5.17/Daily Community: Can the head and shoulders pattern of Bitcoin continue; what is the key to watch?

Live broadcast sharing various mainstream technical indicators application methods, as well as the analysis of technical forms of the day;

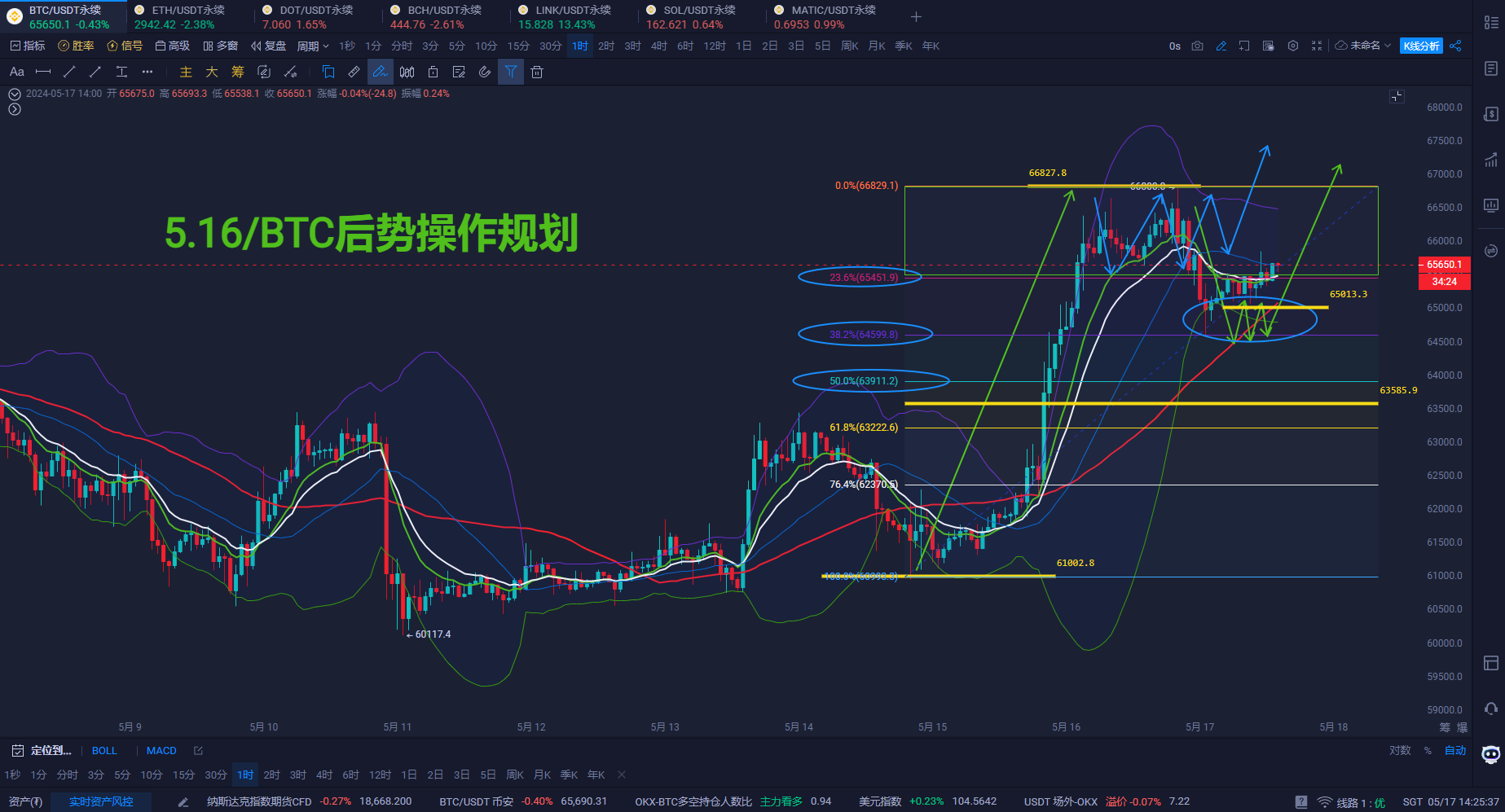

[BTC/Daily Chart/4H Chart]

