Author: KERMAN KOHLI

Translation: Frost, BlockBeats

Editor's note: Cryptocurrency researcher KERMAN KOHLI analyzes the success of Starknet's airdrop from the perspective of token claiming and distribution, data, and time.

Following my previous article on multiple airdrops by Optimism, I wanted to take a look at Starknet's airdrop as I also extracted the data. I hope to explore the main differences in the token claiming mechanism by studying the airdrops of Starknet and Optimism. The data is now outdated by about a month, but considering that the airdrop was completed several months ago, it should not differ too much from the actual numbers.

Claiming and Distribution Model

The main difference between the two methods is that Optimism says "we will personally send the airdrop to your wallet," while Starkware says "come to us to claim your airdrop." In the former case, it is easier for users and saves gas. My personal belief is that if you are performing this operation on a low-cost chain, then cost should not be an issue, and there should be a button to claim the airdrop.

That being said, let's take a look at Starknet's airdrop. Unfortunately, obtaining data is very difficult because:

- Starknet does not publicly report the details of claiming behavior in the analysis data after the airdrop.

- Starknet does not have standard EVM format addresses, which means I had to crack it to obtain the available on-chain data.

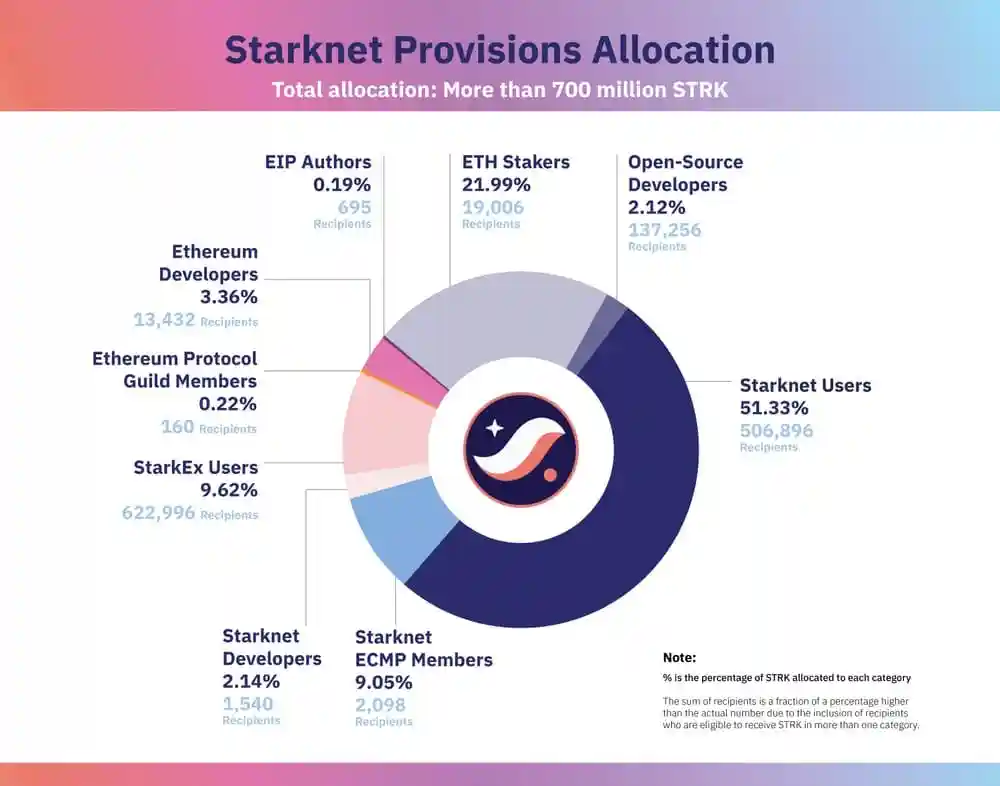

In any case, this is the official chart about how the airdrop was distributed:

