On the afternoon of May 16th, AICoin researchers conducted a live graphic and text sharing session titled "Insight into Coinbase Premium from Major Orders, Is BTC Rebound Expected? (Free Membership)" in the AICoin PC-end - Group Chat - Live. Below is a summary of the live content.

I. Analyzing BTC Trends from BTC Premium

From the historical BTC price and BTC premium, we can see that as long as the BTC Premium MA30 appears as a clear V-bottom at the bottom, the subsequent market trend is likely to be upward. Currently, the V-bottom of the premium data has not yet formed, so we need to observe more and conduct cross-validation with multidimensional analysis.

II. Concept Explanation

1. Large Orders

Refers to large transactions conducted in the market by large investors or institutional investors.

2. Major Orders

It is a large transaction indicator used to detect large trading activities in the market. These indicators help us discover the buying and selling activities of major forces in the market (such as institutions or large fund holders).

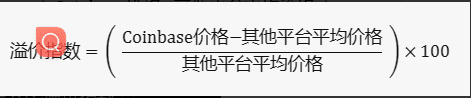

3. Coinbase BTC Premium Index

It measures the price difference of Bitcoin on the Coinbase trading platform compared to other trading platforms (such as Binance, Bitfinex, etc.). This index helps investors understand whether the trading price of Bitcoin on Coinbase is higher or lower than on other platforms.

4. Positive Premium

If the price of Bitcoin on Coinbase is higher than the average price on other trading platforms, the premium index is positive. This indicates that traders are willing to pay a higher price to buy Bitcoin, which may reflect higher demand or liquidity overflow.

5. Negative Premium

If the price of Bitcoin on Coinbase is lower than the average price on other trading platforms, the premium index is negative. This indicates a greater selling pressure on Coinbase, which may reflect traders' eagerness to sell Bitcoin or insufficient liquidity.

III. Analysis of Coinbase BTC Premium Index

The recent Coinbase BTC premium index turned positive on the 2nd and then turned negative on the 14th. This indicates that the demand for BTC in the US market increased at the beginning of the month (US market makers were buying), but as the month progressed, the selling pressure in the US market gradually increased (US market makers were selling). The transition from a positive premium to a negative premium also indicates a change in market sentiment, shifting from optimism to pessimism, possibly transitioning from a buyer's market to a seller's market.

However, in the premium data from the evening of the 15th to the 16th, there were signs of a positive turnaround in the BTC premium, indicating a shift from negative to positive market sentiment. The good news is that BTC also broke through the resistance level, and a sustained upward trend is expected.

IV. Resistance Level and Support Level

1. Resistance Level

An area where the price is difficult to break through. At this price point, there may be a large number of sell orders in the market, leading to an oversupply.

If broken through: there may be continued upward movement, consider holding or increasing positions.

If unable to break through: consider selling part of the position.

2. Support Level

An area where the price is difficult to fall below. At this price point, there may be enough buyers entering the market, causing demand to exceed supply, thereby preventing further price declines.

If the price approaches and rebounds: consider buying, expecting a rebound.

If the price falls below: execute a stop-loss to reduce losses.

V. How to Profit from Major Orders

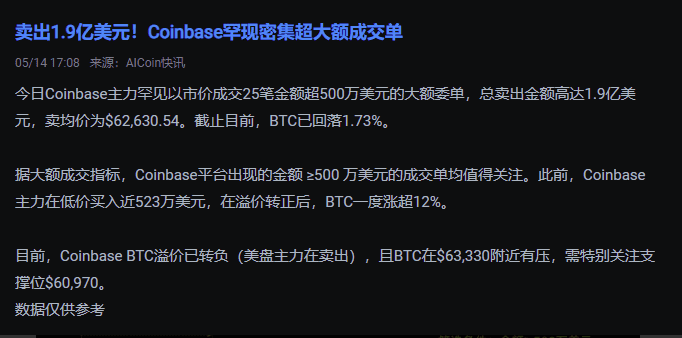

In the current market situation shown in the news flash, the Coinbase BTC premium has turned negative (US market makers are selling), and BTC is near $63,330 with resistance, so special attention should be paid to the support level of $60,970.

