Original | Odaily Planet Daily

Author | Azuma

With the expected change in the approval of the Ethereum spot ETF (Bloomberg analyst Eric Balchunas has raised the probability of approval from 25% to 75%), ETH surged by 20% overnight, breaking through the $3700 mark.

Eric explained that due to some political reasons, the SEC may make a 180-degree turn on this issue. This sudden change seems to indicate that the regulatory direction regarding cryptocurrencies is quietly changing.

Ron Hammond, the government relations director of the most well-known policy lobbying organization in the industry, Blockchain Association, stated that the Biden administration will have three opportunities this week to express a new attitude towards cryptocurrency regulation. In addition to the well-known ETH ETF review, Biden will make the final decision as president on the bill to overturn SAB 121, which has been passed by both the Senate and the House of Representatives, and the House will also vote on the FIT21 bill.

Can SAB 121 be successfully overturned?

The so-called SAB 121, full name "Staff Accounting Bulletin No. 121," is a set of employee accounting rules issued by the U.S. SEC in March 2022 and implemented in April 2022, mainly outlining the requirements of the SEC for financial workers in accounting for the cryptocurrency assets held by companies.

The core content of SAB 121 requires companies that custody cryptocurrencies to record the cryptocurrencies held by their customers as liabilities on the balance sheet. However, the cryptocurrency industry generally believes that this provision is too strict and effectively hinders custodians or companies from holding cryptocurrencies on behalf of their customers, which is not conducive to the further development of the industry. Therefore, the industry has been trying to overturn SAB 121 through lobbying and other means.

Odaily Planet Daily Note: Hester Peirce, known as the "crypto mom" in the industry, has also criticized SAB 121 multiple times.

On May 8, the bill to overturn SAB 121 was submitted to the House of Representatives and ultimately passed by a vote of 228 to 182, with the majority of supporting votes coming from Republican members, but 21 Democratic members also expressed their support.

On May 17, the issue was brought to the Senate and passed again by a vote of 60 to 38.

According to the rules, the bill will now be submitted to the Biden White House, and Biden will make the final decision on the bill before May 28.

