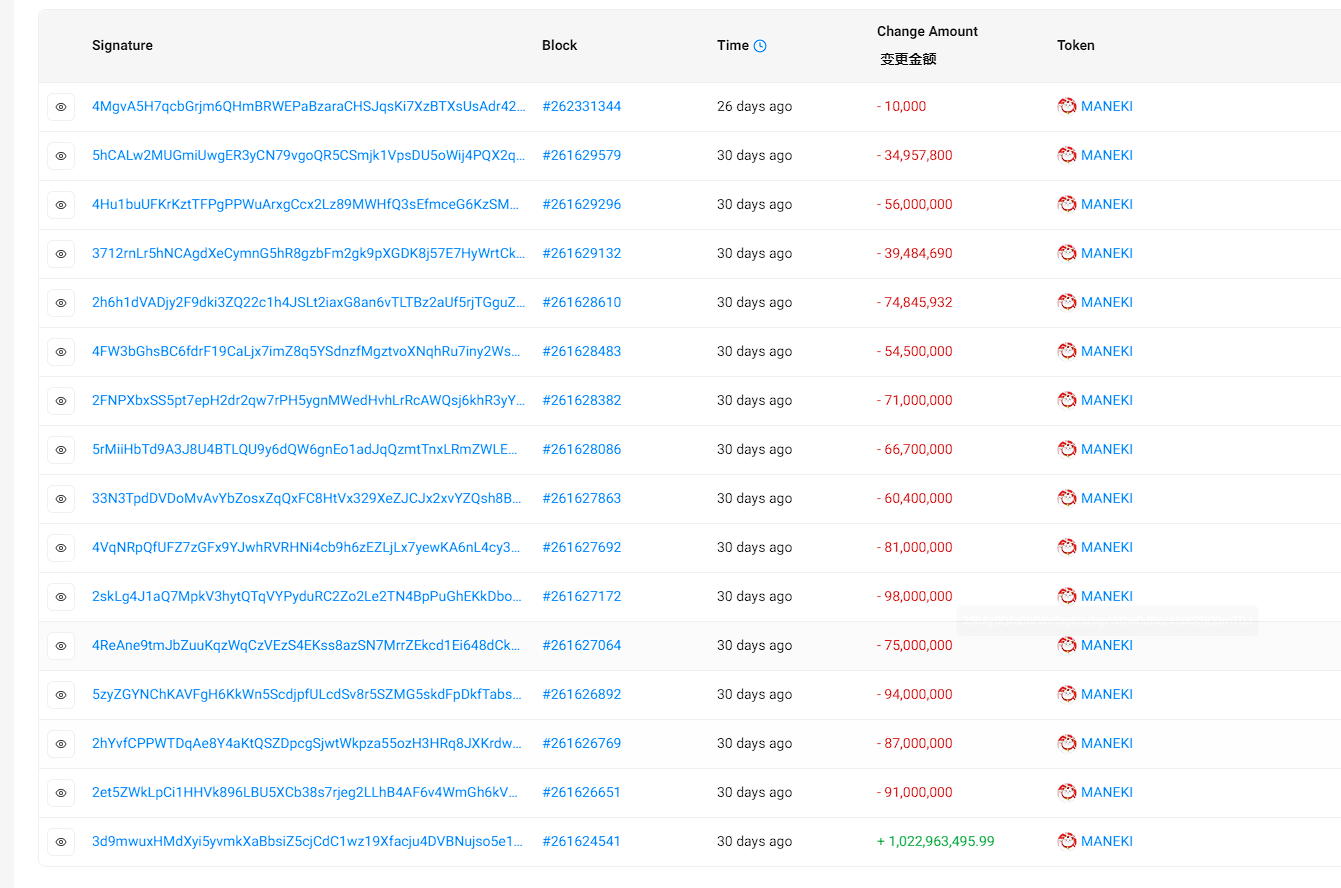

MANEKI launch time: 04-22-2024 14:55, purchase time: 04-22-2024 14:56:48, purchased 718 SOL, accounting for 11% of the total supply of the token. Subsequently, this address distributed these tokens to 15 addresses. The current value of the tokens is approximately $9.55 million, while the total funds in the liquidity pool amount to only $15.5 million. After the user's holdings were exposed by @ai_9684xtpa, there has been no selling. Insider trading is indeed an important route for many smart money players, but in the current situation where blockchain tracking tools are very advanced, the behavior of insider trading seems to be difficult to hide in the dark.

Summary:

1. Snatching the opening is not the choice of smart money

In the analysis of several smart money addresses, only a lottery-style player and an insider trading address adopted the method of snatching the opening. Instead, their choices are more focused on the project initiator or the narrative behind the project.

2. There are no consistent winners, so blindly copying trades is not wise

After analyzing the smart money addresses, it was found that almost every smart money address completely changed their capital scale after seizing 1-2 opportunities. In terms of success rate, most of the tokens they bought also ended up being worthless. Therefore, blindly copying trades from smart money addresses is not reliable.

3. They are lucky, but also contributors

Based on PANews' analysis of the trading scale and timing of these smart money addresses, it is evident that these addresses are almost devoid of small retail investors. They all have a certain level of investment strength and their buying scale is not small, generally in the tens of thousands of dollars. Moreover, these smart money addresses are the main contributors to the price increase of these MEME coins. For example, Sunday Funday's purchase directly attracted numerous followers for 1DOL. It could be said that their profits are not just luck, but the power contributed by their followers.

4. Does the 10U War God still have a chance?

During the analysis of the addresses, PANews found that when these smart money addresses buy, there are often many addresses with similar or even lower costs. However, these addresses tend to liquidate their positions in a short period of time, ultimately missing out on large profits. Therefore, it is not that smart money is always lucky, but they have their own holding methods in terms of strategy. For example, they may first recover some of the costs after the price rises. They may even continue to increase their positions when they see a positive trend for the project. These habits are quite different from the quick in-and-out habits of ordinary players. For most 10U War Gods, opportunities seem to always exist, but being able to truly seize them is the main obstacle to becoming smart money.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。