Data Collection

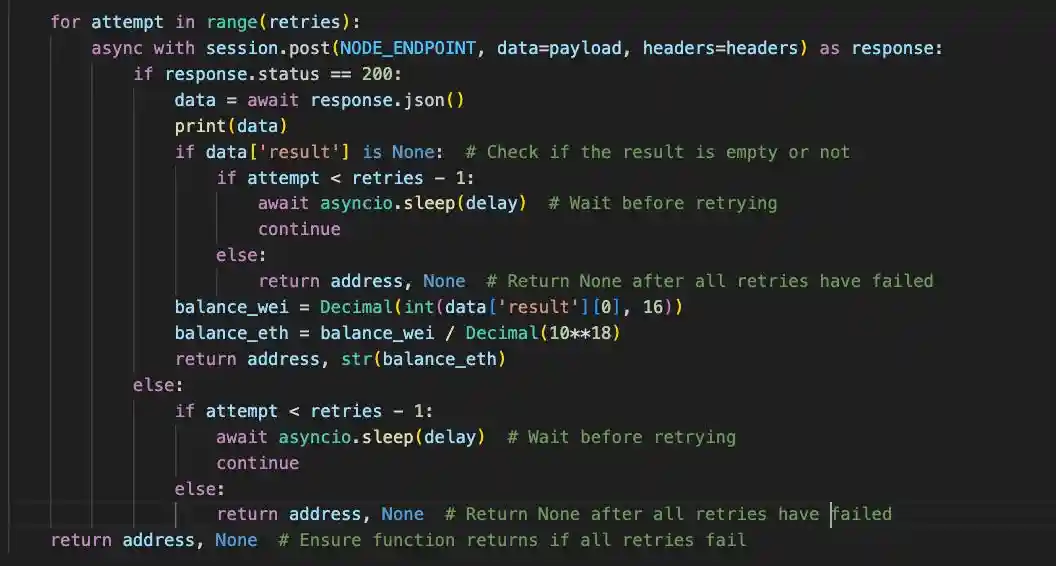

To obtain the data I needed, I basically used:

- 0x06793d9e6ed7182978454c79270e5b14d2655204ba6565ce9b0aa8a3c3121025 as my airdrop retrieval address.

- 0x00ebc61c7ccf056f04886aac8fd9c87eb4a03d7fdc8a162d7015bec3144c3733 as my starting block hash.

- 0x04718f5a0fc34cc1af16a1cdee98ffb20c31f5cd61d6ab07201858f4287c938d as the contract from which to retrieve STRK balances.

I had to use many for loops and byte programming to obtain some interesting segments of the data I wanted.

In the process of extracting the data, I found that only 39.8% of people claimed the airdrop, and the remaining users were basically used for marketing data— in a sense, this is also a good result! Some may say this is bad, but if you can convey information to the widest audience without revealing everything, then you have found the optimal point.

Time Analysis

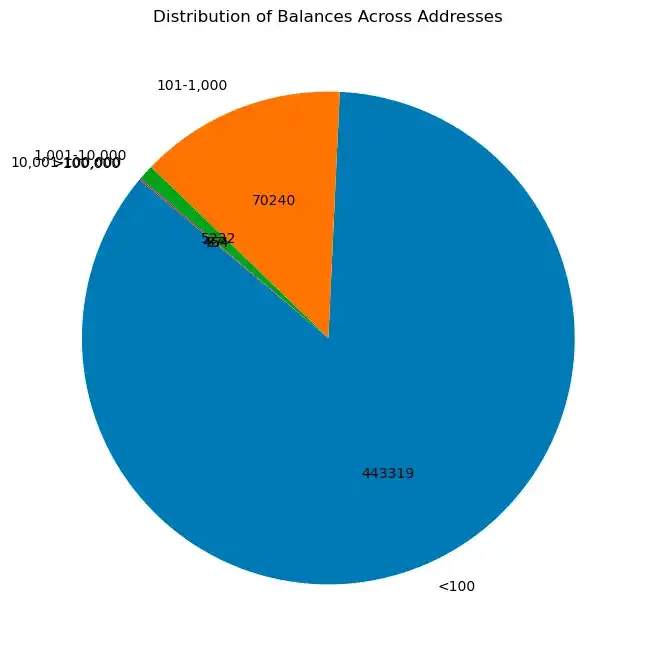

The approach I took was to extract all the addresses that had received the airdrop and then write a script to query the balance of these addresses at the time (i.e., when the script was run). By dividing the balances into "bins," I could see the number of balances distributed in different "bins." However, due to limited data, it was difficult to gain deeper insights into these users. The limited data made the entire analysis more challenging.

Without further ado, let's just show the results! I set a threshold of no more than 100 STRK because the minimum airdrop amount is 111.1 STRK. Below are the distribution situations for different amounts:

- StarkEx users: 111.1 STRK per person

- Open-source developers: 111.1 STRK each

- Starknet users: Ranging from 500 to 10,000 STRK, with different multipliers

- Starknet community members: Ranging from 10,000 to 180,000 STRK

- Starknet developers: 10,000 STRK per person

- Ethereum staking pool: 360 STRK per validator

- Individual stakers: 1,800 STRK per validator, up to 3,200 STRK for higher-risk validators

- Ethereum developers: 1,800 STRK per person

- Guild members: 10,000 STRK per person

- EIP authors: 2,000 STRK per person

Overall, this airdrop did not achieve very good results! The 13.5% retention rate is close to the industry average (which is not high). However, considering that even an ordinary GitHub user like me received 1800 STRK, from a deeper perspective, the effectiveness of this airdrop is much worse than we expected! Only 1.1% of users who received token allocations ultimately retained them. Let's look at some other metrics to help us judge whether this airdrop was successful.