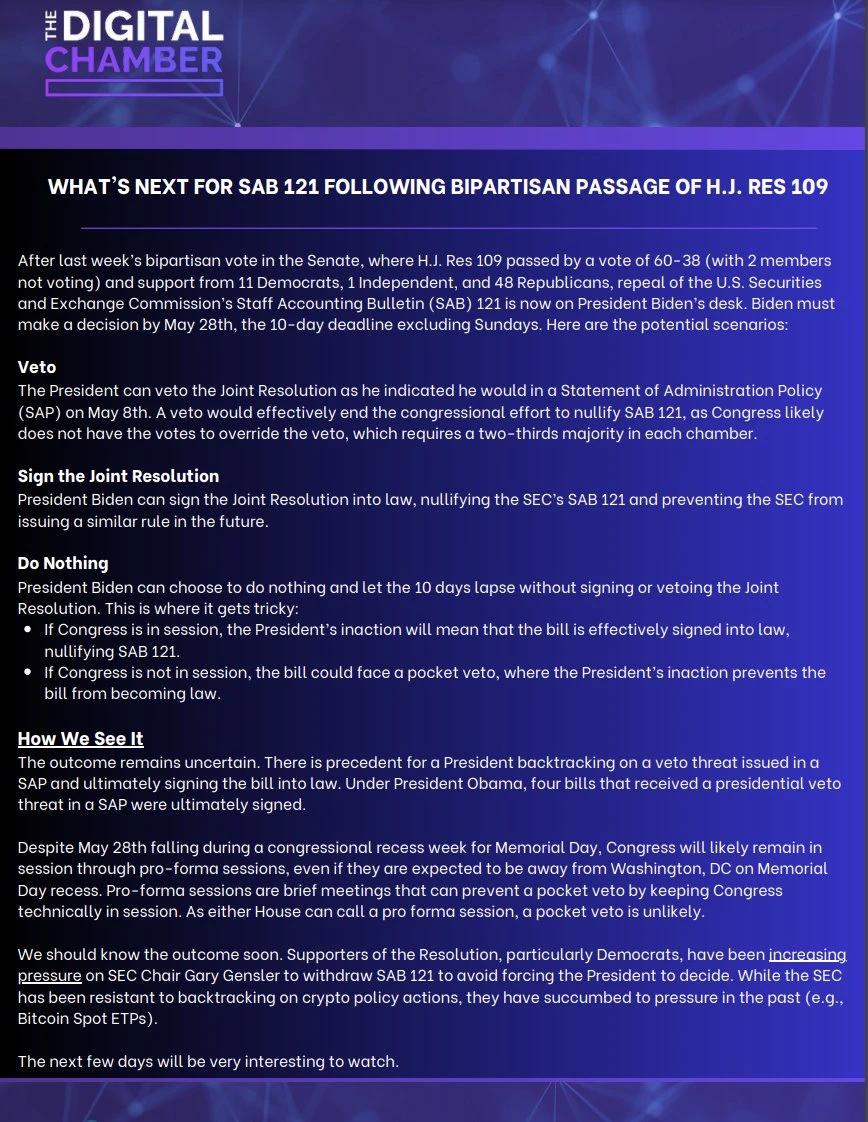

The Digital Chamber has analyzed three possible decisions that Biden may make, as follows.

The first possibility is veto. If this happens, it will be difficult to overturn SAB 121, as both the Senate and the House of Representatives need at least a two-thirds majority to veto the president's decision again. However, based on the previous voting patterns (228 to 182, 60 to 38), it seems unlikely.

The second possibility is signing. If this happens, SAB 121 will be invalidated, and the SEC will not be able to issue similar rules in the future.

The third possibility is postponement, allowing the deadline of May 28 to pass. In this case, if Congress is in session, the president's postponement will automatically pass the bill, but if Congress is in recess, the bill will be forced into a "pocket veto" state.

It is worth mentioning that May 28 is the Memorial Day recess of Congress, but it is not ruled out that Congress will use indirect methods such as pro-forma sessions to prevent a "pocket veto."

As for Biden's potential attitude, Ron Hammond's analysis indicates that although Biden had previously stated that he would veto the bill in the Senate, given the unexpectedly high level of support for the bill in the Senate, making it the most widely supported bipartisan cooperation case other than the "DC Crime" bill, and the Speaker of the House and the Senate Majority Leader both voted in favor, it is not ruled out that Biden may temporarily change his stance, possibly choosing to sign the bill, thereby passing the bill through the legislative process and overturning SAB 121.

FIT 21's Challenge Begins

The so-called FIT 21 (also known as HR 4763), full name "Financial Innovation and Technology for the 21st Century Act," is a new bill aimed at clarifying the regulatory framework for cryptocurrencies.

a16z previously analyzed in an article that if the bill can be passed smoothly, its impact will include:

Providing a safe and effective way for blockchain projects to launch in the United States;

Clarifying the regulatory boundaries between the SEC and CFTC, i.e., who regulates what behaviors in cryptocurrency, and whether digital assets are securities or commodities;

Ensuring supervision of cryptocurrency exchanges and further protecting American consumers by implementing cryptocurrency trading rules.

According to the current progress, all members of the House of Representatives plan to vote on FIT 21 this week (expected to start voting late Wednesday or early Thursday local time, possibly at the same time as the ETH ETF). Earlier, about 50 digital asset organizations and companies, including Coinbase, Kraken, a16z, DCG, and others, had written to House Speaker Mike Johnson through the Cryptocurrency Innovation Committee, hoping that the bill would be passed smoothly.

An analysis by "Fortune" on the prospects of the bill's passage stated that FIT 21 is expected to pass the House of Representatives with a high probability, but is expected to encounter obstacles in the subsequent Senate vote.

Ron Hammond's analysis is similar, indicating that FIT 21 is unlikely to pass the Senate this year, but Ron also mentioned that FIT 21 is likely to receive simultaneous support from both parties, and the level of support in the House of Representatives will also affect its subsequent performance in the Senate vote.

Trump's "Curveball"?

In summary, including the well-known ETH ETF review, the Biden administration will have three opportunities this week to express a new attitude towards cryptocurrency regulation.

The emphasis on the word "new" is because Eric mentioned the possibility of the SEC changing its attitude based on "some political reasons," and Ron also mentioned the changing impact of cryptocurrencies on the election trend, stating that "Trump is winning this group."

On May 9, Trump announced that he would accept campaign donations in the form of cryptocurrencies, stating, "Biden doesn't even know what cryptocurrency is. If you like cryptocurrency, you better vote for Trump."

In light of today's new developments, it's hard not to think about the implications…

However, before the above three major events are finalized, no one knows the real answer to whether the regulatory attitude of the Biden administration has changed. In this regard, Jake Chervinsky, a legal professional who previously served as General Counsel for Compound, stated in a post today: "If the spot ETH ETF is really approved, everyone I know who understands the regulatory situation in Washington will be greatly surprised, but that doesn't mean it won't happen. The real significance of this is that the approval of the ETF may indicate that after the SAB 121 vote, there has been a significant shift in the United States' cryptocurrency regulatory policy, which may be more important than the ETF itself."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。