BTC Trend Analysis and Viewpoint: Yesterday, Bitcoin's trend did not continue the strong rally on Wednesday, but instead rose again; after being blocked at 67000, it showed a slight pullback and closed the daily chart with a small bearish candlestick pattern; with a slight 1.45% decline, the closing price was at 65220, within our expected range of trend yesterday; today's bull and bear trend is crucial for whether the head and shoulders pattern on the daily chart can continue to move upward, it depends on whether the price can effectively break through 67000. Only after a strong recovery of this resistance, the probability of reaching 69000-70000 will increase; if today's price falls again due to the 67000 resistance and breaks below 63500, then the head and shoulders pattern will fail and turn into a range oscillation of 67000-56000. The price trend on the 4-hour chart is more bullish; the three moving averages have formed a bullish arrangement and the upward trend line remains intact; therefore, the operation still needs to maintain a bullish stance; firmly breaking below 63500 will switch to a bearish position. The operation suggestion is to execute the 5.16-hour plan.

5.16/Evening Operation Suggestions and Strategies; the short-term bullish direction of BTC is clear; yesterday, on the 15th, the daily chart closed with a 7% bullish candlestick; therefore, the bearish mindset needs to be avoided; so the focus is only on how to enter the long position in the future;

Plan 1: Conservative type, wait for the price to retrace to 38.2% [64500] and show a clear bottoming pattern, then enter the long position with a stop loss set at 50% [64000] and below 63700-63600; the first target for the long position is 66800. If it strongly breaks through the key level of 67000, then hold the long position until 68500.

Plan 2: If it can consolidate strongly above 23.6% in the evening [65500], then wait for and track the first strong bullish breakthrough of 66800 in the 30-minute to 60-minute timeframe to enter the long position; set the stop loss at 65200-65100 and the profit target at 68500-68800.

For students holding short positions, the stop loss is recommended to be set at 67200-67300; do not hold the position!

For more details, welcome to join the live broadcast room for discussion and exchange!

[BTC/4H Chart Contract Market Bull/Bear Data; Updated daily at 12:00 PM]

BTC/4-hour contract market bull/bear data tracking:

1. Large account bull/bear ratio: Short position holding ratio: 42.45%; Long position holding ratio: 57.55%;

Bull/bear holding ratio: 1.36

2. Large account holding amount bull/bear ratio: Short position holding ratio: 46.27%; Long position holding ratio: 53.73%;

Bull/bear holding ratio: 1.16

3. Bull/bear holding amount person ratio: Short position person ratio: 47.98%; Long position person ratio: 52.02%

Bull/bear person ratio: 1.08

For more details, welcome to join the live broadcast room for discussion and learning!

Recommended Strategy [Strong Daily K]

Support 64600-64000/Resistance 66800-67000

Tencent Meeting ID: 565-877-8060

Five live broadcasts daily: 14:00-21:30 uninterrupted

ETH/DOT Short Strategy Tracking Conclusion: Comprehensive return at 1200%-1400%

[Hunting for Gold House] What can you get from the elite class?

1. Get the midday video at the first time//2. Get the market's intraday viewpoint at the first time

3. Get short, medium, and long-term strategies at the first time//4. Track and guide the strategy throughout

5. Have the opportunity to participate in the exclusive midnight battle//6. Have the opportunity to participate in million-level courses

[Efficient. Accurate. Breakthrough Trading Opportunities Capture]

2023 Annual Strategy Guidance Record

January-December 2023///9 wins 3 losses

January complete/return rate 2322%///February complete/return rate -475%

March complete/return rate 3126%///April complete/return rate -491%

May complete/return rate +560%///June complete/return rate -66%

July complete/return rate +680%///August complete/return rate +82.54%

September complete/return rate 1346%///October complete/return rate 1298%

November complete/return rate 1752%///December complete/return rate 1384%

January-December 2023 complete total 12650%

Single margin 300U*12650%=37950U

2022 Annual Strategy Guidance Record

February-December 2022///10 wins 1 loss

February complete/return rate 2500%///March complete/return rate 2500%

April complete/return rate 2626%///May complete/return rate 3698%

June complete/return rate 3081%///July complete/return rate 7033%

August complete/return rate 4694%///September complete/return rate 5046%

October complete/return rate 1438%///November complete/return rate 2362%

December complete/return rate -474%///

February-December 2022 complete total 34504%

Single margin 100U*34504%=34504U

Each strategy//has evidence and can be traced back to the start time to the year, month, day, hour, minute, and second, with graphic and text records. Interested parties can scan the code to join the group for certification!!

(Scan the code to follow the official account and experience more services)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。