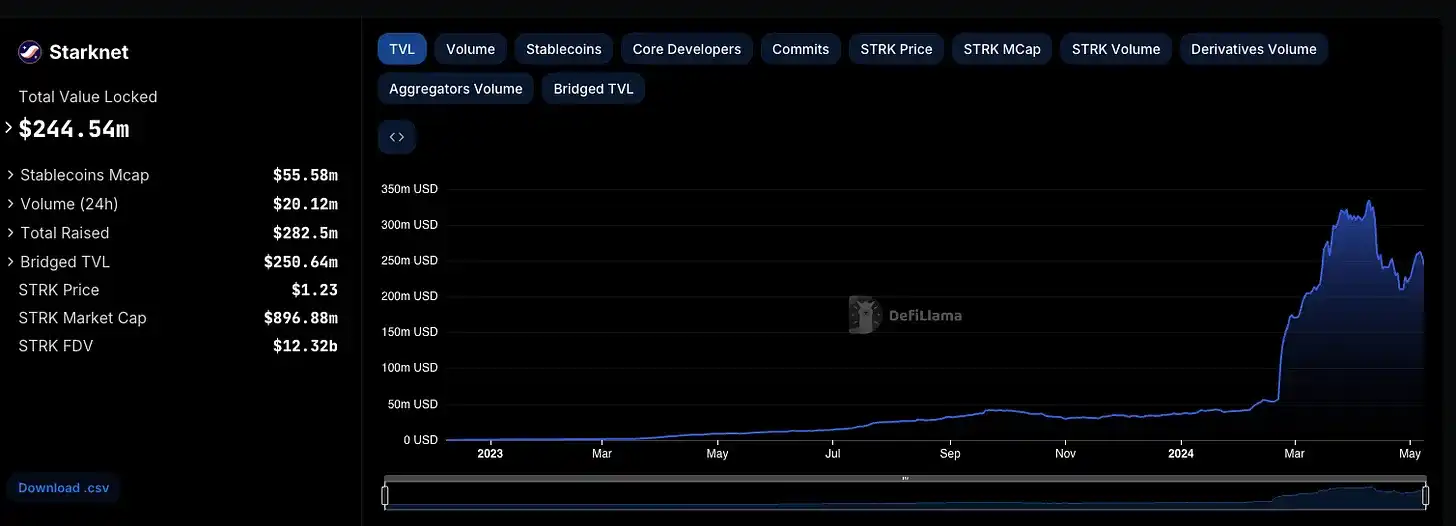

A simple proxies metric is the price trend of the token. Below is the price trend chart of the STRK token over the past 3 months:

The price has dropped by 50%, but there has been a structural adjustment in the overall market during the same period. The performance is not ideal, but at least it did not drop by 90%.

Let's look at it from another perspective: TVL. At least our friends at DeFi Llama can help with this.

TVL rose to around 320 million USD, then dropped to around 210 million USD, which is a fairly good retention rate. However, we do not know how much Starknet paid to achieve these numbers. Fortunately, I have the number. That number is 67,078,250.942674.

If we assume the average token price is 1.50 USD, we can rephrase this equation, as Starknet spent 100,617,376 USD to acquire approximately 300 million USD of TVL, or in other words, about 3 USD of STRK tokens can buy 1 USD of TVL.

My next question is how many users there are so that we can understand the CAC model of this equation. I redraw the above chart with the percentage of users included.

Okay, from here on, let's give some credit to Starknet and only consider the "less than 100 tokens" category. Spending nearly 100 million USD, they acquired 519,282 users. This means that they spent about 200 USD per user. If we recalculate with retained users (holding more than 101 tokens), the cost per retained user would be 1341 USD.

This is lower than the retention CAC seen in airdrops on Arbitrum and other platforms, which can be as high as thousands or even tens of thousands of USD. Although Starknet's airdrop is not very good from a retention perspective, it is relatively good from a CAC perspective compared to other airdrops I have seen. My paper is similar to what we saw in the Optimism airdrop: allocating tokens based on diversified attribute standards can yield substantial returns.

Conclusion

Starknet's approach to distributing a large number of tokens to different groups is relatively thoughtful. The data also clearly shows that they ensured diversity in the distribution. This is also a common feature I observed in successful airdrops compared to failed ones.

So, why don't more projects consider diversity in user attributes for airdrops? The reason is that collecting, analyzing data, and drawing conclusions is a very difficult task—especially in the case of large amounts of data. However, Starknet used a relatively simple standard and still ensured diversity in the distribution. In fact, with the right tools, the distribution can be more targeted.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。