If the resistance level is broken through: there may be continued upward movement, consider holding or increasing positions.

If the price falls below the support level: execute a stop-loss to reduce losses.

At this time, for cautious users,

Entry condition 1: When the Coinbase BTC premium turns positive and the price steadily rises, consider entering to buy.

Entry condition 2: When the price approaches the $60,970 support level and a rebound signal appears, consider buying, expecting a rebound.

In addition, it is important to note that when Coinbase major orders frequently sell and the BTC premium turns negative, it is advisable to avoid entering at high levels.

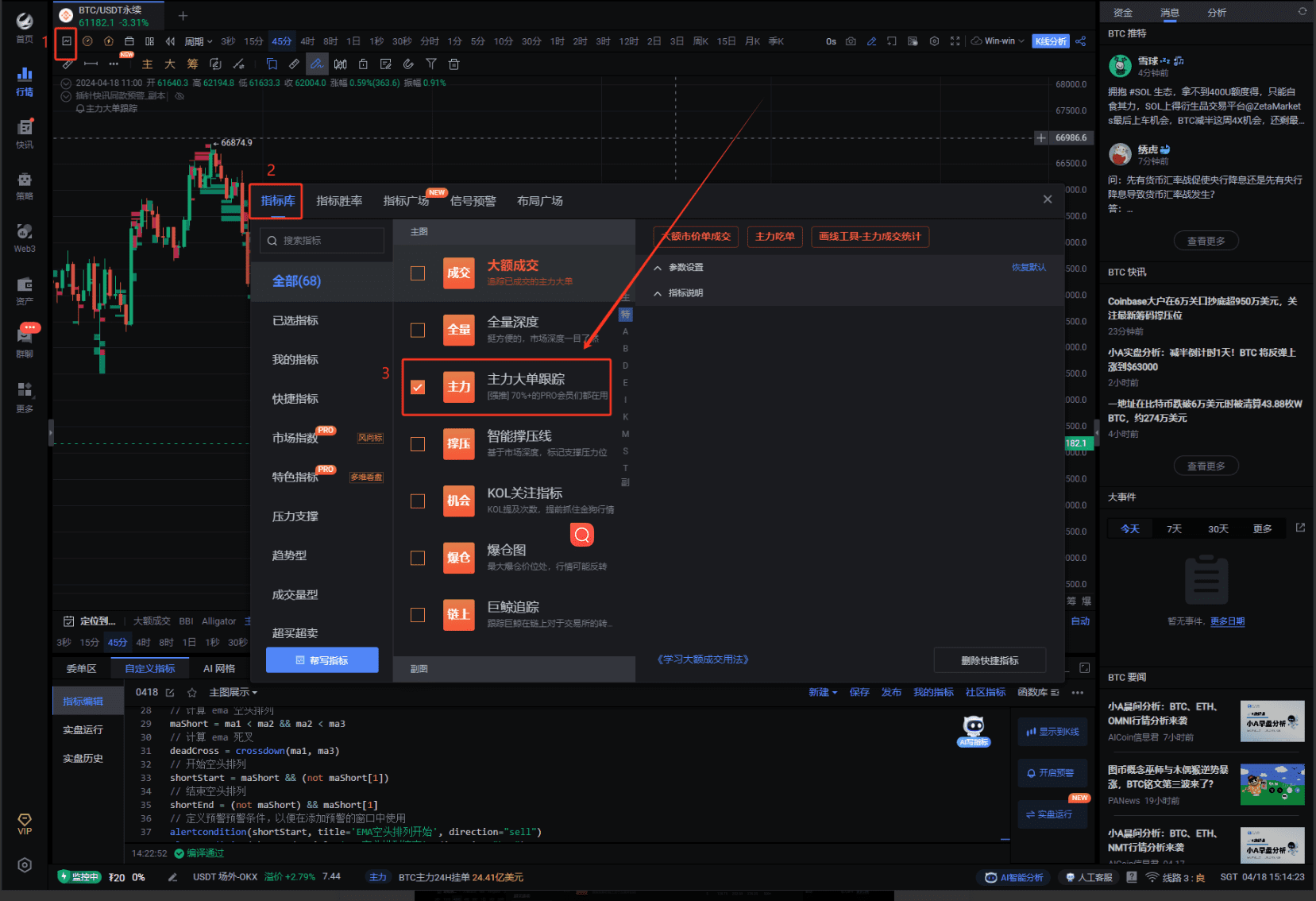

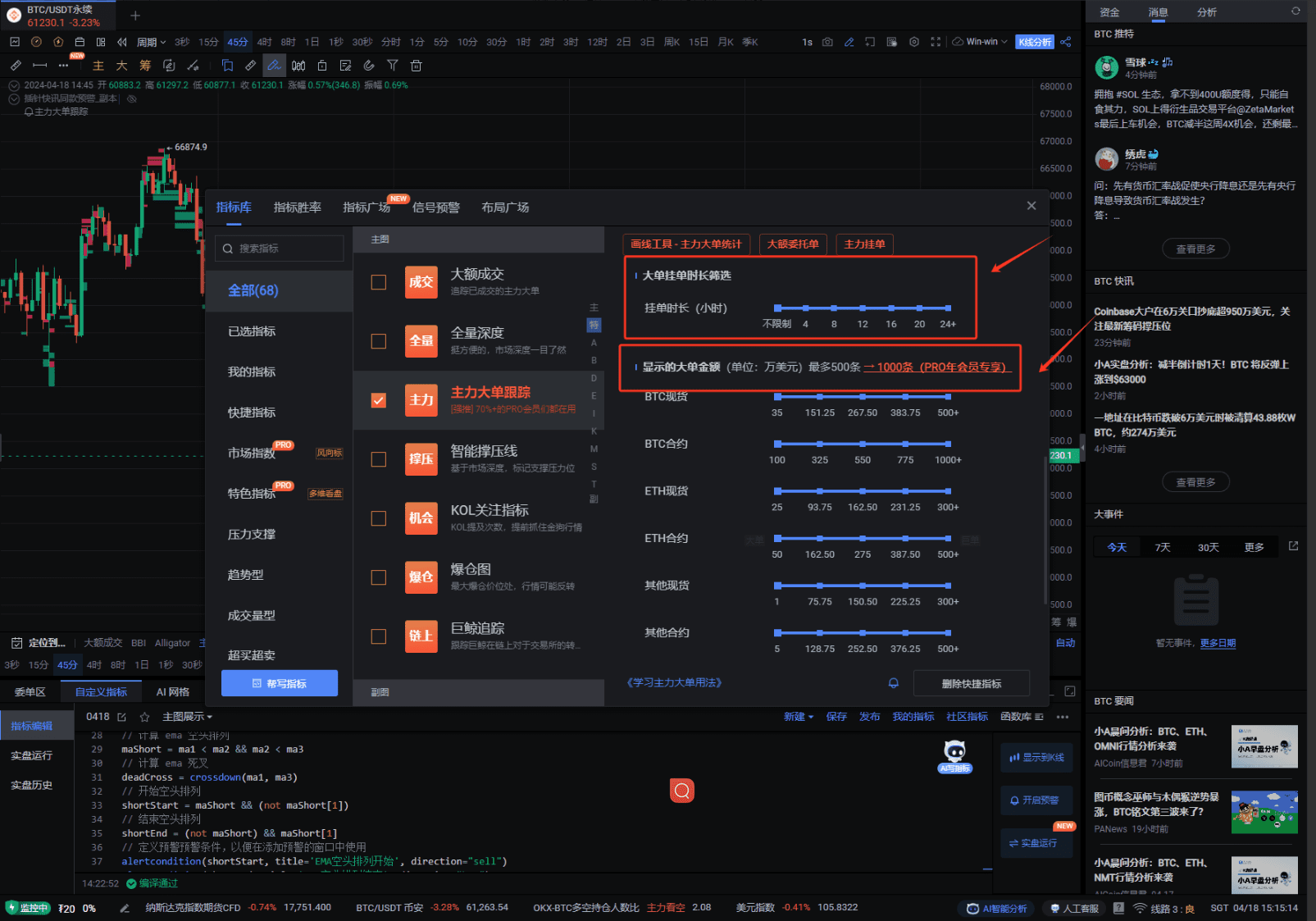

VI. How to Set Major Orders

The entry is as shown in the figure. We can also customize the order duration and the amount of the major order.

VII. Criteria for Filtering Major Orders

In the current market situation, we are filtering major orders exceeding $5 million.

The reasons are as follows:

1. Historical Data Support

Historical data shows that the total amount of major orders bought by Coinbase at low prices is approximately $5.23 million, and after the premium turns positive, BTC once rose by more than 12%. This phenomenon indicates that $5 million is a figure with practical reference value, providing important clues about market behavior.

2. Strength and Confidence Behind High-Value Transactions

High-value transactions are usually conducted by traders or institutions with more experience and a deep understanding of market dynamics. The decisions of these participants are based on in-depth market analysis and strong financial support, making their trading direction more reliable.

3. Influence on the Market

Large transactions have a significant impact on market prices. This influence often attracts the attention of other market participants and triggers reactions, thereby forming clearer market trends.

VIII. Relationship between CPI and BTC Trends

The most common impact of CPI on BTC price increases is: when CPI data meets or is lower than expected, it is a positive signal for the market, and BTC is likely to rise; conversely, when CPI is higher than expected, it is a negative signal.

In the data on the 15th, the CPI met expectations.

In addition, although the CPI data met expectations, the inflation data for the past four months has been higher than expected, further fueling bets on interest rate cuts.

Impact of the CPI on the market on the 15th:

1. Enhanced Market Expectations for Interest Rate Cuts

Investors' expectations for a rate cut by the Federal Reserve have strengthened.

According to CME FedWatch, about 73% of traders expect the Federal Reserve to cut interest rates at least once between September.

2. Financial Markets Rise

Benefiting from the positive impact of low CPI, the S&P, Dow Jones, and Nasdaq indices have reached or approached historical highs, with increases of 1.17%, 0.88%, and 1.40% respectively.

3. The CPI data also warns investors of potentially overly optimistic sentiment

Although the CPI data is positive, the current global economic situation is still close to mild stagflation, with risks of economic growth slowdown.

The market's reaction to the CPI data may be overly optimistic, and investors should be wary of potential economic and political instability.

IX. Cryptocurrency Traders Should Pay Special Attention to Macroeconomic Data

1. Cryptocurrency markets usually respond quickly to macroeconomic data

On the afternoon of the 15th, after the CPI data was released, it surged from $61,315 to $66,640, highly reflecting market sentiment.

2. Impact of Economic Policies

The Federal Reserve's interest rate decisions have a wide-ranging impact, determining market liquidity and investor sentiment.

Cryptocurrency traders need to understand policy changes, such as how interest rate cuts or hikes affect the pricing of risk assets.

3. Investor Sentiment

Macroeconomic data such as CPI and PPI (Producer Price Index) not only affect fiat currency markets but also directly impact the decisions of cryptocurrency traders.

For example, high PPI data may indicate rising costs, affecting CPI, which in turn influences Federal Reserve interest rate decisions, ultimately affecting cryptocurrency market sentiment.

X. Analysis of People and ETH Trends

1. Prediction for People: Sideways

2. Prediction for ETH's 1-hour Trend: Bearish

PRO members and signal alert members have access to high-quality tools tailored for lazy friends, and custom indicators can help any AICoin user plan their trades and trade their plans. For more custom indicator strategy displays and multiple alert reminders, feel free to experience the custom indicator membership for free for a limited time. Click the link below to experience: https://aicoin.com/en/vip/chartpro

Recommended Reading

For more live content, please follow the AICoin "News/Information - Live Review" section, and feel free to download the AICoin PC-end

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。